How was the Easter holiday?

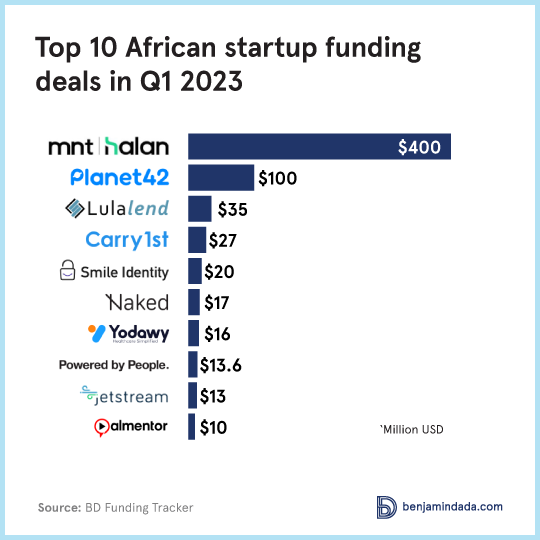

Last week, we published a Q1 2023 report on the state of VC funding in Africa. Compared to Q1 2022, funding for African tech startups plunged by 36.8%, and the number of deals also dropped to 92 from 130, a 29.2% decrease.

Guess what? Nigeria’s situation is more dire as funding declined by 92.1% last quarter compared to the same period in the previous year. Analysts say that the continued global downturn is a critical factor for this slowdown.

You should make out time to read our findings.

Meanwhile, in today’s letter, we will cover:

- the latest on digital lending regulation in Nigeria

- how Cameroon is digitising Visa application

- the embattled Healthlane CEO and his venture

We will also share updates from the BD Funding Tracker, opportunities, noteworthy stories and more at the end of the letter.

The big three!

Soko Loan is among the 178 licensed digital lenders in Nigeria

The news: About three months after the Federal Competition and Consumer Protection Commission (FCCPC) approved the operations of 106 digital lenders in Nigeria, the commission has added 72 more lenders to the list; making it 178.

One of the most notable lenders on the latest list that was released by FCCPC last week is Soko Lending Limited (Soko Loan); the company received conditional approval.

Why it matters: In March 2022, Soko Loan was one of the predatory lenders that FCCPC cracked down on over customer privacy violations.

“Soko Lending appears to be the most consequential digital money lender with multiple apps and brand names covering a significant share of the digital lending market, and one of the most prolific actors in violating consumer privacy, fair lending terms and the ethical loan repayment and recovery practices,” Babatunde Irukera, the CEO of FCCPC said last year.

Prior to the FCCPC raid, the National Information Technology Development Agency (NITDA) imposed a ₦10 million sanction on Soko Loan for privacy invasion in 2021. A 2022 investigation by Nigerian journalist, David Hundeyin also revealed other irregularities around the lender; including illegal operations in the country.

In fact, at the time, Nigerian authorities announced that it is investigating Soko Loan’s parent company—Philip Consulting. However, no official findings regarding the investigations have been disclosed.

The continued revelations regarding the illegal activities of digital lenders like Soko Loan led to the development of digital lending guidelines that allow the FCCPC to vet and license lenders in the country.

Zoom in: Since January, Google has been requiring digital lenders in Nigeria and Kenya to provide to obtain approval from local regulators and submit documentation, or they will be removed from its Playstore.

More recently, the big tech said that it will prevent lenders from gaining access to users’ photos, videos, and contacts in a bid to address predatory behaviour.

Will the aforementioned efforts curb predation from lenders like Soko Loan?

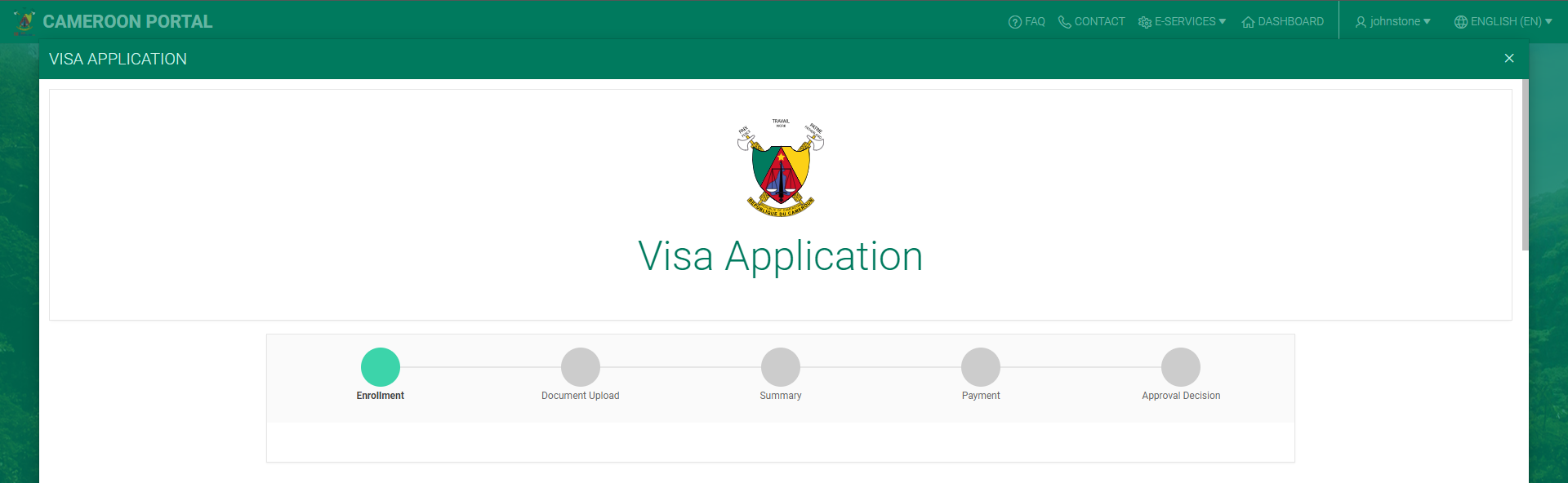

Cameroon is digitising visa application

The news: Effective April 2023, all Cameroon entry visa applications will be done online, according to the country’s Minister of External Relations Lejeune Mbella Mbella. “The eVisa system shall, gradually but steadily, be installed at various land and maritime border posts,” Mbella Mbella said.

This is coming a month after Cameroon’s President, Paul Biya signed a decree updating the conditions of entry, stay, and exit of foreigners in Cameroon

The country’s foreign ministry is launching the eVisa in collaboration with Ivorian security and biometric solutions provider, Impact Palmarès R&D SAS. In 2020, the company did a test run of the eVisa system at the Cameroonian embassy in Côte d’Ivoire.

Why it matters: “The e-visa system [aims] to make Cameroon a more attractive destination, address the grievances of the Cameroonian diaspora and upgrade the consular system to international standards,” Mbella Mbella added.

How it will work: Applications will be submitted via the eVisa website following established administrative procedures. Thereafter, the visa fees will be paid via various methods, including Mastercard, Visa, Paypal, Mobile Money, Orange Money, Moov, Wave, Safaricom, Airtel, Vodacom, and Africell.

An eVisa authorisation will then be issued to the applicant who will be able to go either to a diplomatic mission or to a border post to retrieve the visa within three days. In this final stage, the applicant’s biometric data, fingerprints, facial images, etc., will be collected.

Zoom out: Experts say that if not properly managed eVisa systems are prone to cyber-attacks and it can also increase the chances of document forgery.

“One measure to prevent identity theft and forgery of documents is to ask applicants to pay the visa fee with a debit or credit card issued in their name,” Radu Cucos, the former Chief Information Officer at the Moldovan Foreign Service, who led the development of the Moldova e-Visa Service, said. “This measure is extremely useful because banks verify the identity of their clients when issuing debit or credit cards.”

Healthlane wants to rebrand its offering

The news: Cameroonian healthtech startup, Healthlane says it’s currently making [undisclosed] changes to its business model. In an email seen by Benjamindada.com, Healthlane CEO, Alain Nteff said that the company intends to make the “transition as smooth as possible”.

Four months ago, two investigations by local tech media outlets revealed an ongoing high burn rate, layoffs and rising debts at the company that has previously received commendations from its users.

Although Nteff said he will respond to the allegations, he has not made any public statement regarding the investigations at the time of this report. Most of Healthlane’s social media handles have been inactive for over nine months now.

Dig deep: Healthlane is a pivot from Nteff’s first venture, GiftedMom; the company was founded in 2012 to provide quality healthcare for pregnant women. However, when Nteff lost his mom due to misdiagnosis, the company pivoted to focus on preventive healthcare by providing on-site medical checkups to patients.

Prior to the financial crises, Healthlane raised $2.4 million raised in 2020 after graduating from Y Combinator. In 2022, the Cameroonian startup received $100,000 in equity-free funding through the Google Black Founders Fund Africa—an additional $200,000 in Google Cloud Credits. A development that some of the company’s employees said they were unaware of describing the happenings at the company as “shady and confusing”.

What now? Nteff hinted that the business model rebrand means that Healthlane physical laboratories and offices will be closed down.

Before now, its Lagos-based office was closed down last year due to the high facility maintenance cost; including rent, electricity, repairs, and generator and pool maintenance. Last year, the company reportedly wanted to sell its Cameroon office to Reevy, Healthlane’s nutrition partner in the country.

While we wait for Healthlane’s next plan, Nteff disclosed that annual health plan subscribers can get partial refunds. He also advised users to download their health history from the mobile app before the end of this year.

State of funding in Africa

“In uncertain times, investors will seek to de-risk an already risky investment by concentrating capital in markets where the revenue opportunity is exponentially large,” Peter Oriaifo, Principal at Oui Capital told Benjamindada.com in February. “Capital will concentrate further on the big four markets—Egypt, Kenya, South Africa, and Nigeria.”

Our Q1 2023 state of VC funding in Africa underscores Peter’s argument, the big four remained the most funded regions on the continent, raising about ~90% of the entire funding between January and March.

Q2 is here! Find the African startups that raised over $135 million in the first week of the quarter in the table below.

Noteworthy

Here are other noteworthy stories in the media that we covered and/or are reading:

- Solomon Osadolo’s journey to becoming a global content design talent: Osadolo is a Content Designer at HubSpot, a global CRM platform. Before moving to the UK as a global tech talent, he was the Content Design Manager at Flutterwave. What’s his personal and professional story?

- Exploring the rumour and benefits of a potential Moniepoint acquisition of Payday: Moniepoint may acquire Payday last valued at $20 million. If the acquisition goes through, both parties could benefit from leveraging each other’s infrastructure. Here is our analysis.

- Nigeria inaugurates digital innovation council to drive Startup Act: Nigeria’s President Muhammadu Buhari has inaugurated the National Council for Digital Innovation and Entrepreneurship with the mandate to guide the implementation of the Nigeria Startup Act.

- West African Monetary Institute to receive $8 million from African Development Fund to support enhanced banking identification and financial sector efficiency in the West African Monetary Zone.

- Kenya’s government is struggling even to pay its ministers: For the first time since it gained its independence in 1963, the government of Kenya has failed to pay its employees, Quartz Africa reports.

- Twitter isn’t a company anymore: In a court filing on Tuesday, April 4, Twitter Inc. quietly revealed a major development: It no longer exists.

Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Vendease — Head of Product and other roles

- Moniepoint — Motion Graphics Designer

- Stitch — Product Manager

Data & Engineering

- Flutterwave — Senior Core Switching Engineer

- Kuda — Technical Lead and Data Engineer

- Wave — Director of Engineering

Admin & Growth

- Seerbit — Editorial and Research Content Lead

- M-KOPA — Strategy Manager

- Paystack — Sales Associate

Have a great week ahead.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore