Regardless of harsh economic conditions affecting purchasing power, Africa’s smartphone market continues to show recovery signs. Consumers are buying more devices than ever, notwithstanding several drawbacks, such as currency devaluation, import restrictions, and inflation.

Research firm Canalys has posted its third quarterly analysis of the African smartphone market, reporting that the continent shipped 17.9 million units between July and September 2023. This is 12 percent more than the shipments recorded in Q3 2022 and reflects a further improvement from the 9 percent growth noticed in Q2 2023.

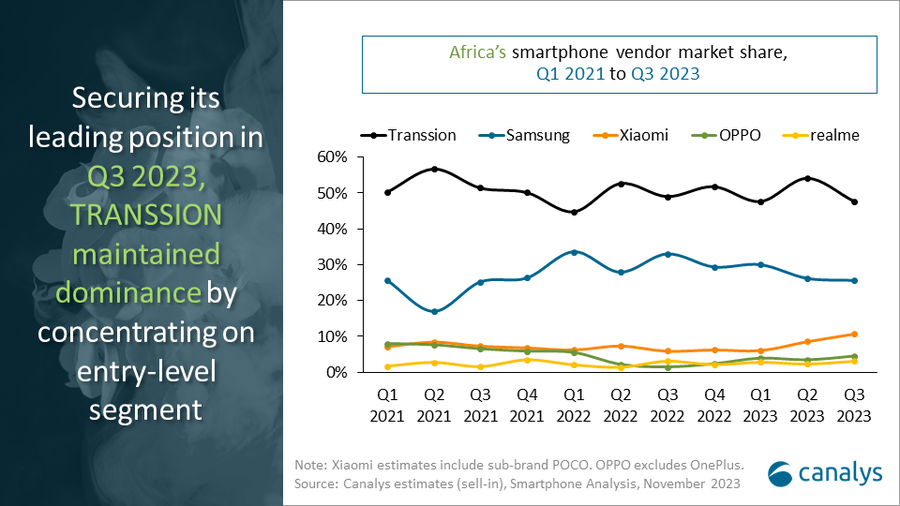

Chinese smartphone maker Transsion—known for its Infinix, Tecno, and Itel brands—retains its top position in the market, growing 9 percent year-on-year to secure a 48 percent share.

South Korean rival Samsung has been experiencing issues with its mid-to-high devices, costing the brand a 13 percent drop in annual shipments. However, it maintains its second place in the market, with a 26 percent unit share.

Xiaomi, another Chinese maker behind RedMi, Roborock, and Pocophone, comes in third place, with an 11 percent share and 100 percent annual growth in imports. Guangdong-based OPPO follows closely with a 4 percent share and 259 percent shipment growth. Per the report, both brands have invested heavily in several markets, especially in northern Africa.

“The African market demonstrates strong resilience in demand and supply amid macroeconomic challenges. Despite rapid currency devaluation, South Africa’s smartphone market exhibited a remarkable growth of 20 percent. This surge was fueled by the demand for entry-level devices, particularly catering to the extensive pre-paid segment,” says Canalys Senior Consultant, Manish Pravinkumar.

“Nigeria’s smartphone market expanded substantially, with Transsion playing a pivotal role by offering entry-level devices and Xiaomi successfully positioning itself as an aspirational brand for many consumers, gaining popularity with products such as the RedMi series A2, Note 12 4G, 12, and 12C,” Manish subsequently added.

Though impressed by the upticks, Canalys expects demand to slow down next year; growth in smartphone shipments would be limited to single-digit percentages. As adoption proliferates in many parts of the continent, hurdles setting up unaffordability continue to exist.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore