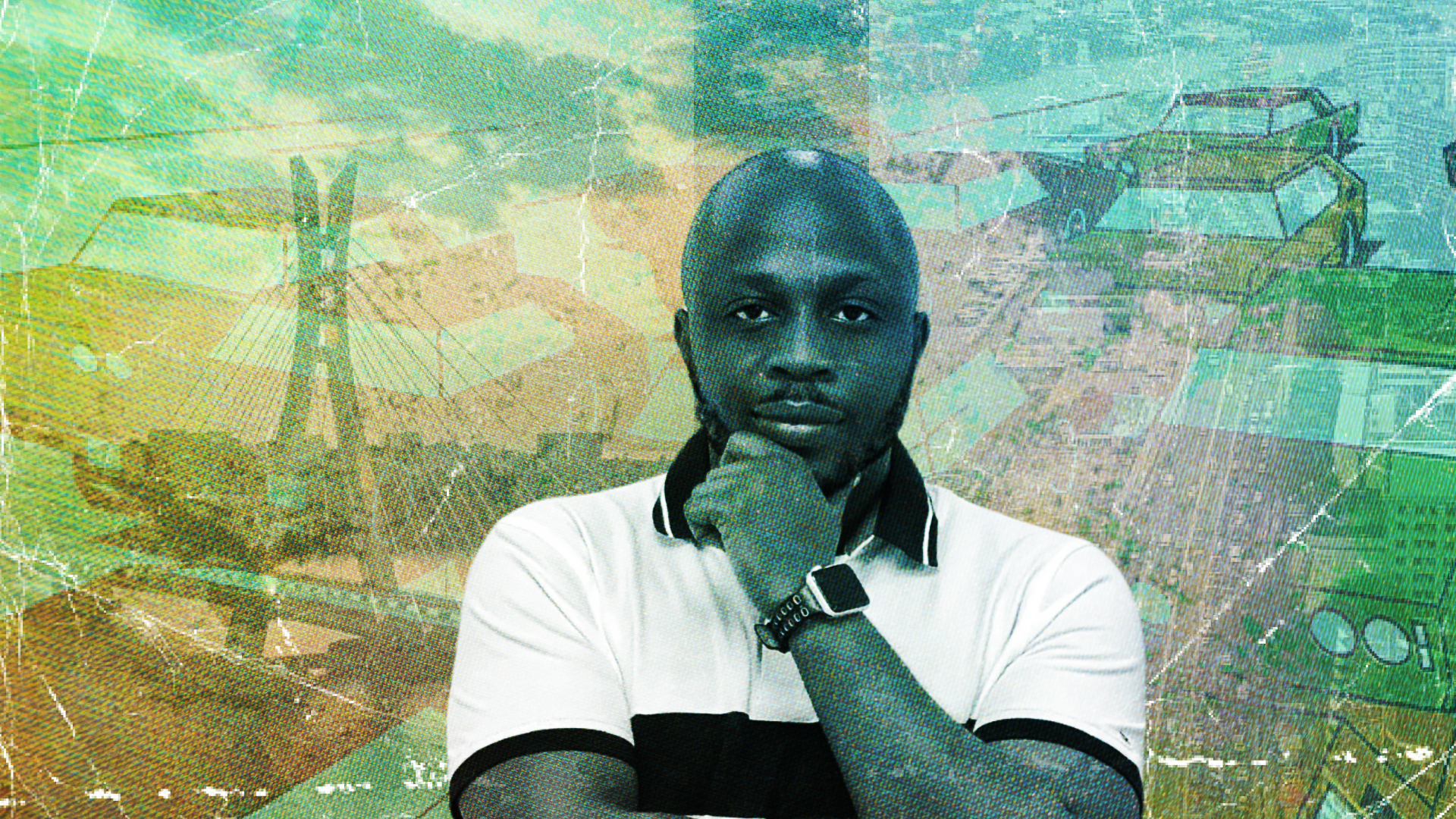

Seyi Adefemi built Drive45 into a ₦1.5 billion revenue business with zero marketing budget. Now, armed with Cascador’s ₦2 billion catalytic fund, he’s ready to solve Nigeria’s mobility problem at scale.

The mathematics of vehicle ownership in Nigeria no longer makes sense. A brand-new Toyota Camry now sells for about ₦100 million ($65,166). Even second-hand cars average ₦9 million ($5,845), while the minimum wage stands at a meagre ₦70,000 ($45) a month. For someone earning ₦500,000 ($325)—seven times that minimum—buying a car is still far out of reach.

Seyi Adefemi, founder of Drive45, captures the frustration in a chat with Condia, pointing to how deep the problem runs for millions of Nigerians. “So where does everybody fall?” he asks, hinting at the gap between aspiration and reality.

It’s this question that drove Adefemi to build Drive45, a rent-to-own vehicle platform that’s fundamentally different from asset financing services like LagRide and Moove. Instead of temporary access, Drive45 offers a pathway to permanent ownership—customers rent vehicles for three to six years and, upon completing payments, own the asset outright. For the average Nigerian, this means accessing a ₦9 million car through manageable monthly payments while building toward ownership, with Drive45 retaining rights to reclaim and resell vehicles only in cases of payment default.

Three years after bootstrapping this model from nothing; in May 2025 Adefemi stood before judges at Cascador’s exclusive Pitch Day and walked away with ₦2 billion ($1,298,895) in catalytic funding. Earning validation for a business model that’s already generating ₦1.5 billion ($974,171) annually, and the largest single award in the program’s history.

It was a win that went far beyond the money. For Adefemi, the ₦2 billion was fuel for a vision years in the making—— a plan to close Nigeria’s mobility gap. He had spotted the problem early, built a quiet but effective solution, and was now ready to change how millions of Nigerians get behind the wheel.

The stealth strategy that built ₦1.5 billion ARR

Drive45’s numbers reveal methodical, under-the-radar execution. Monthly recurring revenue (MRR) sits at ₦130 million ($84,428), serving blue-chip clients including British American Tobacco, Olam, PZ Industries, and Eko Electricity Distribution Company. It operates over 200 vehicles nationwide, has recorded no payment defaults in three years, runs with an eight-person team, and spends nothing on marketing.

“We figured that the only way we can attract investor interest is if we show traction,” Adefemi explains. “We focused on building rather than chasing VCs at the early stages.”

The real bottleneck came from understanding that Nigeria’s vehicle pricing crisis was strangling both consumers and Original Equipment Manufacturers (OEMs). Over the past eight years, average car prices in Nigeria have jumped by more than 120%, pushing even long-standing corporate buyers toward financing options. For decades, companies like Hyundai, Kia, and Isuzu could count on corporate clients ordering 20–30 vehicles a year, cash upfront. But as prices climbed into the tens of millions, those same clients began requesting payment terms the OEMs couldn’t accommodate.

“These OEMs need 100% of their cash now so they can ship out and bring in new consignments,” Adefemi notes. “Their model isn’t structured to offer payment plans.”

Drive45 became the bridge and breakthrough, paying OEMs in full up front while extending flexible financing to their clients. The approach unlocked stalled sales for manufacturers and gave businesses a viable path to vehicle ownership without damaging their credit profiles. It became the quiet engine behind Drive45’s growth.

Corporate focus drives stability and scale

For a bootstrapped business, corporate clients offered payment predictability that individual consumers couldn’t match.

“When you move into B2C, you need to give allowance for about 5% default,” Adefemi says. “Can a bootstrapped business afford that? No.”

The corporate value proposition extends beyond financing. Drive45 converts capital expenditure to operating expense, flattening unpredictable fleet costs into manageable monthly payments. For a company needing 10 vehicles—a ₦1 billion upfront investment—the model preserves cash flow while eliminating dedicated fleet management needs.

About 75-78% of Drive45’s fleet consists of utility vehicles directly tied to clients’ revenue generation rather than executive transport. The model works across three revenue streams: procurement margins from dealer pricing (5-10% below market), monthly service charges (12-15% of rental fees), and asset retention when clients choose subscription over ownership.

The Cascador catalyst

Adefemi’s path to Cascador began with a recommendation from Luther Lawoyin, founder of PricePally, who had participated in the 2023 cohort. The timing proved perfect—while earlier cohorts offered only mentorship, the 2024 program introduced financial incentives that dramatically increased competition.

“In Luther’s cohort, there was no financial incentive,” Adefemi recalls. “It was just come and learn. So, the competition wasn’t very intense. In my cohort, there was an incentive, so the number of people applying was crazy.”

The ₦2 billion grant is both validation and transformation. While technically debt rather than equity, Cascador’s 23% interest rate saves Drive45 approximately ₦14 million monthly compared to 35% market rates available from traditional financiers. More importantly, the funding provides 100% asset financing, eliminating Drive45’s need to co-invest in vehicle purchases.

“Has Cascador given me a grant? No. But has Cascador given me a grant indirectly? Yes,” Adefemi says, highlighting the ₦168 million in annual interest savings.

This financial freedom positions Drive45 for aggressive scaling. Projects in the pipeline over the next 60-90 days are expected to double monthly recurring revenue to ₦240 million, pushing annual revenue toward ₦2.8 billion.

The ₦2.8 billion expansion vision

With constraints removed, Drive45’s growth strategy spans three dimensions. Geographically, expansion targets Port Harcourt, Abuja, Kano, and Kaduna—Nigeria’s key commercial centres. The company will establish its first dedicated marketing team, moving beyond OEM partnerships that have powered its early growth.

Perhaps most significantly, Drive45 is preparing to enter the B2C market. Currently, 99.5% of revenue comes from enterprise clients, leaving the individual consumer market virtually untapped.

“We’ve not even touched individuals like yourself,” Adefemi notes. The shift requires different risk management and capital allocation, but the market opportunity is enormous given Nigeria’s vehicle affordability crisis.

Regional expansion into West Africa represents the third growth vector. Benin Republic, Togo, Ghana, and Ivory Coast all face similar mobility challenges, with Ivory Coast particularly attractive due to its stable currency.

“The same play we make in Nigeria, we’ll make the same play in Ghana,” Adefemi explains. “Just go local. Access cedis, buy in cedis, earn in cedis. You don’t have a problem.”

This expansion occurs within Nigeria’s evolving mobility ecosystem, much of it driven by Cars45 alumni. While Cars45 provided learning experiences, its alumni network has spawned multiple ventures addressing different aspects of vehicle access. Drive45 operates not in isolation but as part of a broader movement to democratize mobility.

As vehicle technology evolves toward Compressed Natural Gas (CNG) and electric vehicles, Drive45’s asset-agnostic enablement model remains relevant regardless of propulsion technology. The core value proposition—eliminating prohibitive upfront costs—stays constant whether serving internal combustion engines or EVs.

“EV is a very interesting play,” Adefemi observes. “With Chinese tech making charging more real, portable, and accessible, and adaptable to Nigerian electricity fluctuations, I won’t be shocked if over the next two to three years, we start seeing a lot more EVs on the road.”

Profitability and market validation

Drive45 expects to reach profitability by Q4 2025. Until now, all earnings have been reinvested into growth, with retained earnings covering equity portions for financing partners. Cascador’s 100% funding removes that limitation, unlocking faster scale.

With ₦1.5 billion in annual revenue and zero defaults, the model has already proven both demand and operational resilience. Cascador’s ₦2 billion injection now sets the stage for expansion—into more regions, into B2C, and potentially into international markets.

For Adefemi, this next phase is about more than scaling a business; it’s about reshaping access to mobility in a country where traditional ownership no longer makes financial sense.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore