For Obinna Ndukwe, a public servant who runs online seminars as a side business, the moment of crisis arrived midway through a presentation. He was addressing over 1,000 students online when his screen went blank. His data had vanished.

“It brought me great embarrassment,” Ndukwe recalled. His frustration isn’t unique. No fewer than seven small businesses in Nigeria have told Condia of their struggles, as they grapple with the pressure of soaring data costs on their livelihoods.

Starting January 2025, Nigerian telcos implemented a significant upward review of their data tariffs—after much pressure on regulators to grant the sector a much-needed lifeline. While the companies framed the hike as a move to “increase the value of data for money,” many small business owners and professionals have felt the opposite, seeing it instead as a blow to affordability and access.

For the telecom operators, this wasn’t an arbitrary decision. MTN, for instance, hadn’t increased its data tariffs since 2013, despite a decade of mounting pressure from rising diesel costs, foreign exchange volatility, and inflation affecting nearly every part of their operations. After years of pushing for relief, the Nigerian Communications Commission finally approved a capped 50% increase in January 2025. MTN began rolling out the new prices the following month—a fight we detailed in this November 2024 explainer on the sector’s financial strain. Airtel also began implementing its revised rates around the same time, explaining the move as a necessary response to “escalating operational costs.”

The hike, regardless of provider, has become an unwelcome tax on small digital operations such as online sales, virtual training, remote consulting, and marketing, forcing many to adapt, cut back, or absorb the extra cost in an already harsh economy.

A sudden 50% tax on digital survival

The tariff adjustment has forced many to rethink their monthly budgets. Before February, MTN users could spend ₦3,500 for 10 GB. Now, that same amount barely covers 7 GB. Heavy users have seen their data costs jump by as much as 45%, with some high-capacity plans quietly dropped. For many small businesses, staying online now demands ₦5,000 to ₦10,000 monthly—eating into profits and squeezing already tight personal budgets.

Airtel customers faced similar changes. The ₦3,000 plan that once offered 20 GB now gives only 10 GB. Other popular options were revised upward in cost or reduced in value—₦5,000, which used to fetch 18 GB, now buys 13 GB. Like MTN, Airtel attributed the hike to rising operational costs, citing inflation and currency pressures. But for users, the outcome was the same: shrinking data for more money.

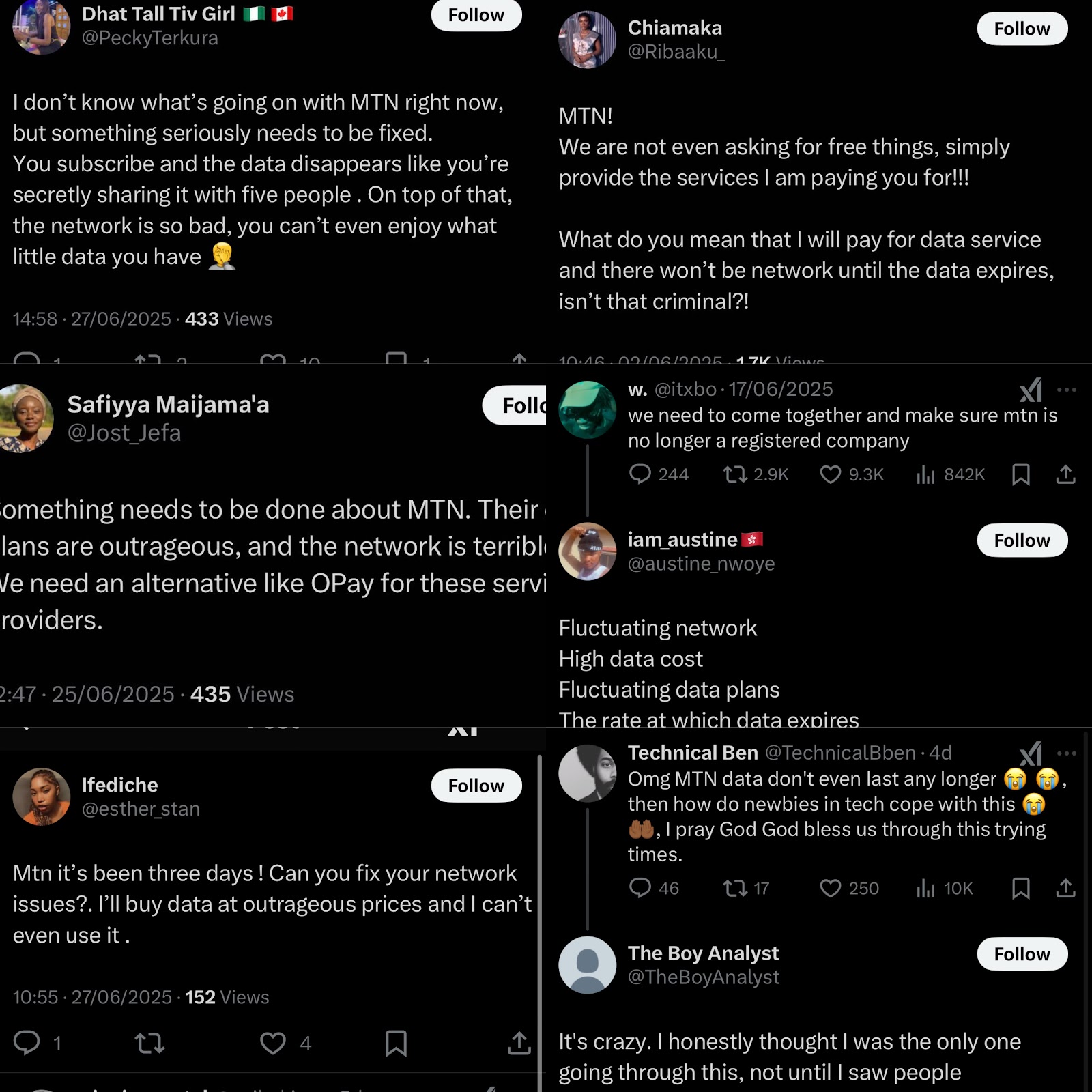

Beyond the price increases, subscribers reported that airtime and data no longer stretch as they once did. A ₦500 airtime voucher that previously covered three 10-minute calls now disappears in two days. Across both networks, complaints of rapid data depletion and unreliable service continue to mount.

“I can’t afford to purchase data as I used to, and I had to abandon other service providers,” said Folu Hammed*, a book designer in Ibadan. “Now if MTN develops network issues, I have no option but to wait, and it affects my business and daily transactions.”

This financial pressure is forcing difficult choices across the board. Hammed, who runs a sales and picture book design business, now finds herself spending significantly more on connectivity. Similarly, Alu Yemi Adesoji, a crypto trader, reports “spending more than budgeted for on data.”

The ripple effect on reach and operations

But the financial strain tells only one part of the story. For businesses that live and die by their online presence, the consequences are more insidious, affecting their very ability to reach customers.

Bisola Onike*, an online vendor in Ibadan, noticed reduced engagement across her social media channels. “I noticed a reduction in reactions and responses to my posts,” she told Condia, attributing this to customers likely “minimising their use of data” due to the higher costs.

Her story highlights a vicious cycle: as she struggles with the higher cost of data to promote her goods, her potential customers are also rationing their data usage, meaning they are less likely to see her products.

This invisible barrier throttles the organic reach that is the lifeblood of many digital-first businesses. The scale of this digital squeeze becomes clearer when considering the broader impact across Nigeria’s entrepreneurial landscape. Many business owners now report paying up to ₦24,000 monthly just to stay online—nearly minimum-wage levels—while data packages that once supported essential digital activities like webinars, monitoring promotional campaigns and cryptocurrency trading have been downgraded or removed entirely.

With less affordable internet, both businesses and their customers reduce online activity, which directly impacts reach, engagement, and revenue—the very foundation of Nigeria’s digital economy.

To adapt, switch, or wait

This digital squeeze is forcing entrepreneurs into difficult corners, compelling a range of responses from reluctant adaptation to risky consolidation. To cope, Razaq had to make a tough choice. “I can’t afford to purchase airtime as I used to, so I had to abandon other service providers,” she explained, leaving her solely reliant on MTN. “Now, if MTN develops network issues, I have no option but to wait, and it affects my business and daily transactions.”

While some, like Razaq, feel trapped, others are attempting to make a virtue of necessity. Otih Collins*, a pastry chef in Lagos, noted that the change forced his operation to “streamline costs and re-evaluate resource allocation.” This led to a more deliberate approach. “I started prioritising value over volume in both my data usage, communications and my work habits,” he added.

This widespread frustration is also triggering a predictable market reaction: a search for alternatives.

Social media is rife with comments from frustrated users looking to switch providers. “I was forced to get an Airtel router, that’s how ridiculous the current MTN data pricing is,” one user posted.

Some, like Ndukwe and Adesoji, now rely on Airtel alongside MTN, employing a multi-SIM strategy to manage rising costs and hedge against network issues.

Whether they adapt, switch, or simply endure, the underlying challenge remains. For the millions of Nigerians relying on the digital economy—a sector hailed as the country’s future—the rising cost of its most basic utility is seemingly a direct barrier to opportunity, a daily source of anxiety, and a critical challenge to their resilience.

*Some names have been changed for privacy reasons.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore