What are Nigerians doing with their money?

With over 5 million users and ₦2 trillion ($2.8 billion) paid out, PiggyVest has become a force in West African savings. The 2024 Savings Report, based on a survey of 10,000 Nigerians from diverse backgrounds, marks the second annual release of insights into the evolving financial habits of Nigerians.

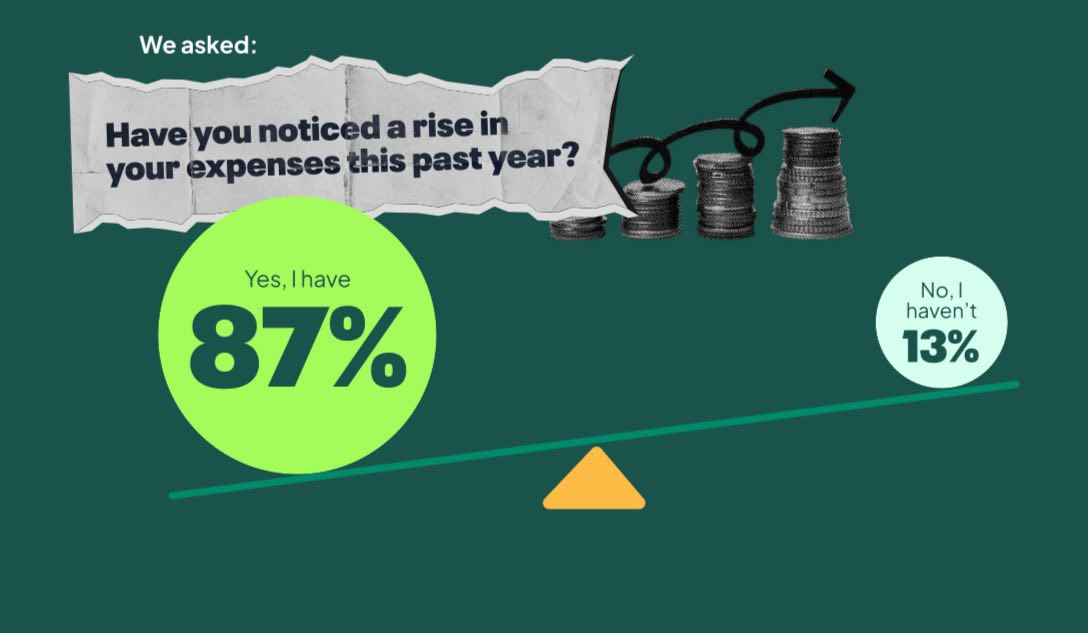

This year’s findings reveal a worrying increase in the percentage of individuals not saving at all—now at 43%—compared to last year. Food continues to dominate spending, with 83% of respondents prioritizing it as their top expense, while the economic burden of supporting extended family remains significant, with many still facing the pressures of “black tax.”

How these changes will reflect broader trends is something to look out for. We have highlighted the five most compelling discoveries in this article.

37% of Nigerians earn below ₦100,000 monthly

More than a third of Nigerians now report earning below ₦100,000 per month. This trend impacts daily budgeting decisions, as higher costs of essentials are leaving little room for disposable income.

Men are 1.4 times more likely to earn over ₦1,000,000 than women, while Generation X generally has multiple income streams, unlike Gen Z, who largely rely on a single job.

With older generations adapting to financial pressures with extra sources, Gen Z may feel the pinch most, as their single incomes compete with rising expenses.

46% of Nigerians contribute monthly to extended family

The cultural expectation of financially supporting extended family, or “Black Tax,” affects over two-thirds of Nigerians, with nearly half contributing monthly and another quarter helping occasionally.

This burden takes a toll on disposable income, especially for younger earners and entrepreneurs who might otherwise reinvest in their own growth.

43% of Nigerians don’t save or used to save

With inflation now at 32.15%, the daily reality of making ends meet has cut down savings for 43% of Nigerians, who either stopped saving or were never able to start. Essentials like food, which make up 83% of expenses, keep taking up a bigger chunk of budgets.

For some, building emergency savings simply isn’t possible, leading to a heavier reliance on short-term fixes. As necessities continue to rise in cost, the stability once offered by regular saving habits is becoming less attainable for many.

30% of Nigerians own businesses

Entrepreneurship is thriving, with 30% of Nigerians, particularly among women and Generation X, running businesses. With high unemployment among youth and a rise in digital access, business ownership has become both a survival strategy and a path to independence.

Tech-driven businesses and side hustles now provide practical income options, creating a generation that values flexible, adaptable income sources.

45% borrow from friends and family

The report also highlights about 21% of Nigerians being in debt, relying mainly on informal lending from friends and family (45%) due to limited access to institutional credit.

Limited access to banks and lending platforms makes this trusted system a necessity for many. However, this high-trust lending culture signals a need for fintech solutions that provide secure, accessible credit options.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: November 1, 2024