In 2021, Mariam Attah*, an undergraduate based in northern Nigeria borrowed ₦50,000 from —an unlicensed digital loan provider—to cater for a few bills in school. With the intention to pay back the money with a 1% daily interest rate within 91 days, she provided all the information required, per Know Your Customer (KYC) standards.

However, as the repayment day was near it became more obvious that Mariam will be unable to pay the money on time. “Instead of waiting for the threat messages, I decided to delete the app and also switch my SIM cards,” Mariam said. Months later, she was able to repay the loan at a discounted rate.

With rising poverty rates in Nigeria leading to financial uncertainty, many Nigerians like Mariam see predatory digital lenders as the only source of financial help. These lenders are known for debt shaming their users into paying back their debts, some of the debtors go as far as borrowing from another lender to pay their debts.

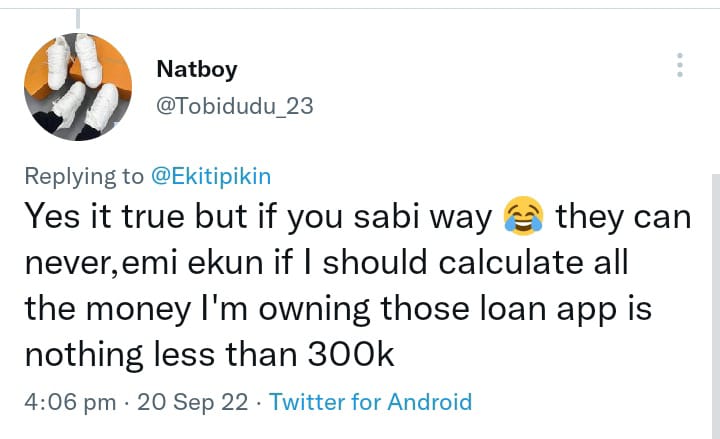

Although other users like Mariam pay back their loans even after avoiding debt shaming, some have found ways to boycott these lenders, so it is an issue of predatory lenders and predatory borrowers. “If I should calculate all the money I am owning those loan apps [it] is nothing less than ₦300,000,” @Tobidudu_23 remarked in a tweet thread where several Nigerian digital loan app users admitted to defrauding these platforms.

Another user, @Adasbillions shared a tip on how individuals can defraud digital lenders without consequences. She said: “After receiving the loan, go to each app setting and disable ALL the permission you give them. Then use Truecaller to block unknown numbers and you can take it a set further by going to the bank to block the ATM card you used to get the loans and request for new ones.”

Wait !!!! LOAN APPS automatically lock your phone when you’re due for payment?

Tf is that Abi these guys dey use scope

— MAYOR OF EKITI (@Ekitipikin) September 20, 2022

Aside from excessive interest rates, hidden charges and disregard for data privacy regulations to debt-shame users, some predatory digital lenders go-ahead to lock the devices of defaulting debtors.—during sign-ups, users grant access to these platforms that enable them to carry out such actions.

In recent times, the Federal Competition and Consumer Protection Commission (FCCPC) has continued to crack down on some digital lenders over data privacy breaches and lack of operational authority. In August 2022, FCCPC developed a Limited Interim Regulatory/Registration Framework and Guidelines for Digital Lending which has been adopted by the inter-agency Joint Regulatory and Enforcement Task Force as an interim step to establishing a clear regulatory framework for the sector.

Despite the aforementioned actions to regulate digital lending, little or no attention has been paid to how users are also defrauding these platforms. Although some Nigerian lenders working with SMEs recently told Benjamindada.com that they have recorded above-average loan repayments, there are still defaulters, especially for consumer loans.

What are the legal consequences of loan defaulting in Nigeria?

In September 2022, the Central Bank of Nigeria (CBN) said it will deploy the Global Standing Instruction (GSI) against loan defaulters under the Anchor Borrower Programme (ABP). The GSI is a policy that allows banks to debit the accounts of loan holders in their banks to settle defaults.

As of November 2021, the CBN revealed that ₦463 billion was yet to be paid by some of the beneficiaries of the programme out of the ₦788 billion that was disbursed. Some economic experts linked the rising default rate to rising insecurity in certain parts of the country, especially the food-producing states.

Recently, Kuda Microfinance Bank, a Nigerian fintech company, reportedly incurred a loss of more than ₦6 million including non-performing loans (NPL). The report said that “NPL recorded by the firm is too high for the comfort calculated at 69%”.

Kuda launched its overdraft program in March 2021 allowing users in the pilot program can borrow up to ₦50,000 at a daily interest rate of 0.3% of any amount they borrow. At the end of Q2 2021, the bank disbursed $20 million worth of credit to over 200,000 qualified users, with a 30-day repayment period.

Can these loan defaulters be dealt with?

A legal practitioner who chooses to be anonymous said that: Although loan defaulting is a civil offence and not a criminal offence—which means you will not be jailed, the court can however rule against you if it is realised that you intentionally want to default on a loan. Also, it is fraud if you lied to get the loan—this is a criminal offence.

The above question is why individuals like @Tobidudu_23 are able to take loans without the intention to repay.

Editor’s Note:

- *the name is not the real name of the source

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore