The Indian government is planning to expand its Unified Payments Interface (UPI) in Africa through commercial partnerships between payment platforms. According to Mint, an Indian business publication, the government is in talks with “several African countries”, including Namibia, Mozambique, and Kenya.

“There are many countries in the world which have similar problems we had before the advent of UPI. These are financial inclusion, supporting rural economies, fintech incubation, transparency, and other things,” says Ritesh Shukla, International CEO of the National Payments Corporation of India (NPCI).

“We are looking at partnering with those countries to help them create their own versions of UPI in a very sovereign manner,” Shukla added.

What is the Indian UPI about?

NPCI conducted the pilot launch of UPI in April 2016. It is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

Currently, UPI has about 300 million UPI users and 500 million merchants who use UPI to accept money for their businesses, according to local media. It is said to be the most popular way that Indians transact online.

According to GlobalData research, cash transactions in India have declined from 90% of the total volume in 2017 to less than 60% in 2021.

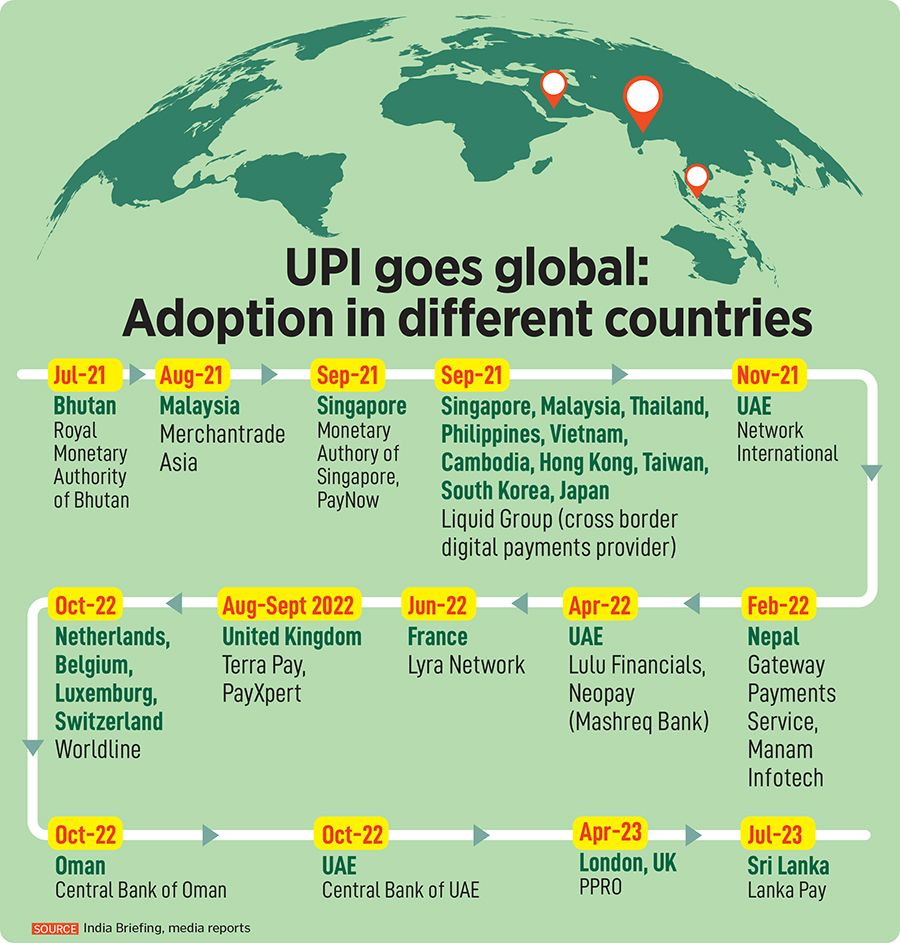

Recently, NPCI linked with Singapore’s PayNow, allowing transfers on the PayNow Virtual Payment Address (VPA) the same as a domestic transfer on UPI. “An Indian tourist in Singapore can now seamlessly pay via UPI for a coffee purchased or even a television,” Forbes India reported. “The PayNow-UPI linkage is India’s first cross-border, real-time system linkage and Singapore’s second. It’s also the world’s first such linkage feature cloud-based infrastructure and participation by non-bank financial institutions,” according to Singapore Prime Minister, Lee Hsien Loong.

“We have about 30 million Indians who live outside India. They send about $100 billion every year. Today, this experience is very, very fragmented, depending on which part of the world you live in. We are trying to see how we can standardize this whole user experience,” Ritesh Shukla, added.

The technology is also undergoing expansion in France, the United Arab Emirates, and Sri Lanka.

Driving UPI’s global adoption through BRICS

During the recently concluded BRICS summit—a grouping of the world economies of Brazil, Russia, India, China, and South Africa—in Johannesburg, Indian Prime Minister, Narendra Modi was quoted in the media saying: “There is scope for working with BRICS on the UPI technology”. BRICS now has six new member states; Saudi Arabia, Iran, Ethiopia, the United Arab Emirates, Argentina, and Egypt.

“UPI is used at all levels from street vendors to large shopping malls. Today, among all countries in the world, India is the country with the highest digital transaction,” he said.

“Through the use of technology, India has taken a big leap in financial inclusion. This has helped our rural population,” Modi said, at the BRICS Business Forum Leaders’ Dialogue in Johannesburg. “Over $360 billion have been transferred to beneficiaries through our direct-benefit-transfer model.”

India also plans to use its ongoing presidency of the G20 forum to make presentations to other nations about its digital infrastructure. G20 is a collection of twenty of the world’s largest economies formed in 1999.

This is a developing story

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: December 4, 2024