In this article, I examine TeamApt’s evolution and draw parallels for how tech companies and startups can operate to make the most of their time in business.

Company structure

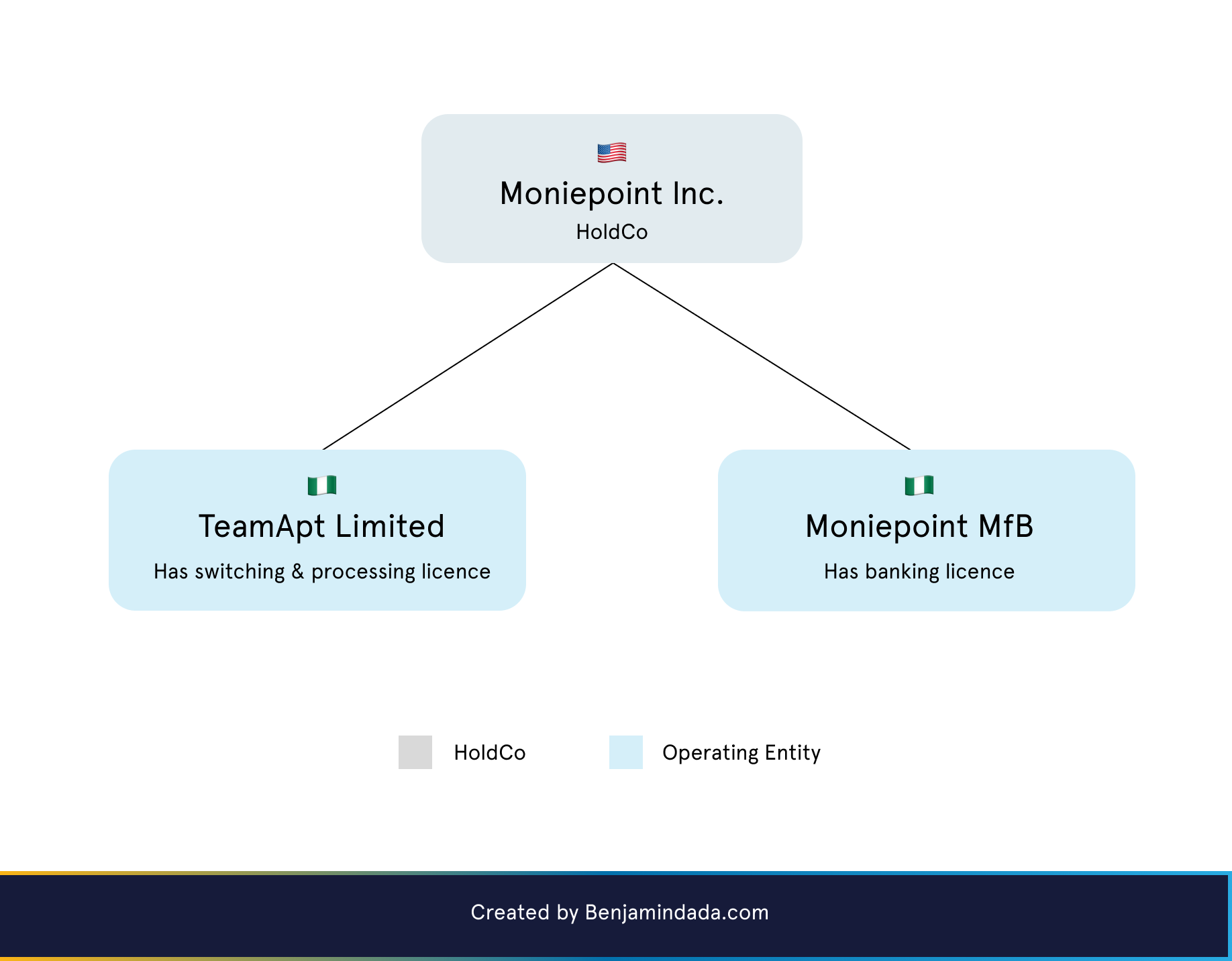

In 2020, TeamApt Limited—a Nigerian company registered in April 2015—created a holding company (holdco), TeamApt Incorporated.

Last week, it announced the name change of its holdco to Moniepoint Incorporated. Moniepoint is the name of TeamApt’s flagship product that offered agency banking services.

In the first quarter of 2022, TeamApt received its microfinance bank (MfB) licence and named it Moniepoint microfinance bank.

Thus, there are three known entities in the TeamApt ecosystem; a holding company (Moniepoint Inc.), and two operating companies: TeamApt Limited and Moniepoint microfinance bank.

This structure illustrated in figure 1 above is what many startups in Nigeria maintain, especially those in a regulated space like financial services.

A Delaware-registered company is created to ease capital access from foreign investors. With a US entity, you can create local US bank accounts to receive US Dollars, as opposed to working through domiciliary accounts. Also, being Delaware, a state with mainstream investment laws, allows both investors and startups to align quickly on legal terms of an investment. So, deals close faster if the entity is registered in Delaware. In fact, YC, a popular accelerator choice for startups in Africa, requires its startups to form a Delaware C-Corp before it invests.

Next, you have a company registered in the startup’s operating country. To apply for a regulatory licence, you need to setup a local entity that will be used to file the application.

So, in TeamApt’s case, their Nigerian entities hold the operational licences to do business in Nigeria. TeamApt Limited holds the Switching and processing licence awarded by the Central Bank of Nigeria (CBN) while the Moniepoint microfinance bank holds the banking licence.

In Nigeria, many startups involved in some level of banking, opt for the acquisition of an MfB to gain quicker access to the underlying CBN licence. Also, there are grapevine conversations that the CBN is unwilling to give out new licences to MfB applicants because of the huge amount of defunct ones.

So, when these startups acquire the MfB, they then file a name change for the MfB, so that it carries the name of their brand. For example, Eyowo acquired an MfB and changed the name to reflect its brand. Thus, Eyowo’s MfB is now referred to as Eyowo microfinance bank. This is the same approach that TeamApt took.

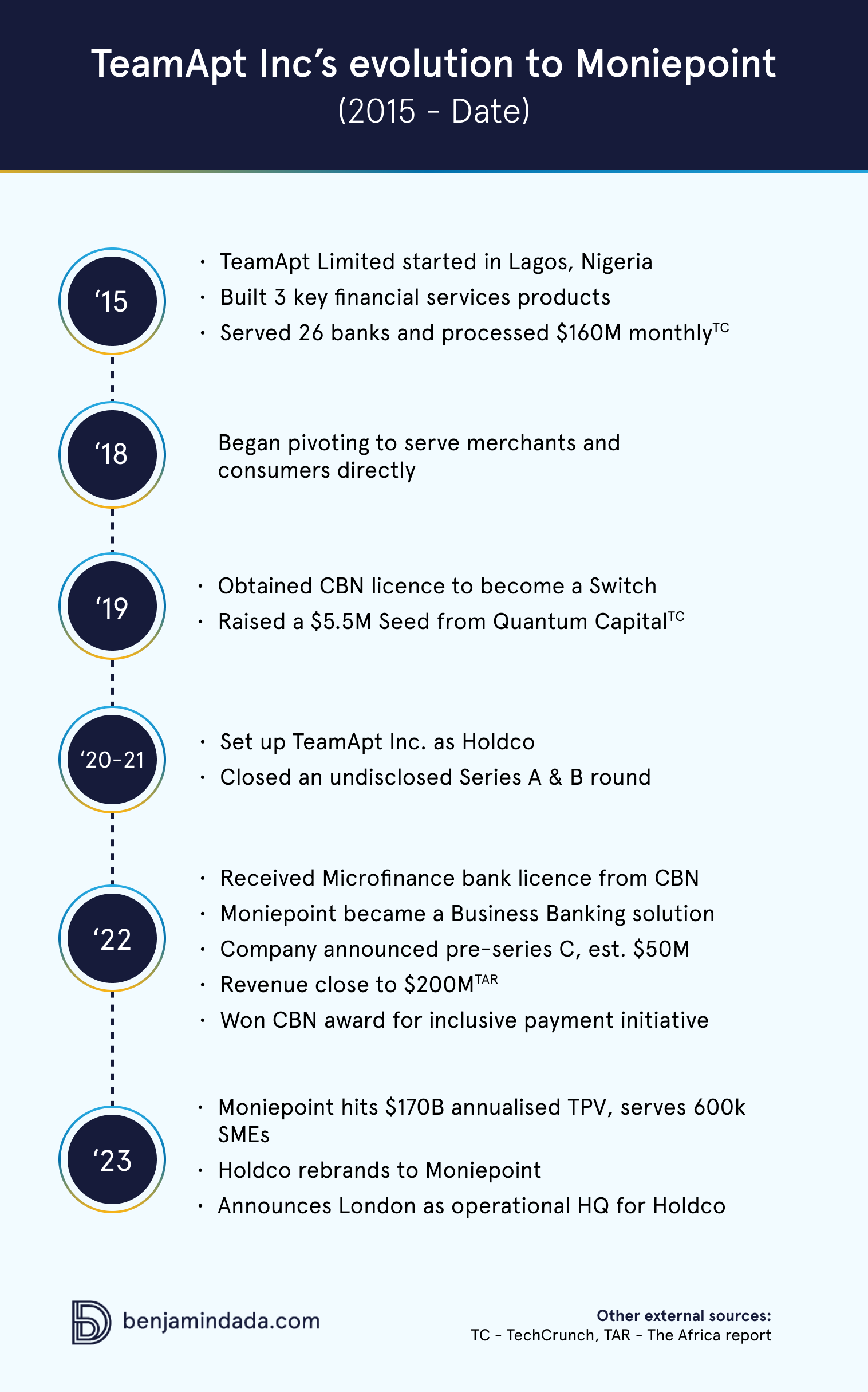

Now, how did TeamApt go from a Limited company that provided development services to banks to becoming a startup selling its products directly to customers. Figure 2 is an infographic that summarises aspects of the evolution.

Starting out as TeamApt Limited

Seven-year-old TeamApt is one company whose story I’ve followed for about five years.

In 2018, I visited their office in Lagos, Nigeria and met with staff, and executives including the CEO.

Guys doing my first feature story where I spend like a day with a company and write about them and I couldn’t be more excited.

Today, I visited Team Apt; mind = blown

Watch out! pic.twitter.com/TakgsopdTU

— Benjamin Dada (@DadaBen_) March 2, 2018

I remember being impressed by the quality of their team and the progress they had made serving about every commercial bank in the country.

TeamApt arrived on the Nigerian tech scene at a time when fintech startups were beginning to spring forth. Paystack (acquired by Stripe) was founded in 2015 and Flutterwave, the year after. But there were incumbent tech companies like Interswitch (founded in 2002), and eTranzact (founded in 2003).

The tech companies founded before 2015, are what I refer to as traditional tech SMEs, not startups. The customer segment and revenue model for an SME is defined, and the risk is low. Unlike a startup where there is a lot of uncertainty and high risk. Anyway, the tech SMEs that we learn about today are ones that bootstrapped themselves to sustainability and/or profitability.

CEO and co-founder of TeamApt, Tosin Eniolorunda had come from six years of working at Interswitch, so, he clearly had a tech SME DNA. I commend his vision and ability to unlearn, relearn and become the leader of a high-growth startup.

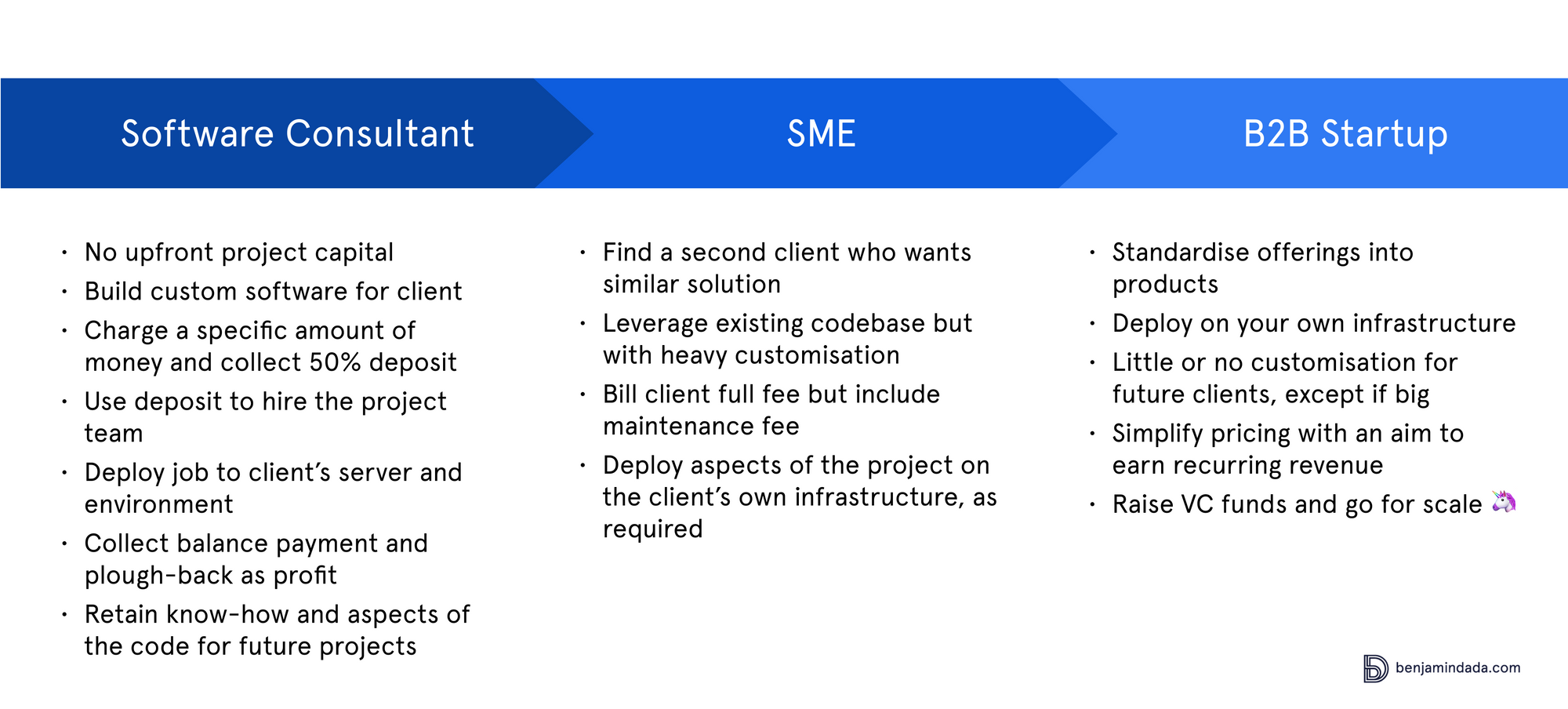

If you start out as an SME, there are three major phases you go through before you become a high-growth startup, if that’s your eventual aim.

Stage one, act as an agency or a development consultant that builds bespoke software for clients. The client pays you a lump sum that is usually enough for you to assemble a team to build the product, pay everyone and plough back profit into your company. At this stage, the client most likely wants you to deploy the solution on their infrastructure. So, all you are usually left with is the know-how and codebase.

Stage two, you take that know-how and or codebase, white-label it and find other clients that could commission you to build and deploy something similar for them. You can charge them for the solution as though you are building it from scratch because most time, it’s not going to be a simply “copy and paste” of the old codebase. Your next client will have peculiar implementation requirements or request additional features. But what makes the profit margin good is the fact that you might need fewer resources, or spend less time than the first time you built something like this.

Stage three, you take all your learnings from your first few client implementation experience and build a single product that you can sell to many businesses. Instead of rebuilding many versions of the same solution and serving only a few clients in a year.

The framework above played out in TeamApt’s case. In a conversation with TechCrunch, CEO Tosin said the company started after closing a deal to build a payment solution for a company. “To start, we closed a deal with Computer Warehouse Group to build a payment solution for them and that’s how we started bootstrapping”, says Tosin.

B2B startups of today operate on this model but leapfrog stage one by leveraging venture capital to build their first product which is then sold to clients. This way, they don’t have to build custom software for a first client just to get access to seed capital for their business. They can simply focus on building a single product that can be resold at little or no marginal cost to many businesses. Here, the main revenue model is usually a fee/commission on each completed transaction carried out on their system.

Enough of the lecture and back to TeamApt. I first met them when they were in between stage two and three of their B2B tech journey.

They had built something that works and were able to resell it to a lot of banks and financial institutions. In an earlier conversation I had with the CEO, he described TeamApt before the 2019 pivot as a type of “digital banking service provider”.

Over the years, they have built enterprise software that includes a white-labelled digital banking product (Moneytor), an enterprise software for small business management (Monnify) and an agency banking platform (Moniepoint).

TeamApt has always had good numbers as an SME. In 2019, TechCrunch reported that they had an engineering team of 40, served 26 African banks, processed $160 million in monthly transactions with revenue growth of 4,500 percent over a three-year period.

With numbers as impressive as this, it makes sense why an investment company, Quantum Capital Partners would opt to single-handedly fund TeamApt’s first institutional round of $5.5 million, initially referred to as a Series A but is more accurately referred to as a Seed round.

The goal of TeamApt’s Seed was to expand their addressable market by building out their business and consumer-facing offerings. “We’re beginning to pilot into much more merchant and consumer facing products…”, CEO Tosin Eniolorunda told TechCrunch. “We were also looking for bigger markets, that was the commercial drive…”, Tosin told me in an interview.

In that same 2019, the CBN awarded TeamApt Limited a Switching and processing licence.

The switching licence is a very coveted licence in the country. According to the CBN’s website, for every three PSSP licences it gives out, it only awards one switching licence.

Becoming a Switch is the highest level on the payments value chain in Nigeria. It requires a minimum capital (shareholders’ fund) of ₦2 billion ($4.5 million) and allows its holders to do switching, card processing, transaction clearing and settlement including other privileges contained in Super Agent, PTSP and PSSP licence.

With the Switching licence, TeamApt was able to run Moniepoint’s agency business which utilises payment terminals, because as a switch you can operate as a PTSP and Super Agent.

Of the three major products that the company built, Moniepoint is the one that took off and became the biggest revenue driver for the company.

The company doubled down on Moniepoint and became “profitable in 2020”, according to an official statement sent to Benjamindada.com.

Setting up a holdco, TeamApt Inc

In 2020, as the company prepared for even more institutional funding, they set up a holdco in the US.

By 2021, TeamApt went back to the market to raised an undisclosed round, which insiders refer to as a Series A and B. Anyway, what was announced was a Series B led by Novastar Ventures, alongside other investors.

Novastar Ventures Partner, Brian Waswani Odhiambo, who spoke on the rebrand said: “Moniepoint is uniquely positioned to accelerate the digitisation of banking for underserved businesses. Its leadership team has deep sector knowledge and an enviable track record in the financial services space, which is evident from Moniepoint’s ongoing success. Since partnering, Moniepoint has already displayed amazing growth and we’re excited to see the evolution of the business, as it sets out to deliver best-in-class banking and business solutions.”

In April 2022, Moniepoint evolved into a business banking solution, supported by its microfinance bank licence.

In July 2022, TeamApt became QED Investors’ first investment into Africa. The following month, the payments company announced a pre-series C round believed to be over $50 million. Novastar made a follow-on funding in the new round while Lightrock and British International Investment (BII) also participated in the round.

Ravi Sharma, Partner at Lightrock, commented on the rebrand, thus: “We are very pleased with TeamApt’s move to Moniepoint. Recognised by millions, this brand reflects the company’s focus on innovation and customer-centricity, while also positioning the business for continued growth in Nigeria and across Africa. We look forward to working with Tosin and the talented Moniepoint team as they go from strength to strength.”

In November 2022, TeamApt won the National Inclusive Payment Initiative Award by the Central Bank of Nigeria (CBN).

Eventually, on January 13, 2023, TeamApt announced that it has brought all its consumer-facing products under one roof and will now be known to the public as Moniepoint, given its mindshare in the hearts of its businesses and customers.

Moniepoint is an all-in-one digital financial services platform that offers payment, banking, credit and business management tools to businesses.

Today, Moniepoint’s technology has powered over 600,000 businesses processing more than $170 billion in annualised TPV*, according to the company. This TPV growth has enabled the company to double their revenue in 2022. Last year, the platform launched a credit offering which has already disbursed over $1.4 billion in working capital loans.

Tosin Eniolorunda, co-founder and CEO of Moniepoint said: “When we started out in 2015, we were primarily providing back office payment infrastructure for banks and needed an apt team, hence the name TeamApt. Since then we have evolved significantly and our flagship business banking solution, Moniepoint, has become our core focus and where we see the future. Now as we head into our next step in our journey, we’ve changed our name to reflect the company’s commitment to enable a world where any business has access to the digital tools and capital needed to grow, no matter its stage, size or location, and as Moniepoint we believe we can achieve this.”

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

ExploreLast updated: November 16, 2024