In the first half of 2024, African startups raised approximately $652.4 million in venture and debt funding.

This figure marks a weighty decrease of about 50.2% compared to the $1.31 billion raised in H1 2023, according to data from BD Funding Tracker. This highlights a continued drop in overall venture capital activity in the region. The number of funding deals also dropped significantly from 148 in H1 2023 to 97 deals in 2024.

Despite the lower total funding, several key trends and shifts in investment focus have emerged.

Kenya edged out Nigeria to take the top spot

As usual, the famous Big Four took the bigger chunk of the pie.

Kenya led with $194.3 million, equivalent to 29.8% of the total funding. Nigeria, in a break from the norm, came in second place with $183.1 million, representing 28.1% of the total. Egypt secured $81.5 million, or 12.5%, while South Africa received $65.9 million, making up 10.1%.

Compared to H1 2023, the composition of the big four remained the same with positions changing. Egypt ($446.3M), Kenya ($339.1M), South Africa ($264.5M, and Nigeria ($159.8M) were the top four respectively.

Series B dominated the half

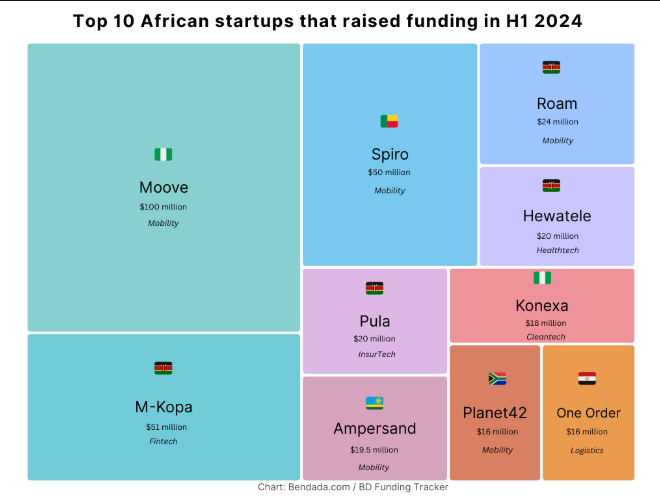

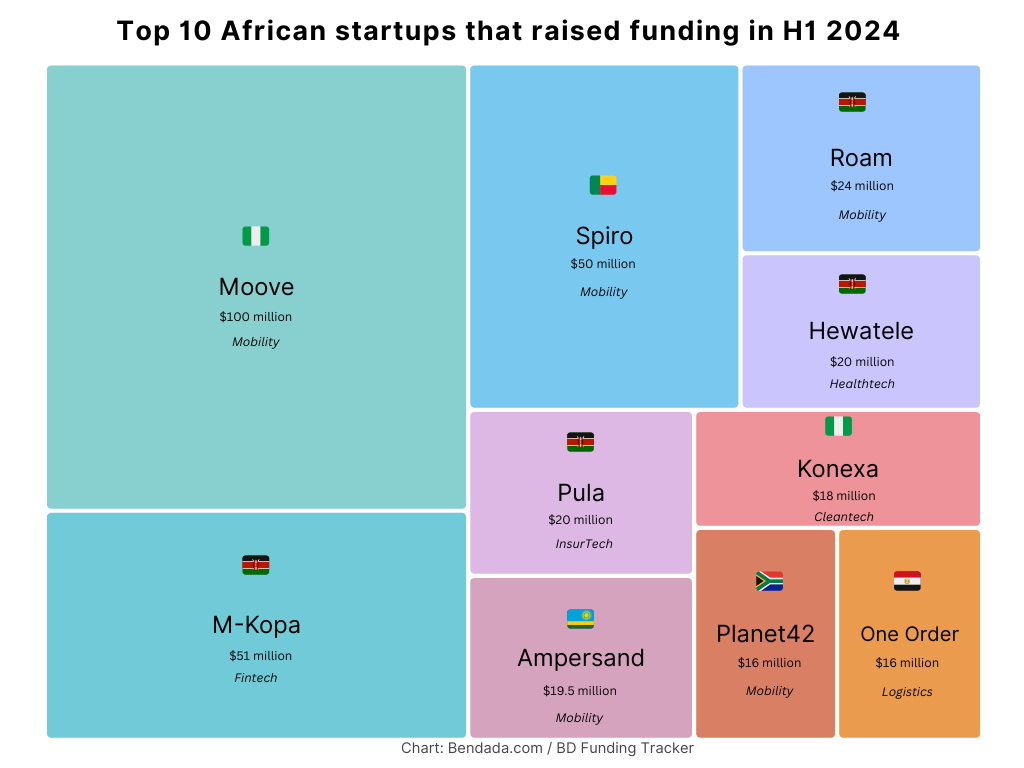

Series B rounds took the lion’s share, with startups raising $135 million, which comprises 20.7% of the total funding. The standout round was Moove’s $100 million from Uber, indicating strong investor confidence in more mature startups that have demonstrated growth and have a proven business model. Pre-Series B rounds accounted for $57 million of the total funding raised.

Pre-seed funding accounted for $13.0 million, which is 2% of the total. This stage typically attracts early-stage investors willing to take on higher risks for potential high rewards.

Seed rounds garnered $58.8 million, making up 9%. Pre-Series A funding, where startups transition from seed to series rounds, represented $16.2 million, or 2.5%. Series A attracted $52.6 million, accounting for 8.1%.

A significant number of deals undisclosed. These figures show the cautious yet strategic approach of investors, with a focus on backing startups that have already shown potential for scalability and profitability.

Mobility took the lead with Fintech following closely

Surprisingly, the mobility sector attracted the largest share, taking in $254.5 million, which accounts for 39% of the sum funding. Fintech, retaining a strong position, received about $109.1 million, which is 16.7% of the total.

Cleantech saw around $77.7 million, representing 11.9% of the entire intake, while healthtech secured approximately $42.2 million, or 6.5%. Agritech received around $30.8 million, making up 4.7%.

Mobility overtaking fintech as the top recipient indicates growing investor interest in transportation innovations, such as ride-hailing, electric vehicles, and logistics solutions. This trend suggests a focus on addressing urban transport challenges and improving infrastructure.

As for cleantech, the proliferation of funding points to a growing emphasis on sustainable and environmentally friendly technologies. This trend aligns with global shifts towards sustainability and the need for innovative solutions to environmental challenges.

Emerging sectors also attracted investment: Crypto and Web3 startups raised about $17.5 million, or 2.7% of the total. AI startups received approximately $9.7 million, representing 1.5%, hinting that AI startup funding isn’t picking up as much steam in Africa. eCommerce, a longstanding, yet-to-take-off darling, secured a paltry $7.1 million, which is around 1.1%.

Debt funding is here to stay

Over a third ($207 million) of the total funding raised came from debt financing with two deals, M-Kopa’s $51 million and Spiro’s $50 million debt financing, accounting for nearly half of the total debt raised. Notably, six out of the twelve recorded debt deals involved Kenyan startups.

This trend is a welcome move that could lead to more sustainable businesses because debt financing incentivises startups to prioritise profitability early on, as they need to generate cash flow to service their debt.

Resilience amidst global challenges

The African tech ecosystem demonstrated resilience in H1 2024, with fewer layoffs and shutdowns compared to previous periods. This stability is likely due to continued demand in essential sectors like fintech, healthtech, and agritech, despite broader economic uncertainties. Lean business models and diverse funding sources have contributed to this stability.

Despite attracting lower total funding amount compared to previous periods, the ecosystem has shown resilience. Fewer African startups are shutting down and reducing their workforce:

- Flutterwave laid off 24 employees.

- Gro Intelligence shut down operations.

- Copia reportedly dismissed its entire workforce.

- Spleet also laid off some workers.

Compared to previous periods, it suggests a closer move to towards the ecosystem’s stabilisation. This stability may be attributed to the essential nature of sectors like fintech, healthtech, and agritech, which have sustained or increased demand despite economic uncertainties.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore