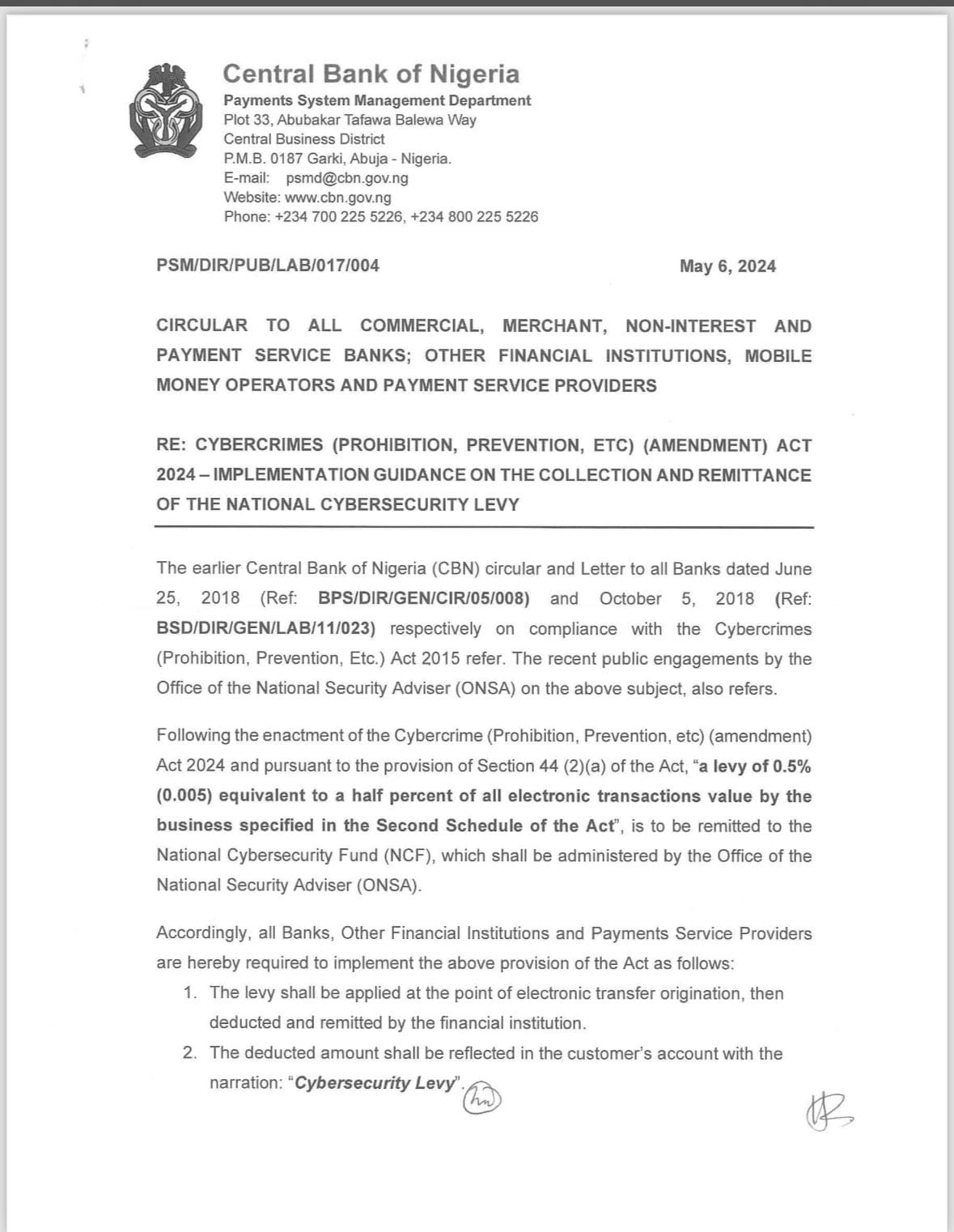

Nigerians who rely on digital payments will soon face a new levy aimed at improving the country’s cybersecurity defences. The Central Bank of Nigeria (CBN) announced a 0.5% levy on applicable electronic transactions, effective within two weeks.

The move comes amidst growing concerns about cybercrime targeting financial institutions in Nigeria. The levy, mandated by the recently enacted Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024, aims to generate funds for the National Cybersecurity Fund managed by the Office of the National Security Adviser.

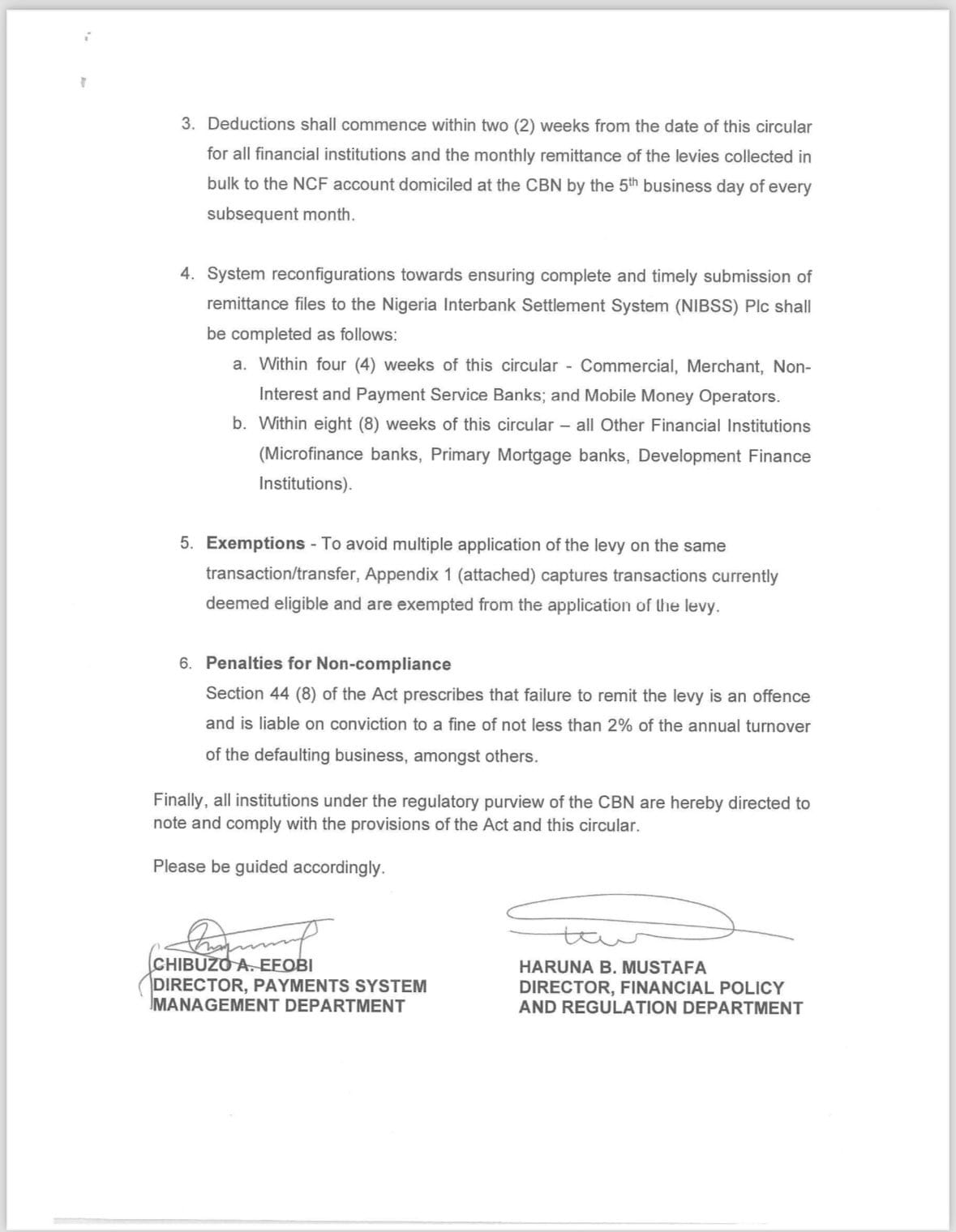

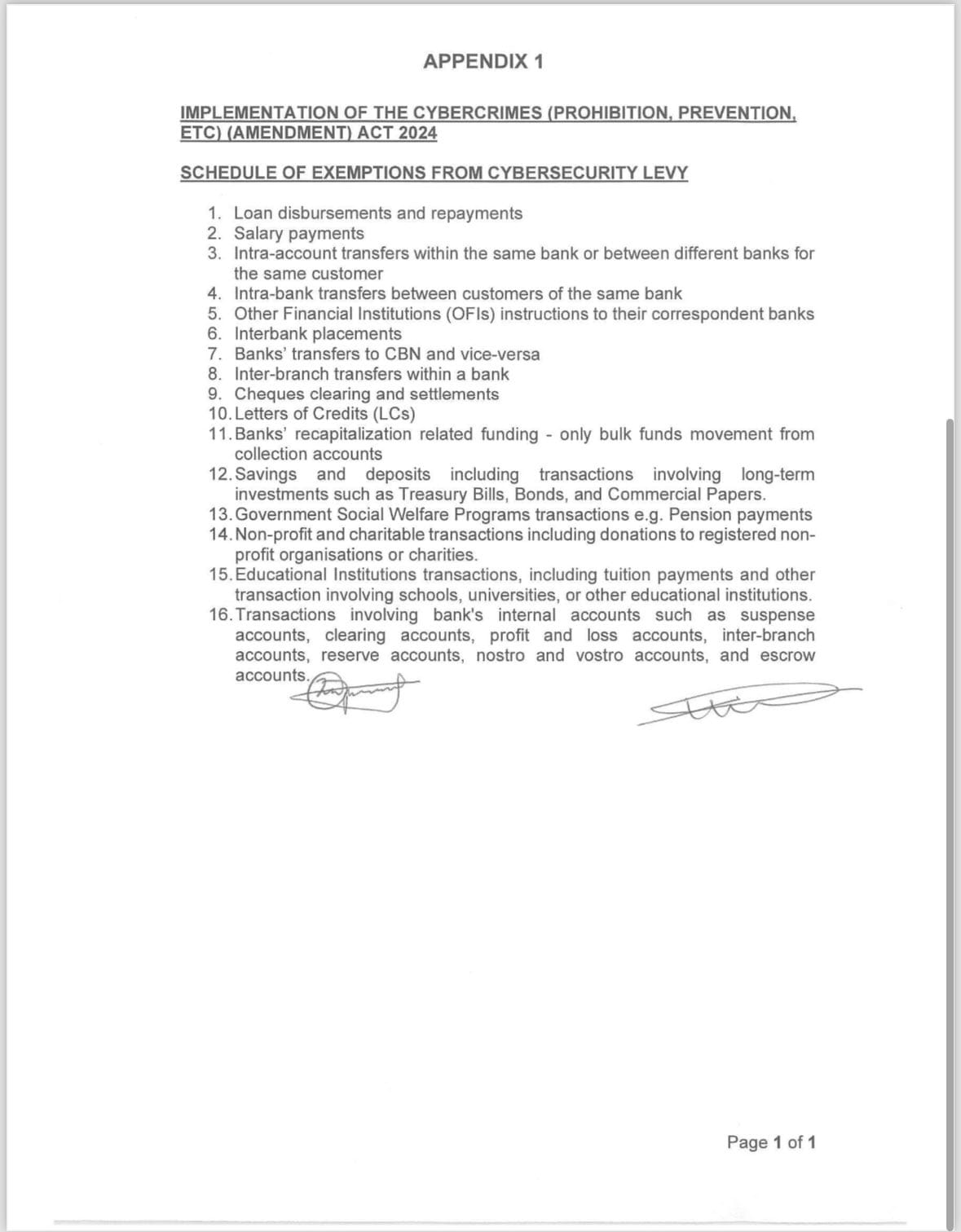

The levy applies to a range of transactions, including online payments, electronic and mobile funds transfers, point-of-sale (POS) transactions, and potentially, ATM withdrawals. However, the CBN clarified that several categories are exempt, such as loan disbursements and repayments, salary payments, specific intra-bank and inter-bank transfers, cheque clearings, and savings deposits.

While proponents argue the levy is necessary to combat cyber threats, critics raise concerns about its impact on Nigerians, particularly those heavily reliant on digital payments. The additional 0.5% cost could discourage cashless transactions and potentially hinder financial inclusion efforts. Transparency in the allocation and utilisation of the collected funds is also a key concern.

The CBN has warned of penalties for non-compliance, with failure to deduct and remit the levy resulting in a fine of up to 2% of the annual turnover of the defaulting business.

This is a developing story

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore