Luke Mostert is the Head of Investments at Future Africa, a venture firm that invests in mission-driven founders solving hard problems that target large markets.

Luke shared how he broke into venture capital, his first-ever deal, and what he has learned from leading investments at Future Africa.

How did you break into venture capital?

My undergraduate program at the University of California, Los Angeles (UCLA) encompassed politics, economics, and philosophy. As a result, I had to write essays analyzing economic and philosophical paradigms. I believe this laid the foundation for my future career path in the tech ecosystem.

In my second year, I helped launch SOSA Investments, a renewable energy social enterprise, in South Africa. This experience rekindled my childhood interest in entrepreneurship.

Jeremiah: Rekindled? How so?

I have always been entrepreneurial since my childhood. For instance, when I was 12 years old, I bought a second-hand vending machine to place in a factory my dad managed and was able to make my money back in just 4 months. The sense of pride savoured by that ‘small business’ lingers to this day. So being a Partner at SOSA Investments reignited my longtime interest in entrepreneurship.

How long were you at SOSA Investments?

A year.

Jeremiah: Wow.

Yeah. I sold my equity after a year. This was for two major reasons.

First, I experienced time zone conflicts. The team was based in South Africa while I was in Los Angeles. Also, I couldn’t obsess with the project as it simply wasn’t my “baby.”

What happened after SOSA Investments?

I tried to get into venture capital by cold emailing and networking with a few VCs in Africa. Thankfully, I got a positive response from the Partners at GreenHouse Capital Africa and got to intern at the firm’s headquarters in Lagos, Nigeria.

How was your experience at GreenHouse Capital?

Amazing!

They gave us real responsibility – I constructed investment memos on the 5 GreenHouse Labs incubator startups, including Bankly, Bitmama, and AllPro (now known as Schoolable). This was how I broke into venture capital.

Interesting. So did you get your first full-time job after interning at GreenHouse Capital?

Not at all. The GreenHouse internship took place in the summer between my third and final year at UCLA. And so, I had to return to UCLA to complete my degree program. During my final year, I joined the UCLA Social Enterprise Academy program, which connected undergrads with social ventures to identify and plan new revenue streams. I was a part of 1 of the 10 teams in the program.

My team and I developed and positioned a social enterprise called Rosebud Coffee into a chain of mission-driven coffee shops across Southern California. Ultimately, we came in 2nd place in the final ‘VC style’ pitch competition, winning a $7500 prize for the new venture model that we named ‘Coffee with a Cause.’ This added an extra layer to the skills gained across startups, nonprofits, and VC over those past three years.

But there was still one problem: I didn’t have a job.

I applied to a VC firm hiring in South Africa and managed to scale through to their final round, but they were specifically looking for a female investor. So I didn’t get the job at the last minute. This hurt me, but I didn’t give up. I kept pitching myself around and two weeks later got a ‘trial’ at 4Di Capital.

I was scheduled to be on a probationary period for the first six months, but I got confirmed for an extended role after three months.

Impressive! How long did you stay at 4Di Capital?

Around two and a half years.

What were the biggest highlights of your stay at the firm?

I got to work on the due diligence for the Valr Series A round, which quickly became one of their most successful investments. This was a major accomplishment for us, as 4Di was the only South African VC firm involved in the deal.

I also had a great learning experience at the firm, as I had the privilege of learning under highly experienced VCs – such as Justin Stanford, Laurie Olivier, and Anton van Vlaanderen. Some of the first VCs out of South Africa.

I would say another highlight was getting promoted to a senior analyst position after a year.

That’s commendable! What contributed to your swift promotion?

I leveraged the generational gap in the team as I was the youngest and thus perhaps understood new tech trends better. This was a strategy, I tried to stay as informed as possible on trends, rounds, and events taking place across Africa. The Partners knew I was constantly reading every tech publication I could lay my hands on.

Consequently, I became a go-to source for information in the team, making me more differentiated and valuable.

Was there any distinct challenge you had to navigate as a Senior Analyst?

Not exactly. In fact, my role as a senior investment analyst was similar to when I was a junior, because the 4Di team was a small one, causing no one to report to me. Consequently, I was still doing what I did as a junior, but on a more independent scale.

I faced more distinct challenges when I joined Future Africa as the Head of Investments.

Jeremiah: Oh really?

Yes. Unlike my analyst role at 4Di, which entailed due diligence, meeting founders, and respecting the roles hierarchy, being the Head of Investment at Future Africa requires me to oversee all sourcing, founders’ interactions, term negotiations, investment memos, investment committee presentations, diligence, and (some) legals.

It’s end-to-end!

Jeremiah: Great transition.

I know, right.

How did you land the job at Future Africa, though?

Through Young African Catalysts, a fellowship I co-founded.

Tell me the backstory to this.

While at 4Di Capital, I tinkered with ideas on how I could accelerate my career. During my brainstorming sessions, I saw the potential in bringing top principals, associates and analysts together to share ideas, deals, and learnings. After all, these positions were – in my opinion – the lifeblood of deal sourcing at most firms.

With that idea in mind, I approached fellow VC, Karl Nchite, one of my closest friends; and together, we founded the Young African Catalysts Fellowship to catalyze collaboration between deal facilitators (mostly young Investment Team members). We currently have grown across Africa and operate on a Slack and Notion community, where YAC fellow, Peter Kisada, former Principal at Future Africa, shared an opening from the firm.

Interested, I sent an email to see if I was a good fit, and in less than 12 hours, I got an email from a Future Africa Partner indicating they were travelling through Cape Town. They interviewed me back-to-back (to-back) and gave me an assignment. I passed this and got an offer within 8 days.

So, yes – the Young African Catalysts Fellowship put me in the right place at the right time.

Let’s circle back a bit to the Valr Series A Round, your first-ever deal. What were some of your biggest lessons from that deal?

Working on the Valr deal helped me to become more founder-centric in my approach as a VC. When working on a deal, I always try to understand the founder’s motivation. This is because I saw how past relevant experience, being rooted in serving humanity and wanting to democratize access to financial services with digital currencies, made Valr’s founders successful.

Hmm. How many investments have you led so far at Future Africa?

Eleven.

That’s great, given your 7-month duration at the firm.

Thank you!

What are the biggest takeaways from leading those 11 investments?

To be honest, I’ve learned more from the investments that didn’t take place [laughs].

However, leading 11 investments end-to-end has compelled my team and me to consider deals only when three key factors are at play.

The first factor is the quality of the founders. They have to be people who are somehow uniquely positioned to solve this particular challenge. For instance, did they grow up with the problem or have they worked in the specific vertical for an extended period? The list goes on.

The second factor is regarding the market of the business. Is the market a VC ‘backable’ one that is capable of supporting a potentially billion-dollar business?

The third factor is the realistic nature of the proposed valuation. Is the startup asking for a valuation proportional to what they’re bringing to the table at this point in time? This is an important factor because we as VCs are also accountable to other stakeholders.

How so?

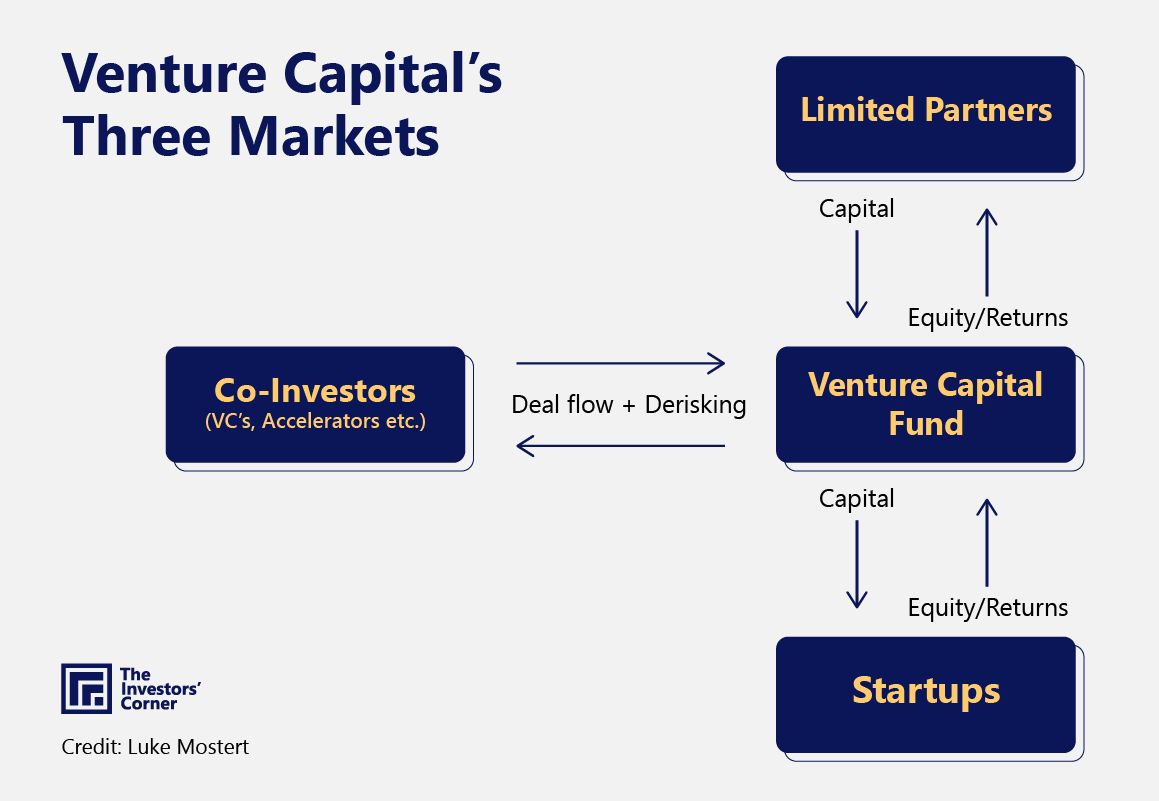

The VC ecosystem is a multistakeholder one.

Right on top, Limited Partners (LPs) provide capital for VC funds to invest. The VC funds collaborate closely with co-investors like VCs and accelerators to invest capital in startups that then provide ROI in terms of equity/returns. This is why we’re keen on getting returns from startups. We have to be accountable to LPs as well!

Handling investments at Future Africa made me appreciate this structure better.

What about the investments that didn’t take place? What did you learn from them?

Well, I’ve learned to always follow the process. Your fund has investment criteria for a reason. It’s important you follow it to the letter and don’t rush to write a check. Else, you may miss out on certain important details and make mistakes that can cost you (and of course your LPs).

Out of all the areas you’ve invested in, which are your top areas of interest?

Edtech and Crypto/Web3

Ouuuuuu! Any reason why?

My passion for edtech stems from personal experience. Growing up, I was lucky to receive a high school scholarship. This gave me the idea to try and get other talented, yet underprivileged kids whom I met into quality schools via scholarships – birthing the idea of the Litoro Foundation. This name is at the heart of this philosophy, with “Litoro” meaning “dreams” in the African language of Southern Sotho.

So far, we’ve managed to fund the high school educations of 20 talented scholars in underserved communities over the past 7 years. But sadly, that’s not enough to solve the problem of K-12 education in Africa. It’s not scalable.

That’s where edtech comes in. With edtech companies like GetSmarter, Snaplify and the UCT Online School, it’s now possible for millions of African students to get access to high-quality education without the need for increased resources. This explains why I’m bullish on investing in edtech startups with Future Africa.

For example, I led the follow-on investment in Nexford University, an edtech company providing low-cost MBA and other programs to people living in Nigeria. We also did a deal with Kibo School, which will provide affordable coding degrees to Africans from a US-accredited university. At Future Africa, I’m also working as the acting Investment Manager for our new Future of Learning Fund, a thematic fund we are developing to invest in Africa’s emerging edtechs.

On the other hand, the Valr deal informed my passion for Crypto (blockchain, cryptocurrency, and web3). It exposed me to the necessity of crypto in driving real change in Africa. For instance, using stable coins can protect Nigerians from the claws of inflation; philanthropists, who want to ensure the safety of their donations, can utilize blockchain wallet-to-payment infrastructure. And when it comes to P2P payments, crypto companies charge 0.2% compared to traditional banks’ 8%. These are just a handful of the use cases that make me enthused about the space.

What are the possible trends you’re excited about?

Building on my interests, the future of fintech is headed towards crypto, DeFi, and blockchain-based systems. I foresee solutions where there is crypto on the backend and traditional finance (visible) on the frontend (e.g., PayPal, Flutterwave etc.).

Geographically, I’m really keen to see startups move to the Francophone region of the Democratic Republic of Congo – the 4th largest African population.

What’s your typical deal-sourcing process?

I try to talk to as many stakeholders as possible – both within the Young African Catalysts program and outside it. As if that’s not enough, I’m constantly meeting with VC firms in the US, Europe, and across Africa. I’ve taken over 60 distinct VC meetings in the last 6 months alone, meeting 3-4 different VCs weekly on average. This progress is paying off, as the last deal I just did was entirely sourced from a VC I’ve been sharing deals with.

I also work with a few accelerators like TechStars Toronto and Injini in an advisory/mentorship capacity.

Your process requires a huge deal of relationship building.

It does.

So how do you stay on top of the minds of the different stakeholders involved in it?

I just focus on providing value. This helps me build long-lasting rapport enabling doors to open and conversations to flow. Lastly, I’m quite accessible on social media.

Oh. Do you regularly share your thoughts as a VC on LinkedIn and Twitter?

Yes.

Venture Capital ‘Backable’? 💡

— Luke Mostert (@lukemostert) September 26, 2022

I’ve reviewed over 3000 African startup pitch decks in the last 4 years. The most important question I ask myself each time is.. ⬇

‘Is this startup VC ‘backable’?’ A thread 🧵 pic.twitter.com/XpdRsPmYmt

What inspires that thought leadership, and what keeps you going?

I got inspired to share my thoughts and learnings with the world because I firstly want to understand VC better myself. On the other hand, I want to help founders understand and demystify the VC world. I hope to debunk the myth of VC being an elitist sector by making it accessible to everyone across Africa and other emerging markets.

Nothing gives me more joy than seeing my tweets and posts help founders master how they can be successful and decide whether to choose VC funding or not.

What’s your piece of advice for founders?

If you want to succeed in your startup journey, it’s not enough to think about your mission. You need to be obsessed and willing to risk your short-term career. Remember, startup building is not an easy path, and it’s not for everyone. But the rewards are huge.

And for aspiring VCs?

Aspiring VCs underestimate how much they can achieve even without a job. Learn to pitch VCs about potentially great deals. For instance, if you think there is any deal I should be investing in, pitch it to me. In the worst-case scenario, you’re on my radar. In the best scenario, I will hire you. Either way – you’re learning and winning.

VC firms want to see initiative and someone not seeking a VC job simply because it’s trendy – it’s a specialized field, and one needs to be committed.

Finally, immerse yourself in the VC experience by reading relevant classics like The Power Law by Sebastian Mallaby and Secrets of Sand Hill Road by Scott Kupor. Venture capital is about curiosity – just keep learning and exploring, that’s what compounds.

Editor’s Note:

The Investors’ Corner is our latest web series spotlighting the stories of African-focused investors and how they make investments on the continent.

We will publish a new episode of The Investors’ Corner (TIC) bi-weekly on Saturdays by 8:00 AM (WAT). This season of TIC is done in partnership with and anchored by Jeremiah Ajayi, a Content Marketer for SaaS and VC.

You can contribute in two ways. One, let us know which investor you’d like us to feature. Two, give feedback and public praise for the episodes that you connect with.

If you’d like to partner with us to create other formats of this content, please reach out to hello@benjamindada[dot]com.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore