In this last letter of 2022, we are bringing you a roundup of important activities in the tech policy and venture capital scenes.

In Letter 143, we examine:

- the state of venture funding in Africa in 2022

- possible trends in the venture capital space in 2023

- the top tech policies introduced in Nigeria in 2022

and other noteworthy information like:

- exciting reads for the holidays.

- the launch of Zero to Scale 2.0

- opportunities and others.

State of funding in Africa

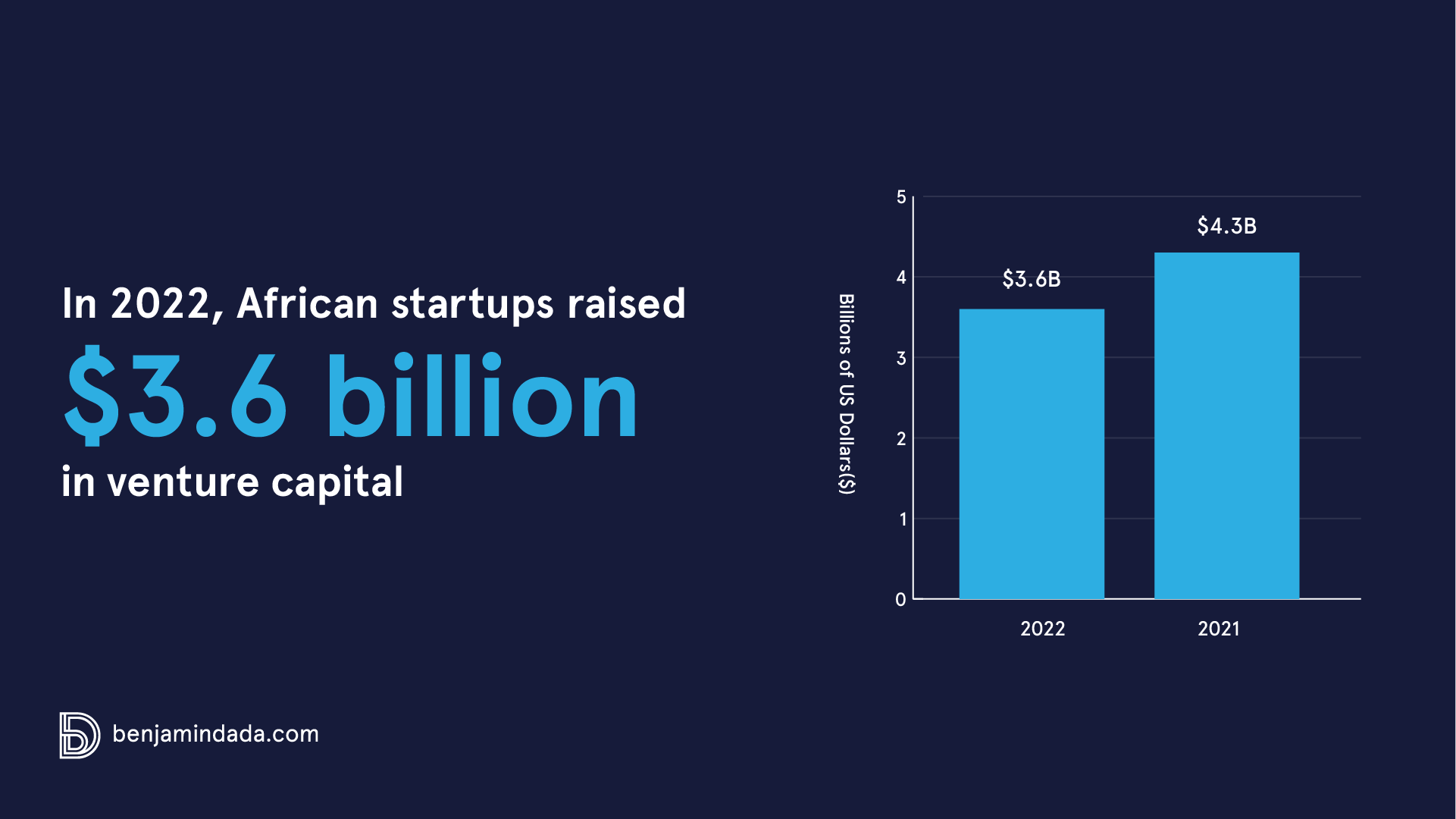

In 2022, African startups raised $3.6 billion in venture capital

The news: Over 360 African tech startups secured about $3.6 billion in venture capital in 2022, according to BD Funding Tracker. This is less than the ~$4.3 billion that was raised on the continent in 2021, based on The Big Deal’s 2021 report.

Experts say that it is due to the global economic downturn which has led to the slowdown of VC funding. However, we tracked 39 undisclosed deals which might imply that the $4 billion record that was set last year was attained this year too.

Methodology: BD Funding Tracker curates deals by Africa-founded companies with Africa as their primary market in terms of operations or revenue— not based on HQ or incorporation.

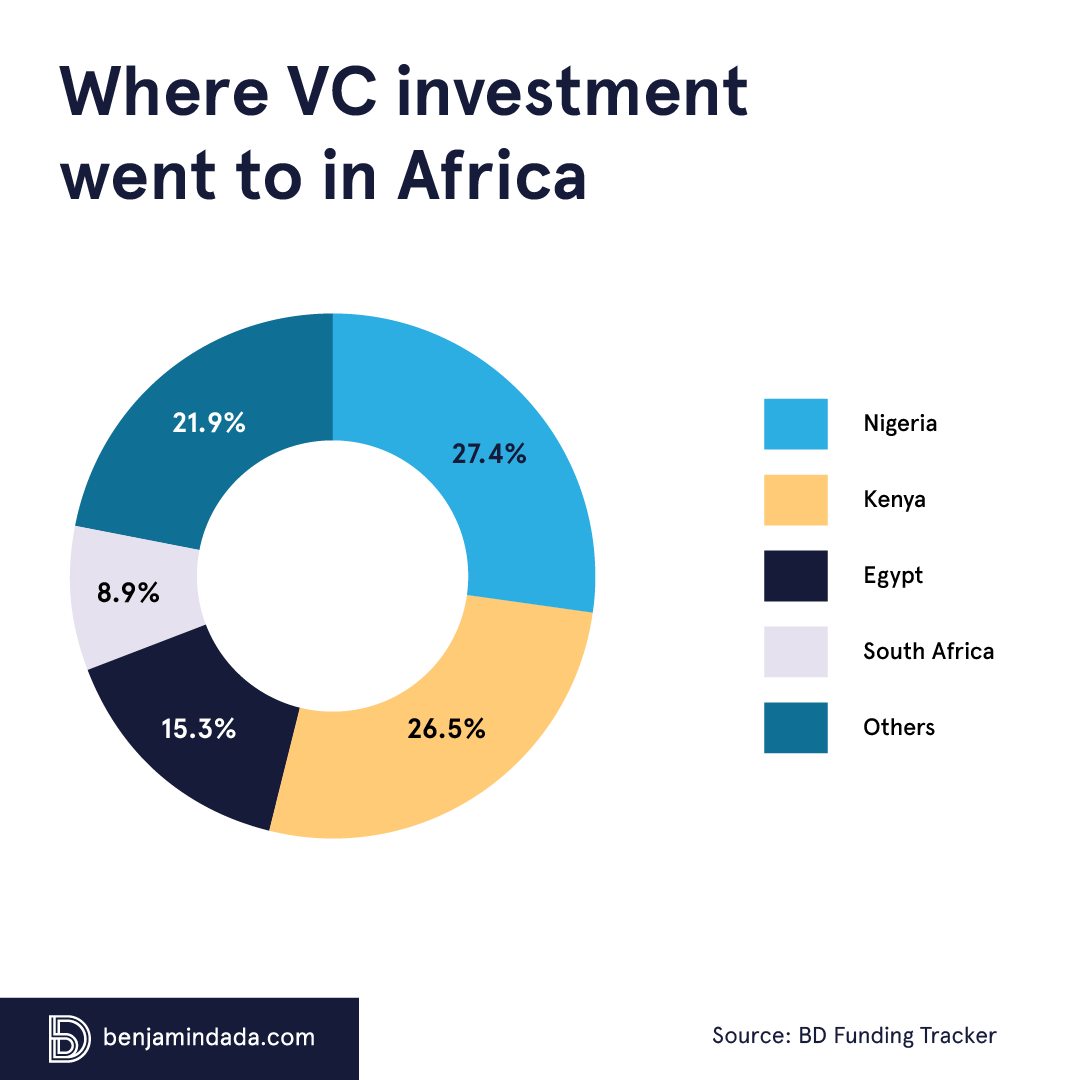

Insights: Nigerian startups accounted for 27.4% ($967.2 million) of the total funding. Kenya, Egypt and South Africa followed with 26.5% ($936.3 million), 15.3% ($541 million) and 8.9% (~$315 million) respectively—the big four countries retained their title as the top funding destination, accounting for 78.1% of the total funding.

Meanwhile, fintech companies made up 36.11% of the continent’s venture capital inflow in 2022, less than the 53% it recorded in 2021, according to The Big Deal. Other top-funded sectors include: e-commerce, logistics, and cleantech.

In the cleantech sector, seven startups jointly raised $381.6 million across eight deals. The cleantech sector’s performance can be attributed to the increased conversations around climate change action, including the United Nations Climate Change Conference that was held in Egypt in November 2022.

Although no new African startup was disclosed to have crossed the $1 billion valuation mark to become a unicorn, some significant mega rounds were recorded. The top five venture capital deals on the continent this year were; Sun King’s $260 million Series D in April—which was recently topped to $330 million.

Others include: Flutterwave’s $250 million Series D—the company’s planned Nasdaq IPO was affected by regulatory challenges, a $150 million Series B by Yassir, Wasoko’s $125 million Series B and Moove Africa’s $105 million pre-Series B—this mobility fintech company raised $183.3 million in 2022 across five funding rounds.

Six African investors predict possible trends in the African VC landscape

In September 2022, we launched the Investors’ Corner, a web series spotlighting the stories of African-focused investors and how they make investments on the continent.

Since its launch, we have interviewed six top investors on the continent including Jake Kendall, Partner at DFS Labs; Maya Horgan Famodu, Founder & Partner at Ingressive Capital and Luke Mostert, Head of Investments at Future Africa.

In this roundup, we curated what these six investors described as the possible trends in the African tech ecosystem.

- Increased investment in digital commerce: “I foresee a surge in the number of investors in the digital commerce space. This is already happening as we’ve had certain interesting African and global funds reach out to us to help understand the market. I also see top talent from around the world coming to work in Africa. There are still lots of people who leave but we also see a lot of them coming back to start or work in African companies which is exciting.” — Jake Kendall, Partner at DFS Labs.

- The future of fintech is crypto: “Building on my interests, the future of fintech is headed towards crypto, DeFi, and blockchain-based systems. I foresee solutions where there is crypto on the backend and traditional finance (visible) on the front (e.g., PayPal, Flutterwave, etc.). Geographically, I’m really keen to see startups move to the Francophone region of the Democratic Republic of Congo – the 4th largest African population.” — Luke Mostert, Head of Investments at Future Africa.

- The possibilities in the healthtech sector: “I foresee valuations returning to reasonable figures. Gone are the days when unrealistic, greedy numbers were the norm. I’m also excited about the future development of health tech. I’m particularly thrilled about the possibility of health tech in improving women’s reproductive health.” — Maya Horgan Famodu, Founder & Partner at Ingressive Capital.

- Regulation might harm innovation: “I’m excited about how Africa is increasingly becoming a viable investment opportunity for more global funds. This means more entrepreneurs can execute their brilliant ideas. It’s interesting to see more people returning home as well. On the other side of the spectrum, I’m worried about the new paradigm of capital allocation. The intense regulation and a tighter market might harm innovation.” — Lesego Tladinyane, Investment Associate at Newtown Partners.

- More Series A startups: “I foresee the gap between the seed stage and Series A closing within the next two years. Currently, many African seed startups rarely progress to Series A, but I’m hopeful that will change. We’ll most likely see a rise in Series A startups.” — Caleb Maru, GP at Proximity Ventures.

- Cross-sectoral consolidation: “I think over the next couple of years we will see a lot of consolidation across sectors, but especially in fintech. I also predict some exciting opportunities in the B2B marketplace, retail, and supply chain. Additionally, I think many identity companies will scale massively. I see that likelihood strongly happening. This isn’t a prediction, but I hope someone finally solves an actual intercontinental cross-border payment solution that works and is affordable for the everyday consumer or trader.” — Lexi Novitske, General Partner at Norrsken22.

The Nigerian tech policy landscape in 2022

As the Nigerian tech ecosystem continues to grow, regulators are setting up regulatory structures to guide how activities are done across the country. Nigeria is not doing this alone, other African countries are also actively establishing regulatory frameworks.

However, this roundup focuses on the regulations established or proposed by the Nigerian government. From the startup act to social media, digital lending and cryptocurrencies.

- Nigeria Startup Act: In October 2022, Nigeria’s President, Muhammadu Buhari assented to the Nigeria Startup Act—a year after the first draft was produced. The responsibility of this Act can be summarised thus: creating a conducive environment for Nigerian startups to flourish.

- Regulations against predatory lending: The Federal Competition and Consumer Protection Commission developed regulatory guidelines for digital lending as an interim step to establishing a clear regulatory framework for the sector which has been laden with several malpractices. This was announced in August 2022.

- NITDA code of practice: The National Information Technology Development Agency (NITDA) introduced a Code of Practice designed to regulate social media activities. NITDA said that all foreign and local platforms with more the 100,000 users will be required to incorporate in Nigeria, have a physical contact address in Nigeria, pay taxes and appoint liaison officers who will be their bridge to the government. This bill that was introduced in June 2022 has not been passed, a recent public hearing on the bill was adjourned.

- Nigeria SEC’s crypto stance: In May 2022, the Securities and Exchange Commission (SEC) of Nigeria issued guidelines for the issuance, offering, and custody of digital assets in the country. The SEC says “Digital Asset” means a digital token that represents assets such as a debt or equity claim on the issuer. According to the regulation, entities that intend to offer crypto-related services or products in Nigeria must secure a Virtual Asset Service Provider licence.

- The creation of the Nigerian Data Protection Bureau (NDPB): Previously governed by the National Information Technology Development Agency, President Buhari approved the establishment of the NDPB—to take charge of data protection enforcement in the country—in February 2022.

️ Introducing Zero to Scale 2.0

Over the last 4.5 years, we’ve been at the fore of creating and documenting stories about the tech ecosystem in Nigeria and the rest of Africa. We have launched three web series to cater for the key actors in the ecosystem—founders, talents and investors.

In 2021, we launched #ZeroToScale (ZTS), a founder-focused series anchored by Orahachi Onubedo. We published ten episodes about the stories of founders across the continent.

Following the impact of this series, ZTS 2.0 is here in an audiovisual format. Unlike the regular “sit and interview” flow, we decided to come up with a more engrossing show where we take you behind the scenes.

To bring this to life, we partnered with The Q Company and brought the pioneer anchor to shoot this new season.

Welcome to Zero To Scale Season 2.

Kindly subscribe to our YouTube Channel.

We hope you enjoy it and support us to make more of these for the culture.

Noteworthy

Here are other important stories in the media:

- “No one in venture capital knows what they are doing”: Caleb Maru, a GP at Proximity Ventures, a pan-African VC firm talks about the African VC landscape and his career as a venture capitalist.

- Cowry Card set to power payments for Lagos’ intra-city railways: Cowry Card, by Nigerian YC-backed fintech company—Touch and Pay Technologies, will power payments for Lagos State’s intra-city railway system.

- How to spot a fake Naira note: The Central Bank of Nigeria has released details of the security features on the newly redesigned Naira notes to enable its fight against counterfeiting.

- These African immigrants are making a global impact in the tech ecosystem: African tech entrepreneurs and talents are not just winning on the home front. They are also making a visible impact across the globe. We curated a list of African tech immigrants making a global impact.

- How two tweets from 10 years ago cost this journalist his dream job at CNN: Idris Muktar Ibrahim rose from the trenches of Korogocho in Nairobi to become a high-flying producer at CNN. Just as his star was beginning to shine even brighter, he lost his job this year because of a tweet he made 10 years ago.

- Vice UK asked the Math tutor who posts his lessons on Pornhub—”why?”: A math tutor has raked in over a million views on Pornhub by teaching calculus in a hoodie.

Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Stitch — Head of Product (Remote)

- SafeBoda — Head of Product (Uganda)

- Flutterwave — Product Manager (Nigeria)

Data & Engineering

- Kuda — Android Engineer (Nigeria)

- TeamApt — Enterprise Architect (Nigeria)

- Chipper Cash — Senior Software Engineer (Nigeria, South Africa, Rwanda)

Admin & Growth

- M-KOPA — Head of Analytics (Nigeria)

- Paystack — Demand Gen Marketer (South Africa)

- Chipper Cash — Price Analyst (Remote—UK, South Africa, Nigeria, Rwanda)

Thank you for reading. You will read from us again in 2023!

Happy new year in advance!

Please let us know if you liked this newsletter.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore