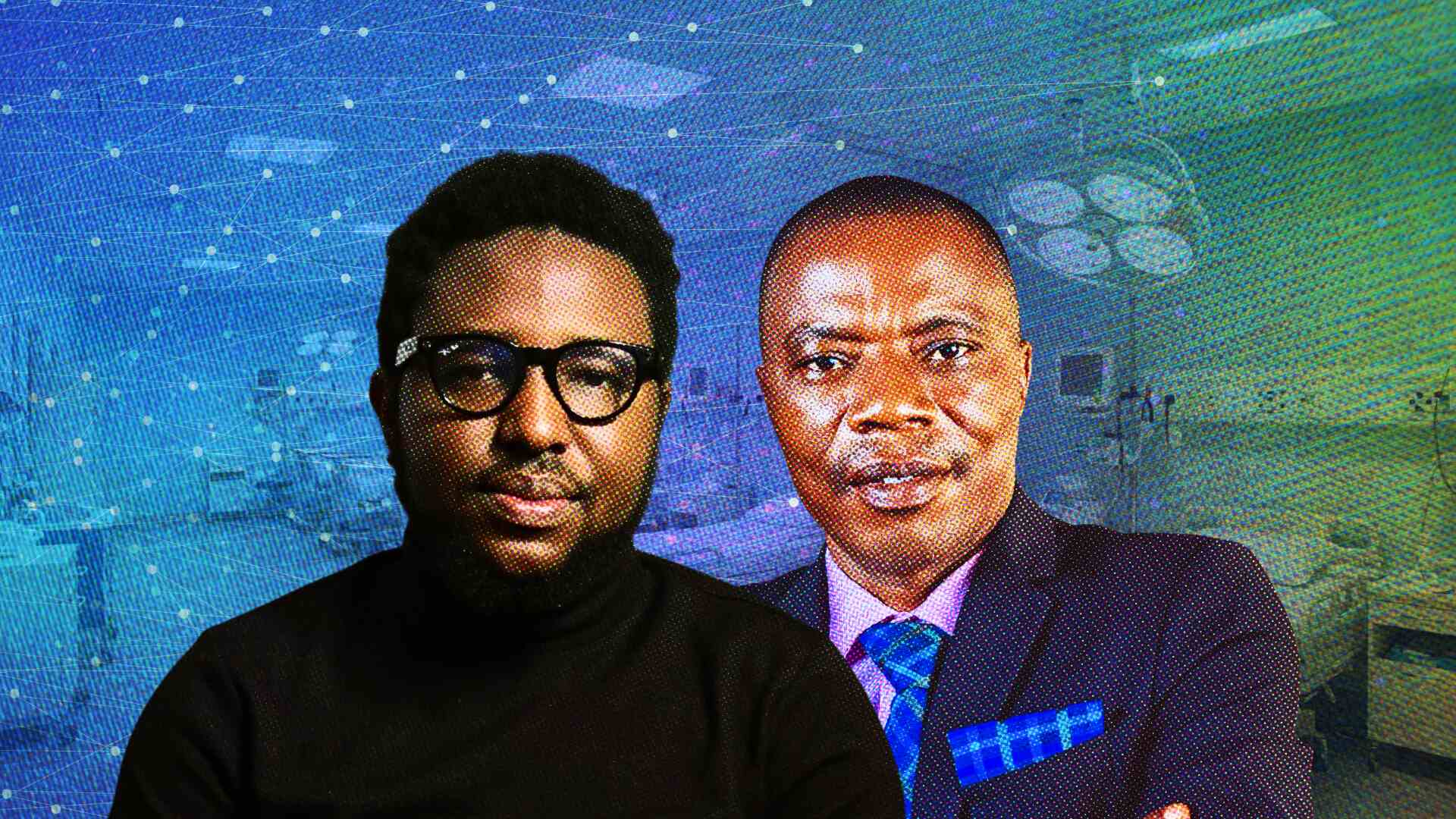

It was a rainy Monday afternoon when Dr Fortune Femioyewole joined our virtual call, his voice steady as he revisited two moments that never left him. “A child died of a lack of oxygen. The woman died because of ₦2,500 ($1.5),” he said. Those moments pushed him beyond the walls of consulting rooms and into the harder work of fixing broken systems.

He is not alone in feeling the weight of a sector on the brink. Between 2019 and 2024, almost 16,000 doctors left Nigeria, fleeing poor pay, crumbling infrastructure, and conditions that make care unsafe.

Against that backdrop, Femi built Fortics Life Group. What began in Ibadan with ₦5 million ($3,200) has grown into a healthcare network reporting half a billion naira in revenue, with more than 28,000 patients served through hospitals and pharmacies in Ibadan and Lagos. Two more subsidiaries are in the pipeline: eFortics, a data arm, and a health-insurance unit still in planning.

On his laptop, Femi toggles through dashboards showing patient numbers from Lekki, inventory levels from Ibadan, and revenue streams threading between facilities. The picture is real-time and paperless—far removed from the helplessness of those early days.

Buying time, not new buildings

Femi’s path from clinician to entrepreneur was shaped by brutal math: half of Nigeria’s registered hospitals are shut. At the same time, the country struggles with one of the world’s lowest doctor-to-patient ratios—around four per 10,000 people, far below the World Health Organisation (WHO)’s 1:600 benchmark. Every closure compounds the crisis.

Rather than pour capital into new builds, Fortics takes a more pragmatic route, resurrecting dormant hospitals abandoned by doctors who emigrated or folded under poor economics. “Looking at the capital we had, what was the point when there were already so many redundant hospitals?” Femi says.

The model is disciplined: lease facilities, repair core infrastructure, and add pharmacy operations to secure steady cash flow. The costs vary sharply by location.

In Lekki, maintaining a site runs close to ₦12 million ($ 7,900) a year, while Ibadan comes in at roughly ₦3 million ($1,990). Even then, every lease is a negotiation. Some hospitals are hollow shells requiring full refits; others retain equipment that can be salvaged. As patient numbers grow, Fortics often reinvests: tearing down walls, expanding bed space, and upgrading infrastructure.

But acquisition goes beyond rent and repairs. Each deal runs through rigorous due diligence: governance checks, community goodwill assessments, and reputational screening.

“If a hospital had a track record of killing patients, it’s a non-starter,” Femi notes. Cost-effective, yes—but also a reputational bet that Fortics cannot afford to lose.

Lean, digital, and tracked

The model relies on tight operations. Every Fortics unit runs cloud systems for patient records, pharmacy sales, and finances. No blind spots.

“We are data-driven,” Femi says. “We run paperless. We use Asana. We know what diagnosis is recurring. We know inventory. We know patient retention.”

That structure is also a safeguard. Across Nigeria, private hospitals have been flagged for recommending caesarean sections in cases that could have been managed otherwise, simply because the surgery brings in more money. Pharmacies are not exempt either. With most running on thin margins, many have turned to indiscriminate over-the-counter sales of antibiotics and painkillers—less about patient need, more about clearing stock.

Dr Sanya, a general practitioner in Yenagoa, notes that in public facilities, such procedures follow strict guidelines, but in private practice, “about five in ten” cases may be influenced by financial motives.

For pharmacists, the tension is similar. “Economic pressures do influence healthcare decisions,” says Rivers-based pharmacist Ijeoma Okoroh. “Some outlets chase sales, but the ones that focus on patient counselling and follow-up build real trust—and that’s better for both care and business.

Femi insists Fortics Life Group draws a line. “What is the condition? What exactly do you need? Nothing more, nothing less,” Femi says. The goal is cost-effective, standardised care, whether in Lagos or Zamfara.

Even with this lean model, the Healthops and Infrastructure company isn’t untouched by Nigeria’s economic shocks. It weathered two recessions and a brutal 2021 that went “very red,” Femi recalls. Yet every other year has been profitable, and growth has largely been organic. One receptionist rose to head of operations, reflecting how the company’s trial-and-error learning built a team that grew alongside the business.

That resilience kept banks satisfied, loans clean, and the initial ₦5 million stake growing into half a billion in revenue.

Data, then insurance

The long game is bigger than hospitals. Fortics already runs its facilities on Helium Health’s EMR platform, but Femi wants more than digitised records. The planned eFortics platform will aggregate patient data, run epidemiological studies, and monetise anonymised insights. With less than 10% of Nigerians covered by health insurance and most telemedicine startups struggling with retention, he sees data as the missing backbone.

“We’re starting with the infrastructure,” he says. “Later, we’ll focus on the data parts and the telemedicine part—once we have the scale.”

Nigeria’s digital health market is not short of activity but fragile. Helium Health drives EMR adoption, Heala offers remote consultations, and APMIS handles insurance billing. New pilots like MySmartMedic in Abuja and pharmacy-based telemedicine in Lagos show appetite, yet cracks remain: unreliable power, weak internet, low digital literacy, and thin regulation. Most platforms focus on a single layer. Fortics is betting that sequencing—hospitals first, then data, then insurance and telemedicine—can sidestep the pitfalls that stalled earlier pilots.

Cascador as the next chapter

This year, Fortics entered the Cascador program after a board member encouraged Femi to apply. He had been wary of programs like it, but the experience was different. The feedback was practical, focused on clarity and execution rather than just vision.

“That was the shift,” he says. “It wasn’t about dreaming bigger—it was about progress and scale.”

The company is now raising capital to grow from three facilities to a nationwide network of 30 hospitals and 30 pharmacies across Nigeria’s six geopolitical zones. The plan is to let urban hubs and pharmacy revenues cross-subsidise rural care, with eFortics providing the data backbone to keep operations consistent. Insurance and telemedicine will only come once that foundation is solid.

Femi frames it simply: “We never had the luxury of money, so we learned to be innovative. That hasn’t changed. Our rule is: don’t throw money at problems, solve them with the right systems.”

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore