The release of the Nigeria Fintech Map 2025 yesterday shows that the fintech boom is here. With over 500 logos jostling for space across payments, lending, and wealth management, the map looks like a crowded Lagos bus stop.

But beneath the logo fatigue lies a deeper question. If the United States currently sustains over 13,100 fintechs, is Nigeria’s 500-strong army an excess?

The numbers game

To understand if Nigeria is over-finteched, we must look at the infrastructure vs. efficiency paradigm:

- The US: In the US, there are companies solely dedicated to student loan refinancing for veterinarians or AI-driven tax optimization for gig workers. They aren’t building banks but features.

- Nigeria: The 500 fintechs are largely building the pipes. Because traditional banks had low penetration for decades, fintechs like Moniepoint and OPay had to build their own rails. In 2024 alone, Nigeria processed nearly 11 billion real-time transactions, pipes that require massive, localized maintenance.

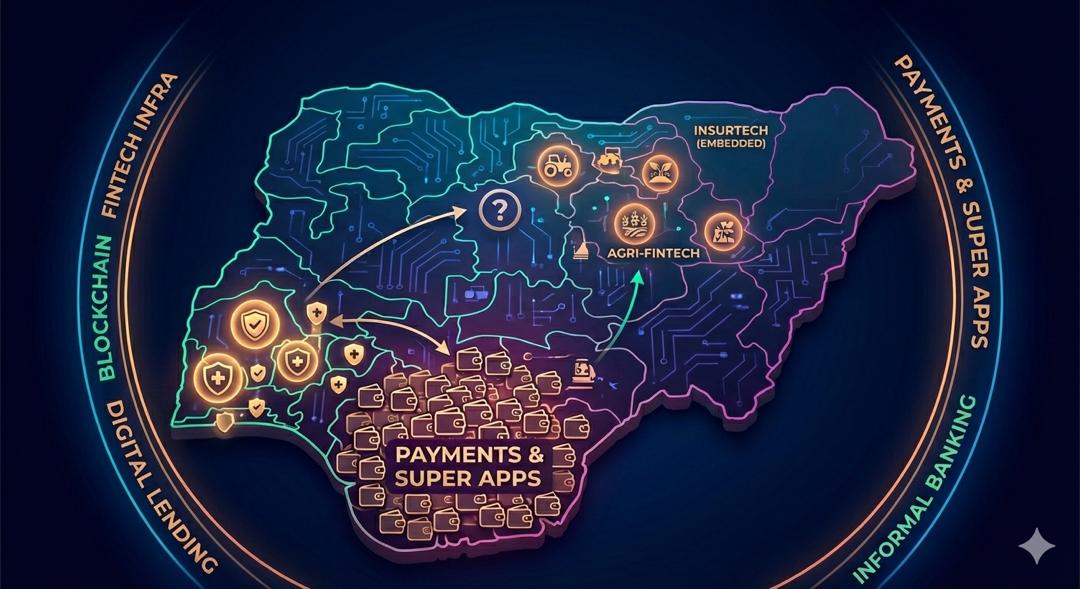

The 2025 map: a story of uneven growth

Looking at the 2025 map, the distribution reveals an ecosystem that is both overcrowded and underserved:

| Sector | Map Density | The Need Verdict |

| Payments | Extreme | Over-saturated. We are currently in a period of heavy consolidation. |

| Digital Lending | High | Essential but Risky. In the high-interest environment of 2026, credit is a lifeline for SMEs. |

| InsurTech | Low | Desperately Needed. Penetration remains below 1%. |

| Fintech Infra | Medium | Critical. The picks and shovels allowing non-tech firms to offer finance. |

Where the next billion-dollar companies live

The map shows that while Payments is a crowded boxing ring, InsurTech and Agri-Fintech have become the vast, open territories of 2026.

For years, insurance was the forgotten child of Nigerian fintech. However, the game changed with the passage of the Nigerian Insurance Industry Reform Act (NIIRA) 2025 last August. In 2026, insurance is becoming invisible. Buying a bus ticket on an app? A ₦200 accident cover is bundled in. Small-scale pay-as-you-go health cover (pioneered by players like Reliance Health or Casava) is also now available for as little as ₦500/month.

Nigeria is now the fastest-growing agritech market in Africa. The fundamental problem has always been that 95% of agricultural land lacks formal title, making it useless as bank collateral.

But companies like Winich Farms and Crop2Cash are rewriting the rules. Instead of land titles, they use a farmer’s transaction history or produce stored in a warehouse as collateral. Just this week, the government launched FarmerMoni 3.0, aiming to provide interest-free loans to 22,000 farmers via private fintech infrastructure.

We don’t need 500 identical apps

Nigeria does not need 500 payment wallets. However, it absolutely needs 1000 diverse financial solutions.

Many of the 13,000 fintechs in the US exist because they solve tiny, specific problems for 330 million people. Nigeria has 220 million people with massive, structural problems: identity, credit history, cross-border trade, and agricultural hedging. We are currently over-indexed on payments and under-indexed on the real economy.

Most of those logos are fighting over the same 20 million banked urbanites. The real winners of 2026 may be the ones who find the sectors where there are only two or three logos instead of fifty.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: February 12, 2026