Bitcoin has climbed above $94,000, its highest in two months, as a wave of bullish sentiment sweeps across crypto markets. Ethereum, Solana, Dogecoin, and XRP have also posted strong gains, with most altcoins up between 7% and 11% in nearly 24 hours.

The upswing comes as political and monetary signals from the U.S. ease market anxiety. President Trump’s reaffirmed support for Federal Reserve Chair Jerome Powell and comments hinting at tariff relief with China helped trigger a rally that’s now liquidating bearish bets in droves.

At a private JPMorgan investor event on Tuesday, Treasury Secretary Scott Bessent said the current trade war with China is “unsustainable,” reinforcing optimism already brewing after Trump publicly committed to lowering the 145% tariffs on Chinese goods.

Markets took that as a signal that global economic tensions could be cooling, opening the door for a continued risk-on environment. In crypto, that means BTC broke through $92K, while Ethereum pushed past $1,700 and Dogecoin soared above 18 cents.

The halving cycle hits one-year mark

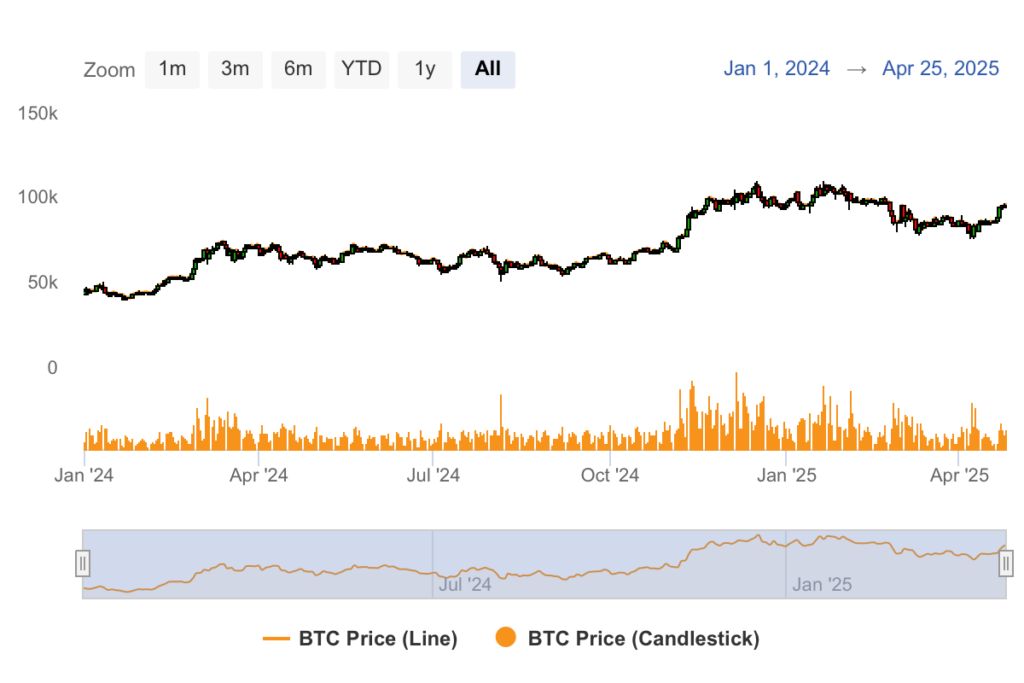

This week also marks 12 months since Bitcoin’s last halving—a major event that historically kickstarts bull runs. But the 2024 cycle has stood out: Bitcoin reached a record $73,600 on March 13, 2024, before the halving even happened. It was the first time BTC peaked ahead of the halving, not months after.

Now, a year later, the renewed momentum suggests the market may still be riding that cycle—but on a new timeline.

Tuesday’s 7% jump triggers $234M wipeout, biggest of 2025

The price surge forced over $234 million in short liquidations, including a single $4.5 million ETH futures position, marking the biggest short wipeout of 2025 so far.

For context, this rivals the $426 million liquidated during the major November 2024 breakout.

Bitcoin’s recent range between $87K and $91K gave little warning before Tuesday’s 7% daily jump, which cleared key resistance and reignited chatter about a possible retest of the $108K all-time high.

Update (April 26, 2025): Bitcoin briefly touched $95,000 in early trading before slipping back to $94,000 by evening, adding another twist to this volatile breakout.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: April 28, 2025