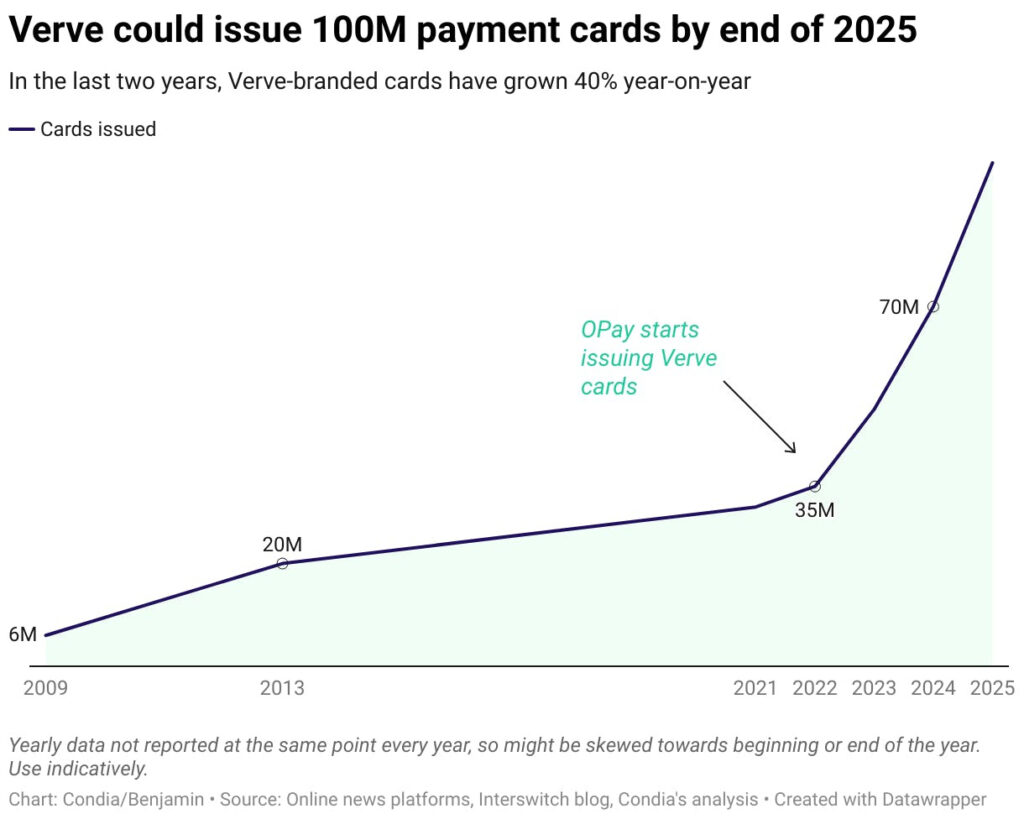

🍔 Quick Bite: Interswitch’s group revenue—which is 94% from Nigeria—grew by 33.7% to ₦91 billion (~$70.5 million) for the year ended March 2024, driven by its Digital Payments segment, which contributed 72% of revenue and grew 41% year-on-year. Verve was a key growth driver, doubling its card issuance to 70 million in two years. However, the company posted a ₦1.7 billion loss before tax, highlighting rising costs and the need for better cost management to sustain profitability.

Interswitch’s latest financial report is a tale of contrasts: soaring revenues and unexpected losses. The Nigerian fintech giant, long celebrated as a leader in the digital payments space, grew its revenue by 33.7% to an impressive ₦91 billion (~$70.5 million) in the fiscal year ended March 31, 2024. This represents a 14% improvement over their growth rate of 2023 and a staggering 135% increase from their 2021 revenue of ₦39 billion.

But it’s not all smooth sailing for the company. While revenue soared, profitability took a significant hit. Interswitch posted a ₦1.7 billion loss before tax, a sharp turn from the ₦12 billion profit before tax recorded in 2023.

Despite the loss, Interswitch’s top-line growth tells a compelling story. The company’s Digital Payments segment—transaction processing, card issuing, and bill payments—performed excellently. It grew by 41% and contributed 72% of the group’s revenue.

What’s behind the loss?

The two factors behind Interswitch’s ₦1.7 billion loss are movements in exchange rates and operational losses.

The cited foreign exchange volatility of ~460 to 1,300 Naira to a dollar crippled the company whose cost base and liabilities are heavily dollar-denominated. Likewise, the company made provisions for its residual share of liability from a major chargeback fraud whose recovery is yet to be completed. In November 2023, we reported the total amount of the fraud amount to be ₦30 billion, with ₦10 billion recovered.

Adjusting for these two loss drivers, the group would have made ₦23 billion in profit before tax (PBT), a 43.48% jump over last year’s PBT.

Nonetheless, the company’s actual losses in foreign exchange liabilities and payments call for a reevaluation of its cost base, which seems to be predominantly in US dollars and hedging strategy. Likewise, the company stated that the chargeback fraud “has resulted in a further review and tightening of existing policies and their observance.”

A blessing and a curse

The foreign exchange crisis in its home country has been a blessing and a curse for the group. We’ve discussed the curse above, now let’s pick on the blessing, Verve’s ~40% year-on-year growth in the last two years.

A component of their Digital Payments segment and a subsidiary, Verve International could hit 100M issued cards if it continues on its recent growth trajectory. You should read the full Verve story on our website, after this newsletter.

However, competition looms from the regulator-backed AfriGO cards operated via NIBSS, the industry’s tech provider and central switch. They have already secured a similar partnership with OPay, one of Verve’s marquee clients.

Verve will now look to rapidly expand its acceptance network to give end consumers and partner issuers more reasons to stick with them. In our Verve story, we cited their AliExpress partnership and the upcoming one.

2025 will be defining.

| Bonus: While Interswitch, the first fintech unicorn has just hit ~ $70 million, Moniepoint—founded by former Interswith employees and the latest unicorn—does more than 2x in revenue. |

📈 Trending Stories

Here are other important stories in the media:

- Temu enters Nigeria. How will it survive where others like Jumia have struggled

- Nigeria’s Central Bank will start to penalise Nigerian banks for cash shortage from December 1

- Namibia shuts down Starlink for operating without licence, confisticates equipments

- Why African Agritech startups tackling climate change attract more funding

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Luminous Digital — Product Manager, Lagos

- RexPay — Product Manager, Hybrid

Data & Engineering

- Develocity — Senior Frontend Engineer, Remote

- Deel — Frontend Engineer, Remote

- Wave — Senior Android Engineer, Remote

Admin & Growth

- Moniepoint — Videographer, Lagos

- Moniepoint — Communications Specialist, Lagos

- ClickOut Media — Head of Content, Remote

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore