While Fincra received a commercial licence to operate as a Payment Service Solution Provider (PSSP) in Nigeria, two other fintechs operating in Nigeria secured licences elsewhere.

First, Chipper Cash, secured a licence to provide money transfer services in Malawi—a landlocked country in Southern Africa with ~10 million adults.

Second, Kuda received a digital banking licence from the State Bank of Pakistan to operate in the country.

In letter 146, we examine:

- the plan to monitor Kenyan’s usage of M-Pesa to curb tax evasion

- Nigeria’s national card scheme launch

- how ChatGPT content moderators in Africa were underpaid and sacked

and other noteworthy information like:

- The latest African Tech Startup Deals

- Opportunities, interesting reads and more

The big three!

Mobile money as a tool for Government regulation in Kenya

Last week, we told you that a Kenyan High Court has asked Safaricom and the Central Bank of Kenya (CBK) to pause the re-introduction of M-Pesa charges for transactions involving a bank account.

Well, mobile money in Kenya—perhaps, one of the country’s most talked about successes—is back in the news again.

The news: The Kenyan government is proposing to monitor the M-Pesa accounts of its residents to curb tax evasion. This proposition is contained in the Budget Policy Statement (BPS) 2023 [pdf] which was released last Wednesday (January 18, 2023).

According to the statement, the Kenya Revenue Authority (KRA) will use systems that will gather intelligence on business production trends, people’s usage of mobile money and ownership of properties. Its system will be linked with telecoms and gaming platforms to ensure compliance.

Context: KRA has been tasked with a goal to double its annual collections from Sh2.1 trillion to over Sh4 trillion ($32.338 million). The tax collector is introducing new initiatives to enable the achievement of this goal, including the introduction of a 16% value-added tax (VAT) on digital services.

Why it matters: “There are only seven million people with [tax] pin numbers,” Kenya President, William Ruto, said. “At the same time, in the same economy, Safaricom’s M-Pesa has 30 million registered customers, transacting billions daily.”

Kenya is one of the biggest mobile money (MoMo) markets in Africa. According to the CBK, the East African country recorded $58 billion in MoMo transaction volume, last year, excluding December.

Zoom out: “KRA integrating tax system with M-Pesa is a really bad idea. Not only is it an invasion of privacy, but individual cash flow on M-Pesa is never a reflection of earnings. It is going to give misleading information and land a lot of small traders in trouble,” John Danson, a social commentator, tweeted.

Kenyan authorities will need to clearly define what they intend to tax because an undefined taxation system might cripple businesses in the country.

The Insider’s perspective

Is it wise to offer BNPL in a country where credit histories or scores are limited?

Hear from Fehintolu Olaogun, CEO and co-founder of the Nigerian fintech, Credpal which partnered with Bolt to launch a ride now, pay later option for users.

We work with all the credit bureaus in our scoring process and also report repayments, which further enriches the continent’s credit data. This integration is one of the most scalable and sustainable ways of driving credit inclusion, with low risk as initial limits are very low and customers can build their way to higher limits with good repayments.

CBN’s national domestic card scheme becomes operational

The news: Last week, the national domestic card scheme by the Central Bank of Nigeria (CBN) and the Nigeria Inter-Bank Settlement Systems (NIBSS) became operational.

According to Premier Oiwoh, Managing Director of NIBSS, “the card would be optimised for local content solely for the Nigerian market and support micropayment and credit, e-government, identity management, transportation, health and agriculture regarding payment.”

The card payment scheme processes payments using debit and credit cards. However, the CBN is yet to disclose the procurement cost and operational charges.

Why it matters: In 2021, the annual value of card transactions in Nigeria was $18.2 billion. The market is expected to grow at a compound annual growth rate (CAGR) of more than 18% between 2022 to 2025, according to a 2022 report by GlobalData.

“Considering the strength and breadth of its banking sector and the rapid growth and transformation of its payments system over the last decade, Nigeria is ideally positioned to successfully launch a national card scheme,” CBN spokesperson, Osita Nwanisobi, said.

Zoom in: Although, there are up to seven CBN-licenced card/payment schemes in Nigeria. Only three are popular.

Verve by Interswitch, Visa, and Mastercard. Verve is a domestic card scheme offering lower costs to local financial institutions. While Visa and Mastercard are international card schemes with dollar-denominated costs, which already makes it more expensive to issuers in Nigeria.

In October 2022, we asked industry insiders what they thought of this new card scheme by the regulator, in partnership with the industry’s tech company, NIBSS.

Kabir Shittu, the COO of Sudo Africa told Benjamindada.com called it a welcomed development that will lead to more competition in the Nigerian cards market. “Interswitch is like a god in the Nigeria card business and billing to financial institutions is ridiculous,” he said. “Adoption, however, will be easy as CBN might ask everyone to come on board as they did with eNaira.”

RuPay had 60% of the card market share in India as of 2020, up from 15% in 2017, according to the Reserve Bank of India.

How ChatGPT content moderators in Africa were underpaid

The news: About 200 Kenyan workers who were working to remove toxic content on ChatGPT were underpaid by Sama, OpenAi’s content moderating partner. According to an investigation by TIME, these workers were paid less than $2 per hour $1.32 and $2 per hour “depending on seniority and performance”.

Why it matters: OpenAI reportedly signed three contracts worth about $200,000 with Sama in late 2021 to label textual descriptions of sexual abuse, hate speech and violence. With this contract, the job description of these workers was to read and label between 150 and 250 passages of text during a nine-hour shift.

One Sama’s employee who was working on the Open AI project told TIME he suffered from recurring visions after reading a graphic description of a man having sex with a dog in the presence of a young child. “That was torture,” he said. “You will read a number of statements like that all through the week. By the time it gets to Friday, you are disturbed from thinking through that picture.”

Sama had to cancel all three contracts it signed with OpenAI in February 2022.

Counter-argument: Contrary to the investigation, Sama argues that it pays employees almost double what other content moderation firms in East Africa pay. It also offers “a full benefits and pension package”, Sama states that it “is uncommon”.

“[We pay] between Sh26,600 and Sh40,000 ($210 to $323) per month, which is more than double the minimum wage in Kenya and also well above the living wage. A comparative US wage would be between $30 and $45 per hour,” the company’s spokesperson told Quartz.

Zoom in: This is not the first time Sama will be facing this kind of allegation. Last year, the content moderator and Meta were sued by an ex-employee over labour exploitation. Starting March 2023, Sama announced that it will discontinue its content moderation operations, this has affected 3% of the company’s workforce.

State of funding in Africa

Mergers and Acquisitions

- Egyptian e-sports platform GBarena has acquired the Tunisian gaming startup, Galactech. The acquisition is a share swap deal worth about $15 million, according to Forbes Middle East.

- DriveMe, a leading mobile technology company in Nigeria, has announced a 100% acquisition of Go!TwentySix, one of the top providers of valet services in Nigeria.

Funding

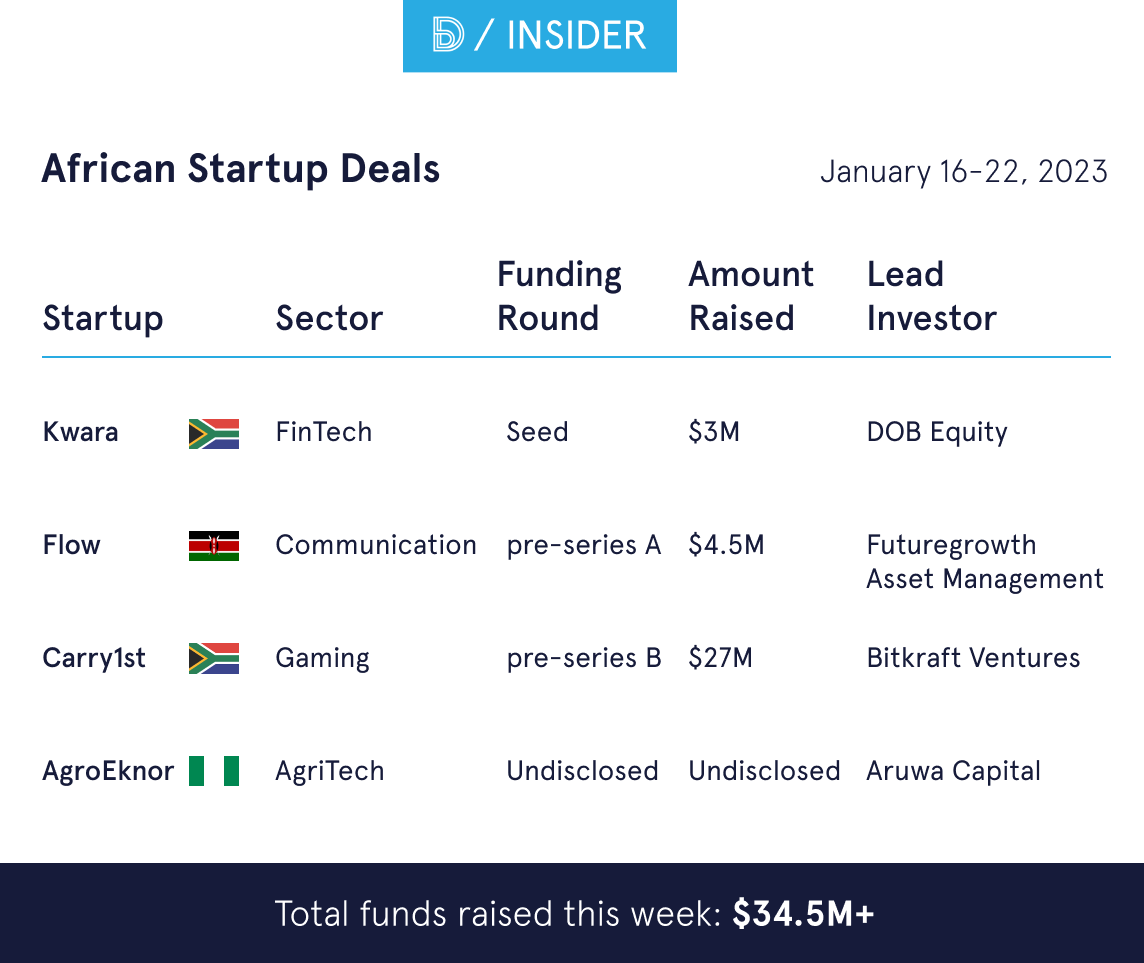

Last week, four African startups jointly raised $34.5 million, according to the BD Funding Tracker. Find more details in the table below.

Noteworthy

Here are other important stories in the media:

- How Jasiel Martin-Odoom helped 100+ startups that raised $2.5 billion in funding: In this episode of TIC, Jasiel Martin-Odoom talks about his career as Africa Investment Officer at Accion Venture Lab.

- TeamApt’s evolution from a tech provider to a B2B startup: In this article, I examine TeamApt’s evolution and draw parallels for how tech companies and startups can operate to make the most of their time in business.

- Aisha Owolabi on content marketing and getting the UK Global Talent Visa: Dara talks to Aisha Owolabi, a Content Marketer about how she moved from Lagos to Mexico and got to the UK with the Global Talent Visa.

- Six ways to make money with Bitcoin in Nigeria: Whether you’re new to Bitcoin or have been following it for a while, this post will help you understand the different opportunities available to you and how you can take advantage of them.

- A comparison of Starlink and existing Kenyan internet service providers: Elon Musk’s satellite internet firm, Starlink, has announced that it will launch its service in Kenya in the second quarter of 2023. How different is it from existing operators?

Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Reliance Health — User Experience Research

- Chipper Cash — Senior Product Engineer

- Fincra — Product Associate

Data & Engineering

- TradeDepot — Data Analyst

- uLesson — Android Engineer

- Andela — Senior Data Engineer

Admin & Growth

- Umba — Head of Sales

- Jobberman — Head of Digital

- Yassir — Marketing Strategy Manager

Thank you for reading. Please let us know if you liked this newsletter.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore