Ask three people in the smartphone business if the market has finally bounced back from two years of slowdown, and you’ll get three different answers. One will point to Counterpoint’s 2025 forecast—up 3% year over year—and call it a rebound. Another will say the numbers are too thin to matter. A third will argue the industry never recovered at all—it just learned how to make stagnation look good.

The data supports all three views at once. Phones are selling again, but global shipments have barely moved. Yet revenues keep climbing. Counterpoint’s data shows global premium smartphone sales jumped 8% in the first half of 2025, pushing average selling prices to record highs. Buyers are holding onto devices longer and spending more when they finally do upgrade.

So is the industry recovering or just reorganising around a smaller, wealthier customer base? The answer depends on where you’re standing—and what you’re selling.

Walk with me.

The premium turn

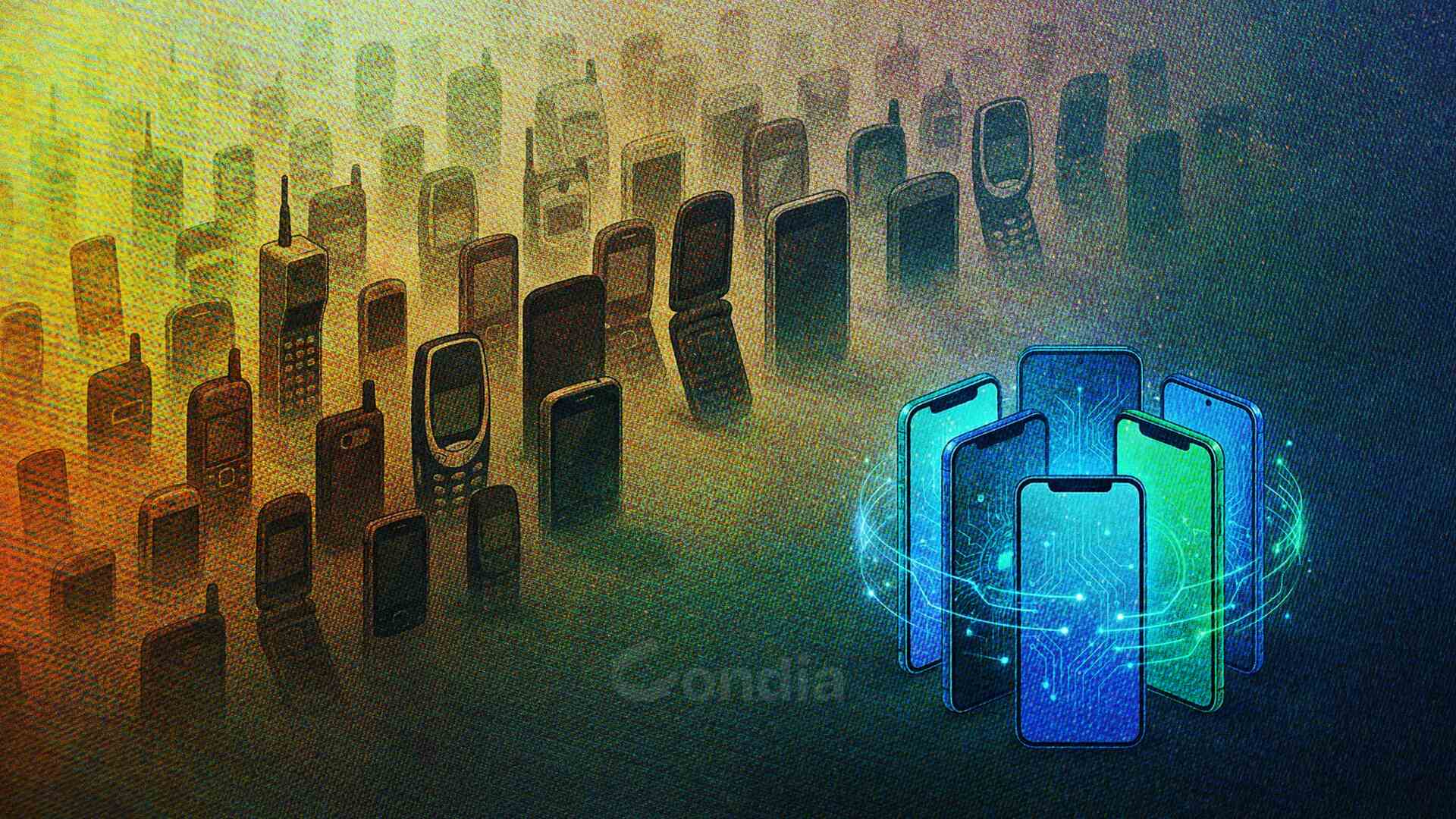

Buyers are keeping their phones longer—three to four years now, up from two—and that one shift is rewiring the industry. If your next upgrade has to last until 2027, you won’t gamble on something that feels dated by 2026. You want a battery that still holds charge in year three, a build that survives drops, and features that don’t expire with the next model. That’s why Apple overtook Samsung this year—not brand loyalty, just buyers betting on phones they won’t regret keeping.

In emerging markets, the logic’s the same, but the math’s different. Most people in Africa, South Asia, or Latin America can’t drop $1,000 on a flagship, yet they’re still holding onto devices longer. They want Apple-level durability and software support, just without the premium price. That’s where Xiaomi and Transsion have struck gold, taking share from Samsung with $300–$500 phones that no longer feel like compromises. The mid-range used to be where you settled. Now it’s where growth happens—a trend we’ve tracked closely in our May and August smartphone roundups this year.

But making those phones is getting harder. Memory-chip costs have spiked up to 50% as AI server demand eats into supply, and manufacturers are passing those costs straight to buyers. The old strategy—cheap phones at scale, razor-thin margins made up by volume—breaks down when your components cost twice what they did last year. OEMs are already warning that prices will climb in 2026, and analysts expect shipments to dip 1% even as average selling prices keep rising.

So manufacturers are pivoting from price wars to intelligence wars. Oppo’s Europe CEO said it clearly: buyers under 35 aren’t upgrading because phones break; they’re upgrading for AI that translates calls, edits photos, and tweaks videos instantly. At MWC 2025, Oppo said generative AI tools will roll out across its full lineup with monthly updates—making “AI phones” the new baseline, not a luxury tier.

Specs like megapixels and battery size matter less now that every phone is “good enough.” Intelligence is the new spec sheet: the thing that separates a device you’ll keep four years from one you’ll regret after two. By 2026, the winners won’t be the cheapest or the flashiest, but the smartest and most future-proof. Premium markets set the bar with durability and on-device AI, emerging markets drive growth through mid-range value, and the old strategy of flooding the market with cheap devices is no longer sustainable. The manufacturers that learn to sell fewer phones that last longer—and justify their price with intelligence—are the ones that will survive the next cycle.

Where growth is an illusion

The overall narrative of a market recovery in 2025 is deceptive. While Average Selling Prices (ASPs) are soaring—driven by premium sales and component costs—unit volumes are actually shrinking. China, the world’s largest market, illustrates this perfectly: sales (sell-out) declined by roughly 2.7% year-on-year in Q3 2025.

This shrinkage is happening even as premium phones mask the distress in the critical mid-tier and budget segments. Since buyers are already prioritising durability and keeping phones longer, fewer of them are left to drive the high-volume, low-margin segment. Vendors are compounding this issue by raising prices or cutting back on budget SKUs to counter rising component costs.

The challenge is intensified in key growth regions like Africa and Latin America. In markets like Nigeria, currency devaluation and higher import costs significantly weakened consumer purchasing power earlier this year, resulting in a notable 7% decline in smartphone shipments in Q1 2025. When the local cost of a device jumps significantly due to FX shocks, the replacement cycle extends even further, putting pressure on retailers and slowing down total unit sales faster than the global shift toward premium devices can offset.

This raises the central question for the industry’s unit volume: If everyone is moving upscale to justify holding onto a phone for four years, who’s left to buy the affordable phone?

The answer may lie in what happens next—because OEMs know hardware alone won’t sell 2026. The next phase of the competition will demand more than just better specs.

| Forecast date | 2025 global shipment growth forecast (YoY) |

|---|---|

| Early 2025 (initial forecast) | 4.2 % |

| June 4, 2025 (revised)** | 1.9 % |

| Late 2025 (final outlook) | ≈ 3.3 % |

The AI divide: Phones that think vs Phones that just work

2026 is shaping up as the year phones stop competing on specs and start competing on brains. Samsung’s Galaxy S25 lets you edit photos and videos instantly, translate calls in real time, and get smart summaries. Google’s Pixel 9 Pro has its Magic Editor doing voice recognition, translation, and object detection. Even mid-range devices are getting simpler AI tools. People notice the difference. Some edits look magical, others show the limits, but everyone sees that phones are starting to think for you, not just follow your commands.

Phones you’ll keep for years now have to last and learn. AI handles tasks like translating calls or cleaning up photos automatically, turning features into real value. Cheap phones no longer impress, and mid-range devices without AI feel outdated the moment you take them out of the box. Intelligence isn’t an optional extra anymore; it’s what separates a phone you’ll stick with from one you’ll regret buying in a couple of years.

This change is splitting the market. The middle tier is shrinking while ultra-smart devices dominate on one end and ultra-cheap phones hold the other, and the “good enough” tier gets squeezed. In emerging markets, that creates new dynamics: some people turn to refurbished AI phones to stay in the game, while those who can pay for the newest features get a clear advantage. It’s like cloud computing all over again—power goes to those who invest in intelligence.

By 2026, the race won’t be about who can make the biggest battery or the sharpest camera. It’ll be who can make a phone that adapts, learns, and keeps up for the next four years. That’s the line dividing winners from the rest.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore