It’s salary week and there are usually two opposing emotions. One, as an employee—you are excited, but still, sad cause debt and bills are lined up. As an employer, you might feel a ‘hole in your chest’ and/or be excited that your best employees are getting rewarded. Whichever side of the divide you are on, we wish you well.

For the 115th episode of our newsletter, BD Insider, we will touch on:

- An open banking future enabled by the CBN

- Impact of Nigeria’s new telephone tax on the average consumer

- African deals of the previous week

We also feature a Tweet of the week and Career opportunities in Product, Design, Engineering and Growth.

An open banking future enabled by the CBN

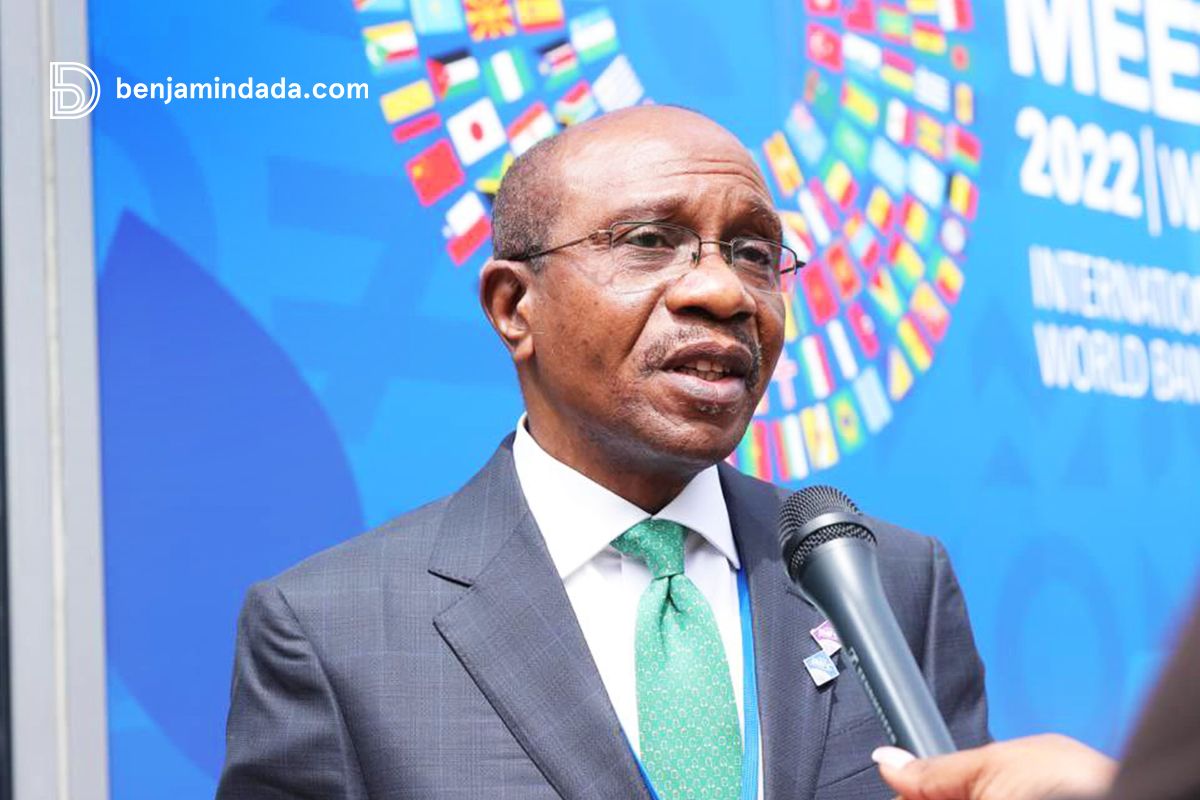

Over a year ago—in February 2021, the Central Bank of Nigeria (CBN) issued a circular to all Deposit Money Bank (DMBs) and Payment Service Providers (PSPs) regarding the issuance of the Regulatory Framework for the Open Banking in Nigeria. Since then, there has been no further comment on Open Banking from them. The quiet broke last week Tuesday when the Bank released an exposure draft of the Operational Guidelines for Open Banking in Nigeria. Being an “exposure draft” means that it’s not finalised, so not yet enforceable. It will be finalised after the CBN collects market reactions following a review by stakeholders.

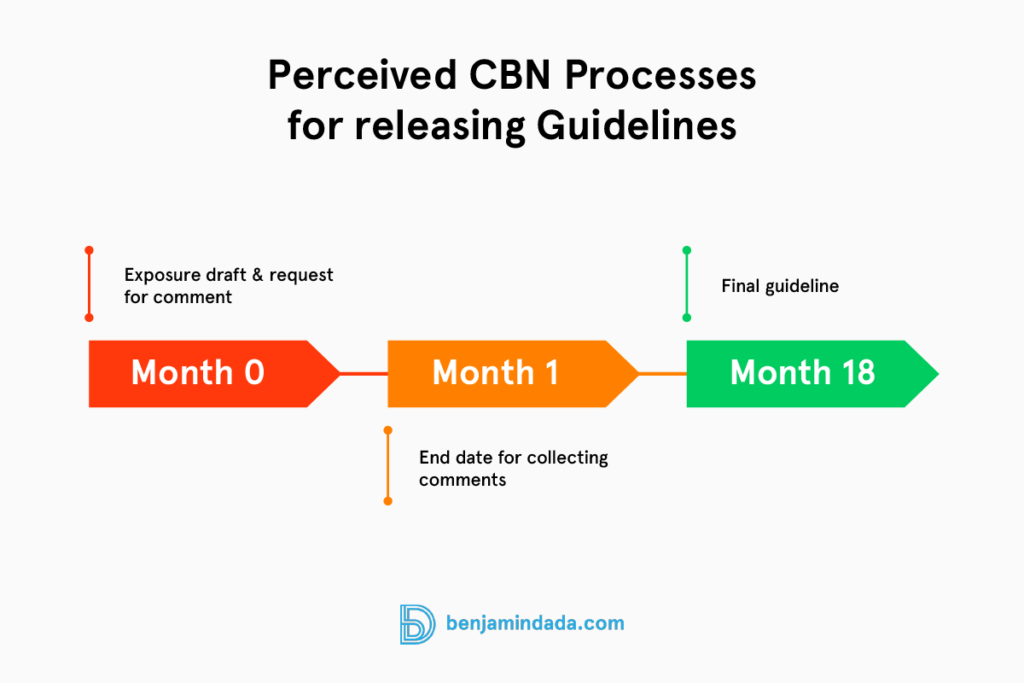

How long does it take a CBN guideline to go from exposure draft to final?

It takes between 15 – 22 months (approximately two years) for a CBN directive to go from an exposure draft to a final guideline.

We know the CBN timeline because we tracked the timeline of two other CBN guidelines—the Shared Services Agreement and the Payment Service Bank (PSB).

In October 2018, the CBN issued an exposure draft for the regulation of PSBs. But it wasn’t until August 2020 (22 months after) that they issued the final guideline for operating a PSB. Similarly, in November 2019, the CBN released an exposure draft on the regulation of Shared Service Arrangements between Banks and OFIs. But only released the final guideline in May 2021.

However, we suspect that there might be slight differences in timelines based on the department issuing the guideline. The two we tracked are from the Financial Policy and Regulation Department but the regulation of Open Banking is under the Payment Systems Management Department. Nonetheless, 15-22 months is a good enough range, and we can expect that the final Open Banking guideline will be passed within that time.

So, what should you do as a player or intending player? Review the exposure draft and start positioning your startup to be ready to take advantage of everything contained in it before 2023 ends.

This is partner content

Nigeria’s plan to further tax Telcos could lead to increased consumer prices

Following the signing of the new National Health Insurance Authority Bill 2022 into law, a telecom tax in the equivalent of a minimum of one kobo per second for phone calls is a part of the sources of funds required to finance free healthcare for the Vulnerable Group in Nigeria.

In 2020, the Nigerian Communications Commission reported that over 150.83 billion minutes of calls within the Nigerian telecoms space. With the provisions of Section 26 sub-section 1c of the Act [and going by the 2020 statistics], the Nigerian government will raise ₦90.49 billion ($18.09 million), annually, from the new tax.

The law defines vulnerable people as children under five, pregnant women, aged, physically and mentally challenged persons, and indigent people may be defined from time to time. Aside from the telecom tax, other sources of income for the Vulnerable Group Fund include the Basic Health Care Provision Fund, health insurance levies, grants, donations, gifts, and other voluntary contributions.

President Muhammadu Buhari on Thursday, May 19, 2022, signed into law the recently passed National Health Insurance Authority Bill 2022, with the aim of expanding health insurance coverage for vulnerable citizens unable to afford the costs of health care in Africa’s most populous country. The new legislation repeals the National Health Insurance Scheme Act 2004.

Recall that: Earlier this month, the Association of Licensed Telecom Operators of Nigeria (ALTON) proposed a 40% upward review in voice calls, short message services (SMS), and data costs. ALTON said this in a letter addressed to the Nigerian Communications Commission (NCC), citing the rising cost of running a business. This 1 kobo tax could be the final trigger for the review.

Tweet of the Week

Of the 5o tech startups selected for Google’s Black Founder’s Fund, 26 were from Nigeria. And only nine out of the 46 sub-Saharan African countries had at least one startup selected.

Here’s the representation of African countries at the Google’s Black Founders Fund for Africa 2021. pic.twitter.com/stz5zxz1Zv

— Benjamindada.com, tech blog (@dadabenblog) May 21, 2022

Tech startup deals

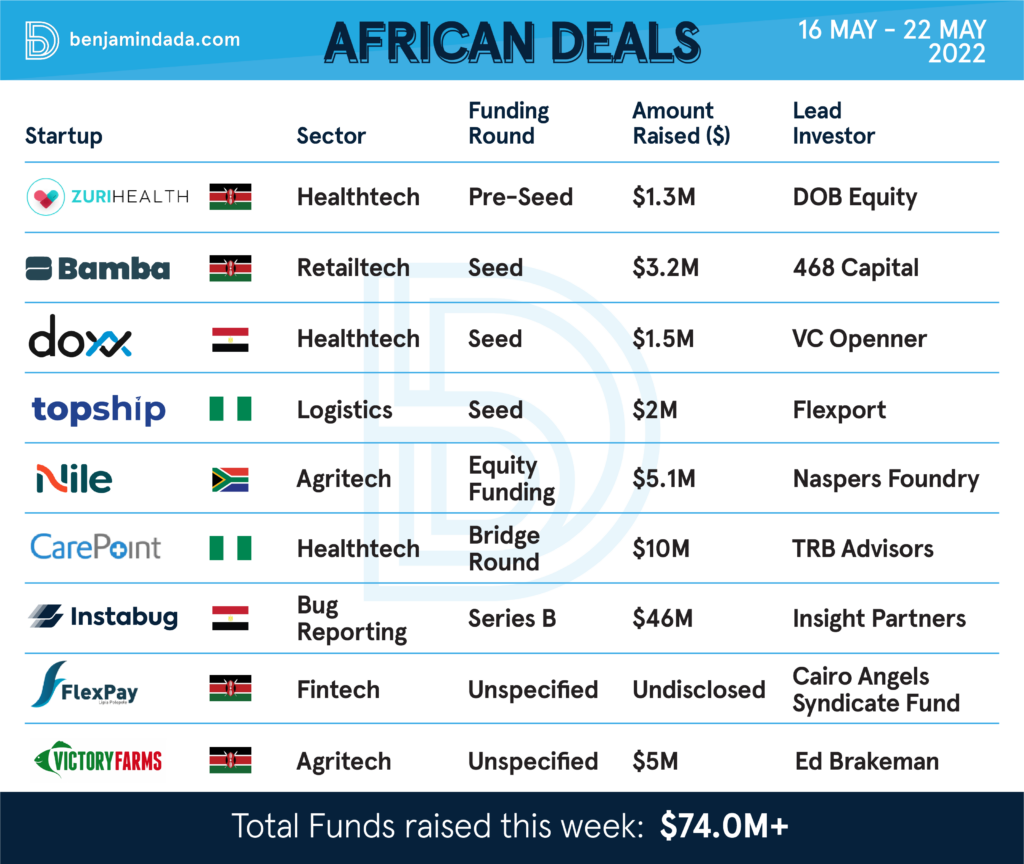

Between May 16 and May 22, 2022, African tech startups raised $74 million in nine deals.

Kenya features the most with four deals. Followed by Nigeria and Egypt with two deals each and then South Africa with one deal.

Surprisingly, only one of the rounds was raised by a fintech company, with healthtech leading with three deals. The image below captures a snapshot.

Did we miss out on any deal? Please reply to this email and we’d attend to it.

Noteworthy

Here are some of the interesting stories that we’ve come across in the past week:

- Nigeria’s SEC’s crypto stance and what you need to know. Find out!

- Vehicle financing in Africa amidst the Russia-Ukraine war. What’s new?

- The metaverse could add $40 billion to Africa’s economy. How?

- How to increase investment in Africa’s healthtech sector.

- “A sweet big lie told to African startups” What’s the lie?

Job Opportunities

We’ve highlighted three job categories in today’s newsletter. The categories are product & design, data & engineering, admin & growth:

Product & Design:

- Mastercard — Product Architect (Kenya)

- Renmoney — Digital Product Manager (Nigeria)

- Branch — Head of Product (Nigeria & Kenya)

Data & Engineering:

- Africhange — Golang Software Engineer (Nigeria)

- Bitt — Senior Backend Elixir Developer (Nigeria)

- Lemonade Finance — Backend Developer (Nigeria)

- Microsoft — Senior Software Engineer, WDX (Nigeria)

Admin & Growth:

- Mono—Content Marketer (Nigeria)

- Brass — Head of Marketing (Nigeria)

- Paystack — Chief of Staff (Remote)

- Mastercard — Snr Counsel, Regulatory Affairs (South Africa)

Other Opportunities:

- Apply for the 2022 Google Black Founders Fund for Africa

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore