Global fintech company Grey has officially launched Grey Business, a multi-currency payments platform designed to help startups and SMEs across Africa and other emerging markets manage international transactions with speed and transparency.

Grey Business was officially launched on February 10, 2026, at an exclusive side event during Africa Tech Summit in Nairobi, hosted in partnership with Paystack and Antler. The launch featured a live product demonstration by the founders, showcasing the platform’s capabilities.

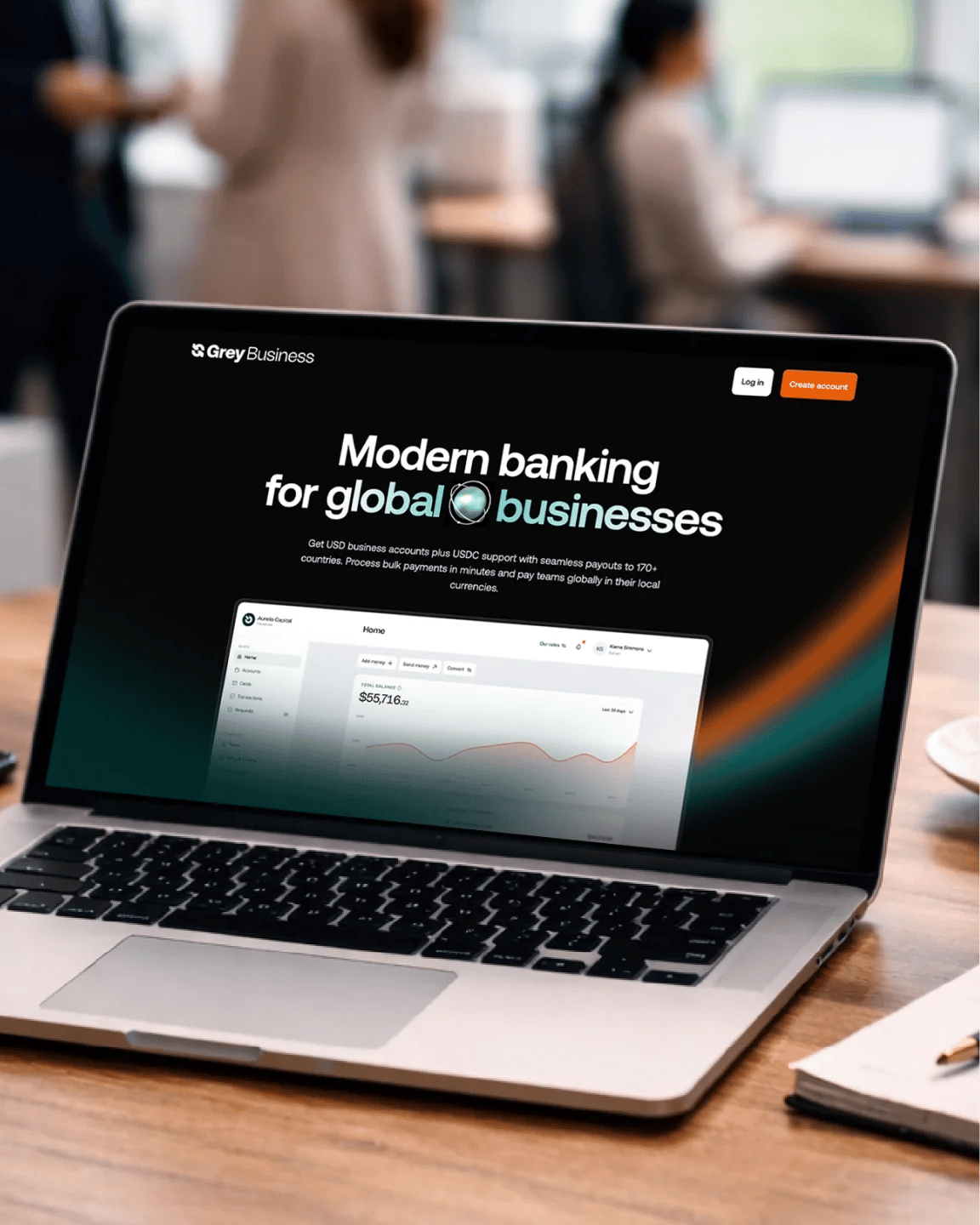

Grey Business enables companies to open and operate USD corporate accounts, send and receive payments globally, and convert currencies instantly at real-time exchange rates. The platform also supports USDC and USDT stablecoin transactions, giving businesses additional flexibility in how they manage and move funds. The new product marks a significant expansion of Grey’s mission to make seamless cross-border banking accessible to individuals and businesses worldwide.

For years, African entrepreneurs and companies have faced complex and expensive cross-border payment processes, slow settlement times, hidden charges, and limited access to foreign accounts, that hinder international expansion. Grey Business eliminates those barriers, allowing users to transact globally as easily as they would locally.

“We’ve seen too many businesses lose time and money waiting for payments to clear,” said Idorenyin Obong, CEO and Co-founder of Grey. “Every conversation with business owners came back to the same pain point: payments. Grey Business was built from those stories. We want to give African companies the freedom to grow without borders.”

Africa’s cross-border payments market is projected to exceed $1 trillion by 2035, yet inefficiencies in remittances and foreign exchange remain a major challenge. By providing transparent rates and instant settlements, Grey aims to help startups and small businesses fully participate in the global economy and scale faster.

Regulated in the U.S. by FinCEN and in Canada by FINTRAC, Grey currently serves nearly 3 million users across 70 countries and facilitates transfers to more than 170 destinations worldwide. More than 1,000 businesses signed up during Grey Business’s beta period. The launch marks the company’s expansion into the B2B payments space, complementing its existing offerings for individuals and remote professionals.

With this milestone, Grey continues to bridge financial gaps for entrepreneurs in emerging markets, offering a single platform where businesses can bank, pay, and operate internationally with confidence.

Businesses can register for Grey Business at grey.co/business.

About Grey

Grey is at the forefront of providing secure and convenient global banking solutions to meet the needs of customers and businesses. Grey holds a Money Service Business license from FINTRAC in Canada, and FinCEN in the USA, and our primary focus is emerging markets. Our range of services enables individuals and businesses to easily own and manage multi-currency accounts. This includes currency exchange, sending and receiving payments to and from over 170 countries, as well as access to virtual cards.

Media contact

For all press-related inquiries, please contact Oyinda

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: February 16, 2026