IVED for improved registration of voters, BVAS for both voter accreditation and e-transmission of results for collation and the INEC IReV portal to offer the public access to view Polling Unit results.

In letter 150, we examine the following:

- SpaceX’s recommendation of payment fintechs for the purchase of Starlink in Nigeria

- layoffs at Chipper Cash and Jumia

- CcHub’s plan to invest $15 million into 72 African edtech startups

and other noteworthy information like:

- the Insider’s Perspective w/ Yiaga Africa’s Head of Elections Projects

- the latest African tech startup deal

- Zero to Scale w/ Famasi co-founder and CEO

- opportunities, interesting reads and more

The Insider’s Perspective

As Nigeria heads to the polls, Paul James, Head of Elections Projects at Yiaga Africa, a leading civic organization promoting public accountability in Africa, talks to Benjamindada.com about the technologies that will power the elections.

“Every technology comes with its challenges which sometimes include human errors. However, it will bring sanity to the process; the good will outweigh the challenges”, adds James.

The big three!

Starlink recommends “Payday, Barter or similar” for Naira payments

The news: SpaceX’s Starlink advises Nigerian customers to use payment fintechs like Payday and Barter to complete their orders. “For Naira payments, please use Payday, Barter, or similar,” reads Starlink’s website.

Why it matters: Since its launch in Nigeria, many customers have complained about their inability to complete their orders in Naira, yet the prices are displayed in naira.

The payment fintechs offer seamless naira-to-dollar conversion and virtual dollar cards that customers can use to make payments.

Although Payday currently allows its users to create dollar virtual card and fund it with Naira, Flutterwave’s Barter shut down its virtual card service in July 2022 due to “an update from our card partner, which will cause the card service to be unavailable for an extended period of time.”

Barter says it is currently “revamping for an improved experience”, Flutterwave has created a waitlist to inform users about the “new Barter” launch date, according to a notification seen by thecondia.com. This recommendation by Starlink means that the Flutterwave product might be up soon.

Zoom in: Last week, Benjamin Dada, Publisher and Editor-in-Chief of thecondia.com completed an order for Starlink using Payday. According to him, “although Starlink says that “for naira payments…use Payday…” it doesn’t mean that Nigerians can make payments using a naira card from Payday. They mean that [these customers] can make payments using Payday.”

These values imply that Nigerians have ordered over 600 Starlinks.

Layoffs continue at Chipper Cash and Jumia

The news: After laying off 13% of its workforce in December 2022, cross-border payments startup Chipper Cash, last week, dismissed more than a third of its workforce. Jumia, a leading e-commerce company in Africa also disclosed in its 2022 financials that it laid off 20% of its workforce in Q4 2022 [pdf].

Zoom in to Chipper Cash: Since last year, several companies across the globe adopted layoffs as a strategy to cushion the effect of the economic downturn—for instance, last year, Chipper Cash’s valuation dropped by 37.5%—from $2 billion to $1.25 billion.

Per FT, Chipper Cash and other companies were offered by FTX as collateral when it planned to get fresh funding to prevent it from its eventual bankruptcy. Recall that in November 2021, the fintech Unicorn raised $150 million in a Series C extension round led by Sam Bankman-Fried’s defunct cryptocurrency exchange platform, FTX.

The company’s entire crypto department was laid off, according to media reports. “Friday [Feb. 17, 2023] was a sad day for Chipper Cash, as many talented people were let go,” Stefano Pard, Head of Revenue at Chipper Cash, said in a LinkedIn post. Aside from the crypto team, the layoffs affected employees across engineering, program management, and IT teams.

Unrelated to the layoffs, Erin Fusaro left her role as the company’s chief technology officer, a week before the latest layoffs.

Inside Jumia: The laying off of 20% of its workforce is another move on Jumia’s path to profitability, the pan-African e-commerce company projects that it will reduce its losses in 2023 to a range of $100–$120 million. Jumia has since discontinued its loyalty subscription offering, Jumia Prime as a cost-cutting measure.

Last year, Jumia co-founders and co-CEOs—Jeremy Hodara and Sacha Poignonnec—stepped down “to support Jumia’s journey towards profitability”, Francis Dufray who was appointed to serve in the interim following the duo’s resignation has now been confirmed as the company’s CEO. Dufray will now be at the helm of the affairs, driving the company into profitability.

CcHub wants to invest $15M into 72 African edtech startups

The news: Co-Creation Hub (CcHub) last week launched a $15 million edtech accelerator to back 72 startups in Nigeria and Kenya between now and 2025.

“Over the next three years, we will have 72 edtech companies launched into the market,” Bosun Tijani, the co-founder and CEO of CcHUB, said.

Why it matters: In 2022, African edtech startups raised only 0.72% of the total venture capital on the continent, according to BD Funding Tracker. This fund intends to add to the efforts of the existing investors in the region.

“We believe [that this fund] will kickstart the ecosystem and reboot it afresh because out of that number, at least you’re sure about half or 20-30% of them would live for another three to four years. And that will allow us to know if technology can truly work for education in Africa,” Tijani added.

The fund is open to edtech solutions across K-12, tertiary education, formal skills, corporate learning and informal skills. Selected solutions will get $100,000 equity-free funding, as well as access to CcHub’s team of expert advisors.

Zoom in: The launch of this fund is a reflection of the Tijani-led innovation hub’s continued interest in the edtech sector. In 2020, CcHub acquired eLimu, a leading Kenyan edtech company and digital educational content provider. The goal of the acquisition at the time, according to CcHUB, was to transform eLimu into its digital education platform arm.

Prior to this acquisition, CcHUB partnered with Nigeria’s premier university of education, Tai Solarin University of Education (TASUED) in 2019, to launch an Edtech Centre of Excellence.

And in August 2020, iHub—acquired by CcHub in 2019—opened the iHub Teachers’ Lounge to equip teachers with 21st-century teaching skills and online teaching tools for richer methods of teaching and collaboration in classrooms.

️ How Famasi went from Zero to Scale

In 2021 when Adeola Ayoola & Umar Faruq Akinwunmi co-founded Famasi, they got an offer for equity-based funding but they declined. What was their motive?

CEO, Adeola talks about it and the company’s growth journey in this episode of Zero to Scale. Famasi Africa started out as an online pharmacy that delivers medications as monthly or quarterly ‘plans’ to its customers.

However, the Nigeria-based health tech startup started to roll out non-chronic plans like menstrual care and sexual health during its beta.

Editor’s Note: Last week (months after this video was shot), Famasi secured undisclosed pre-seed funding from Microtraction and other angel investors.

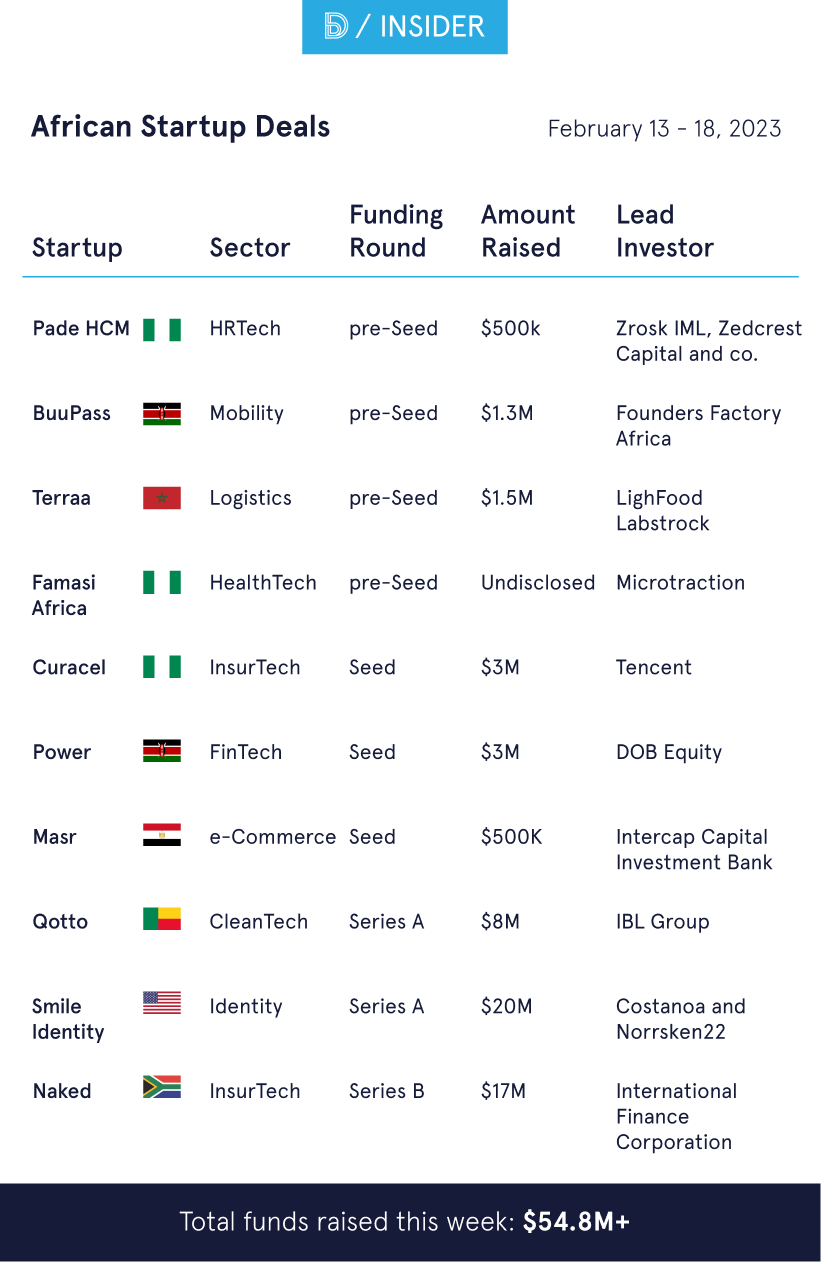

State of funding in Africa

Over $54.8 million was jointly raised by African startups last week. Smile Identity’s $20 million Series B was the highest amount that was raised, bringing the company’s total funding to $31 million, including $7 million raised in their Series A funding round in 2021.

This table provides a detailed breakdown of how the deals from last week.

Noteworthy

Here are other important stories in the media:

- Understanding the technologies that will power Nigeria’s 2023 general elections: Insights into two key technologies; BVAS and IReV—that will enable Nigerians to decide their next political leaders this Saturday.

- CBN did not authorise banks to collect old ₦500 and ₦1000 notes: On Friday afternoon (Feb. 17, 2023), several local news outlets reported that the Central Bank of Nigeria (CBN) has ordered banks to start collecting the old ₦500 and ₦1000 notes from the public with immediate effect. However, the CBN has denied these reports.

- Why is Ghanaian fintech, Dash CEO on indefinite administrative leave?: In this report, Dara talks about the suspension of Prince Boakye Boampong, the founder and CEO of Dash, a Ghanaian startup.

- Equity-free funding for startups in Nigeria: Dara lists five organisations that offer equity-free funding to startups in Nigeria

- Inside Fluidcoins acquisition: Following its inability to raise additional funding, Nigerian crypto payment gateway, Fluidcoins sold a 100% stake to UAE-based Nigerian-led Blockfinex.

- 5G rollout is a catalyst for Namibia’s socioeconomic transformation: Namibia is working hard to become a knowledge-based society, no longer largely driven by agriculture alone. What do 5G technology and access to it mean for Namibia?

Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Flutterwave — Product Manager (Ghana)

- Bamboo — Product Manager (Remote)

- Curacel — Associate Product Manager (Lagos, Nigeria)

Data & Engineering

- Stears — Data Collection Lead (Lagos, Nigeria)

- Norebase — Senior Backend Engineer (Remote)

- Smile Identity — Data Engineer

Admin & Growth

- Eco Bank — Team Lead, Agency & Direct Banking (Nigeria)

- Visa — Manager Consulting Generalist (Nigeria)

- Bamboo — Marketing & Comms Associate and Intern (South Africa and Ghana)

Have a great week ahead!

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: December 26, 2024