Today, we are glad to announce our inaugural State of Funding in Africa report.

The report, which aims to provide a comprehensive view of the African tech funding ecosystem, reveals that, in line with the global downturn in venture capital funding, the African tech sector saw a significant slowdown in 2023.

Here are a few highlights from the report:

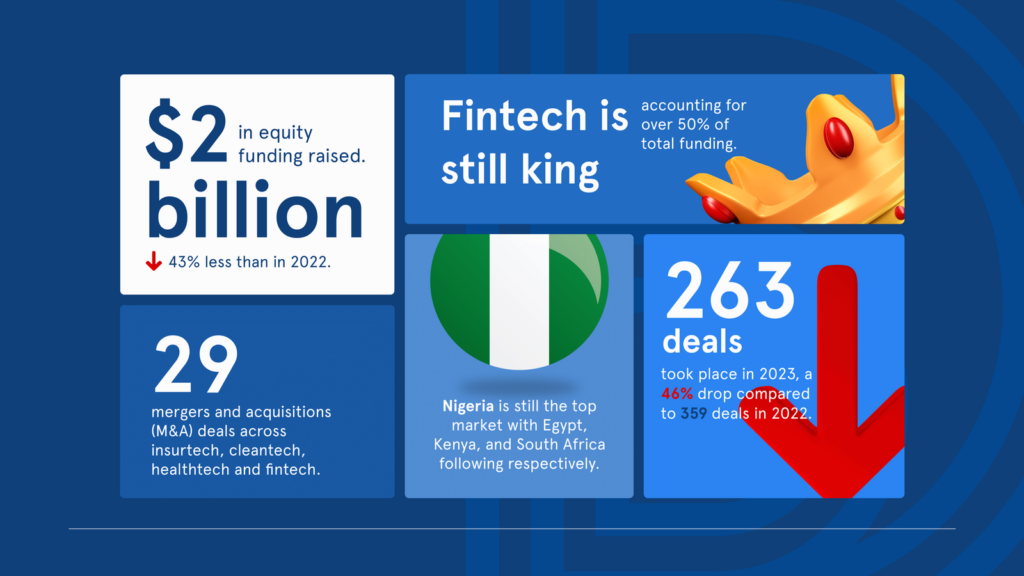

- 2023 witnessed a marked further shift from the breakneck pace of 2021, with overall funding figures declining compared to the previous year’s record highs. African startups raised $2 billion in equity funding in 2023, a 43% decline compared to the 3.3 billion raised in the previous year. While this might seem like a downturn, it reflects a maturing ecosystem prioritizing quality over quantity.

- The traditional “big four” of Nigeria, Egypt, Kenya, and South Africa retained their position as top investment destinations. However, Ghana was displaced by DRC Congo as the fifth-ranked country, highlighting the potential for new hubs to emerge.

- While funding figures decreased, Fintech’s share of funding accelerated from 30% in 2022 to 50%. This was a result of the overall funding decline which exaggerated the place of fintech in the funding circle.

- Cleantech, Mobility, and the e-commerce sector followed, showcasing areas of continued investor interest. However, emerging sectors like AI are poised for future growth, with early signs of a boom on the horizon.

- Profitability and strong unit economics returned to the forefront as the most relevant business metrics for startups. This shift, while challenging for early-stage ventures, signifies a maturing ecosystem where proven business models and solid execution take centre stage.

To download the full 2023 State of Startup VC Funding in Africa Report, click here.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreAdvertisement