Payouts refer to the movement of money from an account (usually, central) to another account (usually, retail e.g individuals) or many other accounts (in bulk).

African payment companies, Stitch and Paystack announced their payouts offering, Payouts, and Transfer, on June 29, 2o22. It was as though the two marketing teams declared June 29 as South Africa’s (SA) Payouts Day.

The South African market is attractive, more so, the payments opportunity. This year, the projected Digital Payments Value in SA is expected to reach $14.31 billion, representing 12.34% of the total African pie of $116 billion. Nigeria accounts for only 10.47% of the continent’s Digital Payments Value, despite having 3x more adults (and more banked people) than South Africa. Some reasons for this gap would be the low disposable income and purchasing power of Nigerians, the weak value of the naira to the dollar, and just overall poverty in Africa’s most populous nation. So, you have 13 South Africans spending more than 100 Nigerians on Card (in dollar terms), according to GlobalData‘s Payment Cards Analytics.

Related Article: The state of the $1.5 trillion B2B payment market in Africa

Little wonder that both Stitch, Paystack, and many others set up shop in SA. The API fintech startup, Stitch officially launched in February 2021 to provide access to transactional data from a financial account. Barely three months later, the payments pull was so strong, that the company launched its first payments offering, InstantPay. Similarly, Nigeria’s Paystack expanded to SA in May 2021. The first payment product both companies launched in SA was a collections (AKA pay-in) product that allowed merchants to collect money from their customers via multiple methods.

Stitch has an account-to-account payment method (AKA a “Pay with linked bank account” method) that allows customers to link their bank account to a merchant’s platform and use it to complete a transaction. For example, ChipperCash uses Stitch to enable users to fund their wallets in SA. Using Stitch, the remittance player/digital bank can enable its customers to fund their wallets, once-off (InstantPay) or recurringly (LinkPay).

Related Article: How API fintech companies are powering Africa’s consumer ecosystem

With Paystack, merchants are able to collect funds across a variety of methods. These methods include debit/credit cards, bank transfers, mobile money accounts, QR codes, or USSD. For instance, PiggyVest uses Paystack’s card payment method automate savings and investments for millions of customers.

As a B2B payments company, first launching a payment collections product in a new market or territory is key. This does two things for you. One, it enables you to win the heart of merchants (your customers), because you are helping them grow by increasing their revenue collection surface area. Two, there is a lot you can do from then on—especially when you are in the flow of funds. You can offer them guaranteed payments, reconciliation, transaction insights, and a better way to spend the money they’ve collected through you. Now, this is where payouts come in.

Enter Payouts in SA

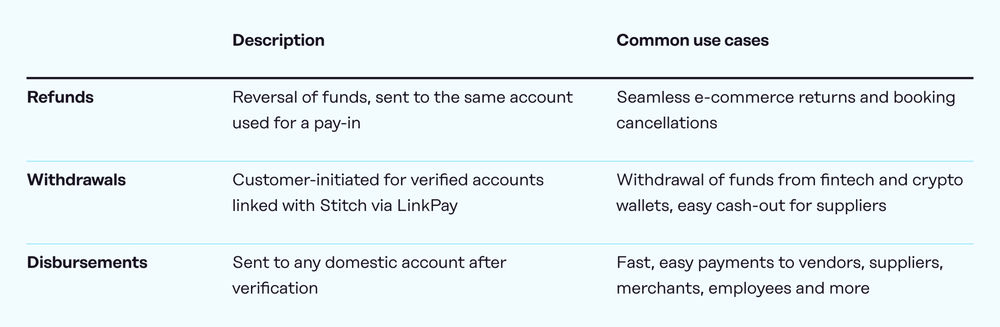

As discussed above, whenever pay-ins occur, payouts will have to occur, at some point. These payouts are typically in the form of refunds, withdrawals, or disbursements.

So, what many merchants used to do was have two providers: one for pay-in and another for payout. “We found that businesses typically switch back and forth between Paystack (where they collect online payments) and a separate platform to send money, which is time-consuming and introduces errors.” reads a blog post by Paystack on launching Transfers in SA.

In Nigeria, every licensed PSSP can do merchant collections by offering gateways and more. There is a lot of partnerships, integration, and product engineering work that goes into building a pay-in/collections product. So, that’s usually a good place to start building your moat. Payouts are more commoditised as you can get a disbursement/transfer API service from fintech-friendly banks like Providus, Sterling, and Wema or from just leveraging a PSP’s access to the service.

In SA, there are System Operators, Third Party Payment Providers (TPPP), and other license categories within the Payment System that allows for collections and being in the flow of funds. Payouts in SA are not as commoditised as in Nigeria because many SA banks don’t have an API for it. Hence why having a payouts API in SA is a worthy achievement.

With a Payouts API, businesses and merchants can programmatically disburse funds, enable withdrawals, and process funds for their customers. Otherwise, these SA businesses would have had to log in to a portal to issue manual refunds, withdrawals, or transfers.

Disclosure: Benjamin Dada, the Publisher, and Editor-at-Large at Benjamindada.com is Stitch’s Country Manager in Nigeria.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore