Starting January 2026, Nigeria’s new Tax Administration act will link financial access to your Tax Identification Number (TIN) and National Identification Number (NIN). From crypto platforms to bank accounts, no TIN means no entry. The move builds on earlier steps like FIRS’s real-time VAT monitoring system, which gave the agency visibility into digital payments to curb leakages and tighten compliance.

The rollout feels a lot like when NIN became tied to mobile numbers; those who moved early had less stress, while latecomers faced long queues and cutoffs.

This guide helps you stay ahead, showing how to check if you already have a TIN, and how to secure one quickly, whether you are an individual or running a business.

What is a Tax Identification Number (TIN)?

A Tax Identification Number (TIN) is a unique 10-digit code issued by Nigeria’s Federal Inland Revenue Service (FIRS) through the Joint Tax Board (JTB). It’s your official tax identity, used to track obligations and unlock access to key financial and government services. TINs come in two forms: one for individuals such as employees, freelancers, and sole proprietors, and another for non-individuals like companies, organisations, and associations.

Why it matters now

Under the 2025 Nigeria Tax Act (NTA), anyone involved in economic activity must have a TIN, even if you are not currently paying tax. Starting January 2026, it becomes the gatekeeper for financial participation, much like the NIN did for SIM cards.

What changes in 2026

- Crypto platforms: Virtual Asset Service Providers (VASPs) must verify both TIN and NIN before onboarding users.

- Banks: Stricter KYC checks across all transactions.

- Digital payments: Extra oversight on transfers and wallet activities.

Services that now require TIN

- Opening a business account

- Applying for government loans or credit facilities

- Import, export, and trade licenses

- Vehicle registration and documentation

- Tax clearance certificates

- Government incentives and waivers

Essential services requiring TIN

- Opening any business bank account

- Applying for government loans or credit facilities

- Obtaining import, export, or trade licenses

- Vehicle registration and documentation

- Securing tax clearance certificates

- Accessing government incentives and waivers

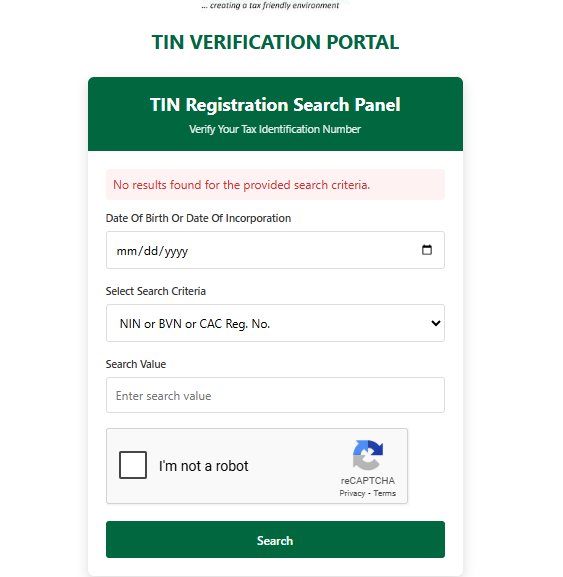

How to check if you already have a TIN

Before applying for a new TIN, verify whether you’ve already been assigned one through automatic systems linked to your BVN or NIN.

Here’s how:

- Visit the Joint Tax Board TIN Verification Portal (tinverification.jtb.gov.ng/)

- Select your date of birth from the calendar

- Choose your search criteria from the dropdown menu:

- Bank Verification Number (BVN)

- National Identification Number (NIN)

- Registered mobile number

- Enter the corresponding digits in the Search Value field

- Complete the reCAPTCHA verification

- Click “Search” to retrieve your TIN

If the system displays “RECORD NOT FOUND,” try alternative search criteria. Only proceed with a new application if all searches return negative results.

Guide to getting your Tax ID before January 2026

The next step in the registration process is straightforward and free:

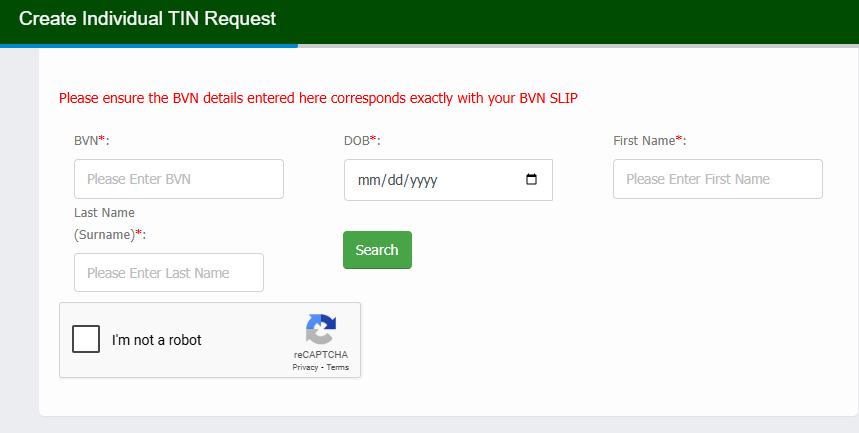

For individual registration:

1. Go to the JTB TIN Registration Portal (https://tin.jtb.gov.ng/)

2. Select “Register for TIN” under the individual option, then fill in your BVN and other required details.

3. Submit the form, and once processed, you can download and print your Tax ID certificate at no cost.

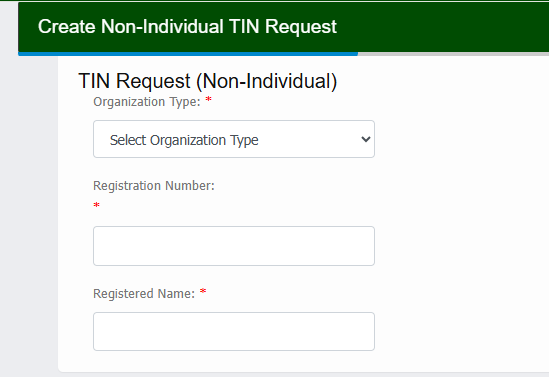

For company registration:

1. Visit the JTB TIN Registration Portal (https://tin.jtb.gov.ng/)

2. Select “Register for TIN” under the non-individual option, then fill in your organisation’s registration number in the format RC1234567 or BN1234567

3. Enter the CAC-Registered name for your business or organisation

4. Then click “Submit” and await further instructions on obtaining your Tax Number.

For all TIN applications

If you’re applying online, no original documents are needed—only those visiting an FIRS office in person will be asked for verification. It’s still best to get it done early before the January 2026 rush.

There’s also a silver lining: individuals can claim up to ₦50,000 or 20% of annual rent as tax relief, provided they submit receipts, tenancy agreements, or commission documents as proof.

For digital assets, the signs have been there since 2022 and by 2024, exchanges like KuCoin had already started adding VAT. Now it all comes together under the Tax Administration Act, tying banking, insurance, and crypto to your TIN.

Read Also: Nigerian passport fees hit ₦200,000 as FG implements second hike in a year

FAQs on Nigeria’s New Tax Act

Q: Who has to pay under the new Act?

Every individual or business that wants to use banking, crypto, insurance, or other financial services in Nigeria from January 2026.

Q: Is there an income threshold?

Yes. Individuals earning ₦800,000 or less a year are exempt from personal income tax, but may still need a TIN for access to services.

Q: If I don’t live or work in Nigeria, do I still pay tax here?

Yes, if you earn income from Nigeria or provide taxable goods or services here.

Q: I already pay withholding tax abroad, like on YouTube earnings in the U.S. Will Nigeria take another cut?

Nigeria may still tax income sourced from Nigeria, but relief depends on whether there’s a double taxation treaty between Nigeria and the country where the income was first taxed. Without such a treaty, you could face additional tax at home.

Q: Does this apply to business or corporate accounts?

Yes. Both individuals and companies must register their accounts with a valid TIN.

Q: What about religious bodies?

Donations and offerings aren’t taxed, but if a religious body runs a business, those earnings require a TIN.

Q: How will FIRS know what I earn?

Banks, fintechs, and payment providers now share data with FIRS. Gifts are not taxed, but income streams are.

Q: What about crypto?

Gains from digital assets are taxable. Losses can only be deducted against profits from crypto, not other income.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore