Africhange is a remittance service that allows Nigerians in Canada to send money back home at the best rates

Political and economic instability coupled with hopes of a shot at a better life have been the driving forces behind African emigration to the global north over time.

Favourable government policies in recent times have seen Canada rise to become one of the most popular destinations for immigrants. The country faces an acute shortage of human resources and has turned to skilled immigrants to fill the gap. For many members of Africa’s thinning middle class, that gap is one they want to fill.

According to publicly available data, over 50,000 Nigerian citizens have gotten permanent residency (PR) in Canada since 2015. Trends have shown an increasing number of immigrants getting PRs for every year since 2015, except for 2020 when the covid pandemic put a stop to global travel. The numbers look to have picked up in the first half of 2021 and looks to surpass previous records.

Immigration, however, rarely means that immigrants are completely cut off from their home countries. There are always family members, friends, and responsibilities left behind to take care of. Responsibilities are often synonymous with finances for Africans in the diaspora. However, staying financially connected to Africans across borders has historically been difficult.

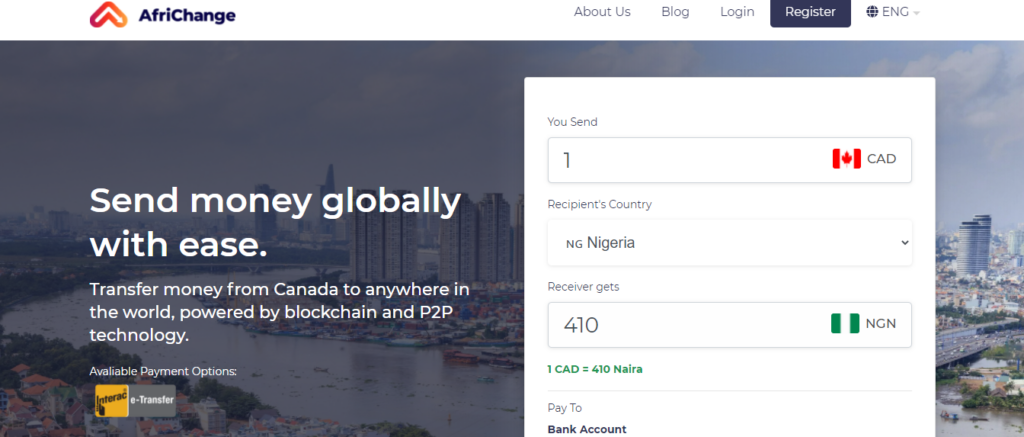

That challenge is what the AfriChange team is solving. With team members in Canada and Nigeria, the AfriChange team is very much aware of how difficult it is to send money across the two countries. Traditional foreign exchange platforms like WorldRemit, Wise, Moneygram, and co are labourious, sell at unfavourable rates, and have had their charges described as “ridiculously high”.

Founded in December 2020, AfriChange has been building a platform to enable Africans in Canada to transfer money back to their folks at home at a faster and cheaper rate. “We’ve built AfriChange to be useful for anyone in Canada who has to send money to Africa, starting with Nigeria” said Tega Gabriel, Communications Manager at AfriChange

The company prides itself in offering some of the sweetest rates for foreign exchange for people in the diaspora. Compared to some traditional remittance platforms, Africhange offers near 33.5% more on each Canadian dollar. This means that for Africans in Canada looking to send money to family members or friends, less can be more.

AfriChange is able to access these higher rates and power payments through blockchain technology and cryptocurrency which is abstracted to give users a unique, seamless remittance experience.

Using AfriChange

As mentioned earlier, Africhange is designed to give a seamless experience to anyone looking to send money to Nigeria. The company is registered in Canada and regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)— the Canadian body responsible for monitoring the financial activities of companies in the country.

To send money using AfriChange, users need to take the following steps:

- Go to the website and input the amount of money you want to send.

- Log in to your Africhange account (or create a new one if you’re a first-timer)

- Input the details of the recipient

- Confirm the transaction details

- Send the Canadian dollar equivalent to Africhange

Users have to create an account due to anti-money-laundering concerns in Canada and Nigeria. The process is very simple and recipients receive the equivalent transaction pretty quickly. According to Tega, transactions typically take only a few minutes to confirm.

Conclusion

Although it is only a few months old, AfriChange is bullish about its product and the market it wants to serve. “The name signifies that we are building for the whole of Africa. We want to create a better remittance experience for Africans in Diaspora,” Tega mentioned to Benjamindada.com

The company plans on expanding to new countries in the near future. A few months ago, it had a Canada to Mexico exchange, however, that has been put on hold until it consolidates the Canada-Nigeria remittance market.

The challenges around cross-border transactions are plentiful and unlikely to disappear anytime soon for most Africans. However, if Africhange can continue to offer incredible rates as they do today, there’s very little in the way of them becoming a household name in remittance.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: November 23, 2024