We have prepared context and insights about this week’s leading news. The stories are:

- Silverbacks cashes out of OmniRetail

- South Africa’s Telkom mobile grows by 10%

- Salus Cloud raises $3.7M to expand Software delivery in Africa

Silverbacks cashes out of OmniRetail

Silverbacks Holdings, an investment firm, has just locked in its ninth profitable exit, partially selling its stake in Nigerian B2B e-commerce startup OmniRetail for a 5x return. The move follows OmniRetail’s recent $20M Series A raise, backed by big names like Flour Mills of Nigeria.

OmniRetail, which connects retailers to FMCG suppliers through its platform, has experienced explosive growth; revenue increased from $ 280,000 in 2020 to over $120 million in 2023, and it processed more than ₦1.3 trillion in transactions last year.

As for Silverbacks, this isn’t their first win of the year. Last month, they walked away with a 29x return from LemFi. According to the firm, its African portfolio is performing exceptionally well, with fintech investments alone returning a 13.7x multiple on investment capital and a 91.9% internal rate of return. In contrast, their non-African exits boast a modest 1.3x.

Zoom out: Meanwhile, OmniRetail’s CEO, Deepankar Rustagi, recently co-invested in the Cape Town Tigers, alongside Silverbacks Holdings.

South Africa’s Telkom mobile grows by 10%

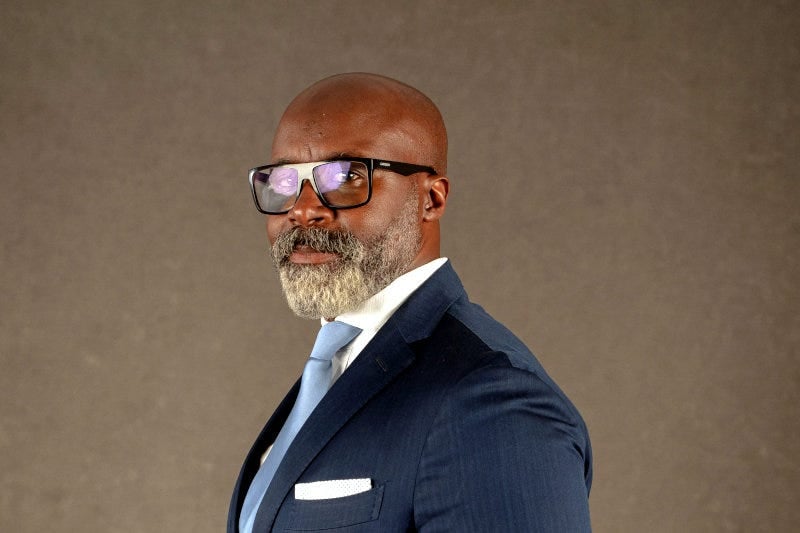

Telkom’s mobile business is quietly carrying the team. The South African telco reported a 10.2% jump in mobile service revenue, thanks to nearly 3 million new subscribers hopping on board last year, mostly prepaid users. That brings Telkom’s total mobile customer base to 23.2 million.

CEO Serame Taukobong called it “the star of the consumer business,” and it’s easy to see why. Despite subscriber growth, average revenue per user (ARPU) held steady at R60 (over $3), which helped boost overall group revenue by 3.3%.

Context: Mobile data demand is also surging. Telkom added over 2 million new mobile data subscribers in the last year, bringing the total to 15.2 million, up 19.5%. A big part of this growth came from outside major cities, where the company’s cheaper data plans are catching on.

On the infrastructure side, its wholesale division, Openserve, is going cross-border. It’s working with global giants like Google to roll out more undersea and terrestrial cables across Southern Africa. A new international connection linking South Africa to Angola and Brazil is already in the works. Fibre revenue is up too; 10% growth this year, with fibre now making up 82% of Openserve’s revenue.

Zoom out: After a four-year dividend freeze, Telkom is finally rewarding shareholders again with a special payout. Full-year earnings rose over 60%, and with cash flow back in good shape, the company also says it’s doubling down on 4G, 5G, and edge computing to power the next wave of digital services across Africa.

Salus Cloud raises $3.7M to expand Software delivery in Africa

Cape Town-based Salus Cloud just raised $3.7 million to make DevOps less of a headache for African startups. The seed round, led by Atlantica Ventures and P1 Ventures, will help the team scale its AI-native platform across Africa, the Middle East, and other underserved tech ecosystems.

Salus launched in 2024, founded by Andrew Mori, also the CEO of engineering firm Deimos, who’s seen firsthand how DevOps gets deprioritised in growth markets. “Startups shouldn’t be spending time building infrastructure that’s not core to their business,” Mori told Condia. “If you’re building a fintech, focus on loans—not on securing Kubernetes.”

So far, five enterprise clients have signed on, with strong traction in Nigeria, Kenya, and South Africa. The fresh capital will go into expanding Salus’s presence in developer communities and tech hubs, improving onboarding, and doubling down on go-to-market efforts across Africa and beyond.

The big bet? That Salus becomes the default DevOps layer for African tech. “We want to support 50–500 enterprise teams and tens of thousands of developers by 2026,” Mori said.

By the Numbers

$1 Trillion

Africa’s cross-border payments market is on track to triple by 2035, hitting $1 trillion, up from $329 billion in 2025, according to a report by Africa-focused VC firm Oui Capital.

The sector is expected to grow at a 12% compound annual growth rate, fueled by rising fintech innovation, increased intra-African trade, and the rapid adoption of mobile money.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore