The Central Bank of Nigeria (CBN) on Tuesday raised interest rates by 25 basis points to 27.50%. The move, aimed at taming persistent inflationary pressures, had been highly anticipated after stock market investors closed Monday’s trading bearish, losing ₦123 billion.

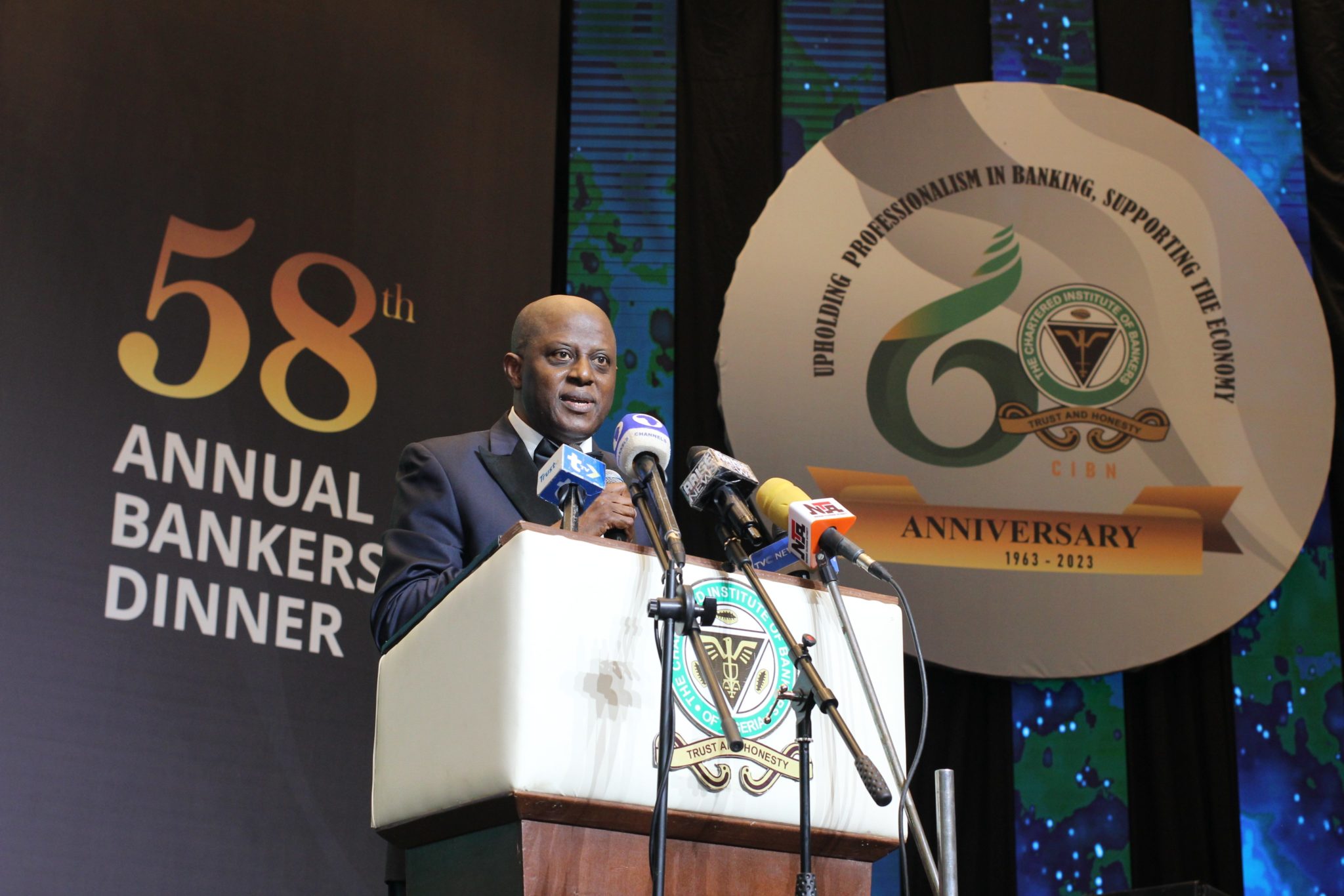

The decision is no surprise to market watchers, who had expected a rate hike following five consecutive increases this year. However, the magnitude of the hike has raised concerns about its potential impact on economic growth. A survey of economists by Condia predicted a moderate hike of 25 basis points ahead of today’s Monetary Policy Meeting chaired by CBN Governor Yemi Cardoso.

“A lot of our problems are still internal. It’s a structural issue, lack of productivity, and lowered oil production,” said Prof. Joseph Nnanna, Chief Economist at the Development Bank of Nigeria. “We need to stop focusing on crude oil; Nigeria has way more to offer that we are not tapping into.”

The monetary policy committee decided on a rate hike based on persistent food inflation and general welfare.

“The meeting was held on the backdrop of renewed inflationary pressures as the headline of food and core measures rose year on year in October 2024, “Cardoso said. “Members agreed to remain focused on addressing price developments.”

Since assuming office in September 2023, CBN Governor Yemi Cardoso has implemented a raft of policy measures to combat inflation and stabilise the naira. Despite these efforts, the currency remains volatile, and inflation has proven resilient.

Analysts argue that a more holistic approach, combining monetary and fiscal policies, is necessary to address Nigeria’s economic challenges. They suggest that the CBN should consider a more nuanced approach to interest rate policy, considering the potential negative impact on growth.

The market’s reaction to the rate hike underscores the delicate balancing act faced by policymakers. While higher interest rates can help to curb inflation, they can also stifle economic activity and job creation.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore