Nigeria Inter-Bank Settlement Systems PLC (NIBSS) launched Nigeria’s Quick Response (NQR) code payment system last week, March 16, 2021.

NIBSS—founded in 1993—is focused on innovating for the financial services industry while facilitating interoperability. Ten years ago, NIBSS introduced an account-number based, online-real-time Inter-Bank payment solution called NIBSS Instant Payment (NIP). The launch of NQR will build on the progress of NIP and further deepen its mission.

NQR code is a payment innovation aimed at unifying the QR code experience for financial services users in Nigeria. It is based on “EMV® QR Code Specification”. NQR is going to be a consolidation of the fragmented “Pay by QR” method each payment service provider offered its merchant. Yet, it will retain the swiftness, seamlessness and contactless ability of QR codes.

As a payment method, each QR code contains a unique information relating to the transaction being performed. So, when it is scanned via an eligible app it reveals the information. In this case, the eligible app is the customer’s banking app.

QR codes are an alternative payment method to PoS and Bank Transfer. The NQR will unify QR codes in the country for a more consistent user experience.

Financial Institutions involved in payments and collections can integrate the NQR network by following the onboarding process as prescribed on NIBBS’s site. The NQR integration kit contains: Admin Consoles, Issuing and Acquiring APIs, Merchant and Sub Merchant App and USSD.

NQR is in line with the CBN’s QR code payment regulation

Earlier in the year, the Central Bank of Nigeria (CBN) released the framework for Quick Response (QR) code payments in Nigeria. The frame work was a means the CBN utilized to regulate the payment option and make its adoption seamless.

The framework highlighted the acceptable standards for implementing QR payments, its interoperability, roles and responsibility of QR payments participants, and risk management principles for QR code payment in Nigeria

The CBN framework categorized the QR code payment specifications into four:

- QR Code Payments in Nigeria shall be based on EMV® (Europay, Mastercard and Visa) QR Code Specification for Payment Systems.

- CBN can also approve the implementation of any other QR Code Standard, as long as it meets its security requirements, demonstrates interoperability and is affordable to end users (merchants and customers).

- All QR Code Payments implementation in Nigeria is mandated to support account, wallet, card and token based QR Code Operations.

- The implementation of QR Code for payments in Nigeria will be based on the Merchant-presented mode specification. In this scenario, merchants will present the QR Code for buyers to accept in order to conclude payment transactions.

The framework grouped the participants—anyone who opts to use the QR code payment systems, into five. It stated that all participants will be guided by existing CBN guidelines on electronic payments channels in Nigeria. The participants include:

- Merchants—anyone who sells goods or services to customers.

- Customers—consumers who pay for goods and services.

- Issuers—Banks, Mobile Money services and other Financial Institutions.

- Acquirers—Banks, Mobile Money services and other Financial Institutions that help merchants receive their payments.

- Payments Service Providers (Switches & PSPs)—institutions that facilitate seamless payment systems.

The framework also mandates that all consumer complaints related to QR Code Payment be resolved in accordance with the CBN Consumer Protection Regulation.

NQR code cost vs POS Charges

NQR code was designed to be “low cost” for merchants, especially when compared to PoS terminal charges. Like most PoS issuance from banks, NQR offers merchants a zero onboarding cost. However, unlike PoS issuance, merchants are not required to commit to doing a particular amount in transaction value.

In 2011, the CBN said merchants should be charged a maximum of 1.25% fee for every PoS transaction subject to a maximum of ₦2,000.00. However, they reviewed the charges in 2019. In a circular sent to banks, the charges per transaction was dropped to 0.50% capped at ₦1,000.

This means that for every ₦1,000 payment received through PoS by a merchant, they should be charged a maximum of ₦5 as processing fee. And no matter the value of the transaction, the processing fee should not go above ₦1,000.

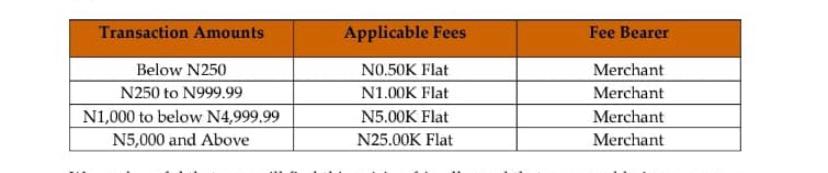

The NQR offers merchants a more affordable payment option as it charges merchants lesser transactional fees. The NQR will charge merchants a ₦0.50 fee for transactions below ₦250, ₦1 for transactions between ₦250 to ₦999.99, ₦5.00 for transactions between ₦1000 to ₦4999.99, and ₦25 flat fee for transactions from ₦5000 and above.

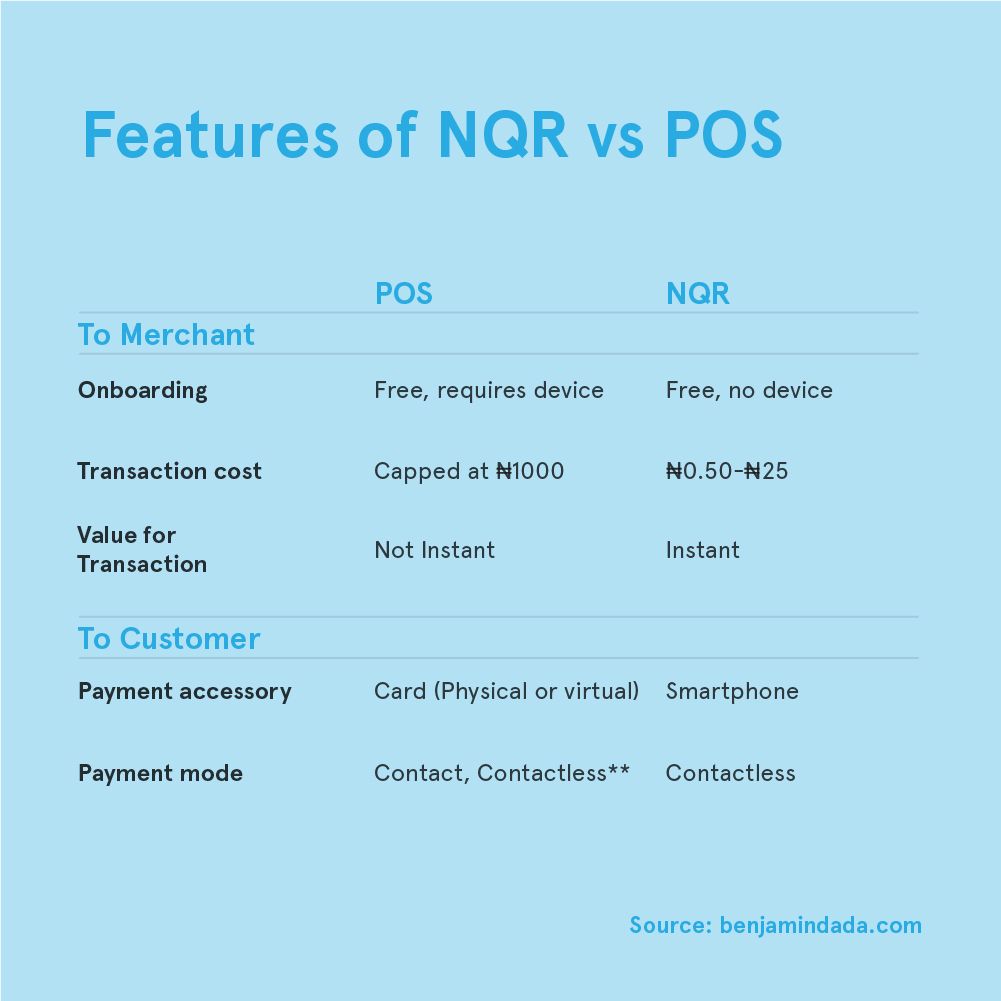

When compared side by side, the NQR code and PoS device has similar features. However, some features distinguishes the NQR code from the PoS device. Like on-boarding cost and instant value for transaction.

The table below shows how the NQR and PoS compare across 5 features.

While it costs nothing for a merchant to request for a PoS device from an issuer, the merchant has to purchase the PoS terminal. A typical PoS terminal costs between ₦65,000 to ₦135,000. The NQR code on the other hand, has zero onboarding fee and infrastructure cost.

The PoS device offers both contact and contactless payment. However, its contactless payment is specific to cards and devices embedded with the RFID (Radio-frequency identification) technology. With the technology in place, a consumer only has to tap this/her card near a PoS terminal to effect payment.

One of the perks of the NIBSS NQR launch is its swift and contactless payment. The NQR code is embedded with processors that enable quicker payment. This allows merchants to receive instant payment regardless of their location. Unlike the PoS, where a consumer has to own a card with RFID technology to access contactless payment, the NQR offers contactless payment to all smartphones.

Its contactless perk is strategic as COVID-19 is still eminent. There’s still a need to heed COVID safety precautions and maintain social distancing. It gives buyers the option to leverage the NQR contactless payment technology to conveniently pay for goods and services without having to touch anything other than their smartphone. It’s a swift scan-pay-receive process.

The NQR touch points are; retail outlets, transportation services (ride Hailing companies, buses), tolling booths, vending machines, and smart retail outlets.

Payments Service Providers can visit their banks, NIBSS website or download the NQR android app to register.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore