In 2019, Tope Alabi and John Obirije set out looking to reshape cross-border payments for millions of Africans. The idea was born out of a deeply personal experience shared by many in the African diaspora—the frustratingly slow and expensive process of sending money home.

For Tope, a Nigerian immigrant who had spent over two decades in the United States, it was part necessity, part ambition. A background as a developer at Consensys, a blockchain software technology company, afforded him insights into how technology could be leveraged to streamline cross-border payments.

Traditional remittance platforms were outdated in a world rapidly going digital. These platforms charged exorbitant fees—sometimes as high as 10%—and often took several days to process transactions. In regions where financial support from abroad was a family lifeline, delays and costs were hassling, barriering financial inclusion.

Alabi moved to the US with his family when he was just 9 years old. Growing up in Houston, Texas, he went after an engineering career and along this line worked as a software engineer in Silicon Valley. But, he always wanted to return to Nigeria to make an impact. This aspiration became more pressing after several years in the industry.

Humble, simple beginnings

In 2017, Tope began visiting Nigeria and, alongside his co-founder John Obirije, took on various projects. Their collaboration began at a Facebook hackathon in Lagos, and by 2019, they identified the cross-border payments challenge.

“At that time, it was expensive and slow to move money. There was a time when I was using Western Union and it took two days for money to transfer from my own US bank account to my local one. It was a big problem, so we started building against it,” he recounts.

Determined to devise a better way to send money, they created Afriex, a platform for zero-fee transfers across borders. It offered faster transactions and better exchange rates than its competitors. It resonated with users, particularly those in the diaspora who regularly sent money home to support their families.

In the early days, reach was modest, serving only Nigeria and the US. However, the platform quickly gained traction. Within six months, the user base had grown by 500% and expanded to Ghana, Kenya, Uganda, and Canada. Now, the platform processes millions of dollars in monthly transactions.

“I remember how we initially went from zero to 300 users just by texting everyone on our phones. We simply reached out to everyone we knew, and those initial users then spread the word. From there, we grew from 300 to 10,000 users purely through word of mouth,” he narrates.

This growth did not go unnoticed. In 2020, they got into Y Combinator. Two years later, the firm had raised $10 million in a Series A round led by Sequoia Capital China and Dragonfly Capital, adding to the $1.3 million seed round it raised in 2021, to bring its cumulative funding to $11.3 million. This influx of capital has enabled it to scale ops even further and explore new markets.

Four years after launch, it now boasts 400,000 users and has expanded its reach, moving beyond the initial US-to-Nigeria corridor to include 8 other African markets. It has now developed a payment network spanning 32 countries across Africa, Asia and Europe.

Yet, Afriex’s ambitions go beyond easing money transfers. The company envisions offering a full suite of financial services tailored to the needs of Africans both in Africa and in the diaspora.

Going global on a high

Afriex’s ambitions go beyond easing money transfers. It envisions offering a full suite of financial services tailored to the needs of Africans both in Africa and in the diaspora. This vision just took a forward step with the launch of Global Accounts.

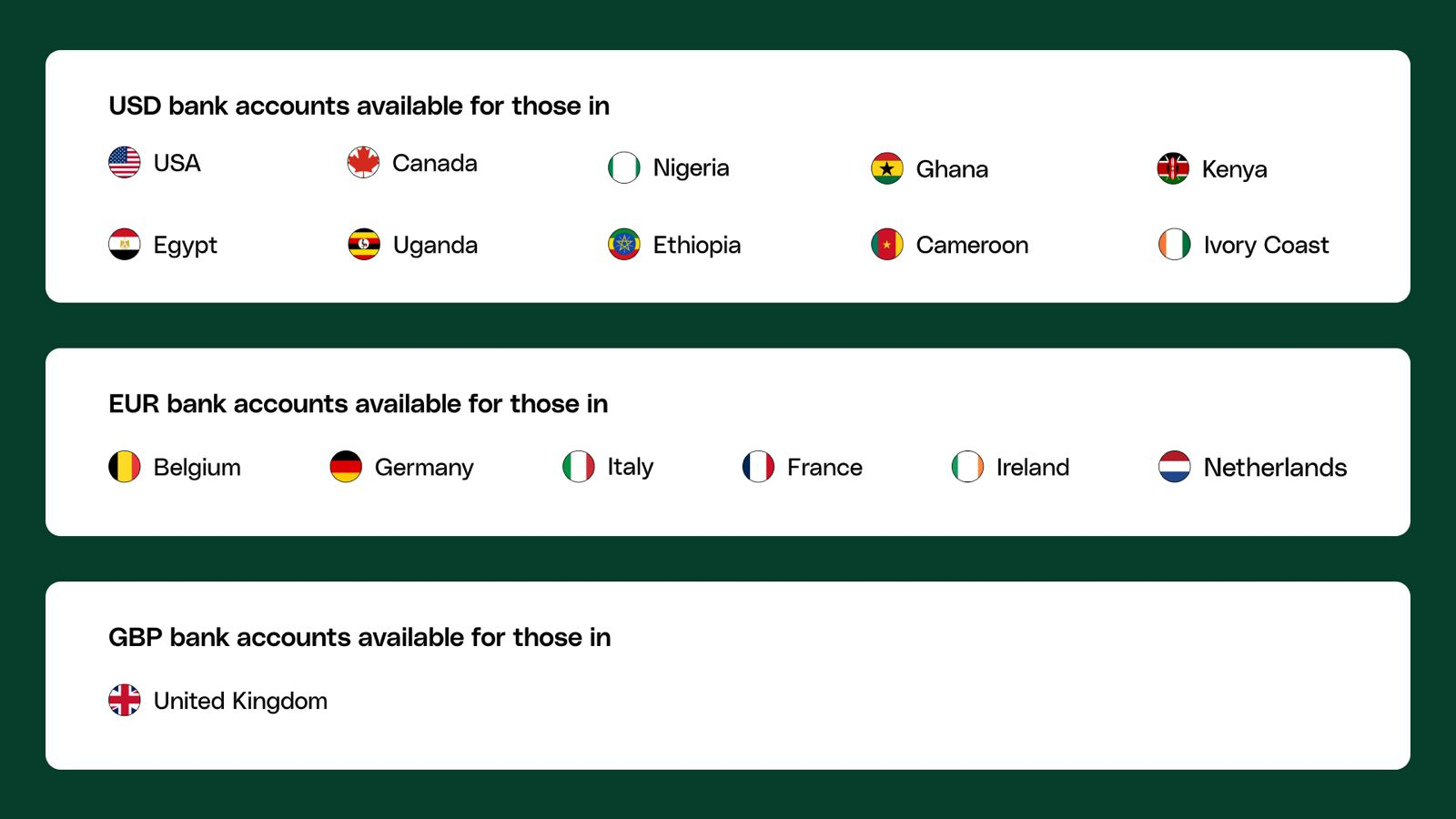

Users can open USD, Euro, or GBP accounts in their name, send and receive money in multiple currencies from one place. This feature is particularly beneficial for users in Africa, where foreign currencies are often restricted, and exchange rates can be highly volatile. An upside is users not having to open new bank accounts when migrating. They can continue transacting without visiting a bank branch.

Global Accounts enables users to manage their finances across borders, whether they are freelancers receiving payments from international clients or businesses looking to expand into new markets. Holding funds in stable currencies like the US dollar or Euro offers a level of financial security. This is often lacking in many countries, where local currencies are prone to devaluation.

“With the main differentiator being our commitment to excellent and consistent service, there are a set of features we have that not every company provides. In addition to intra-Africa payments, Afriex users get a USD, GBP, or Euro account, whether Nigerian, Kenyan, or anyone living in the countries we serve… Our broad and deep service offerings distinguish us from other apps in the market.”

Remittance flows to Sub-Saharan Africa hit $54 billion in 2023, per World Bank data. A slight 0.3% decrease regardless, remittances remained a key income source for the likes of the Gambia, Lesotho, Comoros, Liberia, and Cabo Verde in the wake of food insecurity, drought, supply chain disruptions, floods, and debt-servicing difficulties.

Given that sending $200 to the region still costs an average of 7.9%, a cost-effective means is a no-brainer. A global accounts feature addresses this need by enabling users to receive, hold and transact in multiple currencies, from within Africa.

Meandering uneven routes

Remittance startups are also contributing to a broader movement: financial inclusion. Conventional payment rails in many African countries are often inaccessible to large segments of the population, particularly those in rural areas. A digital-first solution not reliant on physical bank branches helps bridge the gap, in which lies over 350 million financially excluded people.

The platform’s traction, so far, mirrors the rising importance of remittance flow to the region. Being that traditional remittance platforms have long been criticized for their high fees and slow transaction times, low-fees, instant transfer models recently cropping up offer a compelling alternative. They are likely to become increasingly popular as more people gain access to digital finance.

To leverage this trend, Afriex plans to expand to more countries where the need for affordable and efficient cross-border payment solutions is greater. Meanwhile, it explores newer tie-ups and technologies that will enable it to offer an even wider range of financial services, from loans and savings products to investment opportunities.

Despite their explosion, remittance startups face several challenges. One such is complex regulation. Different markets come with different rules, adding to the diversity issue existing both within and outside the continent. This creates uncertainty for companies like Afriex, which must ensure that their operations comply with local laws in each of the jurisdictions they operate. Another test is competition given that fintech is crowded, with new players going into the sector regularly.

To stay ahead, actors must continue finding new ways to meet the needs of its users. Expanding product offerings, entering new markets, or forging strategic partnerships with other companies in the space—card networks especially—are possible tactics to staying ahead.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore