In today’s midweek update, we look at:

- BYD expands into Zambia

- NCC introduces new QoS regulations for Nigerian telcos

- Takealot exits fashion

BYD expands into Zambia

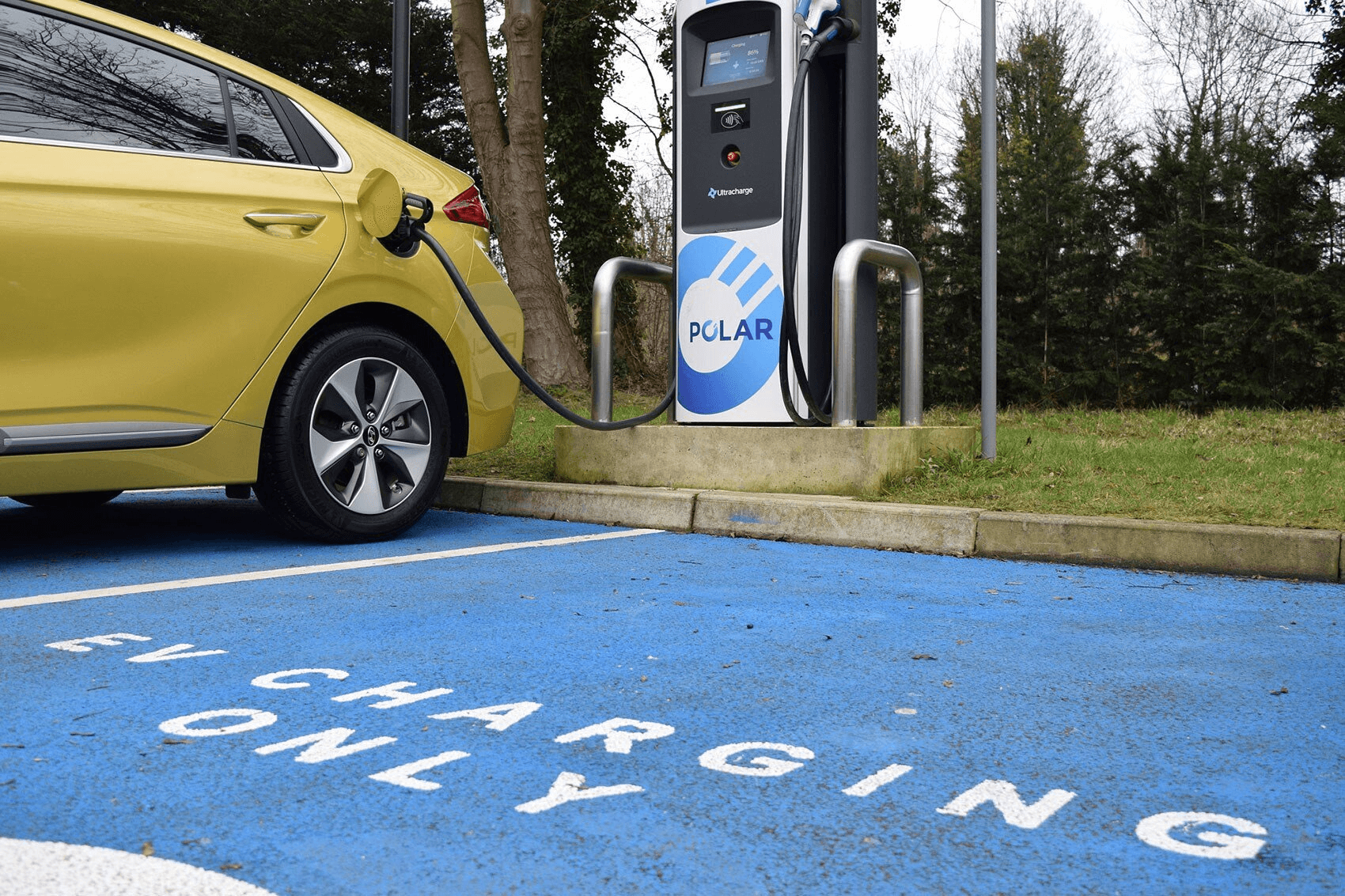

Zambian roads are about to be introduced to Build Your Dreams (BYD) electric cars after the Chinese electric vehicle manufacturer announced its expansion into the country. In partnership with Pilatus Electric Mobility Zambia Limited (PEM), BYD is set to launch its showroom on September 5, 2024.

The company will initially offer three electric vehicle models in Zambia: the Dolphin, ATTO 3, and SEAL. These vehicles boast impressive ranges, making them attractive options for Zambian consumers.

BYD’s entry into Zambia marks a continuation of its strategic expansion into the African market. The company has already established a presence in Rwanda, Kenya, and South Africa.

BYD has also been actively collaborating with local EV companies to support the development and deployment of electric vehicles in the region. Partnerships with BasiGo, Ampersand, and Associated Vehicle Assemblers (AVA) have been instrumental.

Context: The Zambian government is making strides to boost the country’s adoption of electric vehicles. In its 2024 budget, the government has eliminated custom duties on electric motorcycles, cars, buses, and trucks while reducing excise duty on hybrid vehicles from 30% to 25%. This move is aimed at encouraging the use of eco-friendly transportation options.

As Africa’s second-largest copper producer, Zambia is capitalising on its resources to play a key role in the electric vehicle (EV) supply chain. The country has signed a trilateral memorandum of understanding with the United States and the Democratic Republic of the Congo to collaborate on the production of EV batteries.

In Zambia’s emerging electric vehicle market, BYD will face competition from Toyota, which introduced two hybrid electric vehicles to the market late last year.

NCC introduces new QoS regulations for Nigerian telcos

For a while, the Nigerian Communications Commission (NCC) has been at odds with telecom operators over tariff hikes, and tensions may soon escalate further. The country’s telecom watchdog has introduced stricter Quality of Service (QoS) regulations for companies operating in Nigeria.

The new regulations outline specific parameters for network performance, including drop call rates, call setup success rates and traffic congestion. Failure to meet these standards will result in hefty fines, with a base penalty of ₦5 million and an additional ₦500,000 per day of non-compliance. The NCC will monitor telcos’ performance through regular reports and independent measurements.

How the QoS will be calculated: Telcos are evaluated on three key metrics to determine their Quality of Service (QoS). The first two metrics are interconnected: at least 98% of all calls must connect successfully, meaning failed connections should be kept below 2%. The third metric assesses how well they meet customer needs, ensuring they can effectively handle voice and data demands.

The new regulations come in response to the recent 50% telecom service target set by the Minister of Communications, Innovation, and Digital Economy. The NCC plans to collect more granular data and take localised actions to improve service quality to achieve this goal.

Context: While the NCC has been relatively quiet on QoS issues recently, the Commission has a history of imposing fines on telcos for violations, including those related to QoS. The most recent was the 2.3 billion naira ($1.45 million) fine to Airtel for disconnecting Exchange Telecommunications Limited without regulatory approval in 2020.

In 2019, the NCC imposed fines totaling 2.97 billion naira ($1.87 million) on MTN, Airtel, Glo, and 9mobile. Additionally, Airtel and 9mobile each faced a 5 million naira fine that year for breaching the NCC’s Do-Not-Disturb regulation.

Introducing these regulations comes at a challenging time for Nigerian telcos, who are grappling with the impacts of Naira devaluation and high inflation. Despite these challenges, the NCC’s new QoS regulations aim to ensure Nigerian consumers receive reliable, high-quality telecommunications services.

Takealot exits fashion

South African e-commerce giant Takealot is bowing out of the fashion space in South Africa after ten years. It has sold its online fashion retailer, Superbalist, to a consortium led by Blank Canvas Capital. This move signifies Takealot’s shift to focus on its core operations – Takealot.com (general e-commerce) and Mr D (food delivery).

What led to the sale? The decision to sell Superbalist was influenced by the intensifying competition in the South African e-commerce market. The entry of global players like Amazon and low-cost Chinese retailers has created a more challenging market. Additionally, Superbalist’s performance has been lagging, contributing to financial losses for Takealot.

By selling Superbalist, Takealot aims to streamline its operations, focus on profitable areas, and improve its overall financial performance. Meanwhile, Superbalist’s acquisition by Blank Canvas Capital presents an opportunity for renewed growth and development under new ownership.

Context: In 2023, the online retail market in South Africa grew to R71 billion ($3.97 billion). However, Takealot has faced challenges, reporting a trading loss of R252 million ($14 million) for the fiscal year ending March 31, 2024. This loss was largely attributed to Superbalist.

As Superbalist enters this new chapter, it will need to adapt to the evolving dynamics of the South African e-commerce market and navigate the challenges its competitors pose.

By the Numbers

56 million

The amount in dollars that African startups raised in August 2024. August’s funding represents the second slowest month in four years, according to Africa the Big Deal.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore