The startup’s new tax management tool reflects a broader shift in how African businesses handle government obligations

When Nigeria’s 2025 Tax Act took effect in January, most businesses believed their spreadsheets and accountants would carry them through. Cossi Achille Arouko, chief executive of Bujeti, saw something different: an opportunity to embed compliance directly into the financial infrastructure businesses already use to manage their spend and finance.

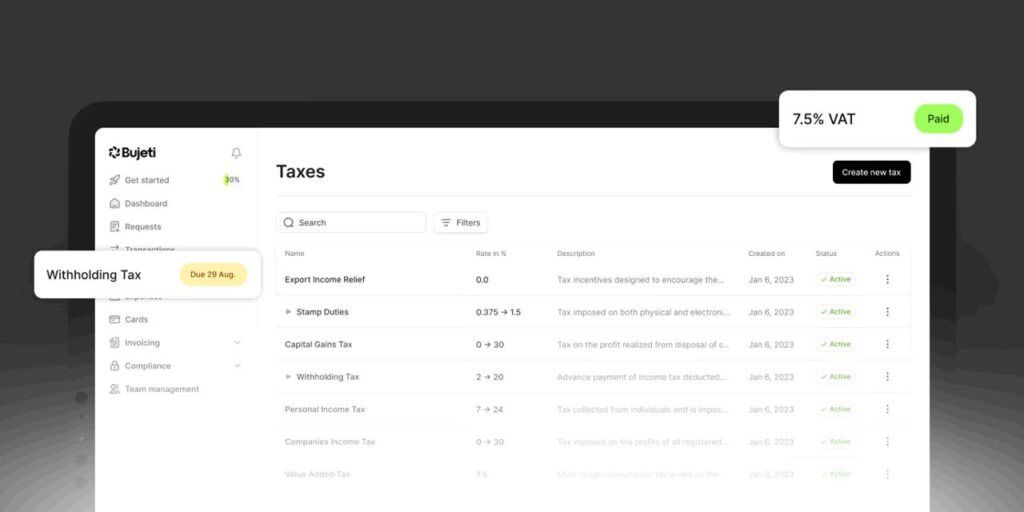

This month, Bujeti launched a tax management solution built into its spend management platform—a product that automatically calculates withholding and value-added taxes, separates tax liabilities into protected accounts, and generates reports for filing.

The Lagos-based fintech, backed by Y Combinator with over $2 million in funding, spent four months developing the tool with input from tax experts at Forvis Mazars and independent consultants.

“Most SMEs don’t fail because they don’t want to comply,” said Titilayo Akinjogunla, Bujeti’s Head of Product Marketing. “They fail because compliance depends on memory, manual tracking, or external advisers who are expensive and inconsistent.”

The product addresses a problem magnified by Nigeria’s new tax rules: businesses often mix tax funds with operating capital, then spend them before remittance is due. Bujeti’s “Tax Vault” automatically ring-fences collected and withheld taxes, ensuring the money stays separated until filing deadlines arrive.

For small and medium-sized enterprises, which contribute 46% of Nigeria’s gross domestic product but typically lack in-house tax expertise, the reforms present a paradox.

Companies with annual revenue below 100 million naira (roughly $60,000) now qualify for zero corporate income tax—but they must still file returns to maintain that status. Higher withholding tax rates apply to vendors without valid tax identification numbers, forcing businesses to verify counterparties before making payments. Penalties for late or incomplete filings have increased.

“The cost of weak financial infrastructure is rising,” Samy Chiba, the startup’s cofounder and operations Chief, said in an interview. “In a more formalized tax environment, control is not a luxury, it’s risk management.”

Bujeti positions itself as a financial control center rather than a digital bank. The platform issues corporate cards with customizable spending limits, enforces approval workflows before payments are made, and now calculates taxes at the transaction layer. The company serves over 5,000 finance professionals across Nigeria and Kenya, with clients including payments company Mono and car rental startup Autogirl.

The tax management launch follows Bujeti’s recent release of mobile applications for iOS and Android, extending payment approvals and expense tracking to smartphones. The company also formalized partnerships with Nigeria’s Small and Medium Enterprises Development Agency in May 2025 and joined the Presidential Committee on Economic and Financial Inclusion’s “SheIsIncluded” initiative earlier this month—moves that signal institutional validation as the platform matures.

Across Africa, regulators are pushing for greater transaction visibility and predictable revenue collection. Nigeria’s reforms are not unique—similar pressure is building in Ghana, Kenya, and Egypt as governments seek to formalize business operations and expand tax bases. Bujeti’s expansion roadmap includes additional currencies and multi-country tax support.

The broader trend matters for investors watching African fintech. The continent’s business-to-business financial technology sector is growing at 13 to 15 percent annually, and fintech revenues across Africa are projected to reach $30 billion by 2025, according to industry estimates. Platforms that embed compliance into workflows—rather than treating it as an afterthought—may gain structural advantages as enforcement intensifies.

Arouko argues the value proposition extends beyond avoiding penalties. “Once money leaves your account as tax, getting it back is super difficult,” he said. “So the real value is stopping mistakes before payment happens.”

For now, the company is betting that as African governments tighten compliance requirements and compress filing windows, businesses will pay for systems that make mistakes harder to make. The product is live, the partnerships are institutional, and the regulatory momentum is building.

Bujeti Tax Management is available to existing users via the platform’s Taxes module.

Last updated: February 12, 2026