For Nigerians living in the UK, financial life is a constant balancing act between “black tax” and personal goals. Remittances have become expressions of duty, identity, and family loyalty. Yet these payments come with trade-offs for the worker. They have reduced savings, little or no investments, and as such, forego long-term financial planning and stability.

For the second time, OhentPay—a leading remittance app—has uncovered the income, spending, and remittance patterns of diasporans. The 2025 UK-Nigeria Remittance report, which surveys over 650 Nigerians, touches on key aspects like the gender pay gap, cultural expectations, and support for Africa-owned businesses.

The UK-Nigeria corridor is important because, after the US, most of the remittance to Nigeria comes from the UK. Conversely, Nigeria is a top-three destination of remittances from the UK, sending over 3.5 billion dollars.

Here are some takeaways from the report.

4 insights from OhentPay’s 2025 UK–Nigeria Remittance report

The four insights are that Nigerians’ earnings mirror the UK’s income distribution, there is a reduction in investments back home, mothers receive most of the remittances, and the top businesses that thrive in the UK.

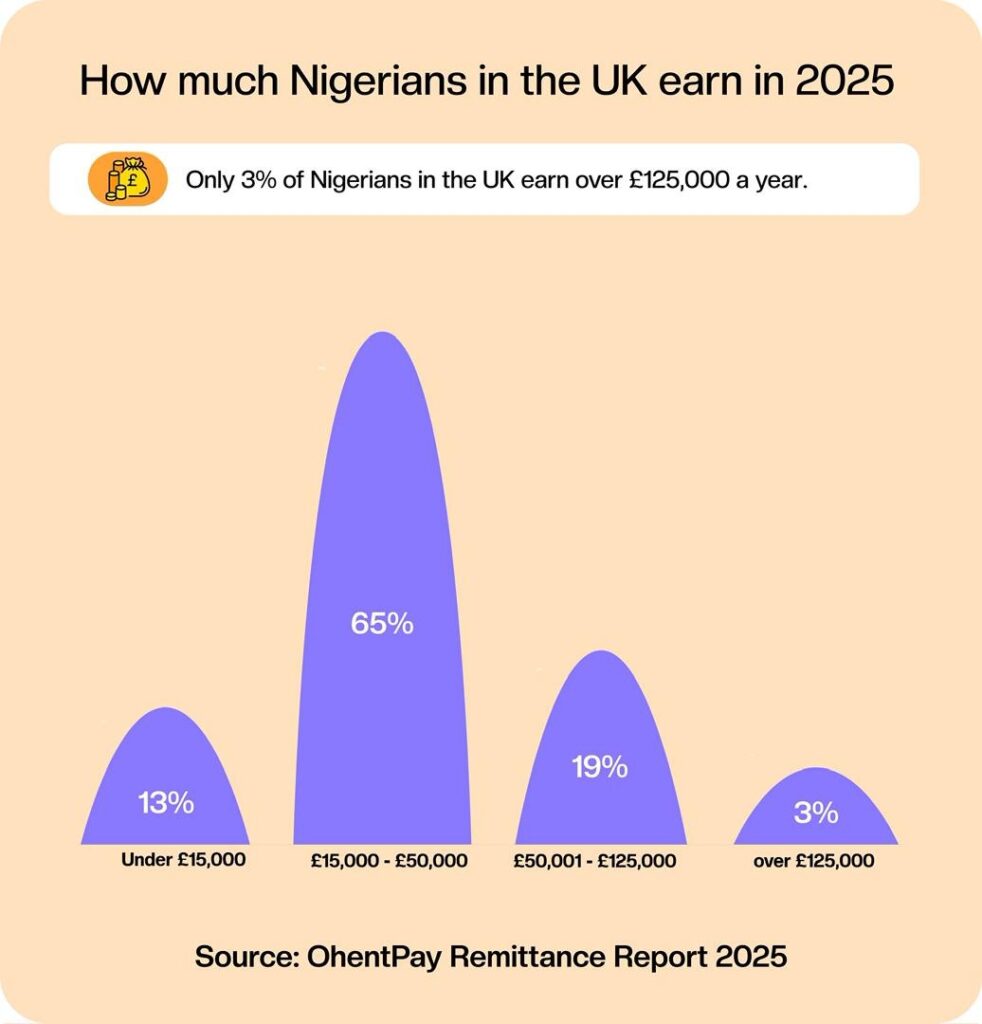

Most Nigerians are earning fairly, according to UK standards (£15,000–£50,000 p/a)

65% of Nigerians in the UK earn between £15,000 – £50,000 annually. Generally, two-thirds (66%) of earners in the UK are in that bracket.

According to the UK Office for National Statistics (ONS), the median gross annual earnings for full-time employees were £39,039 in April 2025.

According to OhentPay, most Nigerians work in healthcare and social care (60%), which contributes 11% to the country’s GDP. Being one of the world’s largest employers, the NHS employs over 1.5 million full-time employees. But that speaks to the low competitiveness of pay for workers.

Tech, indeed, is the place to be. Find out more about how much tech workers earn, and what percentage of Nigerians work in tech, in the report.

The report also touches on the gender pay gap, as Nigerian men earn more than women in the UK and thus tend to send more money back home.

Fewer Nigerians are sending bulk money home, perhaps due to an investment retreat

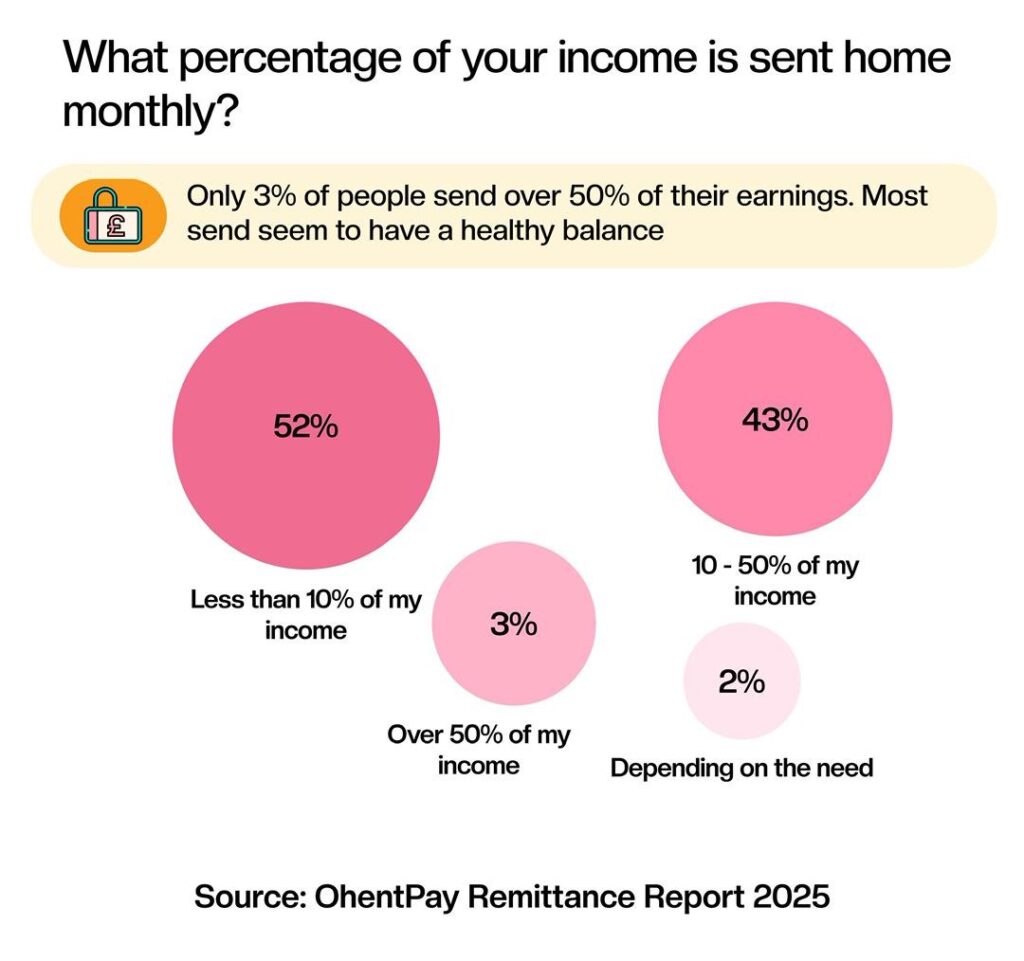

Globally, migrants send about $200 – $300 (£152 – £228) every one or two months, representing 15% of their income. This money is often used to cater to the essentials, like feeding support, medicals, or school fees. However, in one-fourth of the cases, those monies are for investments or other revenue-generating activities back home. In those cases, the average amounts sent tend to be higher.

According to OhentPay, the percentage of Nigerians sending more than £1,000 has dropped from 17% to 12% with the majority of Nigerians (58%) sending £100 and £500 every month. This drop in high-value remittances could be a function of a reduction in workers’ disposable income or a change in remittances’ purpose.

Unsurprisingly, younger adults (Gen Z), aged 18-28, send a larger portion (10-50%) of their income, perhaps due to limited responsibilities. However, these then have attending effects. Fifteen per cent of respondents say they have postponed getting married or buying a home. Another 28% say they are saving and investing less due to family support obligations.

Find out how the data breaks down across age groups in the report.

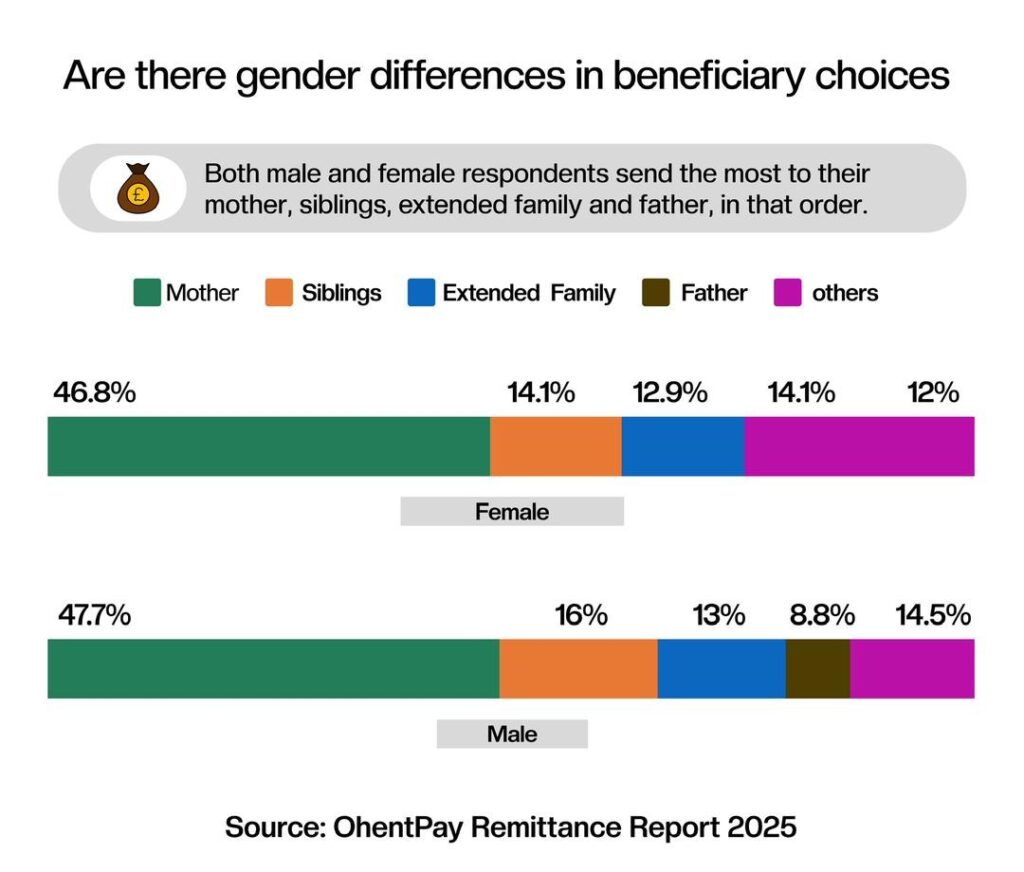

Mothers receive most of the remittances

Over half of all large remittance payouts go to mothers, while siblings receive around 13 %, and extended family members are mostly supported through smaller, occasional contributions.

This aligns with the cascading effect of gender pay disparity, as these mothers were once “women in the workplace” earning less than their male counterparts. Also, in Nigeria’s patriarchal society, many women tend not to work and thus have to rely on support from their families.

Related Article: Black tax accounts for almost 50% of UK-Nigeria remittances per Ohentpay report

Even in the UK, there is a gender pay gap between men and women. OhentPay’s 2025 report reveals that men outearn women at every strata of the income bracket, with the largest difference observed for earners above £125,000. Only 22% of Nigerian women earn over £125,000 in the UK.

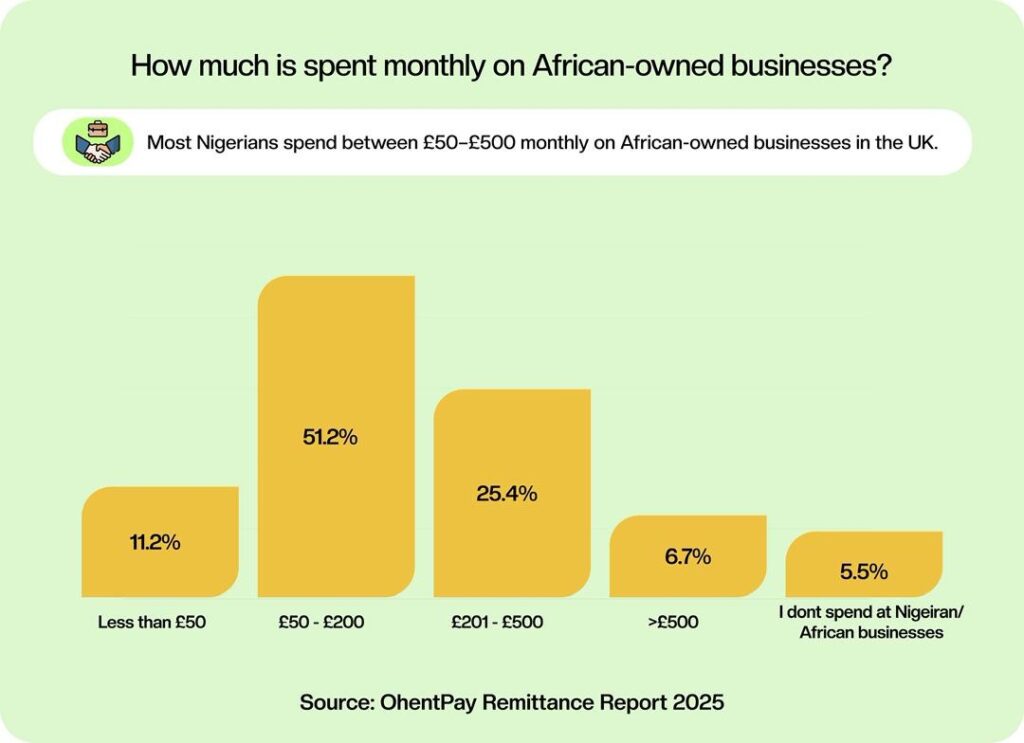

Nigerians and Nigerian food are inseparable

When asked how much is spent monthly at African-owned businesses, 77% of respondents chose between £50 and £500. On what? Food.

Of those who spend at African-owned businesses, 60% of their money goes to purchasing raw African food or dining at African restaurants. This corresponds with why many new food-based Nigerian businesses seek UK expansion for their business.

The likes of Enish, launched in the UK in 2013, have expanded beyond the country. Today, they boast a multi-million dollar business with tens of outlets across the UK alone.

The third top recipient of Nigerians in the UK is beauty salons (barbershops and hair salons).

While food stores help keep a migrant closer to home with familiar tastes, beauty salons help to maintain personal presentation and social identity.

In conclusion, the OhentPay UK–Nigeria Remittance Report 2025 offers a rich insight into how Nigerians earn, send, and spend, providing an inside view of the evolving financial lives of Nigerians as they build stability across two homes.

About OhentPay

OhentPay is a trusted cross-border payments platform that makes it simple to send money from the UK to over 190 countries. Known for its competitive exchange rates and seamless experience, OhentPay empowers people in the diaspora to support loved ones, pay bills, receive funds in multiple currencies, and strengthen their financial ties back home.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore