On Friday, over 85 million computers across the world crashed due to a faulty update from cybersecurity company CrowdStrike. The affected machines, mostly Windows systems, kept restarting repeatedly and showing a blue screen with an error message, leading to a halt in operations across air travel, hospitals, banks, and more.

This whole messy incident shows how easy it is to break the internet, even by accident. Everything’s so connected that one glitch can snowball fast.

The Rise of Starlink in Africa

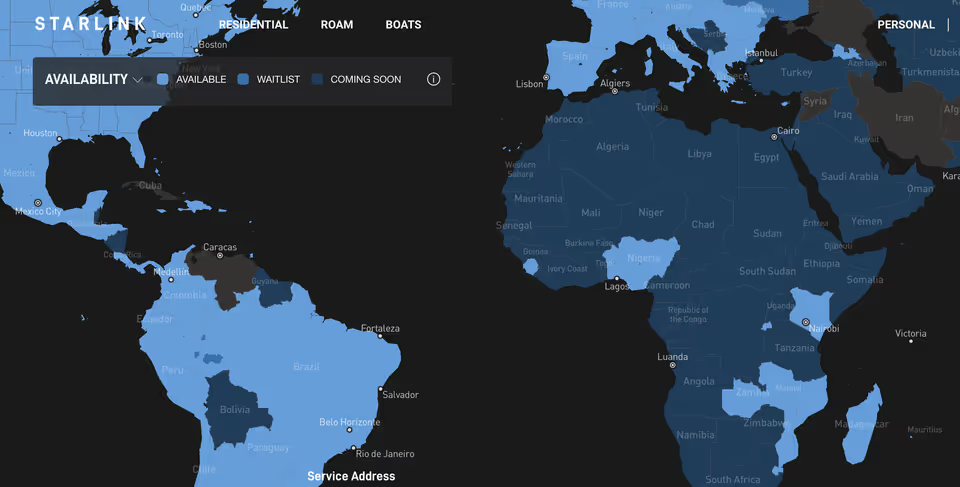

Quick Bite: As of July 2024, Starlink, a high-speed internet service beamed down from space by SpaceX, is now available in 10 African countries. They’re planning to launch in even more soon, with South Africa being the only holdout in the southern region so far. Could Starlink shake things up for other internet providers in Africa?

The Breakdown

With a penetration rate of 43%, internet connectivity in Africa is low and diverse. While urban centres in some countries enjoy decent broadband, many rural areas still struggle with limited or no internet access. This digital divide is a significant hurdle to development, affecting education, healthcare, and business growth

This is where Starlink comes in. Following its launch in Nigeria, the first in Africa, in 2023, Starlink has sought to bridge this digital divide. The satellite network has been launched in Rwanda, Mozambique, Kenya, Malawi, Zambia, Benin, Eswatini, Sierra Leone, Mauritius, and most recently, Madagascar.

Last week, it secured yet another license to operate in South Sudan, following recent approval to operate in Ghana, Zimbabwe, and Botswana.

SpaceX’s goal is to provide high-speed internet to underserved regions worldwide, including Africa. Its high-speed, low-latency services have proved useful for a continent like Africa. This matters because, across Africa, internet access comes in through different routes, delivered through undersea cables (fibre optic cables), mobile networks, and even satellites. These routes have helped the continent grow from 4.5 million internet users in 2000 to over 600 million internet users as of 2022.

This growth has been primarily bolstered by undersea cable connections — only 16 African countries were connected to a submarine cable system in 2008; today all 39 African countries that share borders with the ocean are connected to an undersea cable (with 71 active cable systems). With mobile internet networks responsible for about 50% of the internet users in Africa, its influence is undeniable.

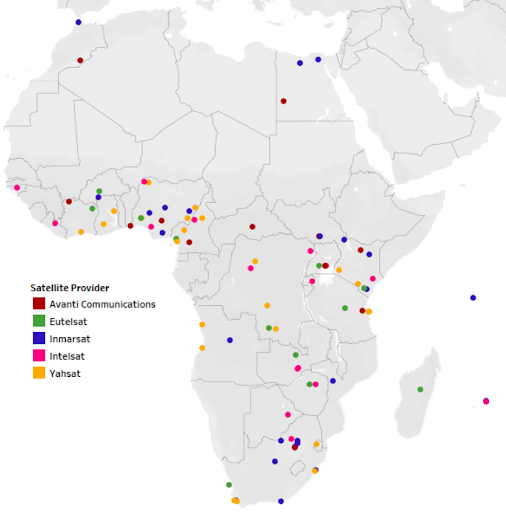

Satellites have also contributed to the growth, mainly offering Direct-to-Home (DTH) television, telephony, and broadband internet services for governments, banks, telecommunication companies, and other businesses.

But Starlink is different. It focuses on selling internet directly to consumers, like you and me. This “retail” approach is a big reason why Starlink is gaining traction in African countries where it’s available. Particularly in Nigeria, where it’s now the third largest internet service provider (ISP) behind Spectranet and FiberOne with 23,897 active subscribers as of Q4 2023. Within the last quarter of 2023, it gained 12,690 new subscribers.

In Kenya, the Communications Authority of Kenya reported that satellite internet users rose from 1,354 to 2,933 in Q4 2023, following Starlink’s launch in July. The number of satellite internet users in the country also crossed the 1,000 mark in the same quarter Starlink launched.

Starlink’s rise in Africa can largely be attributed to its outperforming competitors. Speed test data by Ookla in Q2 2023 showed that Starlink in Nigeria had faster median download speeds than all aggregate fixed broadband providers combined, at 63.69 Mbps to 15.60 Mbps. Upload speeds were more similar during the same time period, with Starlink at 13.72 Mbps and the aggregate of all fixed broadband providers combined at 10.60 Mbps.

Starlink’s reception within the continent has sparked some satellite internet rivalry. In May, Liquid Intelligent Technologies reached an agreement for the distribution of Starlink’s rival OneWeb to Africa. Amazon has also partnered with Vodafone to launch a low-earth orbit satellite constellation called Project Kupier in Africa. In July 2023, Kenya’s leading telecommunications company, Safaricom, disclosed plans to launch a satellite internet service.

Outside the satellite internet space, Starlink is also in direct competition with Africa’s big telcos, such as MTN, Airtel, and Vodacom.

Challenges facing Starlink’s expansion in Africa

Starlink has faced a fair share of licensing and regulatory issues in Africa. In Botswana, Starlink was officially banned at the start of February due to failure to meet all the requirements of the Botswana Communications Regulatory Authority. It could only secure an operating license in May, three weeks after a meeting with government delegates. Earlier in the year, the Postal and Telecommunications Regulatory Authority of Zimbabwe ordered Starlink to shut down its operations in the country, citing regulatory issues.

In South Africa, it’s been reported that the company hasn’t secured an operating license because it refuses to share ownership with locals per the government’s requirements. The company also currently faces regulatory struggles in Ghana and Cameroon.

Another primary hurdle for Starlink in Africa is pricing and affordability. Madagascar boasts the continent’s most affordable Starlink hardware, priced at MGA 1,120,000 ($247.49), followed by Zambia at ZMW 8,000 ($302.99). The subscription fee in Nigeria is one of the cheapest at ₦38,000. In April, it announced a 45% price slash for its hardware in Nigeria, bringing the cost to ₦440,000 from the initial ₦800,000.

Per Statista, one gigabyte of mobile internet in Sub-Saharan Africa amounted to $3.31 in 2023, which is one of the highest worldwide. With these hurdles, Starlink does not signal the death of older operators; rather, it complements existing telecommunication services, and competition in this space would bode well for Africans in the long run.

Trending Stories

Summaries and links to other notable stories in the tech space.

- How One Bad CrowdStrike Update Crashed the World’s Computers

- South Africa’s 2G/3G switch-off timeline raises industry concerns

- Meta fined $220 million by Nigerian government over abusive and invasive data practices

- Apple, NVIDIA, others face backlash over scraping data from YouTube content for AI training

Jobs, Opportunities & More

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Pan African Towers — Graphics Designer, Lagos

- VFD Microfinance Bank — Product Marketer, Lagos

- Exit Five — Head of Product Marketing, Remote

- SocialPilot — Product Designer, Remote

Data & Engineering

- Flutterwave — Senior Android Manager, Lagos

- Tabby — Engineering Team Lead, Remote

- Casava — Java Backend Engineer, Remote

Admin & Growth

- Maze — UX Writer, Remote

- Reliance Health — Content Strategist, Lagos

- Bolt — Operations Manager, Lagos

The Week Ahead

- Nigeria Fintech Forum 2024 – July 25, 2024 – Lagos

- Bumpa Pop-Up – July 27, 2024 – Lagos

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore