Maya Angelou said, “If you don’t know where you’ve come from, you don’t know where you’re going.”

So, let’s align on key moments in fintech to see where the buck is going.

In November 2019, Angela Strange, General Partner at VC firm a16z, delivered a monumental keynote titled “Every company will be a fintech company“. In it, she argued that the SaaS-ification of the entire banking stack would turn every company into a fintech, that is, one that offers financial services without becoming a bank.

The banking sub-sector is notorious for requiring significant capital, heavy reliance on multiple partnerships, and long turnaround times. Yet, it has an established business model. It charges transaction fees and makes net interest income.

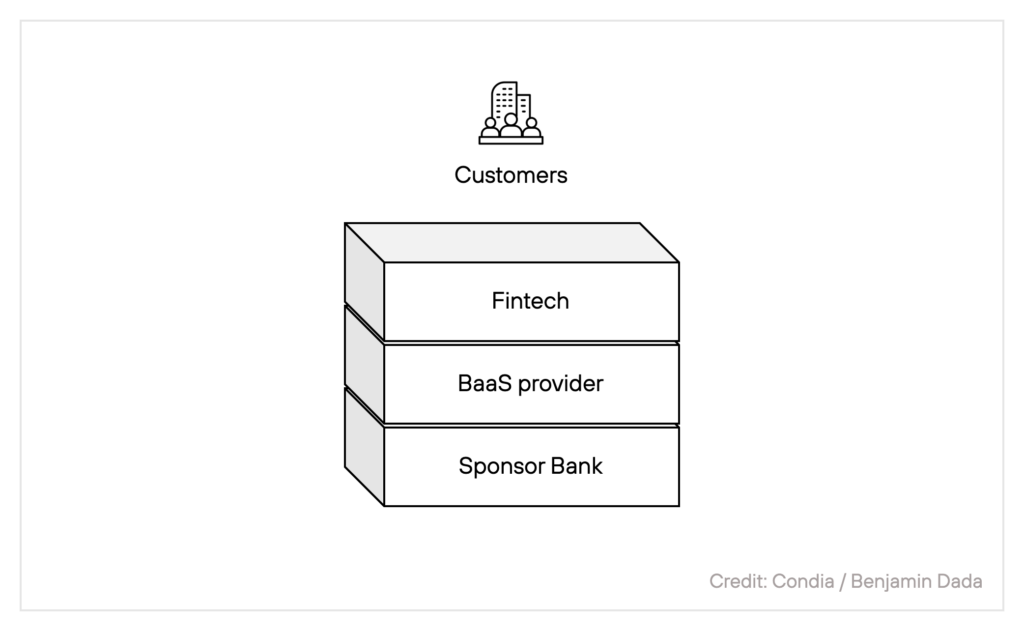

Figure 1 shows a typical banking stack shared by Strange in her presentation. Any company mediating the banking relationship between a fintech (closer to the top of the stack) and a licensed bank is broadly known as a Banking as a Service (BaaS) provider. Figure 2 shows a simplified stack involving just the fintech, BaaS and licensed bank.

With BaaS companies, fintechs could bypass the abovementioned challenges and launch new solutions in weeks instead of years. A new wave of neobanks emerged on the back of BaaS providers.

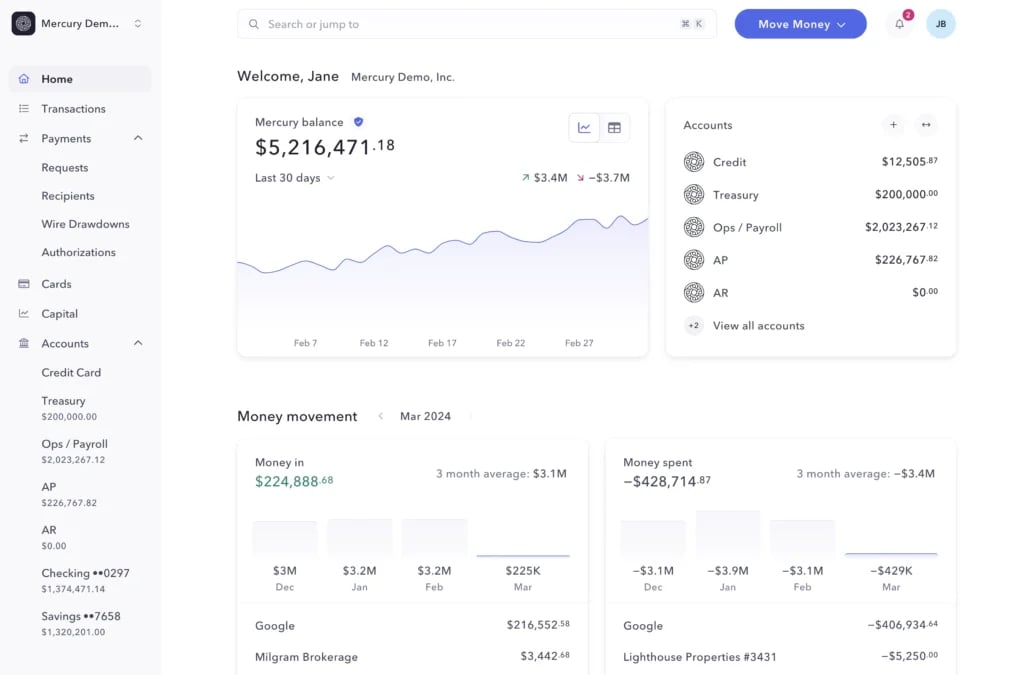

Strange’s embedded finance rally wasn’t without personal interests and an insider’s perspective. Earlier that year, she announced a16z’s investment in Synapse—a BaaS provider in June. Andreessen Horowitz (a16z) led Synapse’s $33 million Series B round. Mercury, a popular neobank that launched business banking solutions in April 2019, used Synapse to issue USD accounts to its customers. Synapse’s primary partner bank was Evolve Bank and Trust, a community bank that built a reputation for partnering with fintechs either directly or through a BaaS.

Unsavoury news about Synapse’s relationship with Evolve Bank and Trust and Mercury

In August 2023, Evolve Bank and Trust notified Synapse of its intention to terminate their partnership. At about the same time, Mercury terminated their relationship with Synapse over billing disputes. Both Synapse’s primary partner bank and marquee neobank client’s split were messy.

In April 2024, Synapse filed for Chapter 11 bankruptcy with about $96 million of customer’s funds still missing. On Christmas day, December 25, Wall Street Journal wrote: The Bank Behind the Fintech Revolution Stumbles After Customer Funds Go Missing

Mercury targeted non-US residents with its USD banking solution, for business reasons, as US residents are better served with banking solutions. Also, immigrants are often underserved by the banking sector mostly because they lack a credit history and a bank-favoured proof of identity like the SSN.

Non-US residents include Nigerians living in Nigeria. Many Nigerians need to open a USD account to participate in the global economy since most of the world’s trade happens in US dollars. For instance, the Dollar is traded in 88% of global foreign exchange transactions and makes up about 60% of global foreign exchange reserves.

However, the existing local commercial banks do not offer a convenient or suitable solution. Onboarding with banks is frustrating. The eventual domiciliary accounts only receive SWIFT transfers which are expensive compared to ACH transfers. In addition, users can’t make international transfers from the comfort of their mobile app. Digital account-issuing fintechs like Wise do not onboard Nigerian residents. So, the likes of Mercury and the African fintechs that came after offered a lifeline.

Thanks to the embedded finance revolution, more US banks (especially the small community banks) were open to becoming partner banks.

Simultaneously, in 2020, the US Federal Deposit Insurance Corporation (FDIC), revised a framework on “brokered deposits” that previously made it harder for banks to take deposits via third parties like fintechs. The final FDIC rule on brokered deposits encouraged the rise of USD-issuing neobanks globally, as the fintechs found it easier to partner with US banks.

Nigeria was not left out.

A new era of core Nigerian cross-border fintech is born

Between 2020 and 2022, a new era of fintechs focused on issuing multicurrency bank accounts, and virtual dollar cards were born. These fintechs include Grey (2020), Raenest—owners of Geegpay ( 2021) and Payday (acquired by Bitmama). Verto, incorporated in 2017, launched multicurrency accounts in 2022.

Also, remittance providers like LemFi (founded in 2020) and Nala (pivoted to remittance in 2021) could now offer USD accounts to African diasporans. Nala partners with Evolve Bank and Trust, according to the website footer. Later-stage fintech Verto launched multicurrency accounts in 2022.

In essence, the first era of cross-border fintech in Nigeria was core.

A third unseen hand that heralded this first era of cross-border fintechs was the ZIRP era (2020-2022). This provided early-stage fintechs with the upfront capital to enter direct partnerships with sponsor banks. For instance, in 2021, Mercury raised a mega round of $120 million in Series B funding. Two years later, it ditched its BaaS partner which helped it get off the ground quickly and went directly to the bank. Speaking of mega-rounds, Flutterwave raised a $170 million Series C in 2021.

Offering USD accounts to non-US residents, especially those on the FATF grey list like Nigeria, carries a heavy compliance burden but it’s surmountable.

The risk associated with providing USD accounts to Nigerians and facilitating currency conversion and cross-border money movement is what makes for its lucrativeness. The Nigerian naira is an exotic or illiquid currency. Thus, net take rates are estimated to be between 1-2.5% which is 25 times better than the net take on G7 currencies. Most of the thriving cross-border startups from this era became profitable by their second year of operation.

The likes of Grey were not the fintech trailblazers in this space, Flutterwave was. In 2017, Flutterwave launched Barter as a retail-focused product for international payments.

However, securing access to a partner bank provides only temporary relief as changes in the bank’s governance stance usually induced by consent orders and enforcement actions by their regulator could cut off a fintech or some of the fintech’s customers from the bank’s services. Mercury, dealing with its regulatory issues in addition to those of its partner banks, has dropped Nigerian startups twice in two years from its list of permissible jurisdictions. Early last year, Flutterwave announced that it was shutting down Barter in a company reorganisation effort. It’s unclear if the shutdown was induced by any compliance or regulation-related action.

To summarise, the BaaS revolution, US FDIC’s 2020 Final Rule on Brokered Deposits and the ZIRP era gave us this set of Nigerian ‘cross-border-native’ fintechs.

Let’s examine what will propel the second era.

The second era of Nigerian “cross-border-adjacent” fintechs

This second era is characterised by a tightened US funding market that requires startups to get default alive. The bar to raise now is higher than the ZIRP era and the existing dry powder is reserved for startups with compelling fundamentals. For many startups, the goal is the extend their runway and preserve their valuation till a potential future raise or exit.

US-based investors account for 60% of the funding that flows into Nigerian startups. Thus, local startups seeking capital from the US are often required to incorporate in the US. Unsurprisingly, four in five Nigerian startups have a US entity. Since investors prefer to invest at the parent company level to maximise returns, the US entity often ends up becoming the parent. As a result, Nigerian startups must report their financial performance in USD, even though their functional currency is the naira (NGN).

Unfortunately, the naira continues to devalue against the dollar. If you thought the strength of the naira in 2020, our reference period, was bad at 380 to $1. As of December 31, 2024 close of 1536 to $1, the dollar has appreciated by over 300% to the naira in four years.

The unification of the Nigerian foreign exchange markets in June 2023 has done nothing to help the situation. Between June 14, 2023 (when the unification happened) and December 31, 2024, the naira depreciated by over 58%.

Despite numerous policies and processes from the CBN, the naira devaluation is not showing any signs of slowing down. The founder of SBM Intelligence, an Africa-focused strategic consulting firm, Cheta Nwanze told Semafor that this year, ” I also expect inflation to remain high, around 28%, and the naira may depreciate to above $1 to 2000 naira [emphasis ours]”.

Naira’s steep devaluation is eroding the value of Nigerian fintechs who have to report their revenues in USD. Doing business in Naira, these startups now have to work twice as hard to book similar or often, worse revenues than in 2020.

Thus, to stymie this erosion of value, fintech startups are turning to markets with stronger currencies to seek growth and sustainability.

Enter the African diaspora and the cross-border payment opportunity.

The move to cross-border payments

Unlike the first era of “cross-border-native” fintechs, the space is no longer a category. It has become a natural progression for those who will see out this funding winter and difficult climate.

Salaries are slow to catch up with inflationary price increases. So, residents of Nigeria will look to their relatives in the diaspora to supplement their income. Thus, we can expect to see more diaspora remittances this year. These remittances serve as a stable source of foreign exchange for the Government which is facing a dwindle in FPIs and FDIs. Thus, diaspora remittances still present an opportunity for builders.

Similarly, naira’s projected slump will increase the demand for USD assets (accounts, and investment vehicles) as a safe haven by locals.

Bamboo, an early-mover in the second era of cross-border fintechs

One wealthtech startup, Bamboo has already announced its expansion into the diaspora remittance space with Coins. Founded in 2020 as an investment app for buying US stocks, Bamboo will now help Nigerians in the diaspora, starting with Canada where it has secured an MSB licence, to send money to Nigeria.

Canada is a popular starting point for remittance startups because of its readily obtainable and versatile Money Service Business (MSB) licence and not just because of the density of diasporan Nigerians there. With a Canada MSB, Nigerian startups can partner with many licenced players in the cross-border payment value chain, kicking off a global cross-border product.

Also, with a Canada MSB, startups will be able to secure a Nigerian IMTO on the foreign route, which presents a more straightforward pathway to IMTO licensing than the local route. Leading remittance player, LemFi also started in Canada and almost every Nigerian cross-border business from the first era has one.

In the ZIRP era, Bamboo, often described as a Robinhood for Africa, raised a $15 million Series A led by two US investors, Tiger Global and Greycroft.

The company is still pushing its original ambitions to democratise access to US stocks for Africans and has recently secured a U.S. Broker-Dealer licence. This licence gives them the optionality of building direct partnerships that enable them to directly offer their US-traded securities instead of relying on DriveWealth LLC.

“This is just the first stage for us to solve a problem that will be useful in serving the diaspora. It is a means to an end, we are building a set of products that will support Africans everywhere.” CEO Richmond Bassey told TechCabal.

To some ecosystem observers, Bamboo’s launch of a remittance product could come as a surprise or pivot. What they fail to see is that Bamboo has simply shown that every fintech can be a cross-border payment fintech.

Combining their core business with the addition of a cross-border angle (which remittances come under) is representative of how many Nigerian startups will operate in 2025 and beyond.

Bamboo’s case for a cross-border (remittance) play

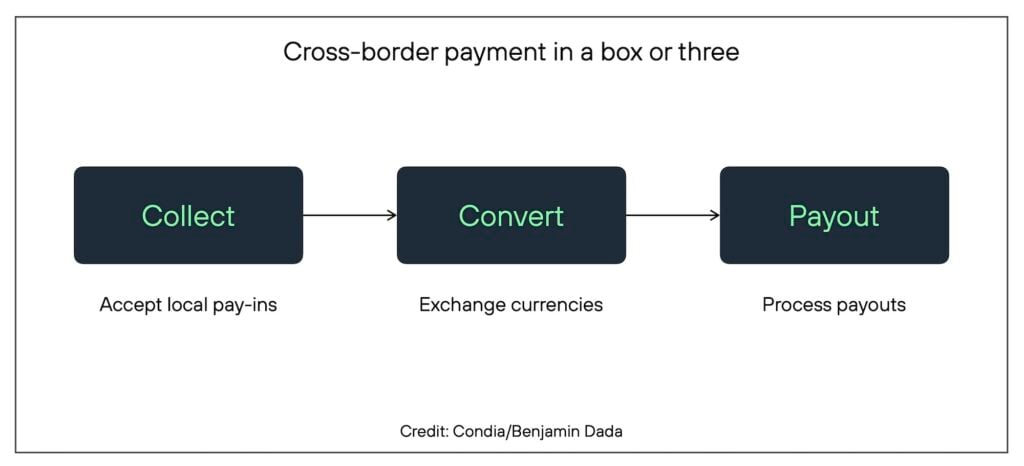

In Bamboo’s case, their core operation of collecting local currency (NGN, for example), converting it to foreign currency (USD), and using it to ‘invest’ (pay for) in US stocks is akin to what the so-called cross-border payment startups do.

It’s only that in the case of Coins by Bamboo, the local currency will be Canadian Dollars and the destination currency, Nigerian naira.

The strengths of a startup like Bamboo that has now dabbled into the cross-border space (remittance) include; existing treasury operations and payment partners.

Most of the big payment infrastructure players in Africa like Flutterwave, one of Bamboo’s partners, are already multi-country and multi-currency. Thus, able to turn a previous-receive (or untapped) market to a send-market. For instance, Flutterwave can collect in Nigeria via its PSSP licence it can also pay funds coming from diaspora to Nigerians via its IMTO licence.

Bamboo can rely on the existing relationship and integration with Flutterwave to power its remittance solution while focusing on its go-to-market strategy.

The investment app can choose to dial up and down across the value chain shown in Figure 1, depending on its business objectives.

Zoom out: the case for other fintechs

Financial services are broad. It includes core areas—basic banking (savings, and loans), payments, insurance, pension, and investment. Other areas include; personal finance management and budgeting. Fintechs start out aiming for a piece of it in an activity known as unbundling. For instance, Bamboo started out focused on the investment piece.

As fintechs grow, they start to rebundle other aspects of financial services, in a strategy that sees them either go deep or wide. With Coins by Bamboo, they chose to go wide in search of other markets.

By dabbling into more than one currency and/or country, local fintechs can instantly become “cross-border” in nature.

So, for instance:

- a merchant acquirer, like Moniepoint, can become the one-stop-shop for its business customers to receive local and international payments.

- a local digital lender, like FairMoney, can start lending in foreign currency.

- a local neobank, like Kuda, can become the bank for the digital nomad.

- an investment app, like Bamboo, can dabble into cross-border payment by offering customers a way to invest back home.

- a PFM or spend management app, like Bujeti, can offer its customers a way to seamlessly track and manage their spending across all their business bank accounts.

- an accounting startup, like Tyms.io, can provide multi-currency accounts to offer real-time accounting insights and eliminate manual bank statement upload.

- a local BaaS startup, like Anchor, offering local accounts can expand to offer USD accounts.

All of the examples listed above, have either already launched their cross-border aspirations, actively or passively exploring.

While the Nigerian “cross-border-native” startups era took off in 2020/2021, with the likes of Grey and Raenest (neobanking), the unrelenting consumer demand for USD and storage accounts, and the need to expand to markets with strong currencies will welcome new “cross-border-adjacent” entrants.

Implication: more cross-border-native startups will emerge to sell shovels

The implication of this gold rush to cross-border payment is that more players selling shovels (infrastructure) will emerge. Shovels in cross-border payment include providing FX wholesale liquidity services, issuing re-issuable virtual accounts, and becoming a super-aggregator for payouts.

It might be hard to list startups operating in the infrastructure space because often the lines between being retail or wholesale-focused blurs since the components are still the same. At other times, we see startups oscillate from one to the other.

For instance, Nium (popular for its payout service) started as a remittance product, Instarem. Wise, which started as a consumer-facing brand now offers a B2B product called Wise Platforms. In Nigeria, the likes of Fincra (launched in 2021), Waza (founded in 2022), and Juicyway (founded in 2021) have emerged with the shovels.

On Monday, January 6, I will be hosting an online conversation with the Juicyway executive team on why Cross-border payments are hot and hard. Set a reminder to join!

Editor’s note, Jan 6, 17:15 (WAT): We corrected the interpretation and figures of USDNGN appreciation and NGNUSD depreciation.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore