InDrive, a ride-hailing service operating in nine African countries, is rolling out a bank transfer feature in Nigeria. The feature supports bank transfers on the app without integration or an in-app payment mechanism.

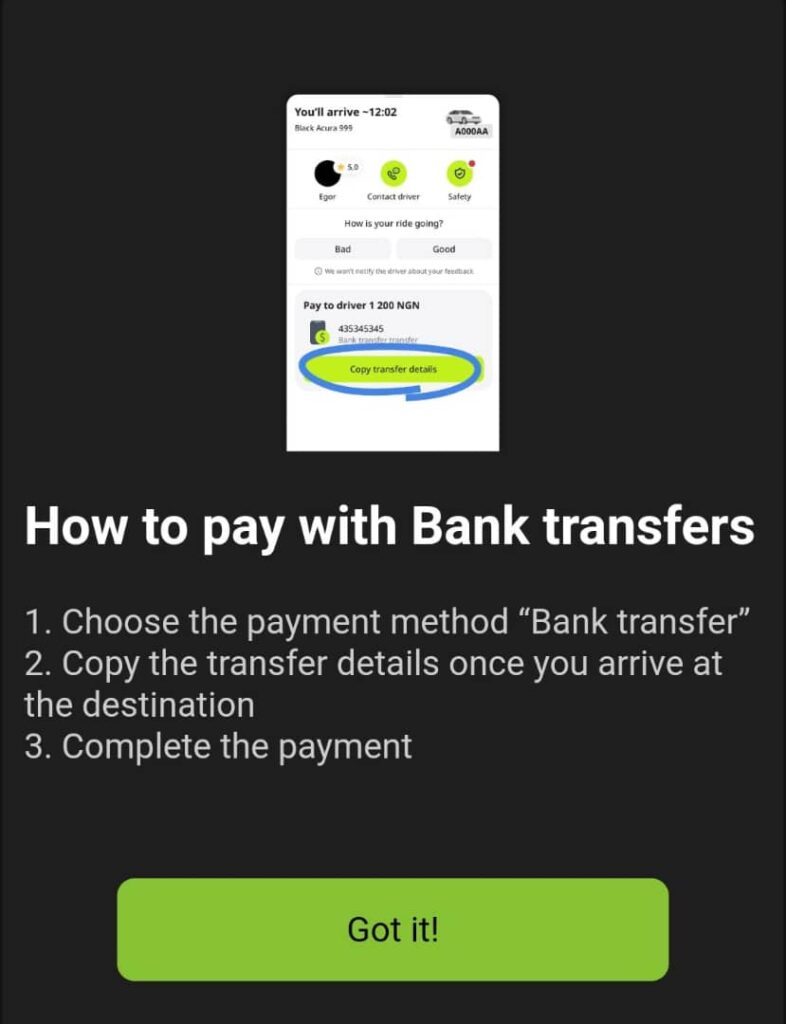

Dubbed “Light Cashless,” the feature allows drivers to display their preferred bank account details within the app, enabling passengers to copy and paste the information for payment directly.

This move positions InDrive as the first ride-hailing platform in Nigeria to adopt this approach. It also affirms bank transfers as the most acceptable mode of trip payment. “There is no payment gateway integration,” an InDrive spokesperson said in a written response, disabusing any ideas that InDrive may dabble in payments. “It is only a copy-and-paste mechanism that allows drivers to have their preferred accounts on their profile.”

This approach contrasts with InDrive’s broader strategy, which includes inDrive Money, a loan product for drivers launched in Colombia four months ago.

This is coming as PYMNTS reported in a recent study that 41% of rideshare customers preferred bank transfers.

While the feature indicates a possibility that ride-hailing apps could expand into e-payment services, this addition extends InDrive’s ambitions to strengthen the platform’s real-time tracking and verification systems. In November 2024, InDrive shared its desire to clamp down on offline rides and heighten verification systems to ensure passenger safety.

For drivers, the tight-fisted nature of InDrive’s numerous policies leaves no loopholes for them to exploit. “It is the same as a card trip. The feature only benefits InDrive,” national treasurer for the Amalgamated Union of App-based Transporters of Nigeria (AUATON), Jolaiya Moses, said in a text.

Another driver said the distance between ride-hailing companies and drivers has widened due to a breach of trust, which could impact the number of drivers willing to use the feature.

“The app (InDrive) does not make themselves available for most of our issues and concerns, they are practically invisible to us,” the driver, an executive of the AUATON said.

The ride-hailing sector in Nigeria faces challenges on multiple fronts. Rising fuel and maintenance costs have pushed drivers to demand fare increases, while macroeconomic pressures have led passengers to seek cheaper alternatives. This has created a delicate balancing act for companies like Bolt, Uber and InDrive which are trying to manage rider churn and driver dissatisfaction. Negotiations will likely be necessary to prevent further driver strikes similar to those seen in 2023.

In the last couple of weeks, members of the AUATON have clashed with leading ride-hailing apps like Bolt, Uber and InDrive over high commissions and promotional offers that continually reduce drivers’ earnings. On Monday, drivers threatened a protest against ride-hailing giant Bolt for introducing a 50% price slash last Friday to increase demand on the app.

These issues have not stopped InDrive from trying their hands at innovative means. The company spokesperson said the latest feature can be turned on following the latest app update.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore