Y Combinator has announced that in addition to the existing $125,000 investment which all accepted startups get, the accelerator will invest an additional $375,000.

According to Y Combinator, “the $375,000 is on an uncapped safe with ‘most favored nation’ (MFN) terms. MFN means that this safe will take on the terms of the lowest cap safe (or other most favorable terms) that is issued between the start of the batch and the next equity round. Simply put, we’re giving the company money now but at terms you’ll negotiate with future investors”.

Both the usual $125,000 [on a post-money safe in return for 7%] and the new $375,000 [on an uncapped safe with a most favored nation (MFN) provision] are not contingent on any milestones by the recipient company.

The $125k safe and the MFN safe will each convert into preferred shares when your company raises money by selling preferred shares in a priced equity round, which we refer to below as the “Safe Conversion Financing” (this will typically be your “Series A” or “Series Seed” financing, whichever happens first). – YC

Only 20% of the companies backed by Y Combinator have failed in the course of backing startups for over 15 years — this is an excellent number per industry standards.

With the introduction of the new standard deal, YC hopes that it “will encourage more founders of any age and from every demographic group and geographic location to take the leap into the startup world, apply to YC, and build their own successful startup”.

Even though the new deal might sound like so much money, some rival investors and accelerators have argued that small angel investors and funds might not want to invest in YC-backed companies. “This [will] just kill seed-stage funds in emerging markets, thus making YC, a silicon valley-based fund without in-depth knowledge of emerging markets, the arbiter of all international ecosystem growth”, Claire Díaz-Ortiz, a venture capitalist tweeted.

This terrific deal will make it even more likely that they find product market fit, raise a successful seed round, and build a world-changing technology company. – Geoff Ralston

On the flip side, YC will create more time for some founders to focus on building their products instead of fundraising. Geoff Ralston, the President of Y Combinator stated that “this is the type of deal that we have wanted to offer YC founders for years — and with the recent success of YC companies, including ten IPOs in 2021 and more to come this year, we are now able to do so.

“This sum will enable founders to focus on launching, building, and scaling their company. It will remove the immediate pressure to fundraise and accept less than favorable terms”, Raltson said.

Since its inception, YC has invested in over 2500 companies. In 2021, the Silicon Valley-based accelerator published a list of its top investments. The list included 130 startups with a minimum valuation of $150 million. The combined valuation of all companies on the list stood at over $300 billion. The list included companies from all over the world as well as one of Nigeria’s tech unicorn – Flutterwave.

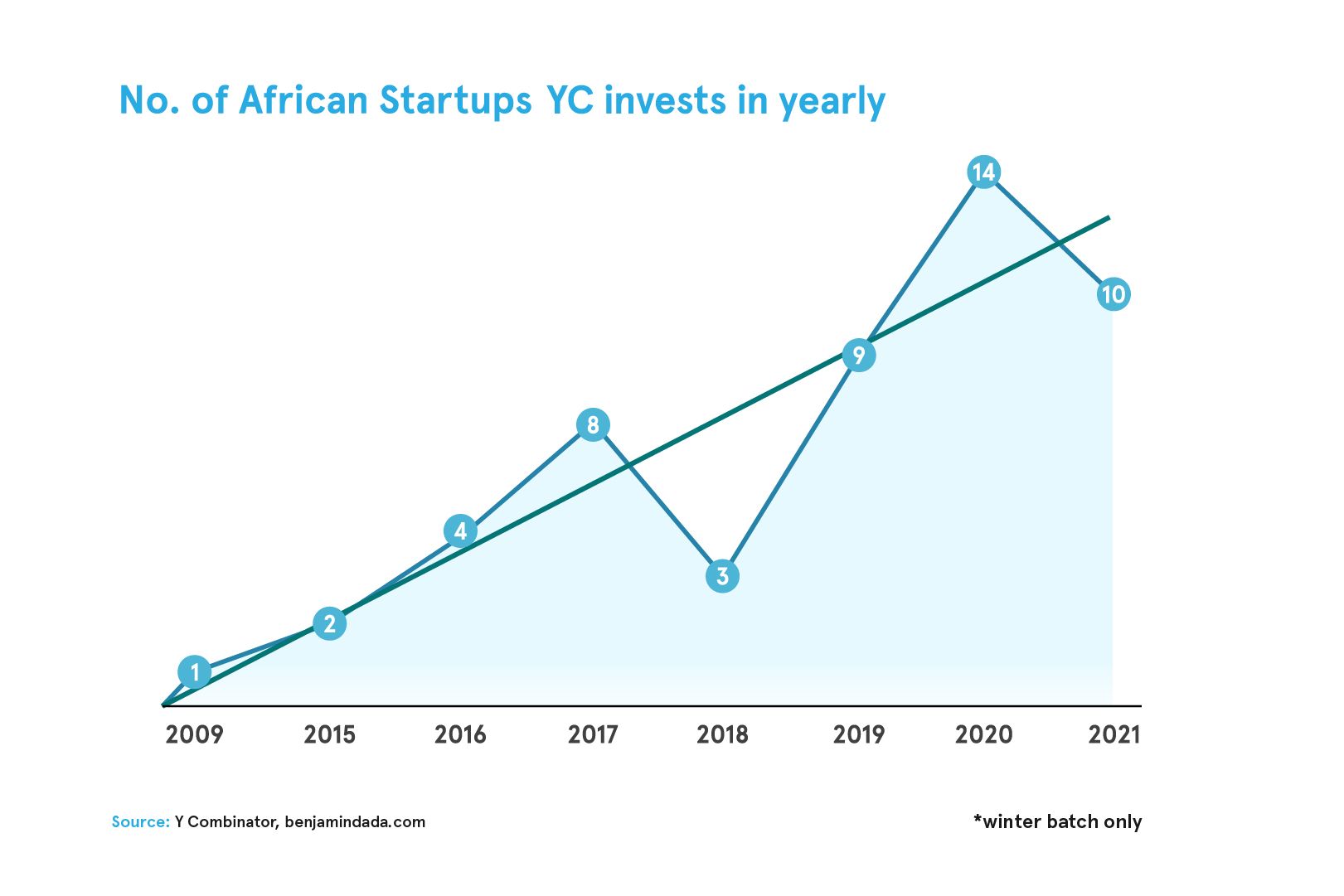

As of 2020, Y Combinator had invested in 40 African startups, including 22 from Nigeria.

Applications for the Summer 2022 YC batch is ongoing.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore