In this edition of The Investors’ Corner, Lesego Tladinyane talks about how he worked on an $8.5 million deal barely a year into his VC career.

Lesego Tladinyane is an investment associate at Newtown Partners, covering crypto assets, Web 3.0 technologies and blockchain.

Lesego discussed how he transitioned into Venture Capital (VC) after five years of trading experience, his most interesting deal (the $8.5 million Shypple deal) and his thoughts about the VC landscape.

What are your responsibilities at Newtown Partners?

On a day-to-day basis, I have to find leads and identify tech companies worth investing in, evaluate prospective investments, and support our portfolio companies. Portfolio management is a major aspect of my job.

What does this portfolio management entail?

It involves meeting with founders to monitor their progress and provide strategic support on their product strategy, go-to-market strategy, and business model.

Jeremiah: Interesting. And what is the frequency of these meetings?

At least twice weekly.

Jeremiah: That’s a great frequency for keeping your portfolio companies engaged.

Absolutely. I must add that the meetings aren’t always about the companies’ progress. Sometimes, I personalize discussions by asking about our founders’ health. Are they okay mentally and physically?

Jeremiah: You seem great at what you do.

Thank you.

How long have you been a VC now?

A year and 10 months.

Jeremiah: Wow. Really?

Yes. My job at Newtown Partners is my first VC work experience. I started working there in January 2021.

What were you doing before you joined Newtown Partners?

I was studying for an MBA in Finance at the University of Cape Town (UCT).

Did you have any work experience before your MBA program?

Yes. I worked as an Emerging Rates Trader at Deutsche Bank and a Senior Trader at Nedbank. I first worked at Deutsche for three years before moving to Nedbank, where I spent 2 years and ten months.

Amazing! How did a trader with over five years of experience end up in VC?

While working as a banker, I did a bit of angel investing, which made me familiar with VC. That familiarity translated into real career interest when I took a sabbatical to pursue an MBA at UCT’s GSB.

There, I developed an aptitude for alternative investments with a specific focus on business model innovation, strategy, and technology. I fostered my new interest by consulting for a few startups and working on innovative projects. One of such project included research on the state of venture capital in South Africa. I also did research work for Vinny Lingham and Llew Claasen, partners at Newtown. The quality of that work left a huge impression, leading them to offer me an investment associate position at Newtown.

Do you find any of your trading skills helpful in your VC role?

Yes. Most of the core skills required in VC and trading are similar. Just like in trading, you need to effectively assess risks with little information, understand cash flows and business models, and deeply understand macroeconomics to succeed as a VC.

How has the experience at Newtown Partners been for you?

Overwhelmingly positive. My role offers limitless opportunities to work with smart people and do the two things I’ve wanted to do all my life.

What are those two things?

One, work on difficult problems. Africa’s huge startup funding gap is a difficult problem and working at Newtown Partners gives me an avenue to solve it.

Two, work in emerging markets. With Newtown Partners actively investing in emerging technology startups, I’m able to achieve this second goal easily.

What is the most interesting deal you’ve worked on?

It’s hard to pick a favourite [laughs]. But I’d say the $8.5M Series A round of Shypple, a Netherlands-based digital freight forwarder tops the list.

What was exciting about the Shypple deal?

About 90% of freight forwarder business, which accounts for 90% of global trade, is fragmented and dependent on error-prone models. Shypple wants to solve this problem by digitizing the air and ocean freight market with its cloud-based supply chain platform. And so, it was exciting to provide funds that will accelerate Shypple’s platform.

How many deals have you worked on in total?

I’ve worked on 14 transactions. I led 5 of them.

Related article: The cheque sizes of active African venture capital firms

What are your top lessons from working on these deals?

I’ve learned that founder-market fit matters. Founders need to have experienced a pain point relating to their startup’s mission and possess grit. Else, the startup will most likely fail. As an investor, I know better to be empathetic. Working on different deals has taught me that founders can be in a bad headspace preventing them from putting their best foot forward. For this reason, it’s vital to be human-centric.

Another biggest takeaway is that the market is dynamic. A year ago, the capital was easy to deploy, with the announcement of funding rounds being the norm. However, that has changed. Liquidity is tighter, and funds are now more careful about capital allocation.

How can founders navigate this funding slowdown?

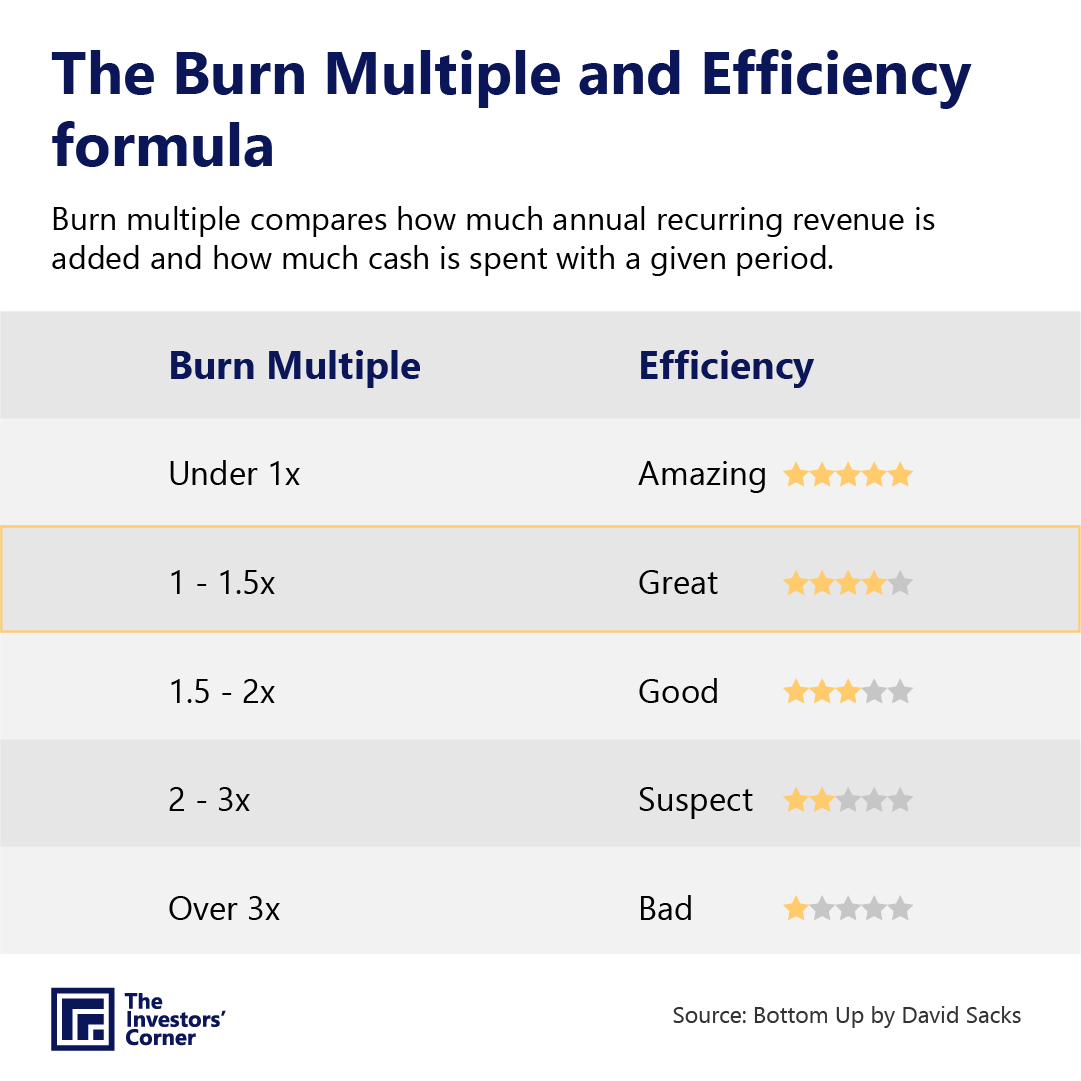

Don’t wrongly assume that your runway will be enough. Instead, be preemptive and constantly think ahead. Overall, aim for a 1 – 1.5x burn multiple.

Let’s talk about the deals that didn’t take place.

I can’t name them all [laughs].

Jeremiah: Haha.

VC is essentially the business of allocating scarce resources to a growing number of interesting opportunities. So there’s always going to be that one deal that gets overlooked.

Sometimes, that might be due to slowness on your firm’s end. Perhaps the startup considers your investment process slow. Or you have to pass on a potentially great deal because the startup’s principles don’t align with yours. For instance, the Newtown Partners team once had to move past a startup we love because its founder has less than 30% equity in ownership.

I get hurt whenever any of such scenarios happen. Fortunately, I’ve grown to know there will always be another transaction. In the event of a missed deal, the best you and your team can do is be retrospective and ask, “is there anything we could have done differently?” “How can we achieve a more optimal outcome in the future?” “Do we need to improve our processes?”

What are Newtown Partners’ investment criteria?

First, we examine the team. Are they a right fit for the problem they’re trying to solve? For example, we might not consider a founder with a sales background trying to launch a machine-learning tool.

We also try to confirm if the startup has existing customers and a good engagement rate. This is important because we’re not a pre-seed fund. We typically won’t invest in startups with less than $300k in ARR.

We also consider the product state, specifically its security, scalability, and maintainability. Next, we look at the startup’s business model and market potential. Will the total addressable market be compelling enough to yield massive returns?

Lastly, we analyze the startup’s cap table. Do its employees have ownership stakes that incentivize them to stay long-term?

If a startup can fulfil these criteria, alongside other necessary due diligence, we’ll most likely invest in them.

How do you source for deals?

I generate deals via three mechanisms. The first is inbound requests, which involve founders reaching out through cold requests. The second involves researching a vertical we are interested in and identifying primary players, whom we then reach out to. The third mechanism entails using my existing client network and reputation among the investor community to source new deals. It requires heavy networking.

How are you able to network successfully?

I’m deliberate about it. After joining Newtown Partners, I developed the habit of attending VC events. After attending these events, I reach out to fellow attendees to establish a connection. Subsequently, I add value by connecting them to relevant people and opportunities. I also schedule catch-up calls where we get to catch up on our professional and personal lives. With time, these relationships grow organically and come in handy when sourcing deals.

What possible trends excite and scare you?

I’m excited about how Africa is increasingly becoming a viable investment opportunity for more global funds. This means more entrepreneurs can execute their brilliant ideas. It’s interesting to see more people returning home as well.

On the other side of the spectrum, I’m worried about the new paradigm of capital allocation. The intense regulation and a tighter market might harm innovation.

What are your thoughts about the VC landscape?

I think most venture firms might not outperform in the long run. Only firms that are huge on branding, are specialists, and go beyond deploying capital will eventually win.

What was a myth you believed before joining VC?

I believed there was little due diligence. I thought the business of VC was investing in a startup simply because you like the founder(s) and their idea. But as an insider, I now realize that a lot of deep thinking and due diligence goes into VC deals. No deal is as easy as it seems from the outside.

What’s your piece of advice for aspiring VCs?

Create your own luck by working on interesting ideas and investment theses. Afterwards, reach out to VCs who will find them relevant. Try to build expertise, too, and commit to continuous learning. The best way to learn is to identify the VCs you want to emulate and ask them for their go-to resources. Ultimately, be true to yourself.

And what do you think founders need to get better at?

Research. Founders need to do better research, especially when pitching. Before you reach out to a fund, find out if your startup fits that mandate. By doing an adequate background check, you increase your chances of raising venture capital.

Editor’s Note:

The Investors’ Corner is our latest web series spotlighting the stories of African-focused investors and how they make investments on the continent.

We will publish a new episode of The Investors’ Corner (TIC) bi-weekly on Saturdays by 8:00 AM (WAT). This season of TIC is done in partnership with and anchored by Jeremiah Ajayi, a Content Marketer for SaaS and VC.

You can contribute in two ways. One, let us know which investor you’d like us to feature. Two, give feedback and public praise for the episodes that you connect with.

If you’d like to partner with us to create other formats of this content, please reach out to hello@benjamindada[dot]com.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore