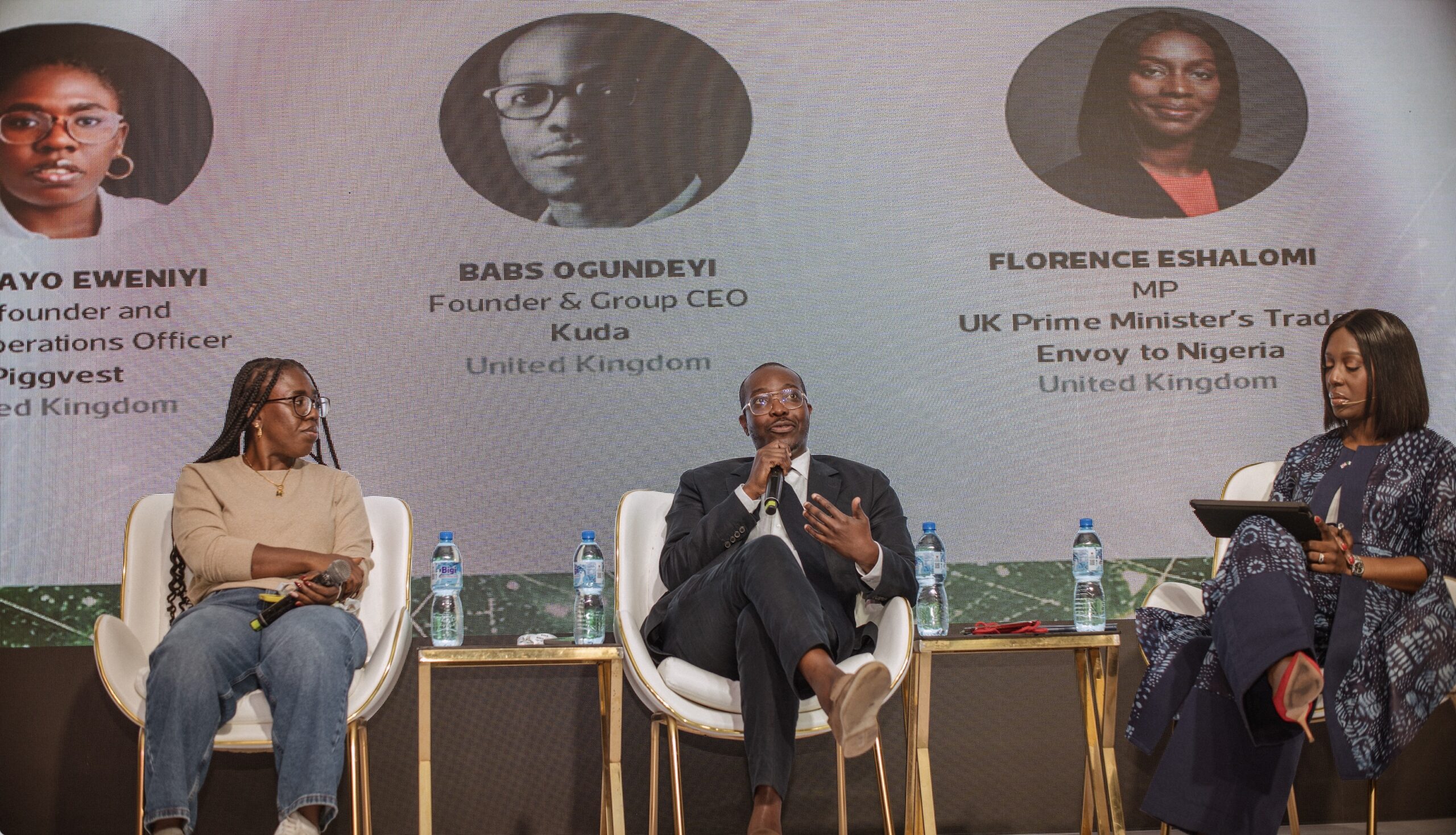

Breaking into international markets remains one of the biggest challenges for Nigerian fintechs, but Kuda Group CEO Babs Ogundeyi has outlined a clear path for scaling beyond local borders. Speaking at GITEX Nigeria and drawing on his experience leading Kuda from Lagos and London, Ogundeyi said the sector’s next phase would depend less on technology and fundraising, and more on how well firms establish trust, credibility, and global relevance.

“The first wave of fintech was a tech race. The next is a trust race,” he said. In Nigeria, where financial institutions often fight scepticism, Ogundeyi sees brand reliability as the most valuable currency. Kuda’s biggest investment, he explained, is not marketing spend but consistency, clear communication, and teaching users to trust a digital bank with their money.

Credibility is another key factor. Ogundeyi described London as a strategic bridge, noting that most of Kuda’s investors are European and prefer a UK entry point. Structuring the company in London provides governance and regulatory reassurance for global capital, while keeping the company’s operations and product development focused on the African market.

Read also: Kuda’s second attempt at multicurrency banking comes with lessons and $15M backing from investors

Finally, he highlighted cultural export. Drawing a parallel with Afrobeats, Ogundeyi argued that Nigerian fintech can reach global audiences by staying rooted in local expertise. “We’ve been able to export our culture to a large extent. We’ve seen it in the music,” he said, noting that acquisitions of UK firms by Nigerian fintechs show this strategy is already underway.

Ogundeyi’s framework offers a practical approach for Nigerian fintechs looking to expand internationally, emphasising trust, credibility, and authentic local expertise as critical considerations for entering global markets.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore