African startups raised $469.92 million across 43 publicly disclosed deals in the first quarter of 2025, according to Condia’s Funding Tracker. This marks a 27% increase from the $369 million raised in Q1 2024.

The data shows a continued pattern of funding consolidation: fewer startups are raising, but in larger rounds. Investor interest appears to be stabilising around high-performing sectors and growth-stage companies, with a strong leaning toward climate-focused and financial innovations.

Last quarter opened on a high note. January alone accounted for $245.2 million, over half of the total raised in Q1. February followed with $185.75 million. By contrast, March was relatively quiet, with only $29.27 million in funding.

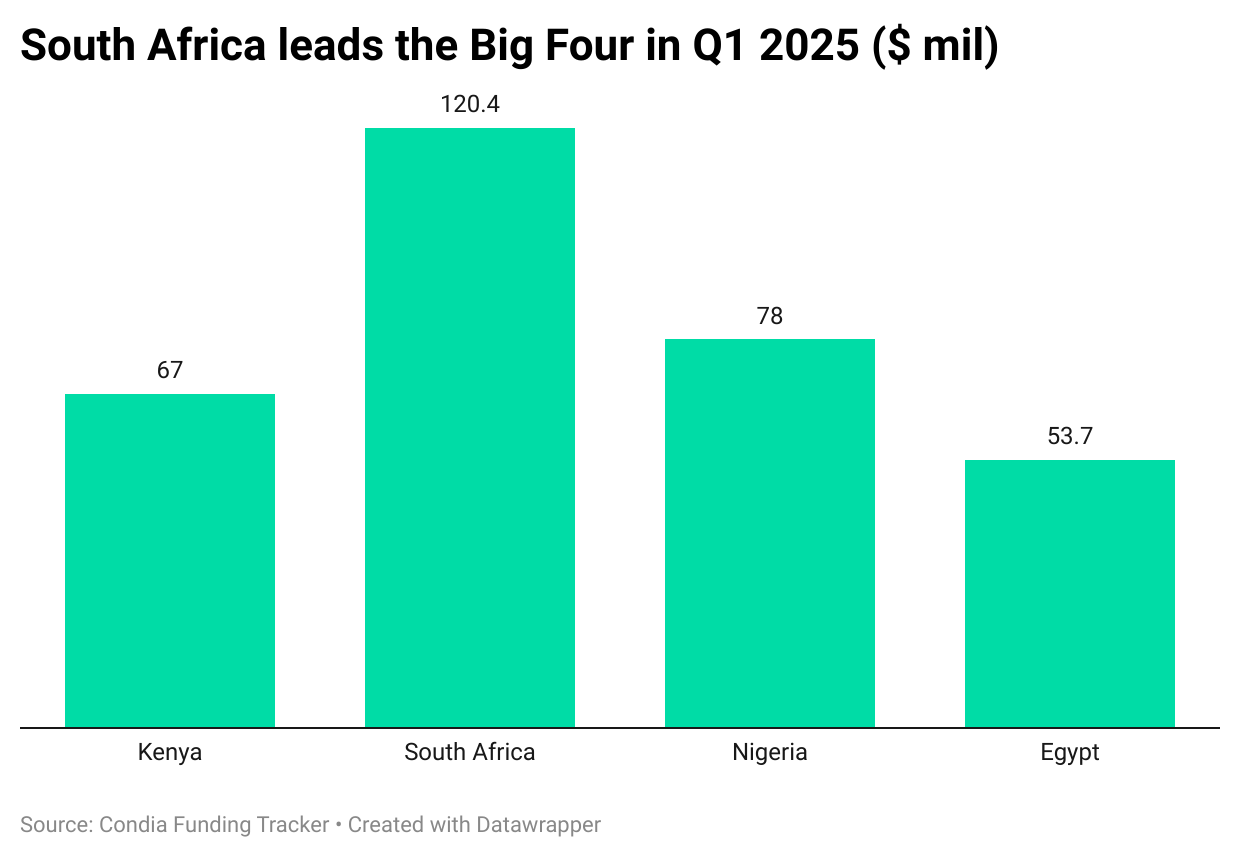

South Africa leads, but Togo breaks into the top five

South Africa emerged as the top investment destination for the quarter, raising $120.42 million, which accounts for 25.6% of the total amount raised. Nigeria came next with $78 million (16.6%), followed by Kenya with $67 million (14.3%) and Egypt with $53.7 million (11.4%).

The fifth spot went to Togo, thanks to Gozem’s $30 million Series B round. Together, these five countries captured 88.7% of the quarter’s total funding, continuing a trend of geographical concentration seen in previous quarters.

In comparison, Q1 2024 saw the “Big Four” of Nigeria, Kenya, South Africa and Egypt command 91.22% of all funding. While the share has slightly shifted, the dominance of these core markets remains strong.

Cleantech takes the lead as fintech bounces back

Cleantech was the biggest winner this quarter, attracting $164.5 million, which amounts to 35% of all funding. This is a sharp increase from Q1 2024, when cleantech raised just 13%. The sector’s rising profile reflects growing investor appetite for solutions addressing sustainability and energy access.

Fintech followed with $117.67 million, 25% of the total. This is a notable jump from the 7.78% fintech commanded in the same quarter last year, suggesting a rebound in confidence for financial services platforms.

Insurtech also made a strong showing, bringing in $76 million, which represents 16.2% of all funding. This marks a shift from previous quarters where insurtech rarely appeared among the top-funded sectors. Logistics startups attracted $36.5 million or 7.8%, further highlighting a shift toward infrastructure-heavy businesses.

Other sectors saw more modest activity. Agritech startups raised $21.1 million, while e-commerce pulled in $12.75 million. Edtech also made a good showing, with Enko Education securing $24 million to expand its network of African schools.

The bigger picture

This quarter’s top sectors contrast sharply with Q1 2024, when mobility led with 31.17% of total funding. That dominance has faded, replaced by a surge in cleantech and fintech deals. This shift highlights investors’ growing prioritisation of climate resilience, infrastructure and financial services.

Q1 2025 shows cautious optimism returning to Africa’s startup ecosystem. While the number of deals has dropped, the rise in total funding signals that larger, later-stage rounds are returning. Cleantech’s emergence as the top-funded sector underscores investor interest in sustainability, while fintech’s rebound indicates renewed confidence in Africa’s digital finance potential.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: April 7, 2025