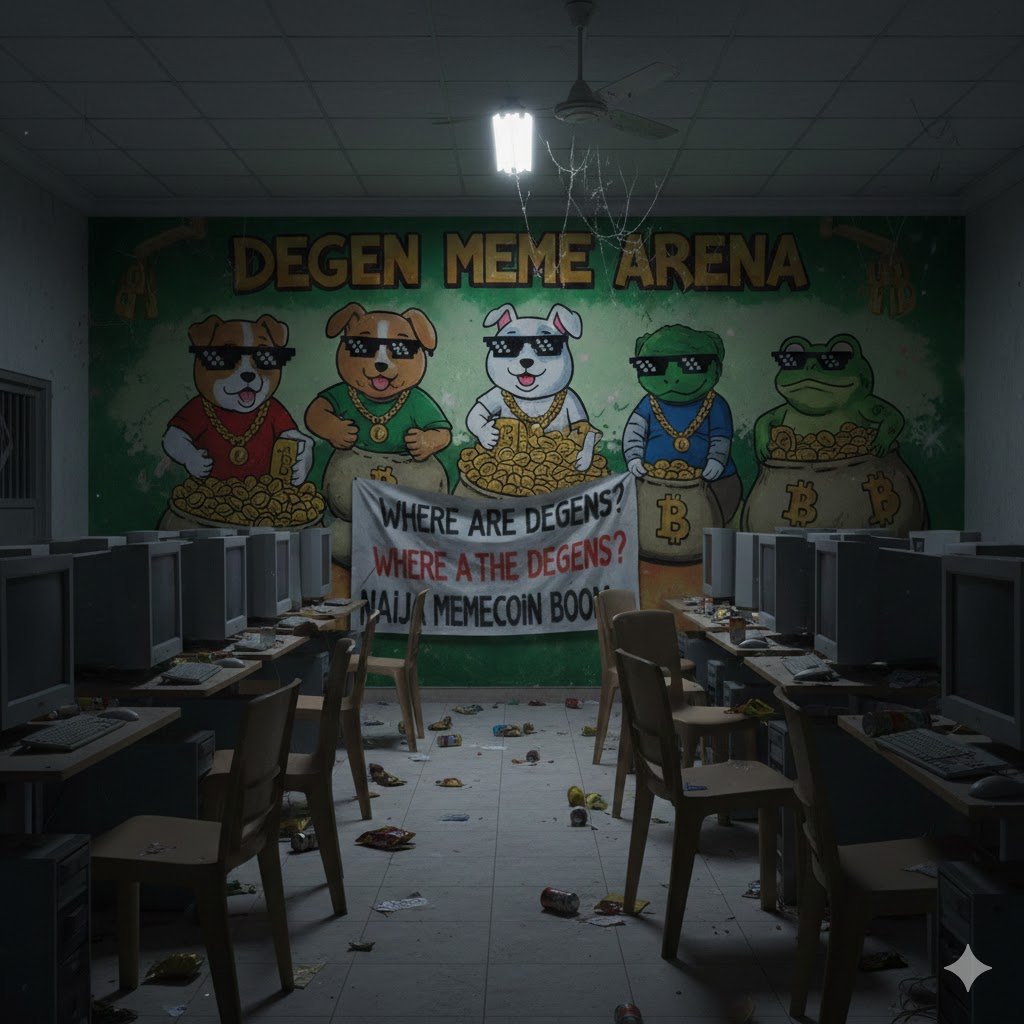

There was a time in the Nigerian crypto ecosystem when high-risk merchants with the bravado of a full-time sports punter dominated conversations.

There was a lot going on then. People were building amazing products. Millions were spent on play-to-earn projects, and there was also an influx of foreign investment into the African crypto space.

The Nigerian crypto space was then largely unregulated, as key financial regulators had yet to make sense of it.

Stories of ‘crazy’ traders who made life-changing money by apeing into unknown memecoin projects went around. A trader reportedly turned an initial investment of $865 into $6.4 million trading Chill Guy, a memecoin that once soared 511% in 24 hours, making its early backers a fortune before it dipped. Stories like this encouraged Nigerians, luring many crypto enthusiasts into memecoin trading.

The art appears to have died now, and the influencers who were floating the lifestyle have moved on to something else.

The memecoin trading era in numbers

The Nigerian crypto ecosystem witnessed two memecoin trading eras driven by external events: the 2021 pioneer era and the 2024–2025 deep cycle driven by different events.

The 2021 era was driven by the coming of age of memecoins and their backing by public figures like Elon Musk.

Elon backed Dogecoin, a dog-themed memecoin, promoting it publicly and leveraging his massive social capital to market it. This led to the first wave of Degens (high-risk investors) in the ecosystem.

Despite the Central Bank of Nigeria (CBN)’s February 2021 bitcoin restriction, Nigeria’s P2P trading volume hit record highs, with some quarters seeing $1.5 billion in trades as retail users moved away from Bitcoin to altcoins and memecoins.

In 2024, infrastructure upgrades and the introduction of a new category of memecoins drove the second wave of memecoin trading.

Solana launched Pump.fun, a resource that allowed anybody to create a memecoin for less than $2. Memecoin projects worth apeing flooded the market, leading to a memecoin trading frenzy.

Polifi tokens (politically influenced memecoins) added to the frenzy following the 2024 United States presidential elections.

Between July 2024 and June 2025, Nigeria processed $92.1 billion in on-chain value. Critically, 85% of these transactions were under $1 million, indicating a massive retail degenerate (degen) trading culture.

The second memecoin trading era was more enduring and sophisticated than the first, given the ecosystem’s maturity at that point.

What experts say about the fall

Olayinka Omoniyi, Head of Marketing and Sales at Convexity, attributed the fall of memecoins to liquidity, fragmentation, and fatigue.

“I think one of the facts is that there are a lot more chains now. Liquidity is fragmented, and you are not guaranteed a lot of Xs,” he told Condia.

“People lost a lot of money trading memecoins, and there is also memecoin fatigue amongst former traders.”

Omoniyi explained that the culture is not entirely dead, as pockets of trading still occur on decentralised exchanges.

Rume Ophi, a renowned industry analyst, added to the discussion, stating that a major career change and better information are largely responsible for the drop in memecoin trading.

According to Ophi, memecoin traders are opting for more stable careers in crypto, pivoting from traders to paid employees.

“A lot of these traders lost good money, and some of them have finally figured out that part of why they lost money was because they were not well-informed,” he said.

“So they have invested in education and are currently looking for careers in crypto. Talking to people to come and invest in memecoins now sounds like rubbish because the industry has outgrown that.”

Ophi explained that some of the influencers who promoted the trade were often after people’s money. According to him, most of them had a stake in memecoin projects, so they used their platforms to promote them and earn kickbacks.

The global state of the crypto market also adds to the overall lack of enthusiasm in Nigeria’s crypto space, as many stakeholders are pulling back and taking their money elsewhere.

Bitcoin has dropped over 28% since the first day of this year, dropping below $60,000 this week — its largest drawdown ever.

This massive drop follows an October peak of $126,210. The milestone follows institutional exchange-traded fund (ETF) outflows and fears of a hawkish US federal reserve under newly nominated chair Kevin Warsh.

An exchange-traded fund is a financial product that exposes investors to a particular asset. This happens through an asset manager, shielding them from having to own the asset directly.

A combination of fatigue, liquidity fragmentation and a pivot to more stable means of income is driving the death of the memecoin culture in Nigeria’s crypto space.

The glory days of memecoins have come and gone. The Nigerian crypto ecosystem awaits the next big thing.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore