As Nigeria gradually transitions towards a cashless economy, many micro, small, and medium enterprises (MSMEs) are embracing digital payment solutions, including POS devices, bank transfers, and online payment platforms.

Among these methods, bank transfers remain the preferred option for MSMEs when receiving payments for goods and services. According to The Nigeria MSME Report 2022, bank transfers account for 23.3% of payments to MSMEs, compared to only 3.04% for POS transactions.

The dominance of bank transfers can be attributed to the high cost of acquiring and maintaining POS devices, coupled with the hefty card processing fees associated with payment platforms. Additionally, many consumers prefer bank transfers due to their accessibility and security compared to card payments.

However, transfer payments are not without challenges. First, bank transfers are not always reliable, occasionally resulting in failed customer transactions. Second, confirming interbank transfers can take between five and thirty minutes, particularly in physical stores where the cashiers or sales attendants have to reach out to store owners or managers in charge of the business account. In addition, reconciling payment receipts with total sales is a time-consuming and error-prone process.

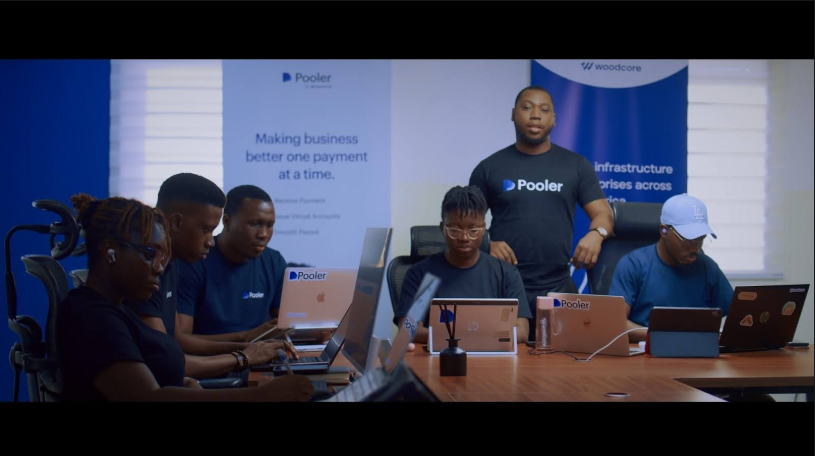

Pooler, a financial solutions platform launched by Woodcore co-founders, Samuel Joseph and Toyin Olasehinde, addresses these pain points for MSMEs.

Leveraging Woodcore’s network of licensed and regulated banking partners, Pooler offers a suite of tools that empower merchants to collect payments via bank transfers more seamlessly and efficiently. With Pooler, MSMEs can enjoy instant transaction confirmation, fast settlement, and seamless reconciliation.

“Pooler wasn’t built to compete with card payments, but to offer a faster and more efficient alternative that eliminates chargeback issues,” said Samuel Joseph, CEO and Co-founder of Woodcore. “Our goal is to leverage our partnership with Kredi Microfinance Bank and other MFBs on the [Woodcore] platform to offer near real-time transactions to small businesses.”

How Pooler facilitates seamless transfer payments for MSMEs

Pooler offers five key features for accepting transfer payments, two of which are designed specifically for MSMEs with physical and online stores: Cashier and Payment Links.

Cashier

The Cashier feature enables physical and online businesses with multiple sales agents to accept and confirm transfer payments faster.

With Cashier, the business owner assigns each sales agent virtual accounts to which customers can make bank transfers. Upon accepting payments, the sales agents receive instant email and WhatsApp notifications, enabling them to confirm transactions without delay. The business owner also receives real-time email notifications and can view payments collected by each cashier on the Pooler dashboard.

At the end of the day, the business owner settles the funds collected by the sales agents into the Pooler account. Alternatively, the business owner can opt for automatic settlement by the close of business.

Payment Links

Payment Links cater to businesses that conduct sales through online channels like WhatsApp and Instagram, rather than a dedicated website. On the Pooler dashboard, these business owners can generate payment links that direct customers to a checkout page where they can pay for products or services via bank transfers.

Payment Links offer several advantages over traditional bank accounts for online businesses. First, payments collected through Payment Links boast a 99.9% transaction success rate, drastically reducing the risk of failed transactions. Second, successful transfer payments are confirmed in less than a minute, allowing merchants to verify payments faster.

Cashier and Payment Links also simplify the reconciliation process for MSMEs. Transactions are automatically recorded on the Pooler dashboard, eliminating the need for manual reconciliation at the end of the day. In addition, payments collected through Payment Links and Cashier accounts attract low transaction fees, reducing costs for small businesses.

To further support MSMEs, Pooler plans to launch an invoice feature that empowers businesses to receive payments from customers or suppliers quickly and streamline their reconciliation process.

“We’re always looking for ways to meet the diverse needs of small business owners, and that’s why we’re thrilled to launch the invoice feature soon. This feature will let users create and send invoices to their suppliers or customers with a ‘Pay Now’ button that takes the recipient to a checkout page where they can pay with bank transfers easily,” said Toyin Olasehinde, COO and Co-founder of Woodcore. “This is just one of many amazing features we are developing to help business owners collect transfer payments seamlessly, and our users can expect to see more in the next few months.”

Pooler enables Nigerian MSMEs to leverage bank transfers for fast and secure payment collection. With Pooler, MSMEs can improve customer service, streamline reconciliation, and manage their finances better, contributing to Nigeria’s economic growth.

To enjoy the benefits of Pooler’s features, business owners can visit poolerapp.com and create an account.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: December 19, 2024