Updated: April 24, 2024

This review was originally published in 2023 to provide an in-depth look at Geegpay’s virtual dollar card. Since then, Geegpay has introduced several new features and updates to its card offering. This 2024 update highlights the key changes and additions users should be aware of. For the most up-to-date information on Geegpay’s virtual dollar card, refer to our 2024 review.

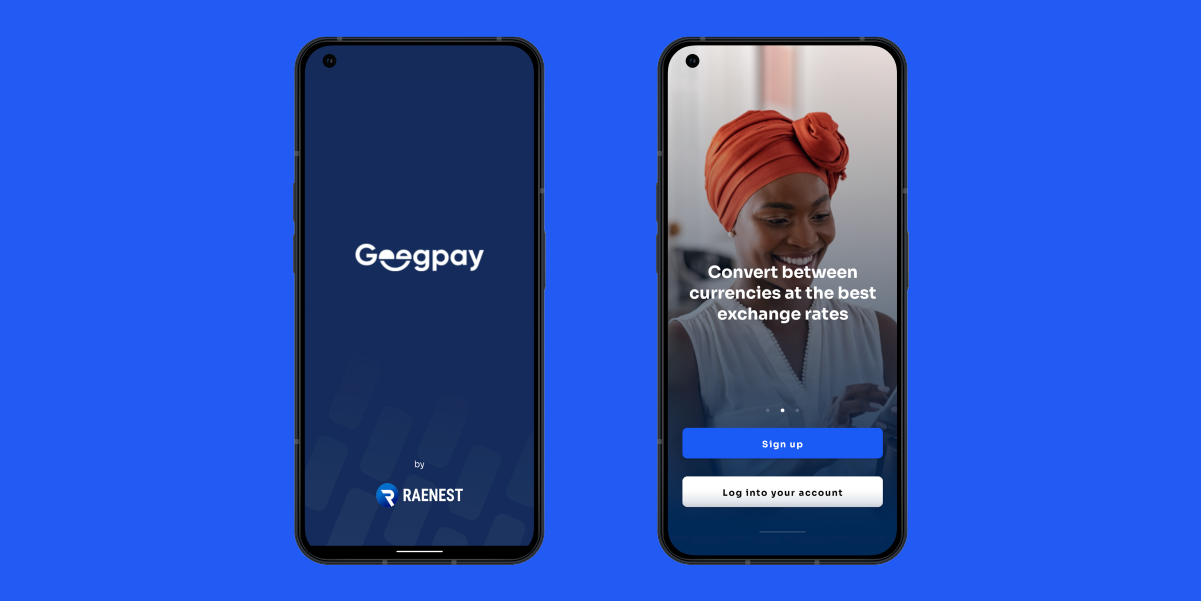

Geegpay offers Africa’s remote workers and freelancers an instant and fully functional way to get paid by their foreign clients faster while saving on unnecessary fees.

The flagship product by Raenest creates virtual bank accounts to send and receive money, multi-withdrawal channels, multi-currency wallets and invoicing. These services are building borderless payment infrastructure for African talents and businesses.

As Africa’s population keeps increasing, skilled workers are having to think beyond borders due to the continent’s high unemployment rate. By acquiring digital skills, African talents can work remotely for international companies.

From the employer’s side, companies are going borderless. Businesses are no longer hiring talents within their geographical locations alone, but are extending their search to the rest of the world. This opens them up to a greater range of talent options and suitable work models, like full-time, part-time, and project-based hires.

However, making and receiving payments has been a challenge for most Africans. Global payment platforms like PayPal and Payoneer either exclude some African countries (like Nigeria) or have exorbitant fees.

Moreover, local bank cards are restrictive with spending which is pegged as low as $20 monthly for users. Also, not all the cards are accepted by multinational e-commerce platforms like Facebook ads, Ali Express, Twitter ads, Google ads, Apple Music, UKIV, Amazon, GCP and Canva.

This is where products like Geegpay come in handy. The fintech solution has become a popular platform for African freelancers on sites like Upwork and Fiverr. Within a year of launch, Raenest has processed tens of millions of dollars for freelancers and employees on these platforms.

We’ve reviewed other virtual card services in the past. Now, it’s time to review Geegpay’s virtual dollar card. Please note that the scope of this article is limited to my experience with their card feature and doesn’t extend to anything else.

What’s Changed: Creating a Geegpay Virtual Dollar Card

Download the Geegpay app from Google Play Store, signup and get your account verified.

Let’s dive in right away.

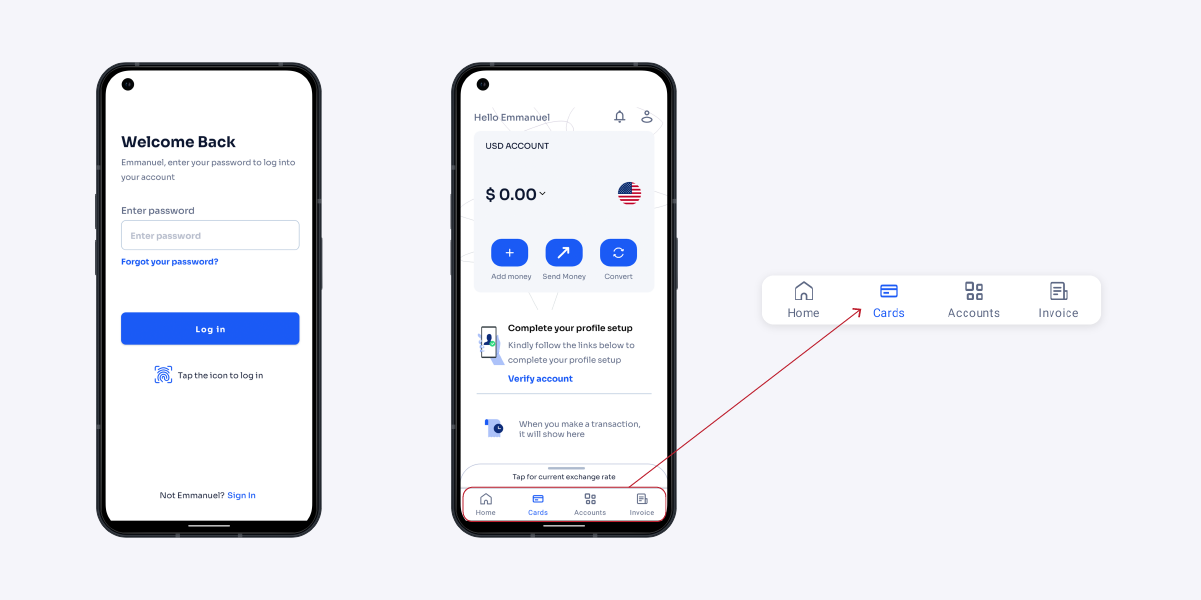

Log in to the app. Check the four buttons at the bottom of the app, and click the card icon 💳.

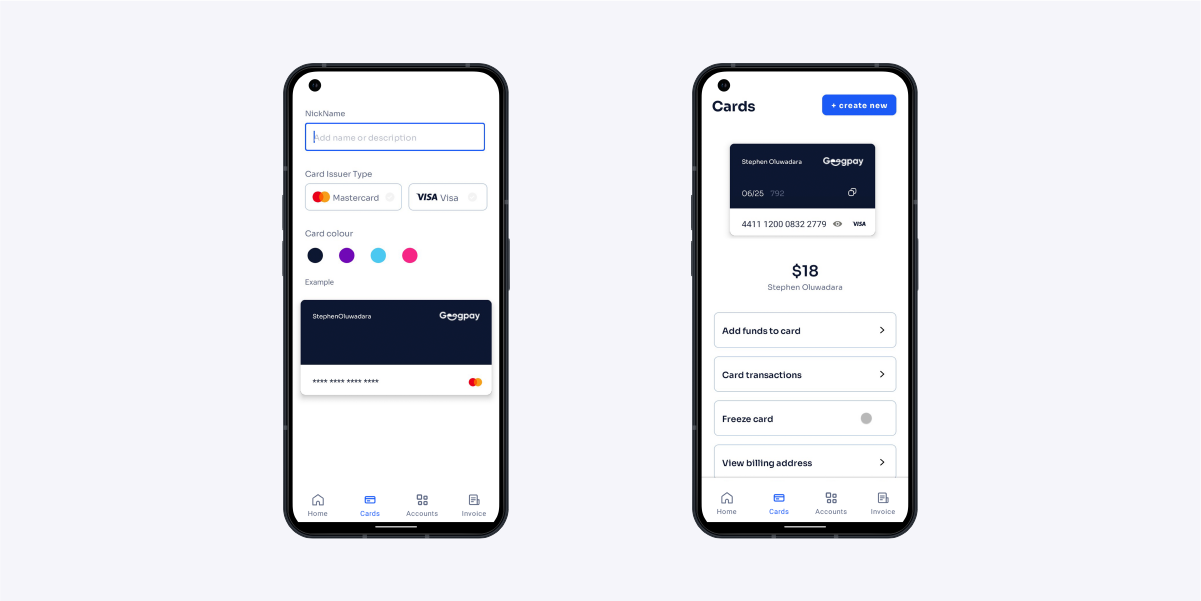

Click on the virtual card tab, then create new. To get started, I must fill in the nickname. The nickname on Geegpay could be an Alias or the purpose of the card. Geegpay now allows you to create up to three virtual cards simultaneously, so I can create a card for advertising, another for bills, another for family, and so on. This offers greater financial flexibility! I can also select a card type I want because there are two types—the Mastercard Card and the Visa Card.

To use the Mastercard, your wallet will be charged $3.0 for card creation and the minimum amount you can fund is $2. Meanwhile, if I use the Visa Card, I’d be charged $2.0 for card creation and minimum amount I can use to fund the account is $2.0.

The funding of the card will be done from my Geegpay wallet.

Funding your account

For first-time card creation, you must fund the card. The minimum funding amount is $2. The money will stay on your card as it is not a fee.

How can you get the $2 or the exact amount you need to purchase what you want into your wallet in the first place? You can use naira to fund your Geegpay wallet, and then, when funding the card, it would help you with currency conversion.

The “Add Money” helped me fund my Geegpay wallet with Naira, providing easy currency conversion for my virtual card and the option to link it with Google Pay and Apple Pay for convenient contactless payments. You can only use bank transfers from your local Nigerian bank account. Remarkably, Geegpay does not charge a fee for funding a wallet, unlike other virtual dollar cards.

On currency conversion, what’s the exchange rate? Also, are there any additional fees for funding the Geegpay wallet?

It was stated in the bank transfer details that the transfer processing fee was zero. Geegpay does not attach any hidden transaction processing fee to the exchange rate. This makes it one of the cheapest virtual dollar cards in Nigeria.

Interestingly, they are more economical than a cross-border fintech app we recently reviewed. If you are a heavy spender, you get to save more naira on Geegpay.

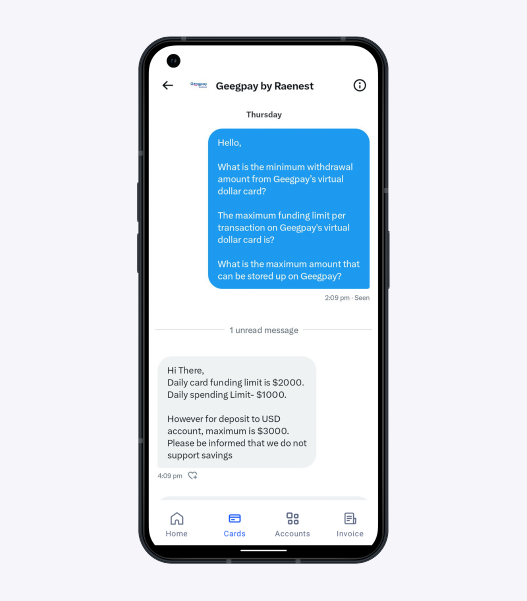

The maximum funding limit per transaction on Geegpay’s virtual dollar card is $2,000 and the daily spending limit is $1,000. However, Geegpay allows you to increase your limit. All you need to do is send a message to their customer service and your limit will be increased.

Using a Geegpay Card

I’ve been meaning to buy a smart wristwatch since my last watch was stolen. So I’m going to use this opportunity to gift myself a smart wristwatch from Aliexpress. I’ll purchase the smart wristwatch using my Geegpay USD Card. It costs $18.49.

I funded my wallet with $20. Immediately, I initiated the card creation I was sent a mail that my card will be created within 5 to 15 minutes. As they stated, my card was created with 10 minutes and I paid for my smart wristwatch.

As shown in the image above, the steps to spend using a Geegpay Card are straightforward.

- Login to your app.

- Go to your Card in the app.

- Ensure your card is well funded for what you want to use it for.

- Click on the eyebar, so your card details can be shown.

- Directly copy the details and paste them into the online shopping site.

Withdrawal

Although Geegpay does not support withdrawal from the card, I can withdraw from the main wallet. Funds moved to the card cannot be withdrawn. Expectedly, the withdrawal value of the dollar is lower than what I paid to fund the account.

As at the time of my withdrawal, the exchange rate from one dollar to naira was ₦745 — a spread of ₦25 from what I paid to buy a dollar.

While the Buy/Sell difference is expected, I believe this is one area in which Geegpay excels compared to their competitors. I got a much lower withdrawal rate on the other cross-border fintech app I checked. This is a competitive advantage for Geegpay as users will be able to withdraw their foreign currencies, salaries and service payments at a higher rate.

Geegpay’s customer service

To review Geegpay’s customer service, I sent a Twitter message and a mail with my personal email address. The message was to clarify some information on their withdrawal and funding limit.

Impressively, both response came back within three hours. My Twitter dm was sent by 02.09pm and the response came back at 04.09pm. I sent my mail by 02.14pm, although their chatbot responded immediately, I got the response to my questions by 04.50pm.

Conclusion

From my review, Geegpay’s virtual dollar card remains one of the best virtual dollar cards in Nigeria. The swiftness of opening an account, competitive exchange rates, and user-friendly mobile app continue to impress. Additionally, the 2024 updates, such as reduced card fees and the ability to manage multiple cards, further enhance its value for online payments and financial flexibility. Finally, their customer support service is fast to handle their users’ challenges.

Disclaimer: Due to the recent instability in Nigeria’s FX, rates might differ from when this review was done. For more information, you can contact Geegpay’s customer support.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore