American economist and Nobel Laureate, Kenneth J. Arrow, noted, “Virtually every commercial transaction has within itself an element of trust.”

Indeed, there is a correlation between societies with strong economies and their trust level. China (60%) and the United States (35%) rank higher when judged by their trust level versus South Africa (23%), Nigeria (15%) and Ghana (5%). Hence, the argument that Nigeria and Africa are a low-trust environment.

The presence of higher levels of trust in developed nations has produced global innovations like Uber, where strangers move around in a stranger’s car, and Airbnb, where strangers house other strangers. Uber and Airbnb have led a shift in how people and over 200 countries think about transportation and short-term accommodation globally. As a result, these companies have amassed immense commercial value. Combined, those two American companies, Uber and Airbnb, are worth $270 billion, which is more than the GDP of Nigeria.

In financial services, the need for trust is more pronounced. Depositors give their money to an institution, like a bank, and hope that it will be readily available when they demand it.

On average, the evidence suggests that entities can trust banks. Tragic events like the 2008 financial crisis detract from the public trust, while stories of savings used to buy a car and wealth from investments contribute to the trust. Guardrails, such as a strong regulatory environment that enforces prudential behaviour, such as maintaining a cash reserve ratio, and public assurances, like deposit insurance, help to build trust.

However, a new dawn in financial services is soliciting public trust once again.

Enter stablecoins, a new era in financial services

Like banks, stablecoin issuers ask holders to trust that their digital tokens are backed by real-world money (fiat) stored in bank vaults or held in other liquid assets—collectively called reserves. But unlike banks, and more like e-money issuers, stablecoin issuers must maintain a 1:1 ratio between tokens and reserves to claim full backing.

Independent auditors can verify these reserves through a process known as attestation. After each attestation, the auditor publishes a report comparing the stablecoins in circulation with the reserves that back them.

Public trust took a hit in 2021 when Tether—the issuer of USDT, the world’s largest stablecoin by market capitalisation—came up short in its reserve backing. The US CFTC fined the company and its affiliates for not maintaining full backing and misleading the public. “In fact Tether reserves were not “fully-backed” the majority of the time,” reads the Order. “The order further finds that Tether failed to disclose that it included unsecured receivables and non-fiat assets in its reserves, and that Tether falsely represented that it would undergo routine, professional audits to demonstrate that it maintained “100% reserves at all times” even though Tether reserves were not audited.”

Why not just back stablecoins with cash reserves?

Chasing higher returns.

A stablecoin issuer might avoid holding only cash or other liquid fiat assets because these tend to earn very low returns. In finance, there’s a general trade-off between risk, return, and liquidity. The more liquid or safer an asset is, the lower its expected yield. Cash and overnight deposits, for instance, are highly liquid but pay minimal interest. Treasury bills or other slightly longer-dated securities, while less liquid, typically offer higher yields to compensate for the time and interest-rate risk investors take on.

Stablecoin issuers, like any capital manager, want to maximise the return on their reserves without compromising redemption safety. By holding a portion of their reserves in longer-term or slightly less liquid assets (for example, 3- to 6-month Treasuries instead of overnight cash), they can generate more income while still maintaining a strong liquidity position to meet redemptions.

In short, backing a stablecoin entirely with liquid fiat assets sacrifices yield for liquidity, whereas holding a diversified mix of short- and medium-term instruments balances liquidity needs with higher returns — a trade-off that directly affects the issuer’s profitability and sustainability.

The subsequent stablecoin regulation from the Tether case has mandated proof of reserve.

Regulatory-enforced attestations for stablecoins

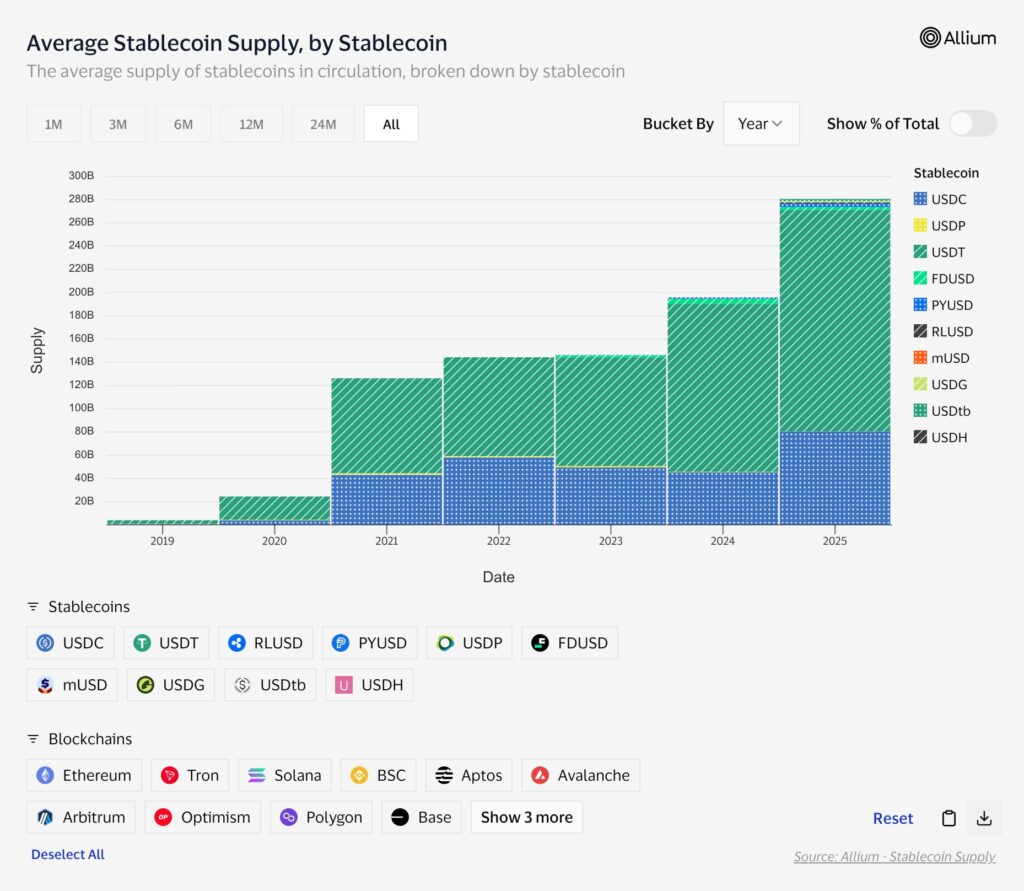

Since 2021, stablecoin supply has more than doubled from approximately $130 billion to $280 billion and counting in 2025. The passage of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act in July 2025 has led to significant year-over-year growth in stablecoin supply. Stablecoin supply went from an average growth rate of 16% in the last three years to 44% in 2025.

Stablecoin issuers must now maintain a 1:1 reserve backing, promptly disclose reserves, and conduct regular audits. “A permitted payment stablecoin issuer shall—(A) maintain identifiable reserves backing the outstanding payment stablecoins of the permitted payment stablecoin issuer on an at least 1 to 1 basis…(C) publish the monthly composition of the issuer’s reserves on the website of the issuer,”. Furthermore, stablecoin issuers “…shall, each month, have the information disclosed in the previous month-end report required under paragraph (1)(D) examined by a registered public accounting firm.”

In Europe, it’s no different, as the Markets in Crypto-Assets (MiCA) Regulation requires stablecoin issuers to provide clear, audited, and transparent information about their reserve assets to ensure consumer protection and market integrity.

These regulations provide the clarity and safety necessary for stablecoins to transition from a niche crypto-asset into a trusted component of the global financial system.

The rise of local stablecoins

When you think about it, the USDC is a stablecoin local to the US, where the fiat currency is USD.

Local stablecoins are a way for countries to access cheaper liquidity. By creating demand for Government bonds as a stablecoin reserve component, countries gain the liquidity to finance their activities without having to print more money. For instance, Circle, the second-largest stablecoin issuer that issues the USDC, has parked $30 billion in short-term US treasury bills, as attested by Deloitte.

Other countries are aware of this and have developed their own stablecoin framework or are in the process of doing so to allow licensed players to issue stablecoins backed by their local currency.

In Europe, the MiCA regulation has spurred the growth of Euro-backed stablecoins. There are now projects like EURC, issued by Circle and EURCV, issued by Societe Generale–FORGE (SG-FORGE). And they are growing in issuance. For instance, the EURC market cap has surpassed $321 million as of November 10, 2025.

Last year, on October 27, a Japanese startup released an eponymous yen-backed stablecoin, JPYC, which has already issued 143 million yen in stablecoins. It aims to get to 10 trillion in three years, while investing “80% of its proceeds in JGBs and 20% in bank savings.” CEO Okabe told Reuters that, “Japan must ensure the yen has a presence in the global stablecoin market.” As “…the stablecoin market is dominated by the dollar, which is a disadvantage to Japanese firms that need to pay extra hedging and transaction costs.”

Africa will not be left behind.

Africa’s place in the emergence of local stablecoins

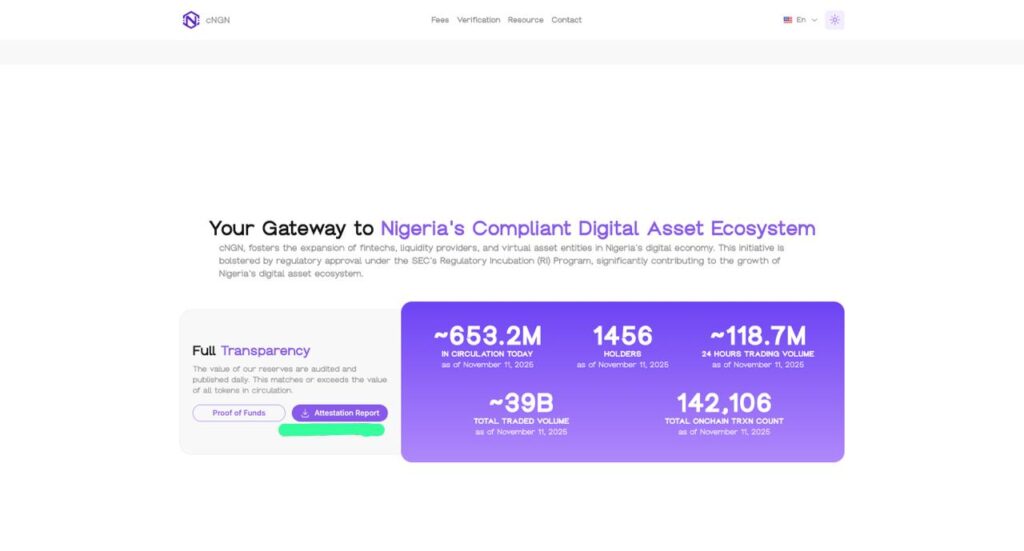

Africa, starting with Nigeria, is emerging with its own local stablecoins. The cNGN initiative, which is growing 77% month-on-month, represents the first generation of regulatory-compliant stablecoins in the region.

Although there are no specific requirements for the issuance of stablecoins in Nigeria, that activity still falls under the SEC’s purview, legal expert Adebayo Fabamise tells Condia. Fabamise is a Managing Partner at Cresthall Attorneys, a law firm that advised and co-founded the cNGN project. Like WrappedCBDC (issuer of cNGN), Cresthall is a member of the Africa Stablecoin Consortium (ASC), which is a Nairobi-headquartered NGO focused on driving stablecoin adoption on the continent while promoting best practices.

By operating within the Nigerian Securities and Exchange Commission’s (SEC) Regulatory Incubation Program, the cNGN project has chosen a path of oversight from day one. “Under the Accelerated Regulatory Incubation Program (ARIP) program, it has licensed virtual asset service providers under a strict regulatory oversight regime…,” says Fabamise.

The requirement for reserve management and attestation in Nigeria is no different from what’s obtainable in other developed countries. “Further to its licensing of the first stablecoin issuer, it provides practical and operational guidelines for reserve management and attestation,” says Fabamise. These guidelines include, “the appointment of a custodian to hold all reserve assets in trust…, the appointment of an attestation auditor who carries out regular at least monthly audit to ensure that the reserve value matches or exceeds the value of stablecoin minted and in Circulation.”

Just like the US, there is no specification on the reserve mix ratio, only that reserves should be held in high-quality liquid assets. Fabamise adds that, “With respect to reserve mix, the only requirement is to keep the reserve in liquid assets, such as cash, money market funds, bonds and no specific requirement as to the ratio of cash to other assets.”

The cNGN discloses on its website the real-time holdings, holders, and amount in circulation, alongside a link to its attestation reports. Also, WrappedCBDC Limited employs the services of Bala Isah Garba & Company, an independent Nigerian chartered accounting firm, which audits them in accordance with the International Standard on Assurance Engagement ISAE 3000 (Revised).

There are 653.2M cNGN tokens in circulation, according to its website.

As of its latest attestation report (October 2025), WrappedCBDC had an excess reserve asset of ₦17.5 million, which beats the 1:1 ratio for stablecoins-fiat backing. It held its reserves in bank deposits (54%) and treasury bills & money market funds (46%).

Condia probed to find out why a Big Four Accounting firm is not the attestation auditor for cNGN. A company representative said that the Big Four firms appeared to have a lower appetite for examining digital assets in new markets.

In conclusion, for stablecoins to serve as a reliable rail for the future of finance in Africa, unwavering proof of their backing is essential, especially given the continent’s low trust environment.

Both market demand and regulation enforce the global standard: trust must earn itself through verifiable, independent, and public attestations. By embracing this standard, Nigeria’s financial ecosystem can set a new benchmark for innovation built on the bedrock of transparency.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore