We have prepared context and insights about this week’s leading news. The stories are:

- Why TymeBank is taking the government to court

- MTN enters the cloud market in Nigeria

- Africa’s getting its own card game together

Why TymeBank is taking the government to court

A 6,500% increase in ID verification fees is now the reality in South Africa. TymeBank, the digital unicorn bank, says it’s a direct attack on financial inclusion, and it’s heading to court.

Zoom in: The fee hike, pushed through by the Department of Home Affairs, raises the cost of verifying an ID from just R0.15 to R10 per check. For a typical onboarding process that requires two verifications, biometric and demographic, that’s R20 right off the bat. Add in card issuance and KYC processing, and the cost to onboard one Social Relief of Distress (SRD) recipient jumps from R55 to around R75. Multiply that across a million customers, and TymeBank is looking at an extra R20 million (~$1.1 million) it says it simply can’t absorb.

Context: The bank has already published an open letter to Minister Leon Schreiber, calling the increase “a crippling blow to financial inclusion.” It says attempts to engage directly with Home Affairs have been ignored, leaving legal action as the last resort.

And TymeBank isn’t the only one sounding the alarm. MicroFinance South Africa, which represents over 1,400 credit providers, has urged the government to hit the pause button.

Meanwhile, the government is framing the hike as part of a broader digital agenda, including e-passports, wallet-style IDs, and automated visa systems, by 2030. Home Affairs refers to the ID verification service as the “cornerstone” of this transformation.

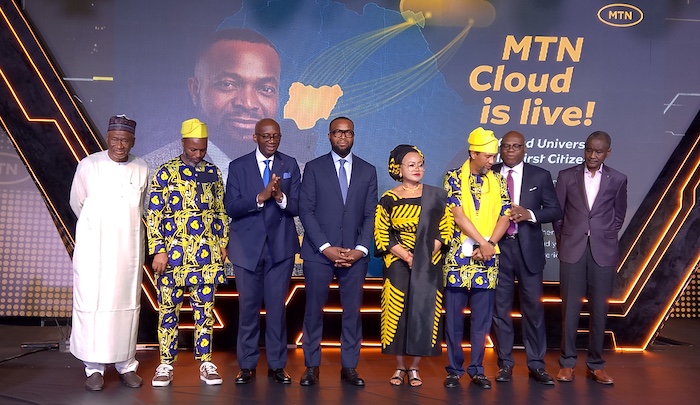

MTN enters the cloud market in Nigeria

Nigerian businesses reportedly spent as much as $850 million on cloud services in 2024, while governmental agencies alone are reportedly spending as much as $500,000 every month. That kind of spending doesn’t go unnoticed. MTN saw the receipts and is stepping in with a $240 million data centre to keep more of that money (and data) on home soil.

Named the Sifiso Dabengwa Data Centre and Cloud, the facility packs 9 megawatts of power and is being rolled out in two phases. The first half is already live, with the second 4.5MW phase coming soon.

CEO Karl Toriola isn’t mincing words: “We believe this is going to be transformative for the technology ecosystem in Nigeria.”

MTN’s bet? Nigerian enterprises, government agencies, and startups would rather run their cloud workloads with a local provider that prices in naira, offers 15–20% discounts, and doesn’t come with dollar-linked headaches.

The telco giant also plans to power the centre with an Independent Power Producer for now, with solar energy coming online next year.

With local players like Nebula by Okra, Nobus, and Layer3 already in the game, MTN is betting that its brand muscle, reach, and financial resources will make it a challenger worth watching.

Africa’s getting its card game together

First, it was Nigeria’s Central Bank’s domestic card scheme, AfriGo. Now, the African Export-Import Bank (Afreximbank) has officially launched the PAPSS Card, a new payment card built “by Africa, for Africa.” It’s the latest move in the continent’s push to break free from global payment rails like Visa and Mastercard, which still process the majority of card payments made by Africans (and charge a premium for it).

What’s this card about? It’s part of the broader Pan-African Payment and Settlement System (PAPSS) playbook, meant to keep payment data, value, and fees within the continent. Afreximbank is calling it a move toward “financial sovereignty,” and they’re not alone. The card is launching in partnership with Mercury Payments, with banks like Bank of Kigali and Access Bank already onboard for rollout.

The launch of the PAPSS Card highlights Africa’s increasing demand for domestic card schemes. In the past year, Nigeria’s Central Bank-backed AfriGo has signed up fintechs such as Moniepoint and OPay, as well as banks like Sterling and Access. Now, PAPSS is stepping into the ring with a card that promises to reduce costs, expand access, and support intra-African trade.

Curious to know the difference between the PAPSS card and AfriGo?

By the Numbers

233%

Daily usage of AI among employees around the globe has increased by 233% in six months, according to Slack’s latest Workforce Index.

Based on a survey of 5,000 workers worldwide, the report also highlights a clear edge for those who’ve embraced the tech; daily AI users are 64% more productive and 81% more satisfied with their jobs compared to those who don’t use it at all.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore