Later today, Bola Tinubu will be inaugurated as Nigeria’s President. Ahead of his inauguration, the International Monetary Fund (IMF) asked Tinubu to broaden the country’s sources of income during his administration.

The resident representative for the IMF’s Nigeria office, Ari Aisen says the incoming administration should significantly reduce its reliance on debt to pay for expenses. In January, Nigeria’s Debt Management Office revealed that the next administration might inherit a public debt of ₦77 trillion if the ways and means advances from the Central Bank of Nigeria are securitised.

To address the country’s debt problems, Aisen said that revenue and spending should be the focus areas. He said the Nigerian government was spending more than it was earning through taxes, which is why the debt issue became worse.

How will Tinubu’s administration tackle this? We will follow up in the coming weeks.

Inside letter 164, we cover:

- the security breach at Nigerian digital asset marketplace Patricia

- Swvl’s continued woes at Nasdaq

- what the ICT sector contributed to Nigeria’s GDP in Q1 2023

and other noteworthy information like:

- the latest African Tech Startup Deals

- events, opportunities, interesting reads and more

The big three!

#1. In 2022, a hack robbed Patricia of $2 million — Report

The news: Last week, Nigerian digital asset marketplace Patricia disclosed that it was affected by a security breach “not long ago”. Following ongoing investigations, the company said it has identified an individual in the syndicate that led the hack.

Due to ongoing auditing processes, Patricia temporarily ceased withdrawals on its platform. The company also said that out of its three subsidiaries—Patricia Personal, Patricia OTC Desk, and Patricia Business—only Patricia Personal, the retail trading application, was affected by the breach.

Further revelations: Corroborating the hack, an investigation by TechCabal says that the security breach happened last year and that the company lost about $2 million.

Also, prior to the latest withdrawal freeze, the report said that Patricia partially suspended withdrawals since January 2022, when the hack happened, to avoid a bank run. “While customers could still deposit money into the app, they couldn’t move their crypto coins to other wallets. Instead, Patricia offered to buy those coins from customers and pay them cash to manage the situation. This workaround continued until March 2023,” reads the report.

Even now, a user on the Platform said he has been unable to make withdrawals in the last two months. “[We] sincerely understand how you feel. Please be informed that the app is not crashing. Our team is working around the clock to rectify this current withdrawal issue. We will fix this, trust us,” Patricia HelpDesk tweeted.

Zoom out: This is not the first hack that has been reported in the Nigerian tech ecosystem this year.

In March, a report by Techpoint revealed that hackers rob Flutterwave users’ accounts of over ₦2.9 billion. The fintech unicorn denied the claim saying that although some merchants’ accounts were compromised “[…]no user lost any funds”. However, the fintech reportedly took legal action to recover the funds and several accounts were blocked.

According to reports, just like Patricia, most of the affected accounts were cryptocurrency merchants. Flutterwave declined to comment on these findings, at the time.

Shortly after the reports about Flutterwave’s hack in March, representatives of Nigerian fintechs held a meeting to develop a joint strategy to tackle fraudulent transactions within their networks, starting with a shared list of suspected criminals, according to Semafor.

However, some experts say that the plan will likely not succeed.

#2. Swvl’s continued woes at Nasdaq

The scene: Egypt-born mobility startup Swvl has not been able to drive smoothly lately. In January, Swvl received its second delisting warning from Nasdaq after the market value of its listed securities dipped below the benchmark of $50 million.

In 2021 when Swvl went public via SPAC with Queen’s Gambit Growth Capital with an initial offer price of $9.95 per share. But the company struggled to maintain its opening share price after failing to turn a profit across its markets due to the economic downturn and weak performance.

From a $1.5 billion valuation when it went public, Swvl’s valuation was $53 million, in November 2022. The company is currently trading at about $1.15 per share.

Swvl has since made large-scale layoffs in a bid to ride. It has reduced its headcount by more than 50%, cut back on executive pay and closed some of its less profitable routes, including in Pakistan.

In January, the mobility company reversed its 2022 acquisition of Volt Lines for $40 million. This made it Swvl’s second acquisition to fall through in recent times; last year, Swvl and UK startup Zeelo called off a planned merger in July, citing turmoil in the financial markets.

What’s the latest? Earlier this month, Swvl received a notification from Nasdaq regarding its failure to file its last year’s annual report. However, the notice has no immediate impact on the listing of the Company’s securities on Nasdaq.

According to the mobility startup, “Nasdaq requires that the Company submit a plan no later than July 3, 2023, to regain compliance. If Nasdaq accepts the plan, Nasdaq can grant the Company an extension of up to 180 calendar days from the due date of Form 20-F to regain compliance.”

The exit route: Last December, Swvl said it had formed a strategic committee “to explore and evaluate potential strategic alternatives”. The mobility company said it was considering “corporate sale, merger or other business combination, a sale of all or a portion of the company’s assets, strategic investment, new debt or equity financings or other significant transactions”.

However, a timeline was not set for the process.

#3. ICT accounted for 17.47% of Nigeria’s total GDP in Q1 2023

What we know: Between January and March this year, the Information and communication technology (ICT) sector in Nigeria contributed ₦3.1 trillion ($6.7 billion) to the country’s gross domestic product (GDP).

According to the National Bureau of Statistics (NBS), the telecoms sub-sector drives the growth in the ICT sector, contributing 14.13% to the overall GDP. Per the NBS, the ICT sector is made up of telecommunications and information services; publishing; motion picture; sound recording; music production; and broadcasting.

Zoom out: Within the period under review, Nigeria’s GDP grew by 2.31% year-on-year in real terms, indicating 1.21% points lower than 3.52% recorded in the previous quarter and 0.8% lower compared to 3.11% recorded in the corresponding period of 2022.

The NBS says the slow growth is due to the demonetisation that process that resulted in a cash crunch in the first quarter of the year.

State of funding in Africa

Last week, the E3 Low Carbon Economy Fund for Africa (E3LCEF), a fund by early-stage VC E3 Capital (formerly Energy Access Ventures), and emerging markets-focused investment bank Lion’s Head Global Partners secured $48.1 million in its first close.

The fund which will provide initial and follow-on funding to startups, such as solar providers and EV startups, supporting low-carbon economies, is targeting to close at $100 million.

As of May 28, cleantech startups have jointly raised about $35 million of the ~$1.3 billion raised by African startups this year. The sector which was one of the top-funded last year, might record the same feat this year with the increased number of cleantech-focused funds.

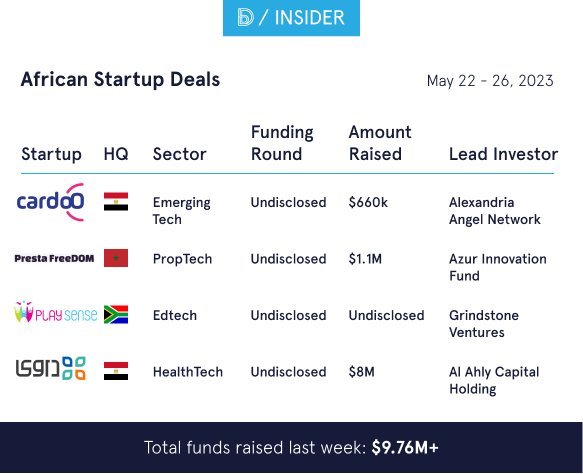

Away from cleantech, find below a summary of the funds that were raised last week.

Note:

Based on the BD Funding Tracker methodology, we did not include the following fundraise that were announced last week:

- $700,000 pre-seed fund raised by Kunda Kids, a media publishing company. Although, it is founded by two Nigerian tech entrepreneurs, its primary market is the UK and an African expansion is yet to be announced.

- Also, the $77.8 million pre-series C secured by Tyme was not added because based on the press statement that was shared with us, Tyme—the parent company of South African digital bank Tyme Bank—raised the fund, not Tyme Bank. We have reached out for clarifications and we will update the tracker as soon as we get a response.

Noteworthy

Here are other important stories in the media:

- Why CV VC excluded Flutterwave, Chipper and Andela from African unicorn list: In letter 160, we told you that the aforementioned startups were excluded from the CV VC African unicorn list, we investigated and here’s what we found out.

- Nigerian startups dominate the inaugural ‘fintech in Africa’ accelerator cohort: Out of the 25 startups selected for the inaugural Amazon Web Services (AWS) FinTech Africa Accelerator cohort, eleven are Nigerian companies.

- Inside ConTech, the community for no-code creators in Africa: ConTech Africa is building a community for no-code tech professionals in Africa to learn, network and grow. Here’s why and how far they have gone.

- Startup Consultative Forum challenges Pantami, as he amends Nigeria’s Startup Act: Reports say that Nigeria’s minister of communications and digital economy Prof Isa Ali Ibrahim Pantami has amended the Startup Act. Is this possible?

- Nigeria’s student family ‘Japa’ route to the UK is closing: Tens of thousands of African postgraduate students will no longer be able to bring family members to Britain under reforms to curb migration, Semafor reports.

Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Metacare — Visual Designer, Remote

- Offshorly — UI/UX Designer Intern, Remote

- Simpu — Product Marketing Associate, Remote

Data & Engineering

- Interswitch — Data Engineer, Nigeria

- Bamboo — Mobile Engineer, Nigeria

- Branch — DevOps Engineer, Remote

Admin & Growth

- Carry1st — Head of Growth, Remote

- Jetstream — Country Director, Nigeria

- Bolt — Country Sales Manager, Nigeria

- Mastercard — Implementation Manager, Nigeria

Other opportunities

- Lendsqr is looking for interns, it can be as short as three months for summer interns, six months for SIWES interns, and up to 1 year for Youth Corpers.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: December 19, 2024