Whether you’re a designer, developer, or content writer, getting paid as a freelancer in Nigeria can still feel like navigating a maze. Between high transfer fees, delayed payments, and limited access to global platforms, most freelancers have had to find creative ways to receive their earnings. The good news is that things are changing.

In 2025, more reliable payment apps will cater directly to Nigerian freelancers and remote workers, enabling them to receive funds faster, convert currencies easily, and avoid the frustrations of blocked platforms. These tools not only make payments smoother but also give freelancers more control over their finances.

This article explores the top payment apps for freelancers in Nigeria, what makes each platform stand out, and key tips for managing international payments efficiently.

Key considerations when choosing a payment app

Before jumping into the list, here are the most important factors to consider when selecting a payment app in 2025.

1. Fees and exchange rates

Some platforms charge per transaction, while others include conversion margins that can reduce your total payout. Always compare rates to know how much of your earnings you’ll actually keep.

2. Speed of transfers

Time is money, especially when clients pay across different time zones. Choose platforms that process transfers quickly, ideally within hours and not days.

3. Ease of use and integration

Look for intuitive, mobile-friendly platforms that integrate easily with freelance sites like Upwork, Fiverr, or Shopify.

4. Security and compliance

Ensure the app offers two-factor authentication (2FA) and complies with Nigeria’s financial regulations to protect your funds.

5. Withdrawal options

Reliable withdrawal methods are crucial. Favour apps that offer virtual dollar cards, domiciliary accounts, or direct transfers to your Nigerian bank.

6. Customer support

Responsive support can make or break your experience, especially when dealing with payment delays or account verification issues.

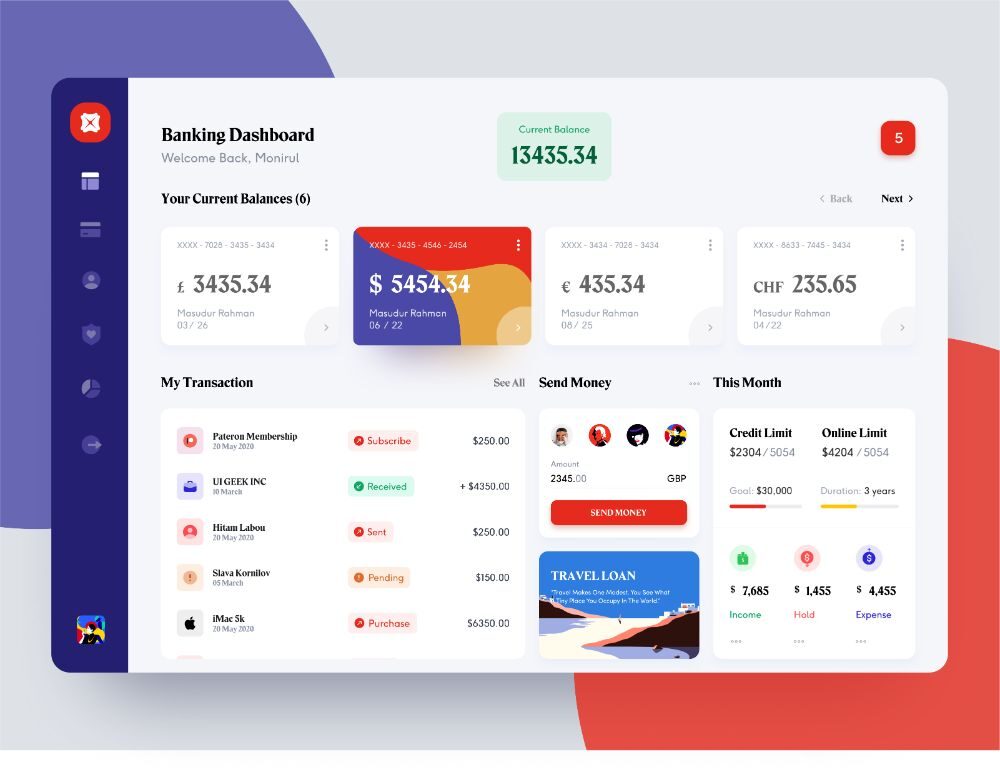

Top 6 payment apps for freelancers in Nigeria

Freelancers in Nigeria now have access to several trusted payment platforms that make it simple to receive both international and local payments directly on their phones. Below is a list of the best apps, grouped into International and Local options, and ordered by their number of Play Store downloads, from highest to lowest.

International Payment Apps

1. Payoneer

Payoneer is the favourite payment method among most Nigerian freelancers. It has been the go-to option for Nigerian freelancers for years. It’s integrated with top platforms like Upwork, Fiverr, and Amazon, allowing users to receive payments in USD, GBP, and EUR.

Why it works:

Payoneer provides users with virtual bank accounts abroad, enabling them to receive international payments as if they had a local account. You can then withdraw directly into your Nigerian bank or use a Payoneer card for payments.

Pros:

- Trusted by global freelance platforms

- Supports multiple currencies

- Transparent exchange rates

Cons:

- Annual card maintenance fee

- Withdrawal fees may apply.

Best for Freelancers on platforms like Upwork and Fiverr who require a secure and reliable payment method.

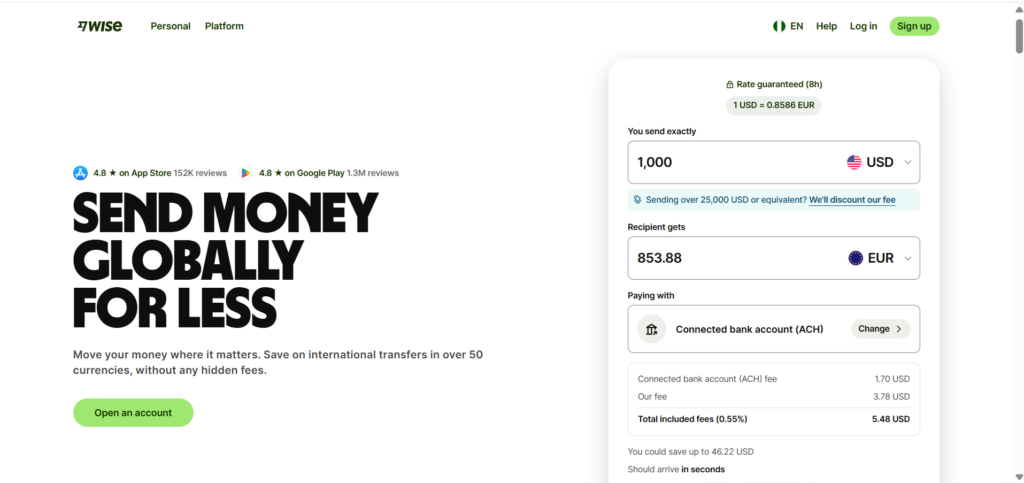

2. Wise

Wise is a global money transfer service popular among freelancers who value low fees and transparent exchange rates. It enables Nigerian freelancers to receive international funds into multi-currency accounts.

Why it works:

Wise is known for using real mid-market exchange rates, meaning no hidden markups, and its transfers typically arrive within hours.

Pros:

- Transparent, real-time FX rates

- Low and predictable transfer fees

- Supports over 50 currencies

Cons:

- Not yet integrated directly with Nigerian banks

- Requires verification for larger transfers

Best for: Freelancers with international clients who want a simple, affordable way to receive global payments.

Local Payment Apps

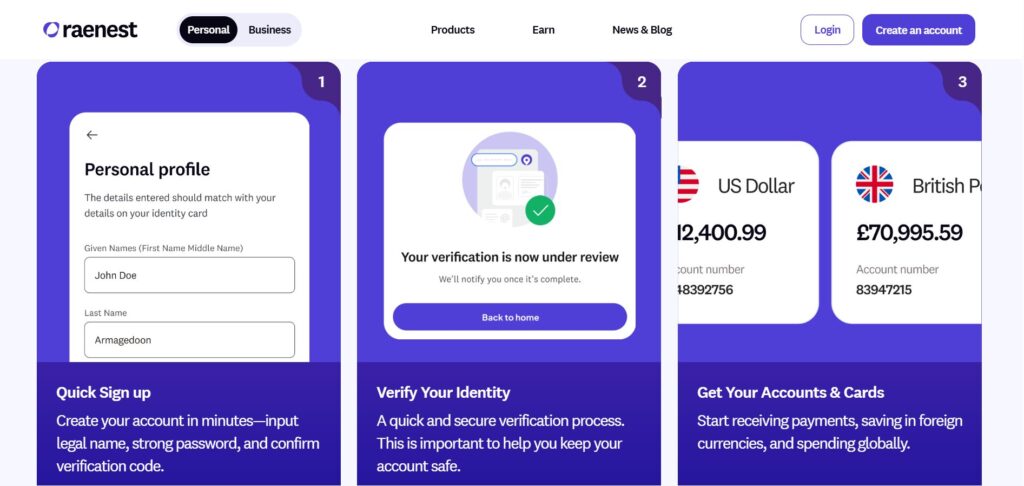

1. Raenest

Raenest, formerly known as Geegpay, is one of the fastest-growing platforms designed specifically for African freelancers and remote workers. It offers virtual USD, GBP and EUR accounts, a virtual dollar card, and easy currency conversion tools.

Why it works:

Raenest enables freelancers to get paid by clients or platforms like Payoneer, Wise, and Fiverr, convert their earnings, and withdraw directly to Nigerian banks.

Pros:

- Quick setup and fast payments

- Transparent FX rates

- Virtual USD card for online spending and subscriptions

Cons:

- Still expanding global integrations

- Transfer limits may apply for new users.

Best for: Freelancers seeking an all-in-one mobile-first payment platform for quick, low-fee transactions.

Related article: Raenest expands to U.S. market in global push

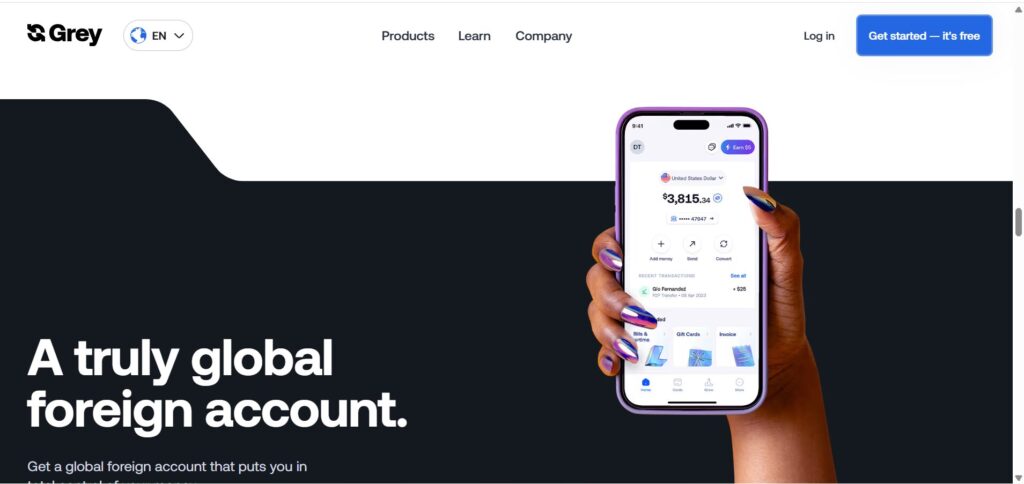

2. Grey

Grey (formerly Aboki Africa) allows Nigerian freelancers to open virtual foreign bank accounts in the US, UK, and EU. It’s ideal for receiving payments directly from international clients or platforms like Wise and Revolut.

Why it works:

Freelancers can receive funds in foreign currencies, convert them at competitive rates, and withdraw directly to their Nigerian accounts.

Pros:

- Free virtual accounts in multiple currencies

- Competitive exchange rates

- Fast transfers and an easy-to-use app

Cons:

- Not yet integrated with major freelance marketplaces

- Customer support can be slow at peak times.

Best for: Freelancers with direct international clients who prefer fast, flexible transfers.

3. Cleva

Cleva is a fintech platform designed for African remote workers and freelancers who earn in foreign currencies. It provides US bank accounts, allowing users to receive payments in USD, convert at fair rates, and withdraw directly into Nigerian accounts.

Why it works:

Cleva offers same-day transfers, no hidden fees, and fast verification, making it one of the easiest apps for freelancers to start with.

Pros:

- Instant US account setup

- Competitive rates and low fees

- Fast and reliable transfers

Cons:

- Currently supports only USD

- Limited integrations with freelance marketplaces

Best for: Freelancers who get paid primarily in USD and want a reliable, mobile-first experience.

See More: Nigerian fintech Cleva gets into Y Combinator W24, raises $1.5 M pre-seed

4. Gigbanc

Gigbanc is a new but powerful option for freelancers and remote workers looking to manage payments from different clients in one place. It supports multi-currency wallets, fast settlements, and innovative financial tracking tools.

Why it works:

Gigbanc combines finance and productivity by helping freelancers manage income, track invoices, and automate recurring payments.

Pros:

- All-in-one wallet for different income sources

- Budgeting and invoice tracking tools

- Low transfer fees and reasonable FX rates

Cons:

- Still expanding to support more regions

- Requires verification for higher limits

Best for: Freelancers and remote teams seeking both flexible payment options and comprehensive financial management features.

Tips for managing international payments

Even with great apps, your fund management skills significantly impact how much you retain. Here are a few practical ways to maximise your earnings:

- Use more than one platform: Combine tools, for example, Payoneer for Upwork clients and Grey or Raenest for direct transfers.

- Watch exchange rates: Track rates daily in apps like Grey or Wise to get the best conversion value.

- Bundle withdrawals: Withdraw larger sums less often to save on transfer fees.

- Keep clean records: Maintain transaction logs for tax filings, visa applications, or grant opportunities.

- Enable 2FA: Always secure your accounts with two-factor authentication.

- Stay informed: Follow fintech updates on X (Twitter) and LinkedIn to stay ahead of policy changes.

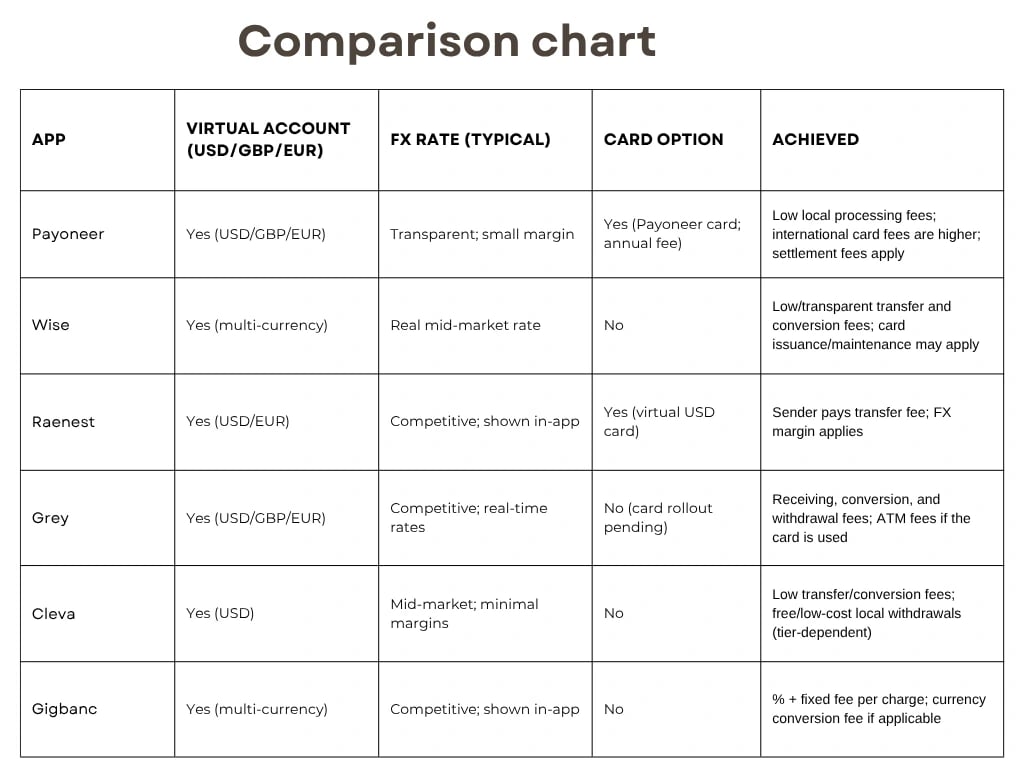

How to read this table

- Virtual account: Lets you receive payments in foreign currencies under your name.

- FX rate: “Competitive” means better than most banks.

- Card option: Ideal for paying subscriptions or making global withdrawals.

- Fees: Vary by verification level, currency, and withdrawal method.

Note: Features, availability, and pricing change often. Always check the latest in-app rates and fee pages before invoicing clients.

Getting paid as a Nigerian freelancer no longer has to be stressful. Platforms like Raenest, Grey, Cleva, Gigbanc, Payoneer, and Wise now make receiving international payments faster, safer, and more affordable.

The key is to choose the platform that best fits your workflow, whether you work with global clients, local startups, or multiple income sources. By managing your finances wisely, you’ll spend less time chasing payments and more time building your freelance career.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore