As oil revenues continue to decline in Nigeria, the country has turned to alternative sources of foreign exchange to stabilise its economy.

Just last year, Agusto & Co projected that remittances to Nigeria could reach $26 billion by 2025. Now, fresh insights from OhentPay—a mobile money and cross-border transfer service operating in over 100 countries—highlight how close we are to that milestone.

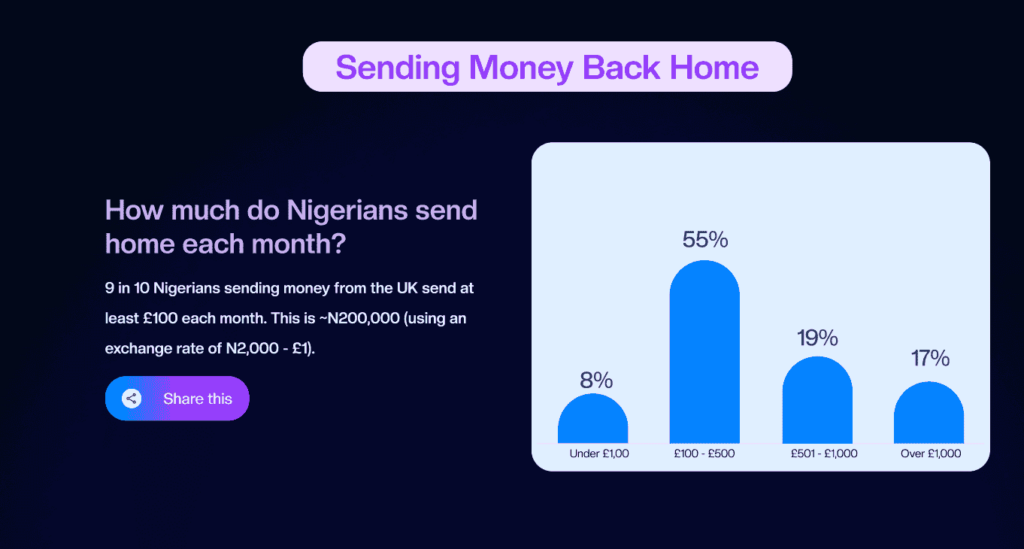

Based on a survey of over 400 Nigerians in the UK, OhentPay’s 2024 UK-Nigeria remittance report reveals that nearly half of these funds, often referred to as “Black Tax,” are sent to support families back home.

For senders earning between £15,001 and £50,000 annually, platforms like OhentPay are essential for converting their earnings into Naira equivalents, ensuring a steady stream of foreign exchange into the Nigerian economy.

As Nigeria remains the largest remittance recipient in West Africa, the impact of the “Japa geng”—Nigerians seeking opportunities abroad—is increasingly visible, from households to businesses.

OhentPay’s latest report explores the habits and motivations of Nigerians in the UK and here are five trends from the report that unpack the numbers and their impact.

5 notable trends from OhentPay’s UK-Nigeria remittance report 2024

Beyond the headline figures, the trends reveal more about these money flows and what they mean for Nigerians back home.

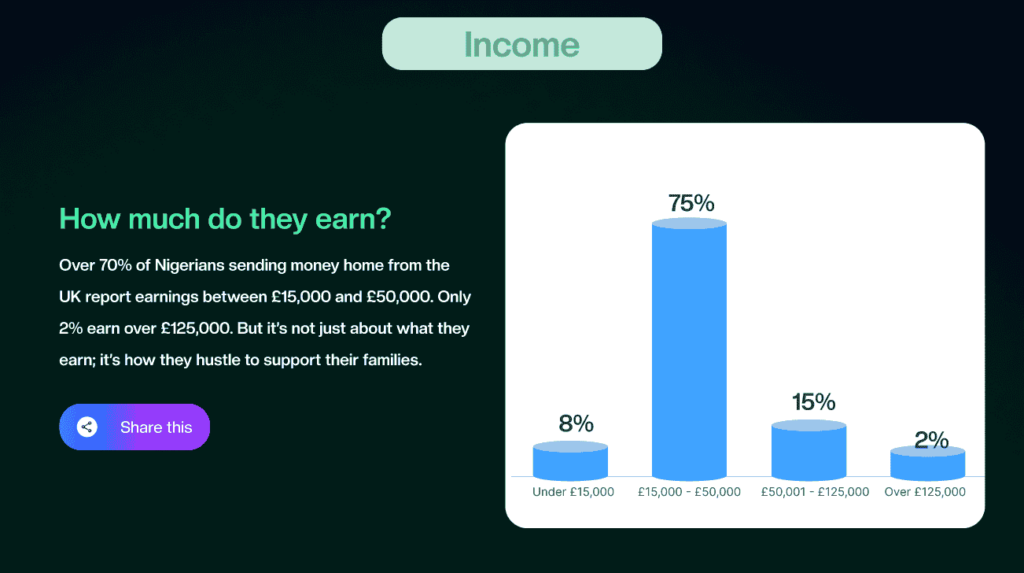

1. Most Nigerians in the UK earn £15,001–£50,000 annually

A significant portion of Nigerian remittance senders in the UK fall within this income range, translating to roughly ₦24.6 million to ₦82.1 million annually. While this might seem like a substantial amount in Naira, it’s important to keep in mind the high cost of living in the UK.

Earnings in this bracket are also influenced by factors such as gender, age, and the length of time spent in the UK. For instance, men are three times more likely to earn above £50,000 (₦82.1 million) than women, reflecting a gender wage gap that mirrors the one seen back home in Nigeria.

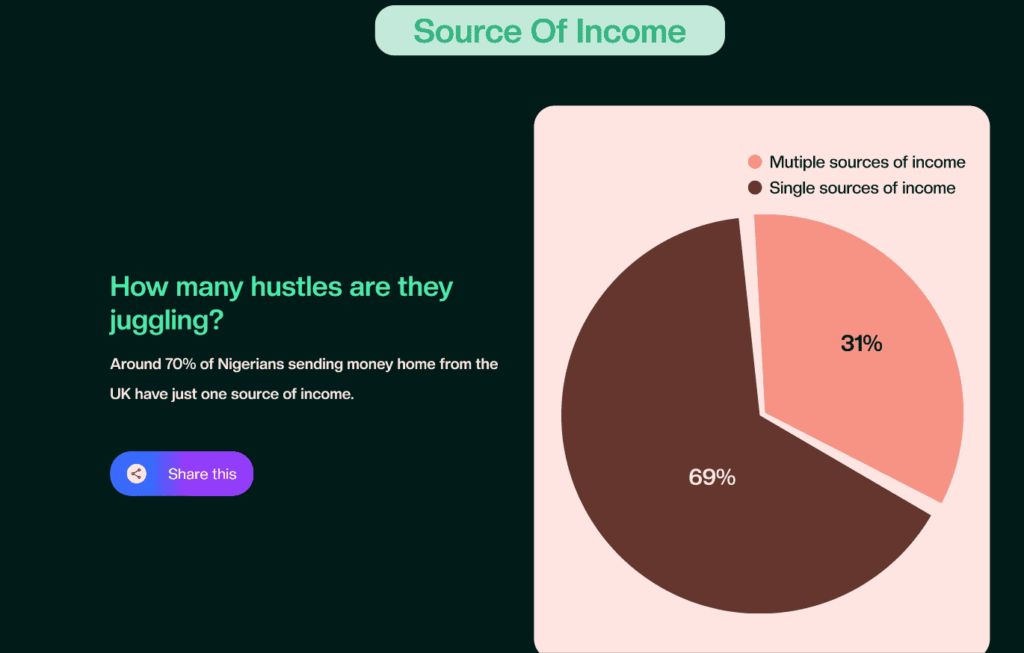

2. Over 63% of diasporans have multiple income sources

While 70% of respondents rely on a single income, those with multiple streams tend to dominate the higher earning brackets. Over 63% of individuals earning £125,000 (₦205,407,500) or more reported having diversified their income. This ‘side hustle’ culture is common among Nigerians abroad and is a trend that echoes PiggyVest’s recent report, which found that a growing number of Nigerians are turning to freelance work or small businesses as a way to increase their income.

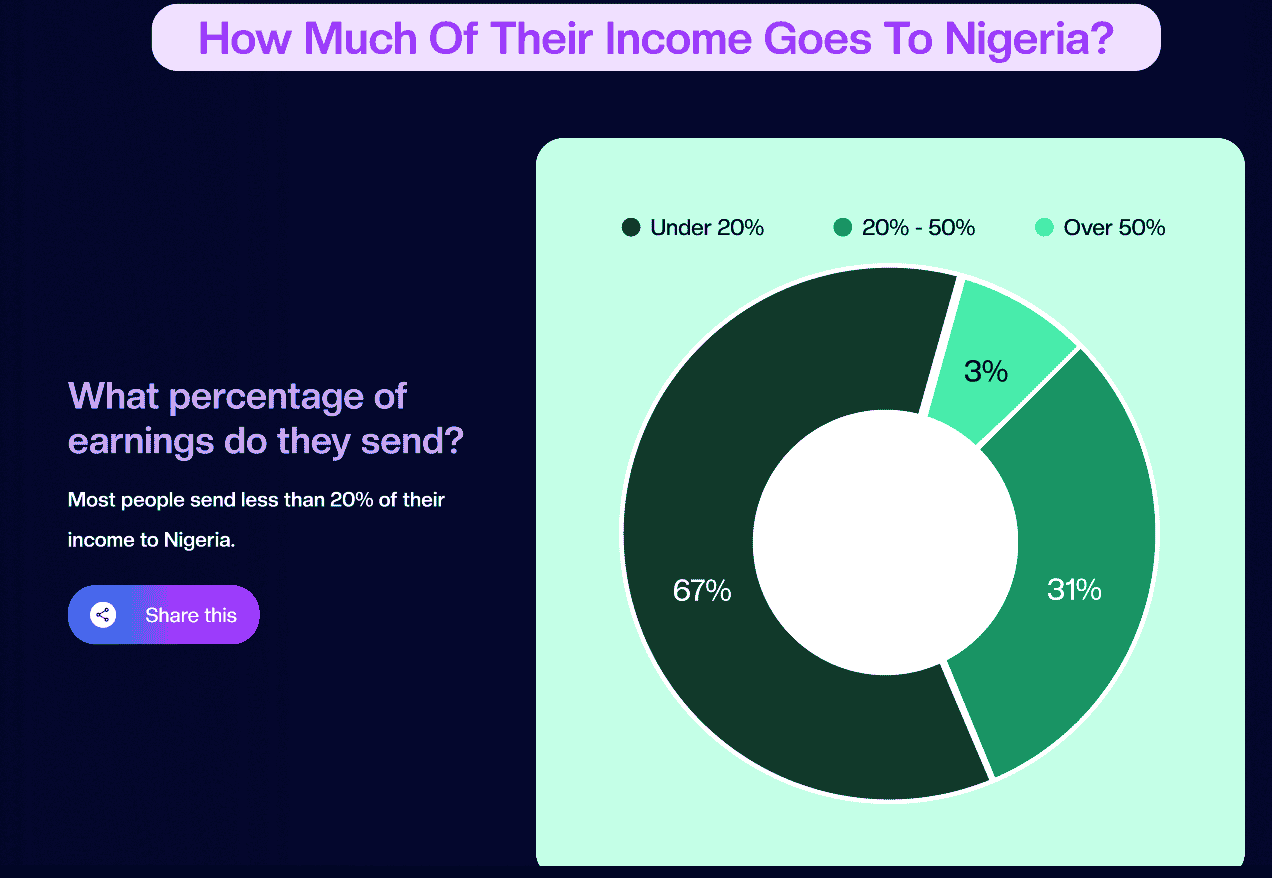

3. Nigerians in the UK send between £100 and £500 back home monthly

Most Nigerians in the UK send between £100 (₦164,326) and £500 (₦821,630) monthly. While these amounts might seem modest, they actually represent a significant portion of the sender’s income, especially when factoring in the cost of living in the UK.

Higher earners and long-term residents tend to send larger sums. Interestingly, the report highlights the familiar tradition of men being more likely to send larger amounts—and doing so more frequently.

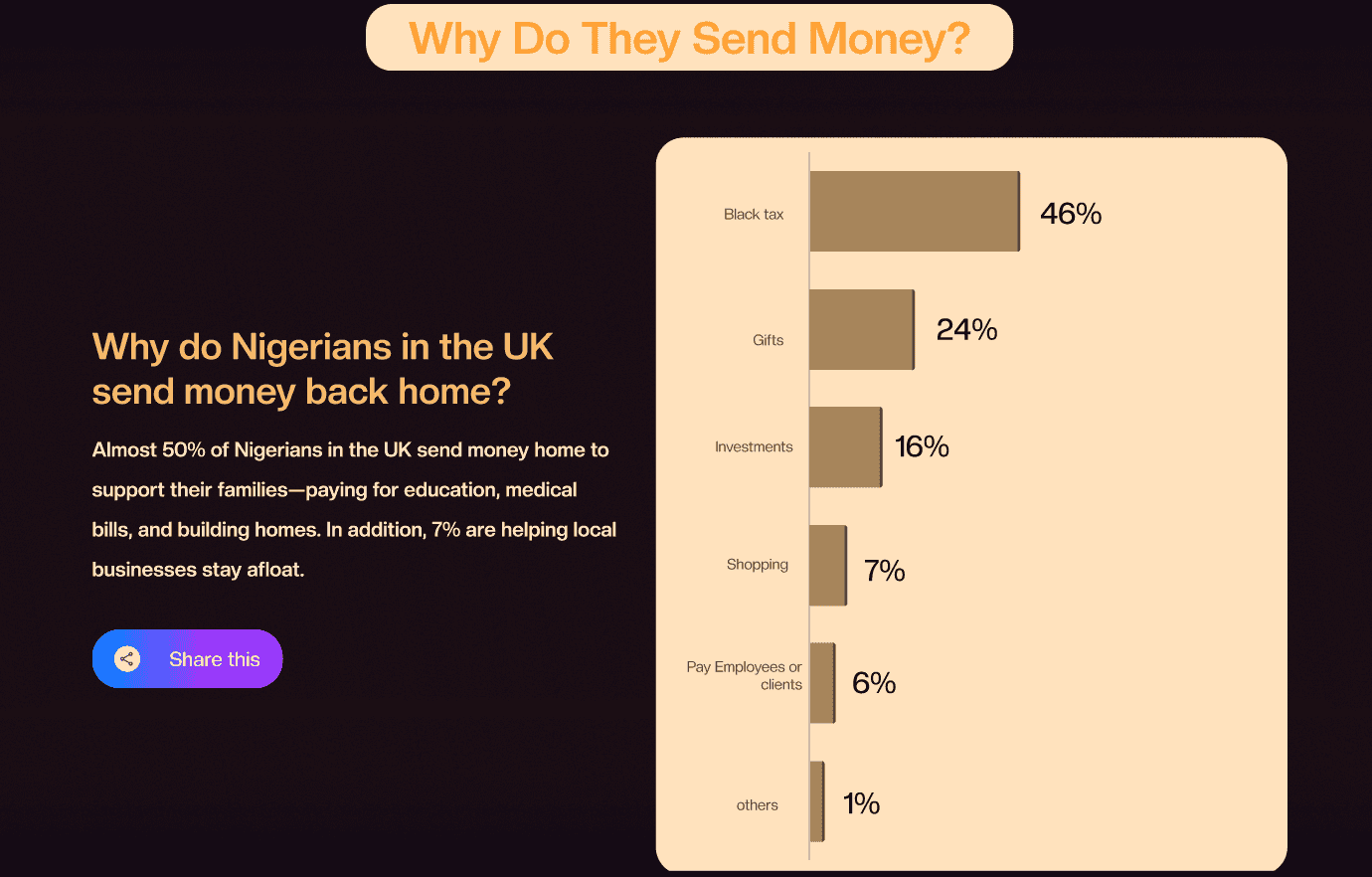

4. 46% of those remittances are Black Tax

“Black Tax” accounts for 46% of remittances, as many Nigerians prioritise supporting their families back home. This financial obligation is vital in sustaining households and communities, but it can also strain the sender’s finances.

Other common reasons for sending money include gifts (24%), investments (16%), and business contributions.

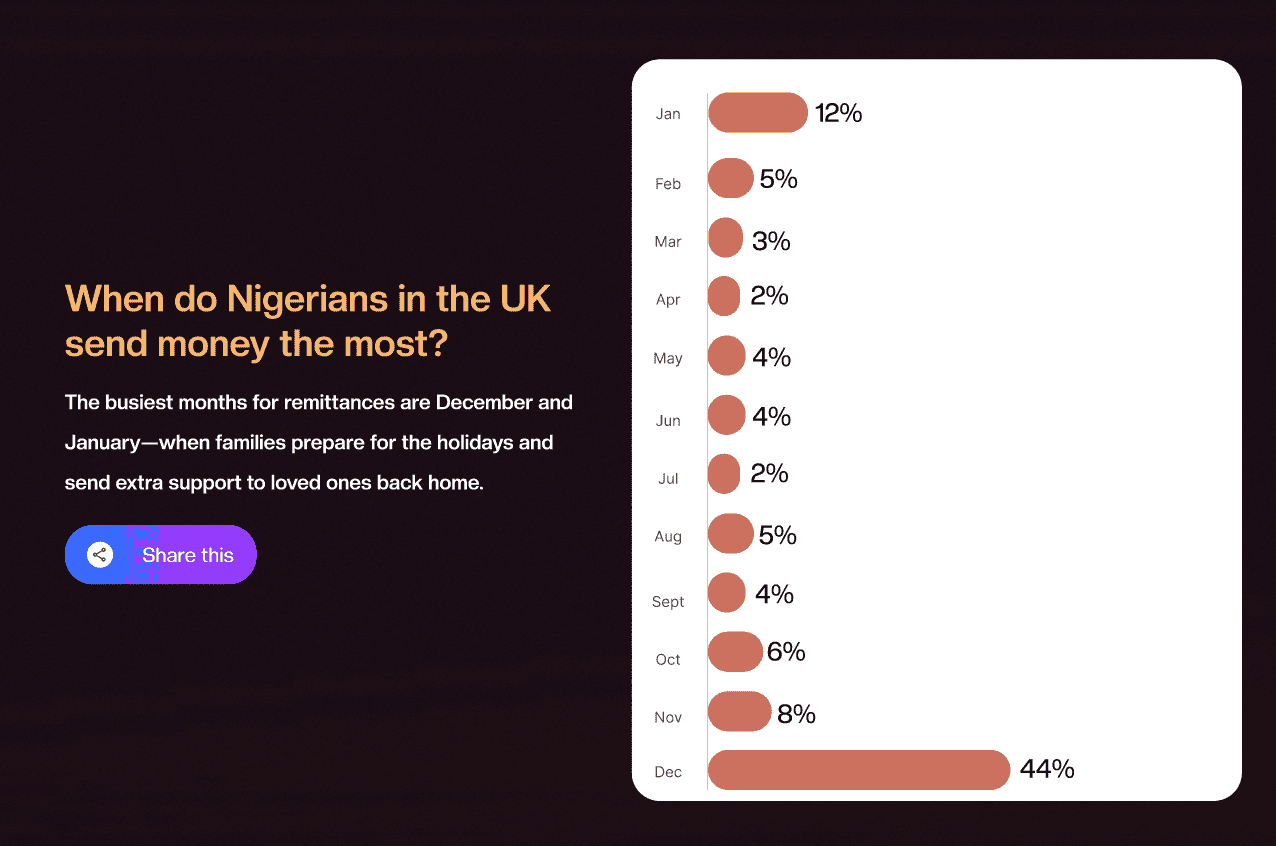

5. Nigerians in the UK sent money home mostly in December and January.

The festive season drives 44% of remittances in December, as many Nigerians send money to support their families during the holidays. January sees another spike when families cover post-holiday expenses like school fees, providing vital financial support and strengthening family bonds.

Bottom line

As more Nigerians seek opportunities abroad, due to challenging economic conditions, their financial support will keep playing a key role in helping sustain the nation’s economy. OhentPay’s report shows that these funds have made a real difference and what really stands out is the ongoing need for secure, efficient, and affordable transfer services, ensuring that the impact of these funds continue.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: December 10, 2024