Every time a dog attack made headlines—whether in Lagos, Abuja, or as far away as Chennai or California—someone tagged him on Facebook. “Come and see o, another wild animal,” the comments read. Another child mauled. Another owner turned on by their own pet. Another round of social media outrage, drawing that uneasy line between companionship and danger everywhere.

As a German Shepherd owner, he’d become the unofficial defender of dogs on Nigerian social media. But the more he investigated these attacks, the clearer it became that the real problem wasn’t ‘‘wild animals’’—it was Nigerians who bought pets without understanding what they were getting into.

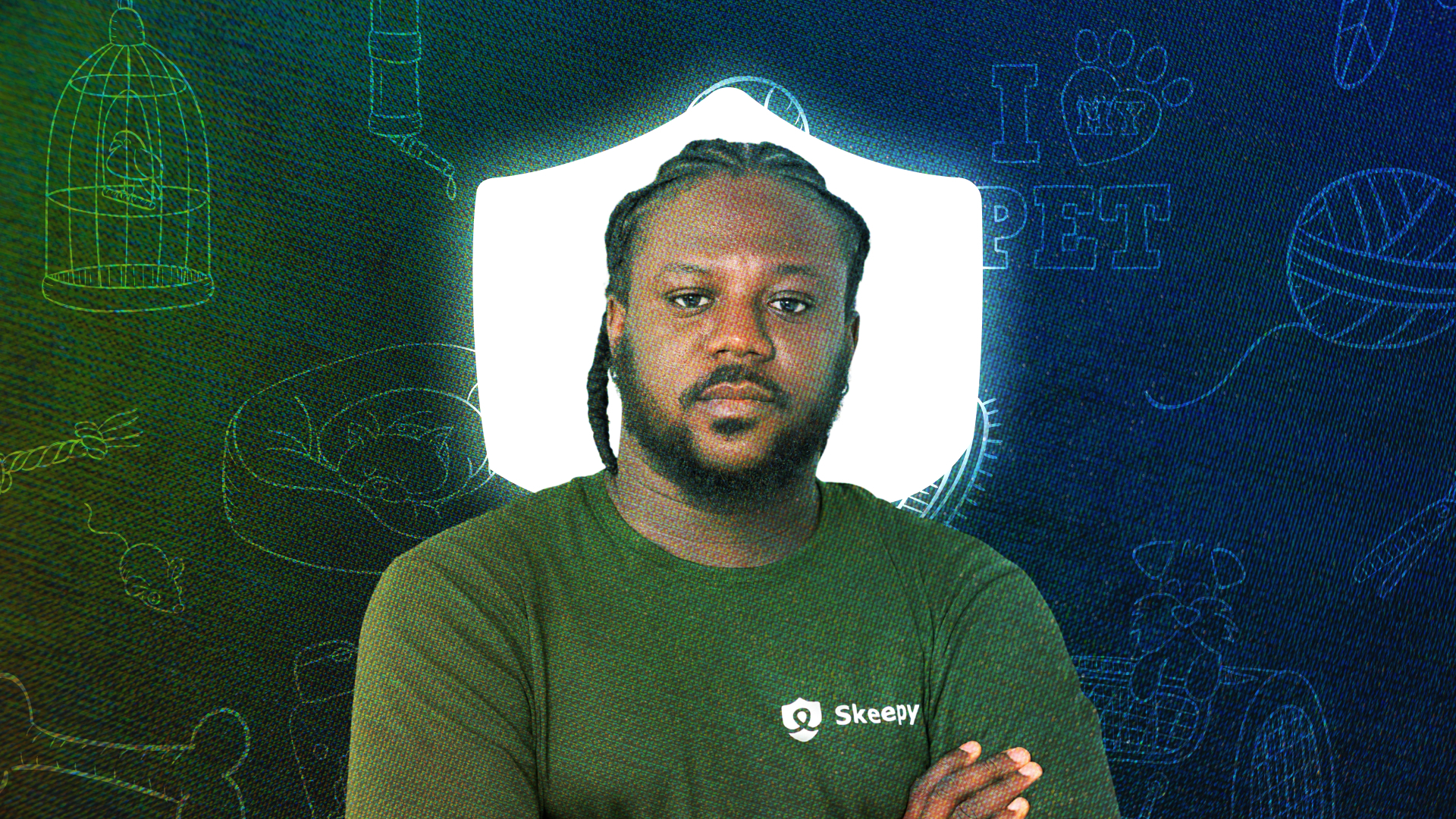

“Before a dog runs mad,goes crazy or attacks you, it would have shown the signs,” James Ogunjimi, CEO of Skeepy, explains in the rundown lobby of some hub where we huddled for an interview in Yaba. “Most people buy pets because it looks like what’s in vogue. They want a dog that looks tough. They don’t bother to read up on the behaviour.”

His advocacy for responsible pet ownership first started as a Facebook hobby and much later, a veterinary campaign. Sharing cute dog videos to counter the attack stories. Educating people about breed temperaments. Explaining that German Shepherds need daily exercise or they lose their minds——that some dogs require socialisation or they turn violent, that feeding dogs alcohol or snuff to make them “tough” creates the very aggression that kills children.

But as Ogunjimi spoke with more pet owners across Lagos, Abuja, and Port Harcourt throughout 2023 and early 2024, a different crisis emerged. The same people committed enough to learn proper pet care were going into debt to keep their animals alive. That discovery led him to launch Skeepy in May 2025, operating in stealth for 13 months while building partnerships with major veterinary clinics across four states.

While most Nigerians still see pets as luxury accessories for the wealthy, a growing cohort of urban professionals are discovering what American pet owners learned decades ago: loving an animal means expensive veterinary bills. The difference is Nigeria lacks the financial infrastructure to make pet healthcare affordable. Skeepy’s HMO plans to bridge that gap. It will do this by spreading surgical costs across predictable quarterly payments, targeting 3,000 subscribers in its first year while building a pet database that could position the company as the authoritative source for Nigerian pet ownership.

Pet care as lifestyle marker, but at a steep cost

The scale of Nigeria’s pet economy surprises even industry insiders. Lagos alone hosts over 100 veterinary clinics. Abuja has nearly as many. Each established facility serves roughly 500 regular clients who return monthly for routine care and emergencies—a customer base that collectively generates millions in annual revenue across major cities.

The two largest pet hospitals—Critters and House of Pluto—operate facilities that dwarf many human hospitals. Both are foreign-owned, with expatriate management and equipment standards that reflect international veterinary practices. “They are bigger than some of the premium hospitals in the way they are managed,” Ogunjimi notes.

But the market extends far beyond these flagship facilities. Nigerian-owned clinics like TruthMiles in Ikeja and Dulham in Lekki maintain premium standards with pricing to match. Smaller operations like PetMedic serve middle-tier customers who can’t afford island rates but still prioritise professional veterinary care.

The customer base driving this infrastructure defies easy categorisation. Bank employees spending ₦60,000 ($39) monthly on pet expenses. Civil servants negotiating payment plans for ₦700,000 ($453) surgeries. Young professionals allocating significant portions of their salaries to veterinary care, grooming, and emergency reserves.

“People spend a lot on their pets,” the founder said. “The average pet owner is willing to spend above a million naira annually. Someone earning ₦150,000 ($97) monthly will agree to pay ₦700,000 ($453) if you help them spread the payment.”

These aren’t wealthy expatriates driving market growth—they’re Nigerian professionals who view pet ownership as a lifestyle marker alongside gym memberships and international travel.

”Surgeries as high as ₦700,000”

The infrastructure gap between premium veterinary care and Nigerian salaries creates predictable financial crises. Pet owners delay routine care rather than face unknown costs, turning minor infections into complex surgical procedures.

Puspa Ramloo, House of Pluto’s owner, described unnecessary castration surgeries to Ogunjimi—procedures that could have been avoided if owners had brought their pets in earlier for routine check-ups. TruthMiles and Dulham both offer informal buy-now-pay-later arrangements to help customers manage emergency bills that regularly exceed ₦500,000 ($324).

“Sometimes surgeries can be as high as ₦700,000 ($453),” he explains. “A civil servant once had a bill of over ₦700k, and Dulham had to work out a payment plan which she agreed to.”

The psychological toll compounds financial stress. Pet owners know they’ll pay whatever it takes to save their animals, but uncertainty about costs creates anxiety that affects medical decisions. “Before a dog starts showing symptoms for the first time, you just think, I don’t know how much they’re going to charge me in the vet clinic,” Ogunjimi says. “So you don’t visit the vet until the problem escalates.”

One woman told him she gave away her dog after paying a massive veterinary bill—not because she didn’t love the animal, but because she couldn’t risk another financial emergency. Another cancelled a three-month-planned event because her cat wouldn’t stop throwing up and she was panicking about potential costs.

Even more extreme cases illustrate the emotional investment. A Port Harcourt woman called veterinarians frantically at midnight seeking sedation for her surviving parrot after its partner died, desperately trying to calm the grieving bird.

The HMO solution: Familiar structure, new market

Skeepy’s HMO approach mirrors human healthcare financing with pet-specific modifications. Quarterly and annual subscriptions provide coverage for routine care and emergency procedures, with surgical caps ranging from ₦200,000 ($129) to ₦800,000 ($518) depending on plan tier.

The mathematics depend on insurance fundamentals—most pets won’t need surgery in any given year, but monthly premiums from healthy animals fund emergency procedures for the unlucky few. Partner veterinarians access coverage through web-based dashboards, submit claims automatically, and receive payment within 14 days.

The system eliminates informal credit arrangements that currently strain clinic operations while providing pet owners with predictable expenses. “If you have an HMO plan and your pet starts showing symptoms, don’t overthink it. Just take the pet there.”

Plans are structured around familiar pricing—₦8,000 – ₦32,000 ($5 -$20) per treatment segment—with annual costs designed to keep total monthly pet expenses under ₦60,000 ($39) for most subscribers. Wait periods prevent adverse selection, ensuring customers can’t join Tuesday and claim surgical coverage Wednesday.

Early veterinary partnerships suggest genuine market demand. Clinics in Kaduna and Ogun states reached out unprompted after seeing Skeepy’s initial marketing. Established Lagos facilities including TruthMiles, Dulham, and PetMedic equally scrambled to join the fray.

While waiting for the law to catch up

Being the first to do anything means you are responsible for building structure from the ground up. Nigeria’s pet insurance market exists without regulatory frameworks—both opportunity and threat for a company needing operational flexibility. The National Health Insurance Authority (NHIA) confirmed they lack jurisdiction over animal health products, leaving companies like Skeepy– to be the first– to navigate compliance through existing insurance and veterinary regulations.

“We had a meeting with the deputy General Manager for NHIA in Lagos Zone, Dr. Bethuel Abraham. He said you can’t wait for regulators. You have to move first,” Ogunjimi recalls. “Human HMO was launched in the 1980s. NHIA wasn’t set up until the 1990s.”

Insurance underwriters initially resisted covering an untested market, citing the lack of actuarial data and regulatory clarity. Skeepy continues to explore pathways for risk coverage while focusing on veterinary credentialing as its primary compliance strategy.

The compliance strategy focuses on veterinary credentialing through the Veterinary Council of Nigeria (VCN). Partner clinics must maintain VCN approval for both facilities and practitioners—a requirement that excludes informal veterinary services while building regulatory credibility for future policy discussions. Skeepy has begun those high level conversations, Ogunjimi assured.

Beyond immediate insurance needs, Skeepy plans to launch a national pet database in the second quarter of 2025, tracking ownership patterns and vaccination records across Nigerian cities. The data strategy reflects understanding of how successful Nigerian companies build long-term competitive advantages through regulatory alignment rather than venture capital.

“Policy will take us farther than venture capital,” Ogunjimi says flatly, citing companies like Dangote and Remita that succeeded by synchronising with government realities rather than Silicon Valley playbooks.

3000 subscribers and a national database

Skeepy’s immediate success depends on converting 3,000 Nigerian pet owners to prepaid insurance within its first year of operations—ambitious for an untested category, conservative given underlying veterinary spending patterns.

The distribution strategy leverages existing veterinary relationships. Each partner clinic introduces HMO plans to established customers, providing immediate access to pet owners already committed to professional veterinary care. Additional marketing targets pet owner communities on Instagram and TikTok, where engagement rates suggest significant interest among younger demographics.

Ogunjimi largely operated as a one-person model in the early days, but has currently expanded to accommodate a six person team across marketing and partnerships. Some of the targets include accelerating clinic onboarding across his target of 12 states.

The broader vision extends beyond insurance to pet matchmaking, events, and most ambitiously, comprehensive data services. But immediate viability requires proving that enough middle-class Nigerians will commit to monthly insurance premiums for their dogs and cats. If successful, the national pet database could position Skeepy as the authoritative source for Nigerian pet ownership statistics when regulatory frameworks eventually emerge.

“When you’ve been within that space, you’ve interacted with pet parents, you are like a pet parent yourself,” the founder reflects on his transition from Facebook advocacy to startup founder. “I think it’s something that just becomes easy. The whole part is, how do we do the technical part of things?”

Whether that confidence translates into sustainable subscriptions will determine if Nigeria’s first pet HMO can solve the financial crisis hiding behind the country’s pet ownership boom.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore