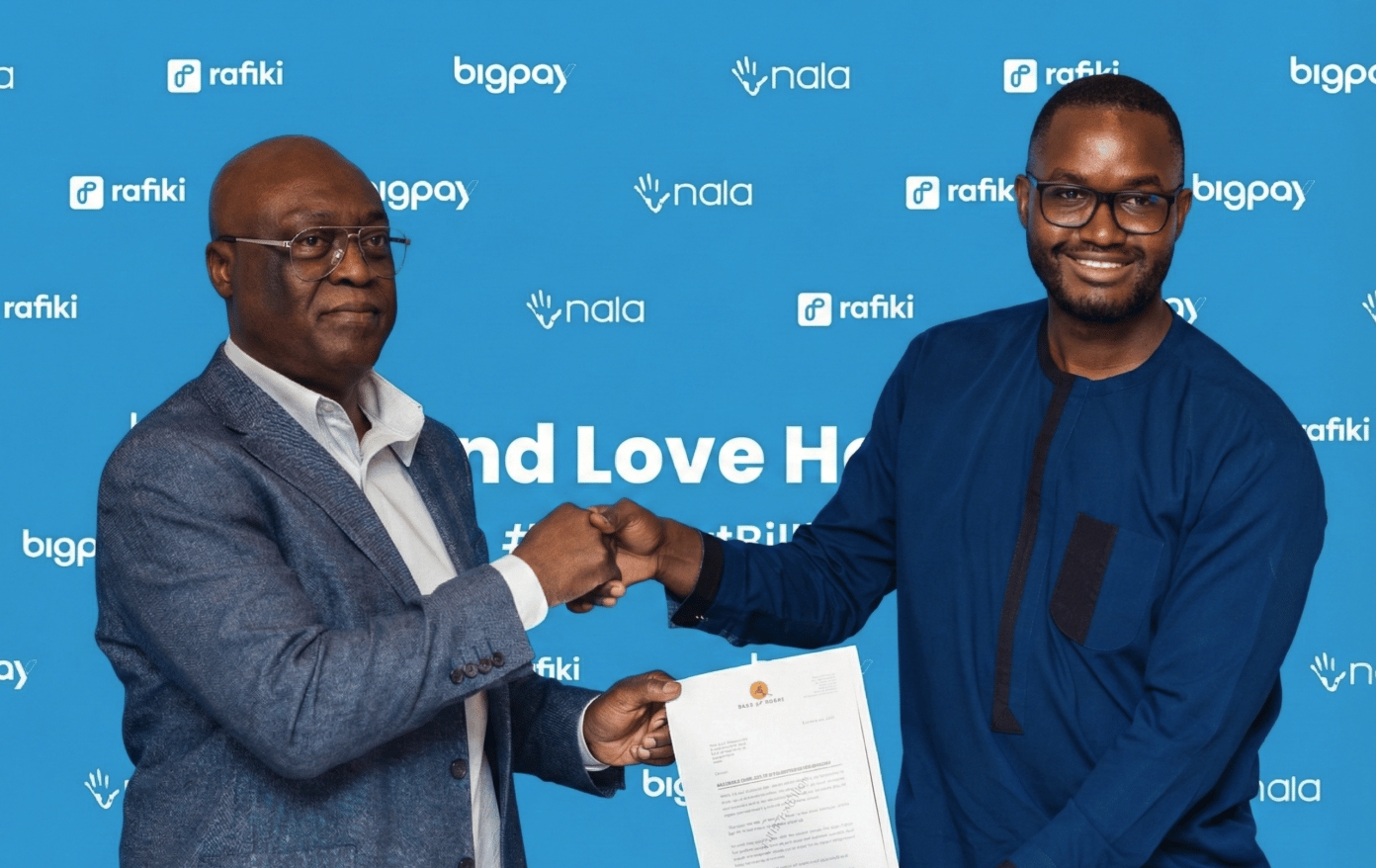

NALA has entered into a partnership with BigPay, a licensed Ghanaian Payment Service Provider (PSP), following its Letter of No Objection (LONO) from the Bank of Ghana to deliver remittances to the country.

Ghana is a key remittance destination in Africa, receiving $4.6 billion annually through formal channels. This ranks it in fifth place behind heavyweights Egypt, Nigeria, Morocco and Kenya, and ahead of South Africa.

Speaking on the LONO, NALA CEO and founder, Benjamin Fernandes said, “We are thrilled to receive official approval from the Bank of Ghana to operationalise our remittance flows in partnership with BigPay…BigPay’s capabilities and reputation make them a natural partner for our mission.“

“This approval from the Bank of Ghana opens a new chapter of opportunity; not just for our two organizations, but for the millions of individuals and businesses who rely on secure, affordable, and efficient financial services,” said Isaac Tetteh, Managing Director, BigPay.

Headquartered in London but founded in Tanzania, NALA is a growth-stage fintech building cross-border payment solutions for individuals and businesses through its NALA and Rafiki brands, respectively. Through the NALA remittance play, it enables migrants in the US, Europe and the UK to send remittances to Africa, a continent that receives $100 billion in remittances annually. Through Rafiki, the group enables businesses to make payments to and from emerging markets, like Africa.

NALA’s B2B expansion played a significant role in the company’s ability to raise $40 million in Series A funding, one of the largest ever by an African company.

Bank of Ghana’s history of banning remittance services

Navigating the regulatory terrain in Ghana’s contested remittance space is not straightforward.

On November 16, 2023, the Bank of Ghana declared eight money transfer operators (MTOs) as operating illegally in the country, including known names like Wise, PayPal’s Xoom and LemFi. As a result, providers like LemFi temporarily suspended their service to Ghana. LemFi resumed three months later, in February 2024, after securing BoG approval.

Similarly, two months ago, the Bank of Ghana struck again. It suspended the remittance partnerships of five remittance providers, including Taptap Send, Send App and Afriex. The press release stated that, “These MTOs conducted unauthorised remittance activities with PSPs – Halges Financial Technologies Limited, Cellulant Limited and Flutterwave Inc., through their settlement bank, UBA Ghana.”

Flutterwave expressed surprise at the suspension directive. “We are surprised by this directive as we have always maintained a cordial and collaborative relationship with the Bank of Ghana. We believe this development arises from a misunderstanding, and we are already in touch with the BoG and our banking partner to clarify matters and work towards a swift resolution,” reads a Flutterwave statement.

A way forward

Countries with volatile and less liquid currencies often attribute the deterioration of their macroeconomic conditions to external factors, like remittance providers. They argue that Money Transfer Operators (MTOs) arbitrarily determine exchange rates, thereby influencing the value of their currencies. They use frequent directives aimed at dictating payout currency (local or USD), moderating new MTO applications or existing remittance partnerships, and specifying FX rate margins to control the market. In 2021, former Central Bank of Nigeria Governor Godwin Emefiele blamed a parallel market rate aggregator, AbokiFX, for undermining the economy.

NALA would be wise to learn from the history of its predecessors as it takes on the Ghanaian market. It is not enough to receive a No Objection from the Central Bank, but ongoing compliance is crucial to prevent reputational damage and service disruptions.

“This approval from the Bank of Ghana marks another step forward in NALA’s mission to transform the global remittance landscape and empower millions through accessible, transparent financial technology,” the startup said in a statement shared with Condia.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: December 12, 2025