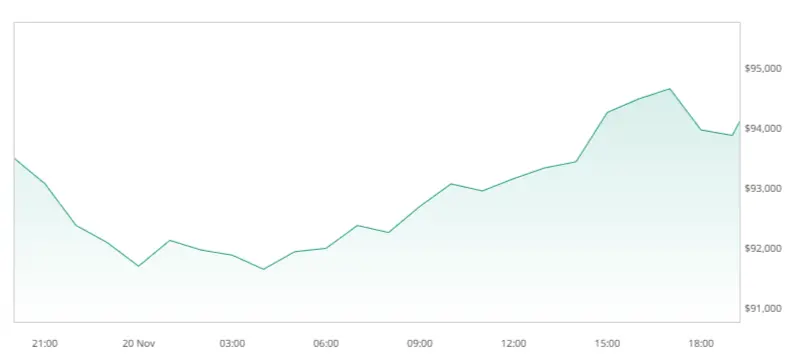

Bitcoin has just reached a new all-time high, closing at $94,100 in the latest trading session. This surge is attributed to significant developments in the crypto and financial sectors, including reports of Donald Trump‘s media company exploring the acquisition of crypto trading firm Bakkt and the introduction of options trading for BlackRock’s iShares Bitcoin Trust (IBIT.)

Earlier today, the world’s largest cryptocurrency, Bitcoin saw its value rise sharply, touching a record high of $94,078 before settling slightly lower at $92,879, as reported by Coindesk. This historic jump has propelled the global cryptocurrency market valuation beyond $3 trillion, setting a new benchmark, according to CoinGecko.

Reports indicate that the announcement of Donald Trump’s social media and technology company’s (TMTG) pre-acquisition of Bakkt, a crypto trading platform, played a significant role in this latest development. Financial Times reported that Bakkt (BKKT) is currently valued at over $150 million, with the deal excluding its crypto custody business, which is projected to decline.

Following the announcement, shares of Trump Media and Bakkt soared, with Trump Media shares rising by 16% to $32 and Bakkt’s by 162% to $29. This surge in Bitcoin’s price follows Trump’s recent victory in the U.S. presidential election, which has seen Bitcoin and other cryptocurrencies like Dogecoin experience significant gains.

During his campaign, Trump positioned himself as the “crypto candidate,” embracing digital currencies on multiple fronts, including accepting donations in various crypto assets. A month before the election, Trump launched World Liberty Financial, a decentralized finance (DeFi) protocol aimed at bridging traditional finance and DeFi.

At a Bitcoin conference in Nashville, Trump expressed his vision of making the United States the crypto capital of the world, even suggesting the establishment of a crypto reserve to cover the nation’s $36 trillion debt. His victory has further fueled Bitcoin’s rise, with the cryptocurrency reaching multiple all-time highs in recent weeks.

Market analysts like Tony Sycamore from IGcom and Chris Weston from Pepperstone have noted that Bitcoin’s rise is supported by the Trump deal talk and traders taking advantage of the first day of options trading on the Nasdaq over BlackRock’s Bitcoin ETF. Bitcoin’s market cap recently reached $1.77 trillion, securing its position as the world’s eighth-largest asset, surpassing silver and Meta.

The recent surge in Bitcoin’s value has been driven by institutional adoption, growing interest from hedge funds, and heightened global economic uncertainty. As Bitcoin climbs to new heights, it signals not only the expanding interest in cryptocurrencies but also highlights the shifting dynamics of the global financial markets.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore